Smart Shopping For The Budget-Conscious

Table of Contents

Planning & Prioritization: The Foundation of Smart Shopping

Smart shopping isn't about deprivation; it's about making informed decisions. It all starts with planning and prioritizing your spending.

Creating a Realistic Budget

Before you even think about shopping, understanding your spending habits is crucial. This means:

- Track your spending: Use budgeting apps (like Mint, YNAB, or Personal Capital) or a simple spreadsheet to monitor where your money goes.

- Identify spending leaks: Look for areas where you're overspending without realizing it – those daily lattes, subscription services you don't use, etc.

- Categorize expenses: Separate needs (groceries, rent, utilities) from wants (eating out, entertainment, new clothes). This helps prioritize essential spending.

- Set realistic savings goals: Don't aim for unattainable targets. Start small and gradually increase your savings goals as you build confidence.

- Use budgeting apps: Many free and paid apps can automate the tracking process, provide insightful visualizations, and offer helpful financial planning tools.

Prioritizing Needs Over Wants

Impulse buying is the enemy of smart shopping. Learning to differentiate between needs and wants is essential for saving money.

- Differentiate between essential purchases and impulse buys: Ask yourself: Is this item necessary for my well-being or survival? Or is it a want that can wait?

- Create a shopping list based on needs: Stick to it religiously when you're out shopping. This prevents you from buying things you don't need.

- Delay gratification for non-essential items: If you want something that isn't essential, wait a few days or weeks. Often, the desire fades, and you save money.

The psychological aspect of impulse buying is powerful. Utilizing strategies like creating a shopping list and waiting before making a purchase can combat this tendency and significantly improve your budget management.

Utilizing Shopping Lists and Meal Planning

Meal planning is a game-changer for budget-conscious shoppers.

- Plan meals for the week: This helps you avoid impulse grocery purchases and ensures you buy only what you need.

- Create a grocery list based on the meal plan: This prevents unnecessary trips to the store and reduces the chances of buying items on a whim.

- Stick to the list while shopping: Avoid wandering the aisles aimlessly, as this often leads to impulse buys.

- Avoid unnecessary snack purchases: Pre-packaged snacks can be expensive. Consider healthier, home-made alternatives.

By carefully planning your meals and sticking to a shopping list, you can drastically reduce your grocery expenses and save a substantial amount of money each month.

Mastering the Art of the Deal: Discounts, Sales & Coupons

Smart shopping involves actively seeking out deals and discounts.

Harnessing the Power of Coupons and Promo Codes

Coupons and promo codes can significantly reduce your spending.

- Utilize coupon websites and apps: Websites like RetailMeNot and Coupons.com, and apps like Groupon offer numerous deals.

- Sign up for store loyalty programs: Many stores offer exclusive discounts and rewards to their loyal customers.

- Look for printable coupons: Many manufacturers offer printable coupons on their websites.

- Use cashback websites: Websites like Rakuten and Swagbucks offer cashback on purchases made through their links.

Smart Shopping During Sales Events

Sales events like Black Friday and Cyber Monday present excellent opportunities to save. However, be a smart shopper:

- Research sales in advance: Compare prices across retailers to find the best deals.

- Compare prices across retailers: Don't assume the first sale you see is the best one.

- Be wary of artificial price inflation before sales: Some retailers inflate prices before a sale to make the discount seem bigger.

- Prioritize items genuinely needed: Don't buy something just because it's on sale if you don't need it.

Negotiating Prices and Exploring Alternatives

Negotiating isn't always easy, but it can yield significant savings on big-ticket items.

- Negotiate prices for large purchases: For furniture, electronics, or cars, negotiating is often possible.

- Consider buying used or refurbished items: Used or refurbished items can be significantly cheaper than new ones, often with minimal compromises on quality.

- Explore alternatives: Consider renting, borrowing, or bartering instead of buying, especially for items you'll only use occasionally.

Smart Shopping Strategies for Specific Needs

Smart shopping strategies vary depending on what you're buying.

Grocery Shopping Savvy

Grocery shopping is where many people overspend. Here are some tips:

- Shop the perimeter of the grocery store: This is where most fresh produce, meat, and dairy are located – generally healthier and often cheaper than processed foods.

- Buy in bulk (for non-perishable items): Buying in bulk can save money, but only if you'll actually use the items before they expire.

- Use store brands: Store brands are often just as good as name brands but significantly cheaper.

- Compare unit prices: Don't just look at the total price; compare unit prices to determine the best value.

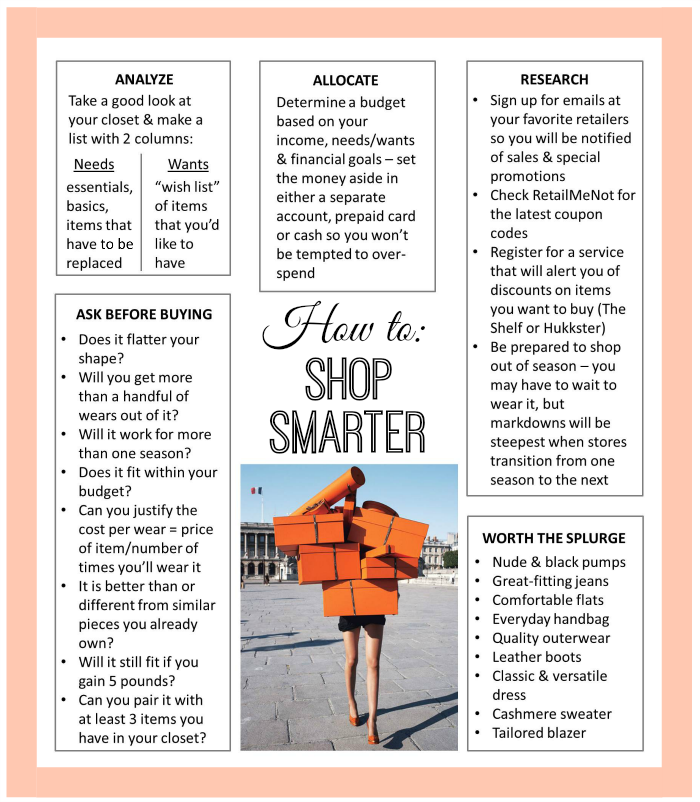

Clothing & Apparel Shopping Strategies

Clothing can be a major budget drain. Here are some tips:

- Shop seasonal sales: End-of-season sales offer significant discounts on clothing.

