Smaller QE: A More Targeted Approach For The Bank Of England?

Table of Contents

Keywords: Smaller QE, Targeted QE, Bank of England, Monetary Policy, Quantitative Easing, Inflation, Economic Growth, UK Economy, Bond Yields, Asset Purchases

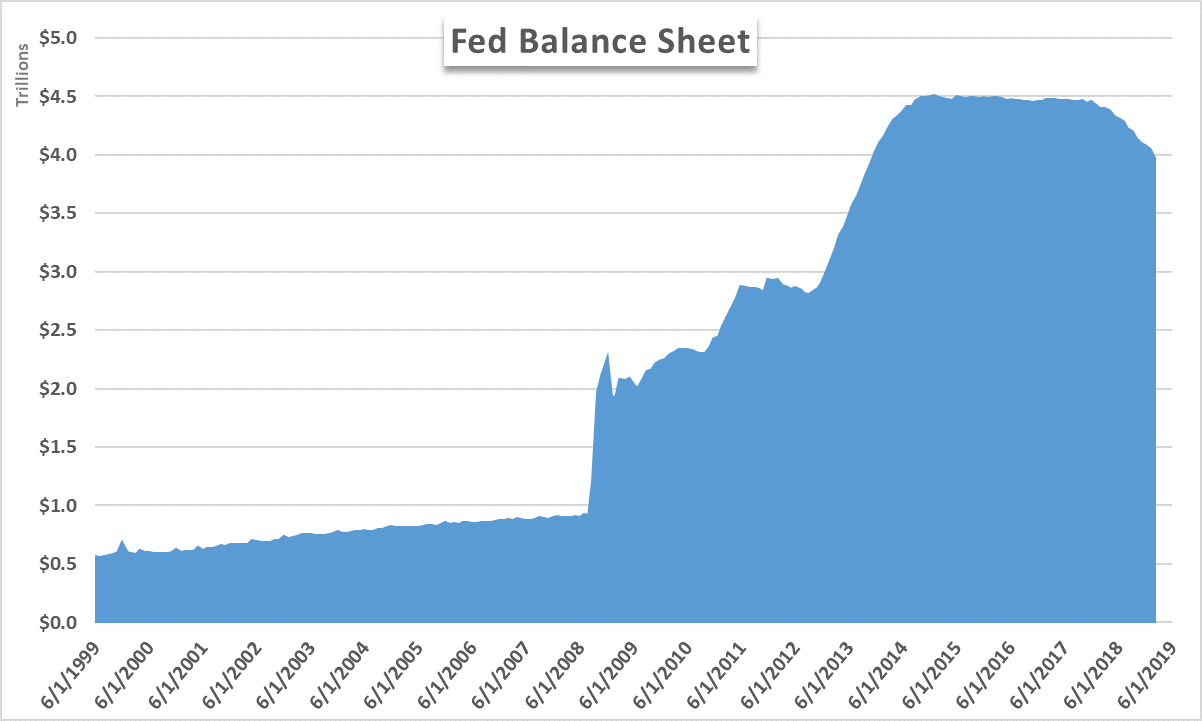

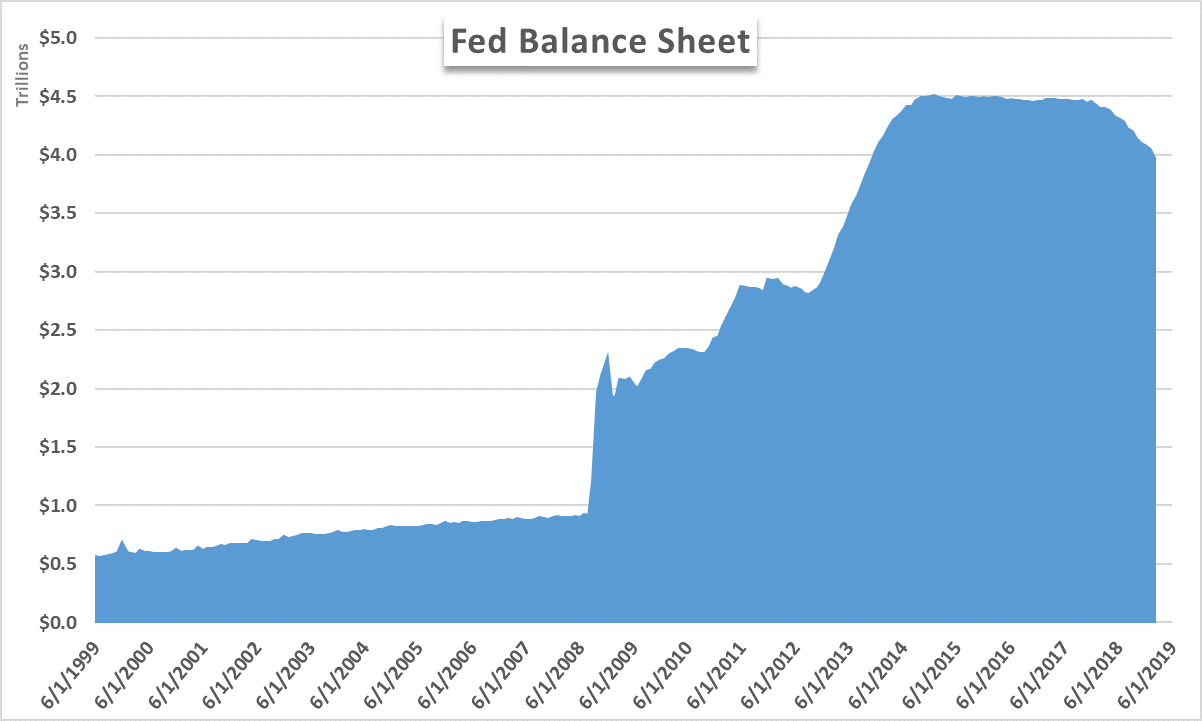

The Bank of England's use of quantitative easing (QE) has been a significant feature of UK monetary policy in recent years. However, the scale of past QE programs raises questions about their long-term effects and potential downsides. This article explores the potential benefits and drawbacks of a shift towards smaller QE, a more targeted approach to stimulating the UK economy. Could a more precise application of QE offer a superior alternative to the broader interventions of the past?

The Case for Smaller QE

The sheer scale of previous QE programs raises concerns about their potential impact on inflation and the broader economy. A smaller, more targeted approach could mitigate these risks.

Reduced Risk of Inflationary Pressures

- Smaller QE injections minimize the risk of excessive money supply growth. Injecting large amounts of liquidity into the economy can fuel inflation if not carefully managed. Smaller, more measured interventions reduce this risk.

- Past QE programs have contributed to inflationary pressures in certain sectors. While the overall impact on inflation has been debated, certain asset classes saw significant price increases. A more targeted approach aims to avoid these unintended consequences.

- Alternative inflation control mechanisms can be employed alongside smaller QE. The Bank of England could combine smaller QE with other tools, such as interest rate adjustments, to manage inflation more effectively.

The relationship between QE size and inflation is complex, and models vary in their predictions. However, empirical evidence suggests a correlation between increased money supply and potential inflationary pressures. Smaller, more carefully calibrated QE programs aim to minimize this risk.

Improved Targeting Efficiency

- Smaller, targeted QE can focus on specific sectors or markets needing stimulus. Instead of broadly injecting liquidity, resources can be directed towards areas experiencing particular economic weakness.

- This offers the potential for greater effectiveness in boosting economic activity. By focusing on sectors most in need, smaller QE could generate a greater return on investment in terms of economic growth.

- However, targeted QE implementation presents significant challenges. Identifying the appropriate sectors, designing effective mechanisms for delivery, and avoiding unintended consequences all require careful planning and execution.

