Stock Market Today: Dow Futures Up, Gold Surges To $3,500 Amid Tariff And Fed Concerns

Table of Contents

Dow Futures and Stock Market Indices

Positive Movement in Dow Futures

Dow futures saw a surprising increase of 1.5% this morning, suggesting a potential positive opening for the overall stock market. This unexpected rise could be attributed to several factors:

- Positive Economic Data: Recent releases of better-than-expected economic indicators may have boosted investor confidence.

- Strong Corporate Earnings Reports: Several major corporations reported exceeding expectations in their latest earnings releases, influencing positive market sentiment.

- Easing Trade Tensions (Speculation): Although tariff concerns remain, there's been some speculation about potential de-escalation in trade disputes, influencing short-term investor optimism.

This positive movement in Dow futures, however, doesn't tell the whole story. While the Dow Jones Industrial Average futures point towards a potential upward trend, we must consider the performance of other major indices.

Performance of Other Major Indices

While Dow futures showed a positive trend, the S&P 500 and Nasdaq futures showed more muted responses, indicating a less uniform market reaction. The S&P 500 futures saw a modest increase of 0.8%, while Nasdaq futures remained relatively flat. This discrepancy could be due to the sector-specific impact of the various factors influencing the market today. For example, technology stocks, heavily weighted in the Nasdaq, may be more susceptible to concerns about global trade and the impact of tariffs on the tech sector.

Gold's Record Surge to $3,500

Factors Driving Gold Prices

Gold prices reaching $3,500 represents a historic high, fueled by a confluence of factors:

- Safe-Haven Demand: Amidst the uncertainty surrounding tariffs and the Federal Reserve's upcoming decisions, investors are flocking to gold as a traditional safe-haven asset.

- Inflation Fears: Concerns about rising inflation due to ongoing trade disputes and potential economic consequences are driving demand for gold as an inflation hedge.

- Weakening Dollar: A weakening US dollar against other major currencies makes gold, priced in dollars, more attractive to international investors.

- Geopolitical Instability: Ongoing geopolitical tensions worldwide further contribute to the perception of risk, boosting gold's appeal.

The $3,500 price point is historically significant and reflects a considerable shift in investor sentiment, indicating a substantial flight to safety.

Implications for Investors

This gold price surge has significant implications for various investor profiles:

- Gold Holders: Existing gold investors are experiencing substantial gains, benefiting from the increased value of their assets.

- Potential Gold Investors: The current price surge may present both an opportunity and a cautionary note. While the price is high, the underlying factors driving this increase suggest potential for further growth, but also the risk of a correction.

- Investors in Other Assets: Investors heavily invested in other asset classes might consider diversifying their portfolios to mitigate risk, given the current market volatility.

Impact of Tariffs and Trade Wars

Current Tariff Situation

The ongoing trade disputes, particularly the tariffs imposed between major economic powers, continue to cast a long shadow over global markets. These tariffs create uncertainty and significantly impact various sectors, leading to price increases and supply chain disruptions.

- Impact on Specific Sectors: Industries heavily reliant on international trade, such as manufacturing and agriculture, are particularly vulnerable to the negative effects of tariffs.

- Retaliatory Measures: The ongoing back-and-forth imposition of tariffs creates a cycle of retaliatory measures, exacerbating the negative impact on global trade.

The current tariff situation remains a significant source of uncertainty and volatility in the stock market today.

Anticipated Effects on the Economy

The protracted nature of these trade conflicts could lead to several long-term economic consequences, including:

- Reduced Global Economic Growth: Disrupted supply chains and decreased consumer spending could significantly hinder global economic growth.

- Increased Inflation: Tariffs increase the cost of imported goods, which can lead to higher prices for consumers.

- Job Losses: Businesses affected by tariffs may be forced to cut jobs or relocate operations.

