Should You Invest In Uber Technologies (UBER)? A Detailed Look

Table of Contents

Uber's Financial Performance and Key Metrics

Understanding Uber's financial health is crucial before considering an investment. While Uber has demonstrated significant revenue growth, consistent profitability has remained elusive. Analyzing key financial ratios provides a clearer picture.

-

Revenue Growth: Uber's revenue has shown substantial growth year-over-year, driven primarily by its ride-sharing and Uber Eats delivery services. However, analyzing historical trends and future projections is essential to gauge the sustainability of this growth. Consider factors like global economic conditions and changes in consumer spending habits.

-

Profitability and Margins: Uber has historically operated at a net loss, though it has shown improvement in recent years. Scrutinizing operating expenses, including driver payments, marketing costs, and research and development, is crucial to understanding profitability margins. Analyzing the company's gross profit margin and operating margin will provide a better understanding of its efficiency.

-

Debt and Financial Health: Uber's debt-to-equity ratio indicates its financial leverage. A high ratio suggests higher risk. Examining the company's cash flow statement and balance sheet is crucial to assess its ability to service its debt and manage its overall financial health.

-

Fuel Prices and Driver Costs: Fluctuations in fuel prices and driver compensation directly impact Uber's profitability. Rising fuel costs squeeze margins, while driver compensation increases can affect the bottom line. Analyzing the company's strategies for managing these costs is important.

Market Position and Competitive Advantage

Uber's market dominance in ride-hailing and food delivery is a significant factor to consider. However, analyzing its competitive advantages against rivals like Lyft, Didi, and Bolt is essential.

-

Market Share: Uber holds a substantial global market share in ride-sharing, but its position varies regionally. Analyzing regional market share data gives a more nuanced understanding of its competitive strength.

-

Brand Recognition and Loyalty: Uber's strong brand recognition and established user base provide a significant competitive advantage. However, maintaining customer loyalty in a competitive market requires continuous innovation and excellent service.

-

Technology Platform and Driver Acquisition: Uber's technology platform is a core asset, enabling efficient matching of riders and drivers. Its ability to attract and retain drivers, and efficiently manage its driver network, is crucial to its success.

-

Regulatory Landscape and Competition: The ride-sharing industry faces evolving regulations globally. Navigating these regulatory changes and adapting to increased competition from established and emerging players will greatly influence Uber's future success.

Growth Opportunities and Future Outlook

Uber's growth potential extends beyond its current core businesses. Expansion into new markets and services could significantly boost its future revenue. However, potential risks and challenges should be acknowledged.

-

Emerging Markets: Expanding into underserved markets presents significant growth opportunities for Uber. However, challenges in navigating local regulations, building infrastructure, and adapting to cultural differences must be considered.

-

Uber Eats and Delivery Services: The food delivery sector is highly competitive, yet presents significant growth potential. Uber Eats' performance and its ability to maintain market share against other delivery platforms will greatly impact overall growth.

-

Autonomous Vehicles: Investment in autonomous vehicle technology could revolutionize Uber's business model, reducing operational costs and potentially increasing efficiency. However, the technology's development and regulatory approval are uncertain.

-

Geopolitical Risks and Regulation: Global economic instability and evolving regulations pose potential threats. Geopolitical events and changes in government policies can significantly affect Uber's operations in various regions.

Risks and Potential Downsides of Investing in UBER

Investing in UBER stock carries inherent risks that potential investors should carefully consider. These risks can significantly impact the company's performance and stock price.

-

Economic Downturns: During economic recessions, demand for ride-sharing and delivery services typically declines, impacting Uber's revenue and profitability. Analyzing the company's resilience to economic fluctuations is crucial.

-

Driver Shortages and Labor Relations: Maintaining a sufficient and satisfied driver network is critical for Uber's operations. Driver shortages, labor disputes, and rising driver compensation costs can negatively impact its business.

-

Increased Regulatory Scrutiny: The ride-sharing industry faces increasing regulatory scrutiny globally. Fines, new regulations, or restrictions on operations can significantly impact Uber's profitability and growth.

-

Cybersecurity Threats: Data breaches and cybersecurity incidents pose a significant risk to Uber, potentially leading to financial losses, reputational damage, and legal liabilities.

Conclusion

This analysis of Uber Technologies (UBER) reveals a company with significant market presence and growth potential, but also facing considerable challenges and risks. Its financial performance, competitive landscape, and future outlook must all be carefully considered. While Uber's innovative services and global reach are attractive, understanding and managing the inherent risks is crucial.

Call to Action: Ultimately, the decision of whether or not to invest in Uber Technologies (UBER) is a personal one. Thorough research and consideration of your own risk tolerance are crucial. Continue your due diligence on UBER stock by consulting with a financial advisor before making any investment decisions. Remember to carefully weigh the potential rewards against the inherent risks of investing in UBER stock.