Other central banks have experimented with targeted QE, with varying degrees of success. For example, the European Central Bank's targeted longer-term refinancing operations (TLTROs) aimed to encourage lending to small and medium-sized enterprises (SMEs). The Bank of England could consider similar targeted programs, perhaps focusing on green bonds to support sustainable investment or specific industries facing particular challenges.

Challenges and Limitations of Smaller QE

While smaller, targeted QE offers potential advantages, it also presents considerable hurdles.

Insufficient Stimulus for a Weak Economy

- A smaller QE program might be insufficient to revive a struggling economy. In a severe downturn, a large-scale stimulus might be necessary to prevent prolonged economic stagnation.

- There's a trade-off between smaller QE and the risk of prolonged economic weakness. A cautious approach might delay economic recovery, potentially leading to higher unemployment and reduced long-term growth.

The current state of the UK economy is crucial to consider. If the economy is facing a severe downturn, a small QE program might prove inadequate. The Bank of England needs to carefully weigh the risks of insufficient stimulus against the potential downsides of larger-scale interventions. Other policy options, such as fiscal stimulus, should also be considered in conjunction with monetary policy decisions.

Complexity and Implementation Costs

- Implementing a targeted QE program is complex. It requires careful identification of target sectors, designing appropriate mechanisms for delivery, and monitoring the impact of the program.

- There are significant administrative and technological challenges involved. The Bank of England needs robust systems to track the flow of funds and ensure transparency.

Designing and implementing targeted QE adds to the administrative burden and requires specialized expertise. This increases the costs associated with the program and necessitates greater transparency and accountability.

Alternative Monetary Policy Tools

Smaller QE isn't the only tool available to the Bank of England. Alternative approaches could be used in conjunction or instead of QE.

Negative Interest Rates

Negative interest rates, where banks are charged for holding reserves at the central bank, can stimulate lending and investment. However, their effectiveness is debated and there are concerns about their impact on bank profitability and the broader financial system.

Forward Guidance

Clearer communication of future monetary policy intentions can shape market expectations and reduce uncertainty, potentially lessening the need for large-scale QE. This approach relies on effective communication and the credibility of the Bank of England.

Targeted Lending Facilities

Instead of or in addition to QE, the Bank of England could provide targeted lending facilities to support specific sectors, such as SMEs or green technology companies. This allows for direct support to struggling sectors without the potentially broader inflationary pressures of QE.

Conclusion

The question of whether smaller, more targeted QE is the optimal approach for the Bank of England requires careful consideration. While smaller QE offers the potential advantages of reduced inflationary pressure and improved targeting, it also carries the risk of insufficient stimulus and increased implementation complexity. The optimal approach will depend on prevailing economic conditions and the Bank of England’s overall policy objectives. The Bank must weigh the potential benefits against the limitations, considering alternative monetary policy tools as well. Further research into the implications of smaller QE and its potential role in the Bank of England's future monetary policy strategy is crucial. We encourage discussion and debate on the topic of smaller QE and its future applications in the UK and globally.