The Federal Reserve's Role and Impact

Fed Policy Expectations

The market is closely watching the Federal Reserve's upcoming policy decisions. Expectations are varied, with some anticipating interest rate cuts to stimulate economic growth and offset the impact of tariffs, while others believe the Fed may maintain its current course.

- Potential Interest Rate Cuts: Lower interest rates could potentially boost economic activity but might also fuel inflation.

- Quantitative Easing: The possibility of renewed quantitative easing (QE) programs is also being discussed, though the market is uncertain about the likelihood of such a move.

The Federal Reserve's actions will have a profound influence on market direction.

Market Reaction to Fed Actions

Historically, the market has reacted differently to various Fed decisions. Rate cuts have generally been met with optimism, while unexpected policy shifts have often caused increased volatility. The market's response to the upcoming Fed decisions will be highly dependent on the specific actions taken and the accompanying communication from the Federal Reserve.

Conclusion

Today's stock market witnessed a complex interplay of factors. The rise in Dow futures offered a glimmer of optimism, but this was countered by the record surge in gold prices to $3,500, driven largely by escalating tariff concerns and anticipation surrounding Federal Reserve policy decisions. The volatility underscores the interconnectedness of these global economic forces.

Key Takeaways: The current market environment is characterized by significant uncertainty, driven primarily by trade disputes and the anticipated actions of the Federal Reserve. Gold's surge highlights investor anxieties, while the Dow futures' rise offers a more nuanced picture of market sentiment.

Call to Action: Stay ahead of the curve by regularly checking our website for the latest updates on the stock market today and make informed decisions for your portfolio. Understanding the complex interplay of global events and their impact on today's stock market is crucial for navigating these volatile times. Consider diversifying your investments and seeking professional financial advice to make informed decisions about your financial future.

Featured Posts

-

Twins Broadcaster Cory Provus Pays Tribute To Bob Uecker

Apr 23, 2025

Twins Broadcaster Cory Provus Pays Tribute To Bob Uecker

Apr 23, 2025 -

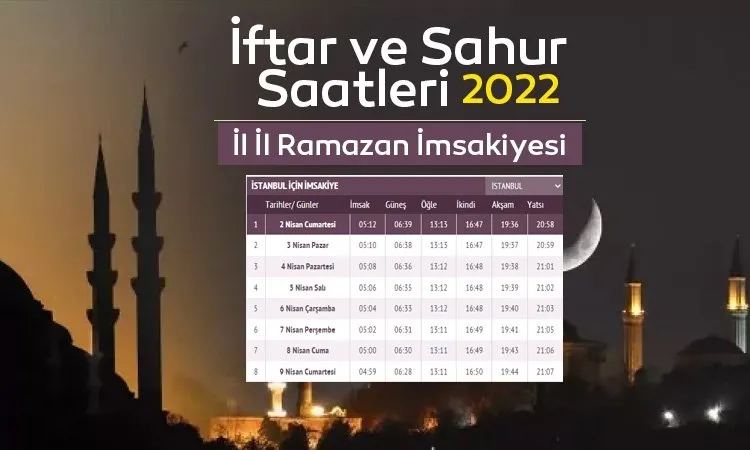

10 Mart 2025 Pazartesi Ankara Iftar Ve Sahur Saatleri Ne Zaman

Apr 23, 2025

10 Mart 2025 Pazartesi Ankara Iftar Ve Sahur Saatleri Ne Zaman

Apr 23, 2025 -

Jackson Chourios Two Home Runs Power Brewers 8 2 Victory Over Reds

Apr 23, 2025

Jackson Chourios Two Home Runs Power Brewers 8 2 Victory Over Reds

Apr 23, 2025 -

Massive Office365 Data Breach Results In Millions For Hacker

Apr 23, 2025

Massive Office365 Data Breach Results In Millions For Hacker

Apr 23, 2025 -

Triunfo De Rayadas Burky Anota Dos Goles

Apr 23, 2025

Triunfo De Rayadas Burky Anota Dos Goles

Apr 23, 2025