Stock Market Valuation Concerns: BofA Offers Reassurance To Investors

Table of Contents

BofA's Assessment of Current Market Valuations

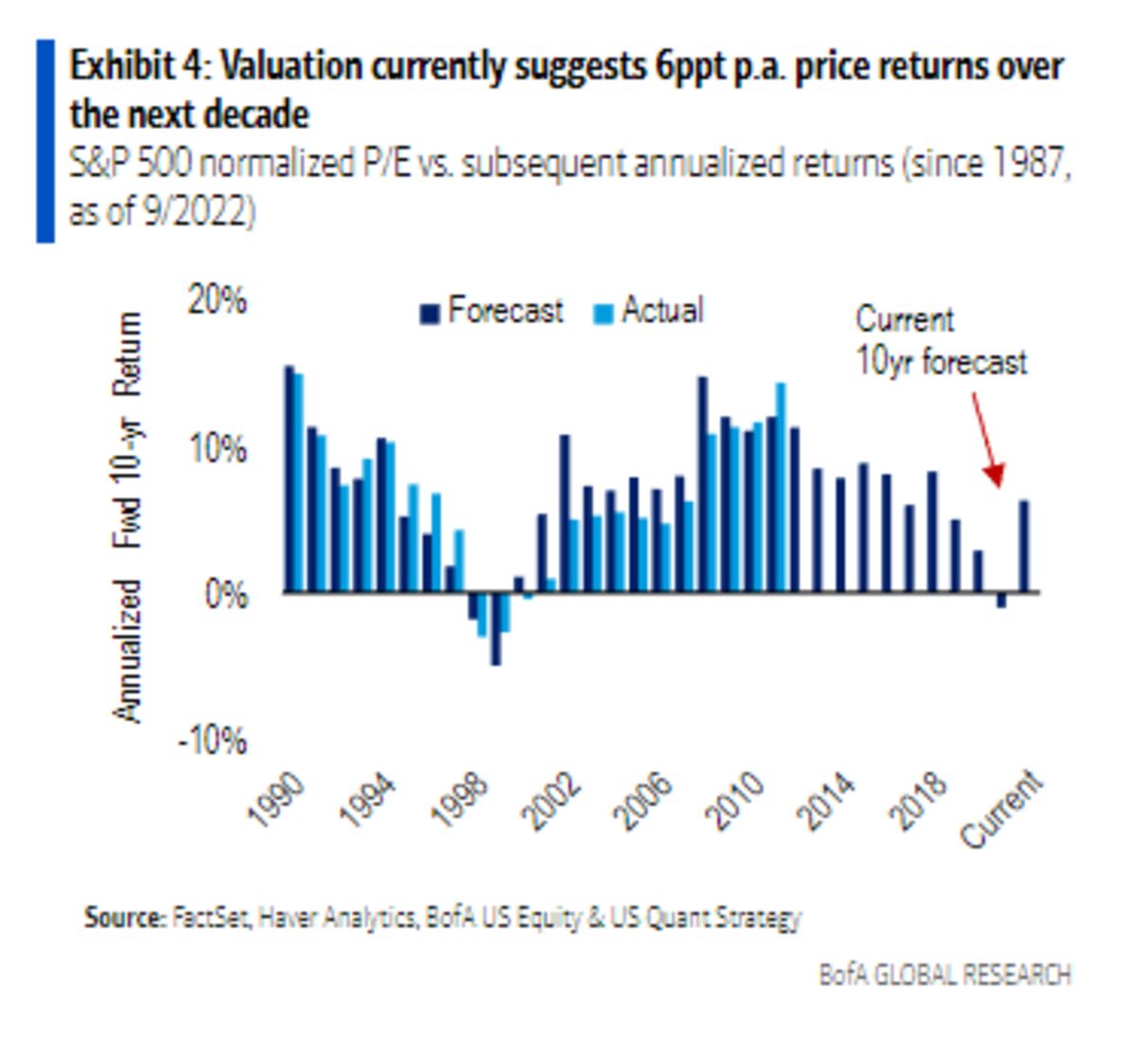

BofA's global research team has meticulously analyzed various valuation metrics to gauge the current state of the stock market. Their assessment considers price-to-earnings ratios (P/E), market capitalization, and other crucial market multiples to provide a comprehensive picture. The methodology employed by BofA involves comparing current valuations to historical averages across different sectors and industries, allowing for a nuanced understanding of market health.

-

Summary of BofA's key valuation findings: While specific numerical data would require referencing BofA's official reports, their analysis generally suggests that while some sectors might appear overvalued based on certain metrics, the overall market valuation isn't necessarily alarmingly high when considering the current economic landscape and projected future growth. Their assessment often includes a range of possibilities, acknowledging inherent uncertainty.

-

Comparison of current valuations to historical averages: BofA's analysis often contextualizes current valuations by comparing them to historical averages. This helps investors understand whether current multiples are unusually high or within a reasonable range considering past market performance and economic cycles. They may highlight periods of similar valuations and the subsequent market behavior.

-

Specific sectors identified as potentially overvalued or undervalued: BofA's research typically pinpoints specific sectors showing signs of overvaluation or undervaluation. These insights help investors make informed decisions about sector allocation within their portfolios, potentially shifting away from potentially overpriced sectors and toward those presenting better value opportunities.