Featured Posts

-

Calendario Laboral 16 5 Millones De Espanoles Disfrutaran Del Puente De Abril

Apr 23, 2025

Calendario Laboral 16 5 Millones De Espanoles Disfrutaran Del Puente De Abril

Apr 23, 2025 -

Yankees Historic Night 9 Home Runs Judges Triple Power Surge

Apr 23, 2025

Yankees Historic Night 9 Home Runs Judges Triple Power Surge

Apr 23, 2025 -

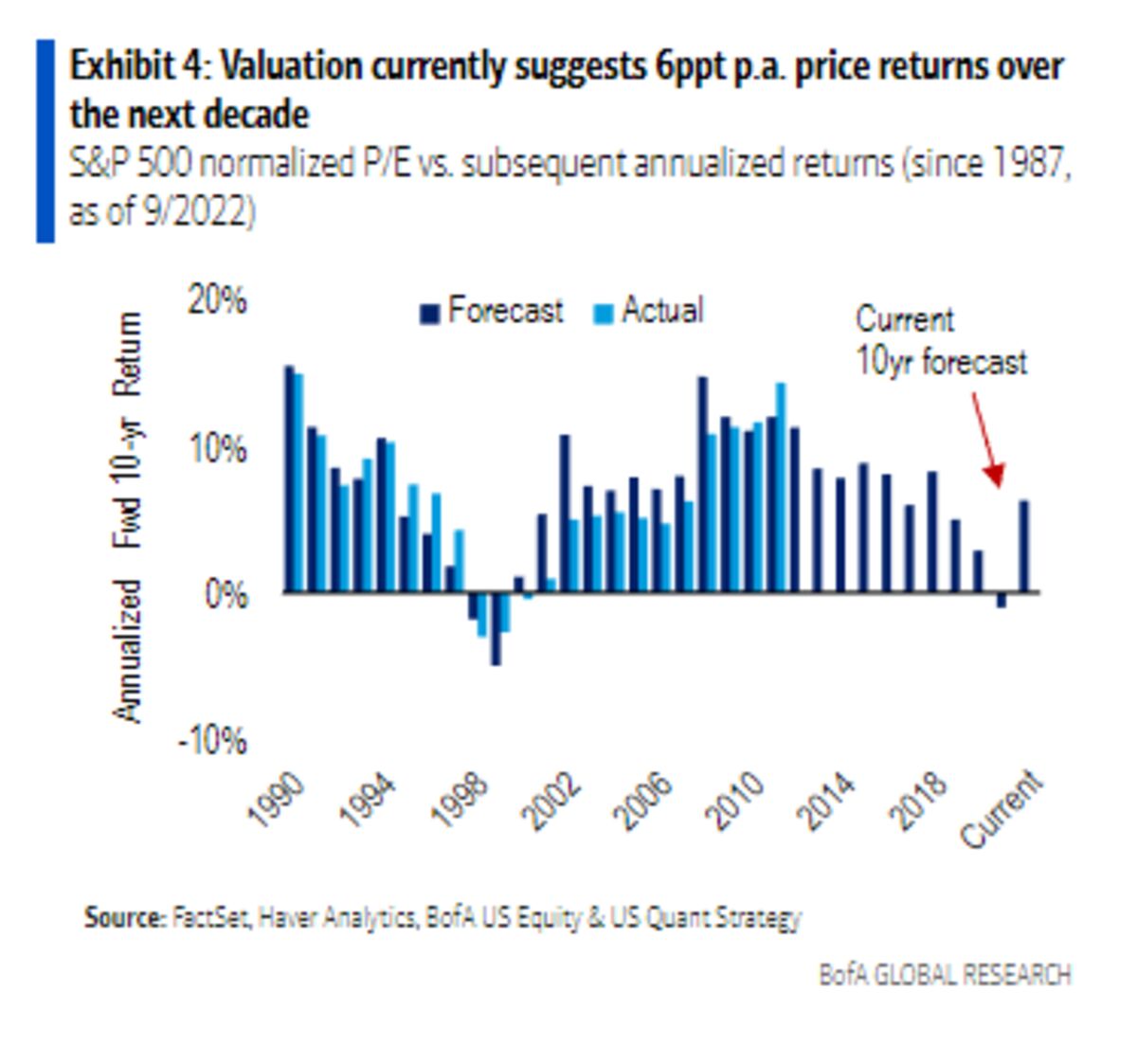

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

Apr 23, 2025

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

Apr 23, 2025 -

Brewers Sweep Tigers In Series 5 1 Final Score

Apr 23, 2025

Brewers Sweep Tigers In Series 5 1 Final Score

Apr 23, 2025 -

Naylors Clutch Hit Propels Diamondbacks Over Brewers

Apr 23, 2025

Naylors Clutch Hit Propels Diamondbacks Over Brewers

Apr 23, 2025