Six-Month Trend Reversal: Bitcoin Buy Volume Exceeds Sell Volume On Binance

Table of Contents

Binance Trading Volume Data Analysis

Analyzing the specific trading data from Binance is crucial to understanding the significance of this shift in Bitcoin buy volume. Let's examine the figures. For the month of [Insert Month, e.g., October 2023], Binance recorded a total Bitcoin buy volume of [Insert Specific Figure, e.g., 150,000 BTC], exceeding the sell volume of [Insert Specific Figure, e.g., 120,000 BTC] by [Insert Percentage, e.g., 25%]. This represents a stark contrast to the previous six months, where sell volume consistently outweighed buy volume.

[Insert Chart/Graph visually representing the buy and sell volume data for the past six months. Clearly label axes and highlight the significant increase in buy volume].

- Detailed breakdown of daily/weekly buy and sell volume for the past six months: [Insert data table showing daily/weekly volume fluctuations, highlighting the turning point].

- Comparison of current volume with previous highs and lows: The current buy volume is [Insert comparison, e.g., 15%] higher than the previous month's high and represents a [Insert comparison, e.g., 30%] increase compared to the lowest point observed during the bearish trend.

- Percentage increase in buy volume compared to the previous month: As mentioned, the buy volume surged by [Insert Percentage, e.g., 25%] compared to the previous month, indicating a substantial shift in market sentiment. This surge in Bitcoin buy volume on Binance is a key indicator to watch.

Potential Factors Contributing to the Reversal

Several factors could be contributing to this significant increase in Bitcoin buy volume on Binance.

Macroeconomic Factors

The influence of broader economic conditions on Bitcoin investment decisions is undeniable. High inflation rates and rising interest rates have historically driven investors towards alternative assets like Bitcoin, perceived as a hedge against inflation. [Insert specific data points on inflation rates and interest rates, and correlate them with Bitcoin price movements].

- Specific examples of macroeconomic factors influencing Bitcoin: The recent [Insert specific economic event, e.g., slowdown in inflation] might have increased investor confidence, leading to increased buying pressure.

- Correlation with other market trends: Observe the correlation between traditional market performance (stocks, bonds, etc.) and Bitcoin’s price to determine if investors are shifting assets.

Regulatory Developments

Regulatory clarity or positive developments in the regulatory landscape can significantly impact investor sentiment. While regulatory uncertainty can suppress trading activity, positive regulatory news can boost confidence. [Insert examples of recent regulatory news impacting the crypto market, referencing credible news sources].

- Summary of key regulatory changes and their effects: For example, a more favorable stance from a major regulatory body could lead to increased institutional investment.

- Impact of specific legislation: Consider any recent changes in tax laws or crypto-related legislation and their effect on buying behavior.

Institutional Investment

The growing involvement of institutional investors in the Bitcoin market is a critical factor. Large-scale investments by institutions can significantly influence price and volume. [Provide evidence of increased institutional interest in Bitcoin, possibly citing reports from financial news sources].

- Evidence of increasing institutional interest in Bitcoin: Reports indicate that [Insert specific example, e.g., several large asset management firms] have increased their Bitcoin holdings, potentially contributing to the higher buy volume.

- Impact of Grayscale or other large-scale investors: Specific examples of institutional investment should be cited to strengthen the argument.

Market Sentiment Shift

A shift in overall market sentiment, as reflected in social media trends, news coverage, and analyst opinions, can trigger significant changes in trading activity. [Insert data from Google Trends, social media analytics, or other relevant sources to demonstrate a shift in market sentiment].

- Examples of shifting market sentiment (e.g., Google Trends data): Increased searches for "buy Bitcoin" or positive news coverage could correlate with increased buy volume.

- Analysis of social media sentiment: Analyzing sentiment on platforms like Twitter can provide further insights into market psychology.

Implications and Future Outlook for Bitcoin on Binance

The sustained increase in Bitcoin buy volume on Binance has significant short-term and long-term implications.