-

Explanation of the methodology used by BofA for their valuation analysis: Understanding the methodology behind BofA's analysis is crucial for interpreting their findings. This involves understanding their assumptions about future growth, interest rates, and other economic variables. Transparency in their methodology fosters confidence in their conclusions.

Addressing Investor Concerns about Inflation and Interest Rates

Inflation and rising interest rates are major sources of investor anxiety. BofA addresses these concerns by analyzing the relationship between inflation, interest rate hikes by the Federal Reserve, and stock market performance. Their analysis often includes forecasts for future inflation and interest rate movements, providing insights into their potential impact on stock prices.

-

BofA's inflation forecasts and their impact on equities: BofA's research incorporates inflation forecasts, estimating the likely impact on corporate earnings and investor sentiment. They may suggest that while inflation can erode purchasing power, it can also lead to increased corporate pricing power if managed effectively.

-

Analysis of the relationship between interest rates and stock valuations: Higher interest rates typically increase the cost of borrowing for companies and can reduce the attractiveness of equities relative to bonds. BofA's analysis explores this relationship, examining the potential effects on different sectors and offering possible scenarios.

-

Discussion of the potential for a "soft landing" or recession: The possibility of a "soft landing" (a slowdown in economic growth without a recession) versus a recession is a key consideration in BofA's analysis. Their projections influence their assessment of stock market valuations and their investment recommendations.

-

How BofA suggests investors should adjust their portfolios given the interest rate environment: Given the interest rate environment, BofA may advise investors to adjust their portfolio allocation, perhaps favoring companies less sensitive to interest rate changes or sectors expected to perform well even in a higher-rate environment.

Geopolitical Risks and Their Influence on Market Sentiment

Geopolitical risks are a significant source of market volatility. BofA's analysis incorporates these risks, assessing their potential impact on market sentiment and incorporating them into their valuation models.

-

Identification of key geopolitical risks impacting the market: BofA identifies key geopolitical risks, such as the ongoing conflict in Ukraine, trade tensions, and other global uncertainties. Their analysis often evaluates the likelihood and severity of these risks.

-

BofA's assessment of the likelihood and impact of these risks: By assessing the likelihood and potential impact of various geopolitical risks, BofA provides investors with a better understanding of the potential for market disruptions.

-

Strategies for managing risk in a volatile geopolitical environment: The report often includes strategies for managing risk, such as diversification across geographies and asset classes, hedging strategies, and careful monitoring of geopolitical developments.

-

Examples of how investors can diversify their portfolios to mitigate these risks: BofA might suggest diversifying investments across different countries and sectors to reduce exposure to specific geopolitical risks.

BofA's Investment Recommendations and Strategic Advice

Based on their valuation analysis and considerations of inflation, interest rates, and geopolitical risks, BofA offers investment recommendations and strategic advice for investors.

-

Key investment recommendations from BofA: BofA may recommend specific sectors or asset classes they believe offer attractive valuations or potential for growth.

-

Suggested asset allocation strategies: Their recommendations often include suggested asset allocation strategies based on investors' risk tolerance and investment horizons.

-

Advice for investors with different risk profiles: Investors with different risk profiles (e.g., conservative, moderate, aggressive) will receive tailored advice regarding suitable investment strategies and asset allocation.

-

Importance of a long-term investment horizon: BofA typically emphasizes the importance of adopting a long-term investment horizon to weather short-term market fluctuations and benefit from long-term growth potential.

Conclusion

BofA's analysis offers a nuanced perspective on current stock market valuations, acknowledging concerns related to inflation, interest rates, and geopolitical risks while offering a measure of reassurance. Their assessment suggests that while some sectors might warrant caution, the overall market valuation isn't necessarily cause for extreme alarm. However, the inherent uncertainty remains.

While BofA offers reassurance, navigating stock market valuation concerns requires careful consideration and informed decision-making. Stay updated on market trends and consult with financial advisors to develop a robust investment strategy that aligns with your financial goals and risk tolerance. Learn more about stock market valuation and BofA's insights to make well-informed investment decisions.

Featured Posts

-

Five Key Economic Points From The English Language Leaders Debate

Apr 23, 2025

Five Key Economic Points From The English Language Leaders Debate

Apr 23, 2025 -

Switzerland Expands Eu Sanctions On Russian Media Outlets

Apr 23, 2025

Switzerland Expands Eu Sanctions On Russian Media Outlets

Apr 23, 2025 -

Brewers Vs Giants Flores And Lee Shine In San Francisco Win

Apr 23, 2025

Brewers Vs Giants Flores And Lee Shine In San Francisco Win

Apr 23, 2025 -

Morning Retail Le Nutriscore Un Indice Pour Mieux Choisir Le Matin

Apr 23, 2025

Morning Retail Le Nutriscore Un Indice Pour Mieux Choisir Le Matin

Apr 23, 2025 -

Provjera Radnog Vremena Trgovina Za Uskrs I Uskrsni Ponedjeljak 2024

Apr 23, 2025

Provjera Radnog Vremena Trgovina Za Uskrs I Uskrsni Ponedjeljak 2024

Apr 23, 2025