Stock Market Prediction: 2 Potential Winners Over Palantir (3-Year Outlook)

Table of Contents

Palantir Technologies has garnered significant attention in recent years, becoming a prominent player in the big data analytics space. However, the stock market is a dynamic landscape brimming with diverse opportunities. This article presents a stock market prediction, focusing on two companies poised to potentially outperform Palantir over the next three years, offering a compelling alternative for investors seeking strong returns. We'll delve into their growth potential, market positioning, and competitive advantages, providing insights to aid your investment decisions.

Company A: Nvidia - A Deep Dive into Growth Potential

Strong Financial Performance and Future Projections:

Nvidia, a leading designer of graphics processing units (GPUs), has demonstrated exceptional financial strength and a robust growth trajectory. Its dominance in the gaming market, coupled with its expansion into high-growth sectors like artificial intelligence (AI) and data centers, positions it for continued success.

- Exceptional Revenue Growth: Nvidia has consistently reported impressive year-over-year revenue growth, exceeding market expectations. (Source: Nvidia financial reports)

- High Profit Margins: The company boasts substantial profit margins, indicating strong pricing power and operational efficiency. (Source: Nvidia financial reports)

- Positive Earnings Forecasts: Analysts widely predict continued positive earnings growth for Nvidia over the next three years, driven by increased demand for its GPUs in various sectors. (Source: Consensus analyst estimates)

- Strategic Acquisitions: Nvidia's strategic acquisitions, such as Mellanox, have expanded its product portfolio and market reach, further fueling its growth potential.

Competitive Advantages and Market Domination:

Nvidia's competitive edge stems from its cutting-edge technology, strong brand recognition, and extensive ecosystem.

- Technological Leadership: Nvidia's innovative GPU architectures consistently outperform competitors, offering superior performance and efficiency.

- Dominant Market Share: The company holds a significant market share in multiple key segments, including gaming, professional visualization, and AI.

- Strong Ecosystem: Nvidia's CUDA platform provides a robust ecosystem for developers, fostering innovation and application development.

- Expansion into New Markets: Nvidia is aggressively expanding into new and emerging markets, including autonomous vehicles and robotics, diversifying its revenue streams.

Risk Assessment and Potential Challenges:

While Nvidia's prospects are bright, potential challenges exist:

- Competition: Intense competition from AMD and other chipmakers could impact market share and profitability.

- Supply Chain Disruptions: Global supply chain disruptions could affect the availability of components, impacting production and revenue.

- Economic Downturn: A significant economic downturn could reduce demand for high-end GPUs, affecting Nvidia's performance.

However, Nvidia's strong brand, technological leadership, and diversified revenue streams mitigate these risks to a considerable extent.

Company B: ASML Holding – Disruptive Technology and Market Disruption

Innovative Technology and First-Mover Advantage:

ASML Holding, a leading provider of lithography systems for the semiconductor industry, possesses a unique technological advantage.

- EUV Lithography Dominance: ASML holds a near-monopoly on the production of extreme ultraviolet (EUV) lithography systems, crucial for manufacturing advanced chips. This grants them a significant first-mover advantage.

- Technological Innovation: The company continuously invests heavily in research and development, ensuring its technological leadership in the semiconductor manufacturing equipment market.

- Essential Role in Semiconductor Production: As the primary supplier of advanced lithography systems, ASML plays a pivotal role in the global semiconductor industry's ability to produce cutting-edge chips.

Scalability and Global Expansion Potential:

ASML's market position and technological leadership ensure impressive scalability and global expansion.

- Growing Demand for Advanced Chips: The increasing demand for advanced chips across various industries, from smartphones to artificial intelligence, fuels ASML's growth.

- Strategic Partnerships: Collaborations with leading semiconductor manufacturers provide ASML with access to crucial markets and technologies.

- Global Reach: The company has a significant global presence, serving major semiconductor manufacturers worldwide.

Investment Risks and Mitigation Strategies:

Investing in ASML also carries some inherent risks:

- Geopolitical Risks: Geopolitical tensions and trade disputes could impact ASML's operations and supply chains.

- Technological Disruption: The emergence of entirely new chip manufacturing technologies could potentially disrupt ASML's dominance.

However, diversification of investment portfolio and continuous monitoring of geopolitical landscapes can mitigate these risks.

Conclusion:

This analysis suggests that Nvidia and ASML Holding present compelling investment opportunities with the potential to outperform Palantir over the next three years. Their strong financial performance, innovative technologies, and strategic positioning in their respective markets contribute to their promising outlook. However, investors should always conduct thorough due diligence and consider their risk tolerance before making any investment decisions. Remember, stock market prediction is not an exact science, and past performance is not indicative of future results.

Call to Action: Ready to explore alternative investment options with the potential to outperform Palantir? Start your research on Nvidia and ASML Holding today and make informed decisions based on your own investment strategy. Remember, thorough research is crucial for successful stock market prediction and investment.

Featured Posts

-

Three Actions To Show Allyship On International Transgender Day Of Visibility

May 10, 2025

Three Actions To Show Allyship On International Transgender Day Of Visibility

May 10, 2025 -

Stephen King 5 Books Every Fan Should Own

May 10, 2025

Stephen King 5 Books Every Fan Should Own

May 10, 2025 -

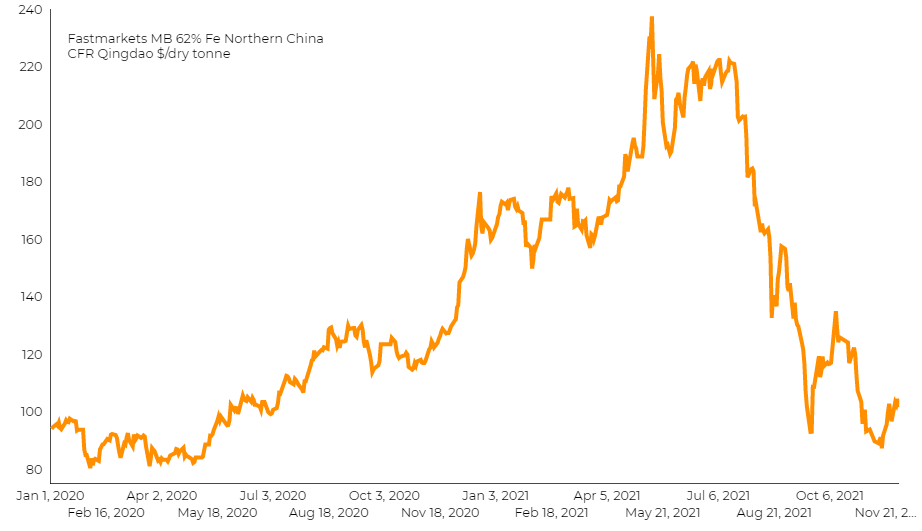

Iron Ore Falls As China Curbs Steel Output Market Impact Analysis

May 10, 2025

Iron Ore Falls As China Curbs Steel Output Market Impact Analysis

May 10, 2025 -

Senate Democrats Accusation Pam Bondi And Hidden Epstein Records

May 10, 2025

Senate Democrats Accusation Pam Bondi And Hidden Epstein Records

May 10, 2025 -

Democratizing Stock Investments The Jazz Cash K Trade Partnership

May 10, 2025

Democratizing Stock Investments The Jazz Cash K Trade Partnership

May 10, 2025