- Short-term price prediction based on the volume data: The increased buy volume suggests a potential short-term price increase. However, predicting the exact price movement is challenging.

- Long-term market outlook based on various factors: The confluence of macroeconomic factors, regulatory developments, and institutional investment suggests a potentially bullish long-term outlook for Bitcoin.

- Possible scenarios for future price movements: Considering various factors, we can anticipate several potential price scenarios, ranging from a modest increase to a significant rally.

- Potential risks associated with the new trend: Despite the positive trend, risks remain, including potential regulatory crackdowns or unexpected macroeconomic shocks.

Conclusion:

The reversal of Bitcoin buy and sell volume on Binance after six months of a bearish trend signals a potentially significant shift in the market. While several factors could contribute to this change, understanding the interplay of macroeconomic conditions, regulatory developments, and investor sentiment is crucial. This data suggests a potential bullish outlook, though investors should remain cautious and conduct thorough research before making any investment decisions. Stay informed on the latest Bitcoin buy volume on Binance and its implications for your investment strategy. Continue monitoring Bitcoin trading volume on Binance for further insights into market trends. Understanding the dynamics of Binance Bitcoin trading volume is essential for navigating the cryptocurrency market effectively.

Featured Posts

-

Dbs On Environmental Reform A Period Of Grace For Major Polluters

May 08, 2025

Dbs On Environmental Reform A Period Of Grace For Major Polluters

May 08, 2025 -

Ray Epps V Fox News A Deep Dive Into The January 6th Defamation Case

May 08, 2025

Ray Epps V Fox News A Deep Dive Into The January 6th Defamation Case

May 08, 2025 -

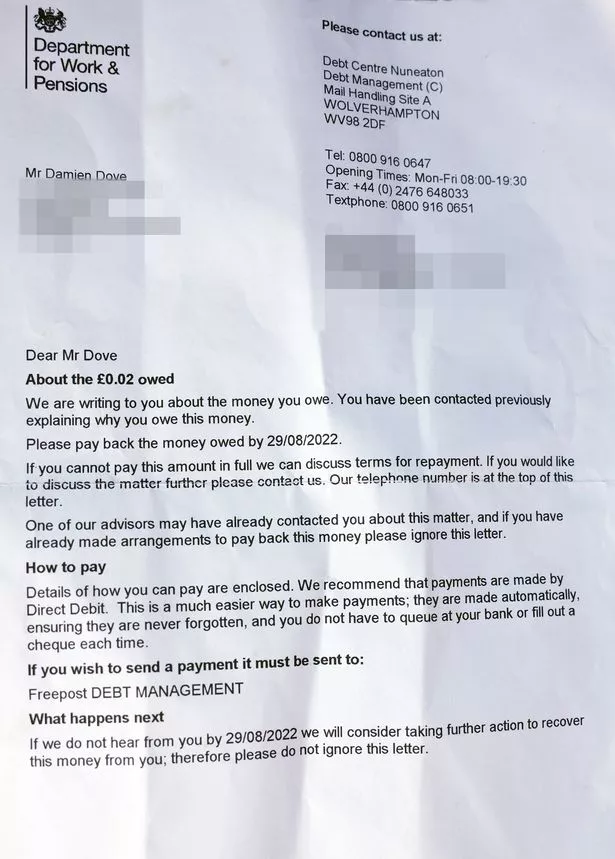

Claim Your Universal Credit Refund Dwp Payments For April And May

May 08, 2025

Claim Your Universal Credit Refund Dwp Payments For April And May

May 08, 2025 -

Winning Lotto Numbers Saturday April 12th Draw Results

May 08, 2025

Winning Lotto Numbers Saturday April 12th Draw Results

May 08, 2025 -

Dwp Benefit Stoppage Four Word Letters Warning Uk Households

May 08, 2025

Dwp Benefit Stoppage Four Word Letters Warning Uk Households

May 08, 2025