Featured Posts

-

Investment Insights Why Dogecoin Shiba Inu And Sui Are Trending Upward

May 08, 2025

Investment Insights Why Dogecoin Shiba Inu And Sui Are Trending Upward

May 08, 2025 -

Us Antisemitism Probe Investigating Anti Boeing Actions On Seattle Campus

May 08, 2025

Us Antisemitism Probe Investigating Anti Boeing Actions On Seattle Campus

May 08, 2025 -

March 2025 Nintendo Direct What Ps 5 And Ps 4 Games Could Be Announced

May 08, 2025

March 2025 Nintendo Direct What Ps 5 And Ps 4 Games Could Be Announced

May 08, 2025 -

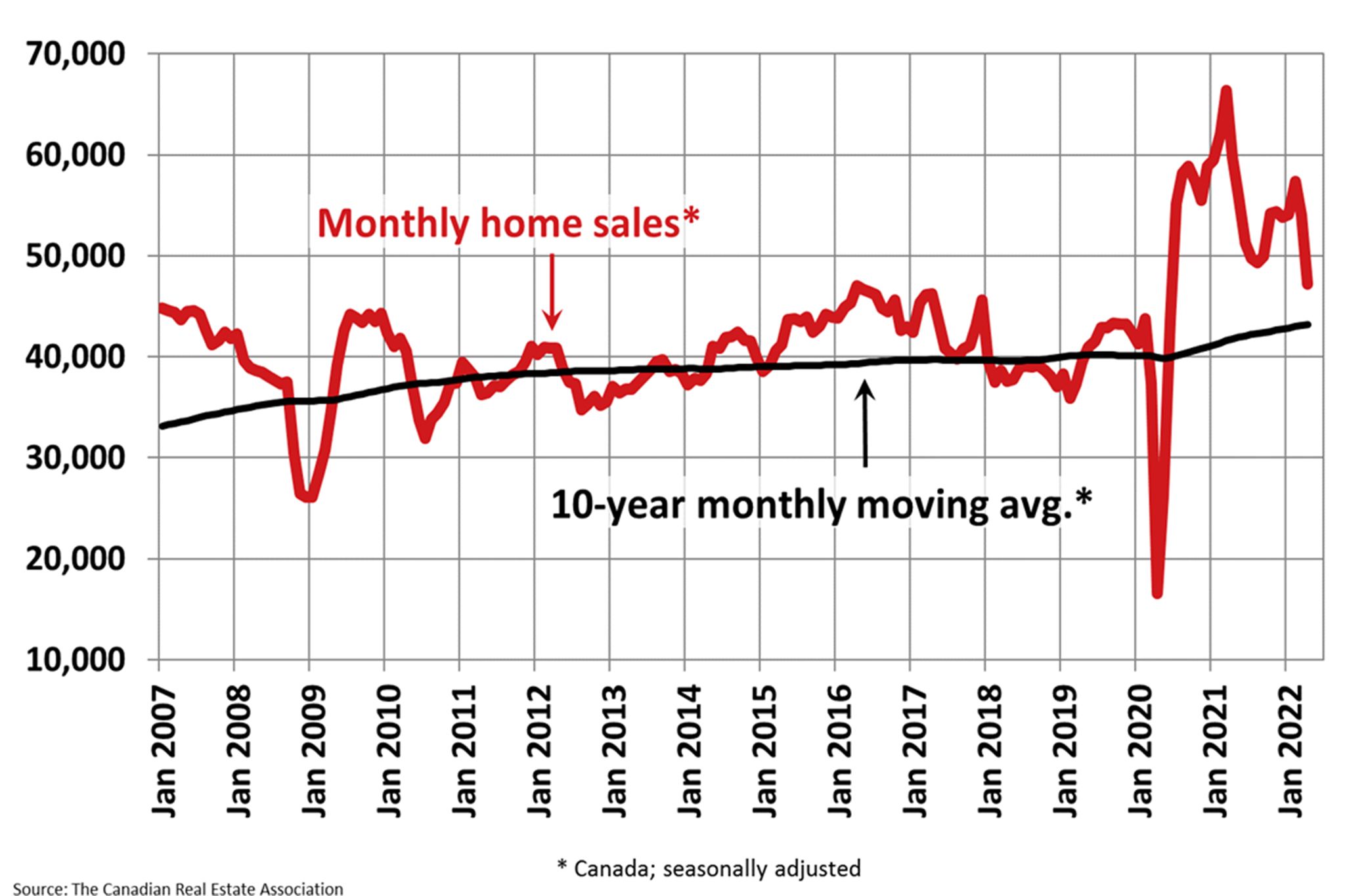

Toronto Housing Market Report Sales Down 23 Prices Down 4

May 08, 2025

Toronto Housing Market Report Sales Down 23 Prices Down 4

May 08, 2025 -

Denver Nuggets Jokic And Key Players Sit Following Double Overtime Game

May 08, 2025

Denver Nuggets Jokic And Key Players Sit Following Double Overtime Game

May 08, 2025