- Invest in high-quality basics: High-quality basics will last longer and save you money in the long run.

- Buy timeless pieces: Avoid trendy items that you'll only wear for a short time.

- Utilize clothing rental services: For special occasions, renting clothes can be more cost-effective than buying.

Building a capsule wardrobe, focusing on versatile pieces, is a great smart shopping strategy for clothing.

Online Shopping Best Practices

Online shopping offers convenience but requires extra caution:

- Compare prices across multiple websites: Use price comparison tools to find the best deals.

- Read reviews: Check reviews from other customers to ensure the product is as described.

- Check shipping costs and return policies: These can add significantly to the final cost.

- Utilize price comparison tools: Websites and browser extensions can automatically compare prices across different retailers.

- Verify online seller legitimacy: Before purchasing from an unfamiliar online seller, research their reputation and verify their legitimacy.

Conclusion: Embrace Smart Shopping for Long-Term Financial Health

By implementing the smart shopping strategies outlined in this article – from creating a realistic budget and prioritizing needs to harnessing the power of deals and coupons – you can take control of your finances and achieve your savings goals. Remember, smart shopping for the budget-conscious isn't about sacrificing your lifestyle; it's about making informed choices that allow you to get more for your money. Start implementing these techniques today and you’ll be amazed at the financial freedom you can achieve. Share your own smart shopping tips in the comments below! And for further reading on related topics, explore resources on budgeting apps and money-saving strategies.

Featured Posts

-

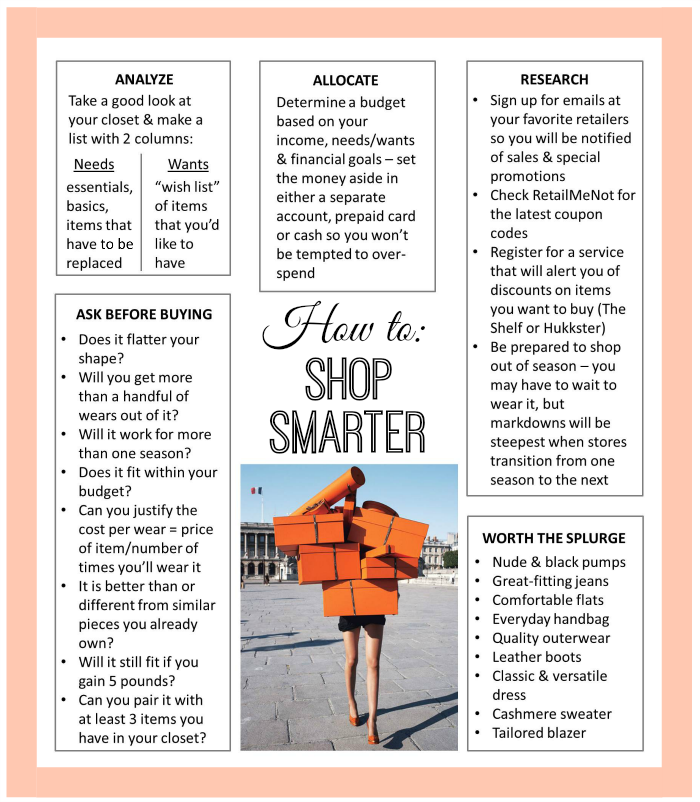

Privatizing Federal Student Loans A Look At Trumps Potential Plan

May 17, 2025

Privatizing Federal Student Loans A Look At Trumps Potential Plan

May 17, 2025 -

Dismissing Stock Market Valuation Concerns A Bof A Based Argument

May 17, 2025

Dismissing Stock Market Valuation Concerns A Bof A Based Argument

May 17, 2025 -

Impact Of Injuries Giants Vs Mariners Series April 4 6

May 17, 2025

Impact Of Injuries Giants Vs Mariners Series April 4 6

May 17, 2025 -

Pistons Outraged Blown Foul Call Decides Game 4

May 17, 2025

Pistons Outraged Blown Foul Call Decides Game 4

May 17, 2025 -

Conflict Resolved Thibodeau And Bridges Discuss Recent Discrepancies

May 17, 2025

Conflict Resolved Thibodeau And Bridges Discuss Recent Discrepancies

May 17, 2025

Latest Posts

-

Apple Tv Discount Ending Soon 3 Months For 3

May 17, 2025

Apple Tv Discount Ending Soon 3 Months For 3

May 17, 2025 -

Dont Miss Out Apple Tv 3 Month Discount For 3

May 17, 2025

Dont Miss Out Apple Tv 3 Month Discount For 3

May 17, 2025 -

Last Chance Apple Tv At 3 For 3 Months

May 17, 2025

Last Chance Apple Tv At 3 For 3 Months

May 17, 2025 -

Apple Tv Special Offer 3 Months Of Streaming For 3

May 17, 2025

Apple Tv Special Offer 3 Months Of Streaming For 3

May 17, 2025 -

Is There A Free Way To Watch Severance Exploring Legal Options

May 17, 2025

Is There A Free Way To Watch Severance Exploring Legal Options

May 17, 2025