Stock Market Valuation Concerns: A Balanced Perspective From BofA

Table of Contents

BofA's Stance on Current Market Valuations

BofA's market outlook is constantly evolving, and understanding their assessment of current market valuations is crucial for investors. Their analysis provides a valuable perspective on the complexities of the financial markets.

-

Summary of BofA's Recent Reports: BofA regularly publishes reports on market valuations, offering insights into various sectors and asset classes. (Note: To provide the most up-to-date information, specific reports and their findings should be cited here, referencing dates and titles of publications. For example, "In their Q3 2024 report, 'Navigating Market Volatility,' BofA highlighted..." ). These reports often incorporate data on key market indicators and provide predictions for future market performance.

-

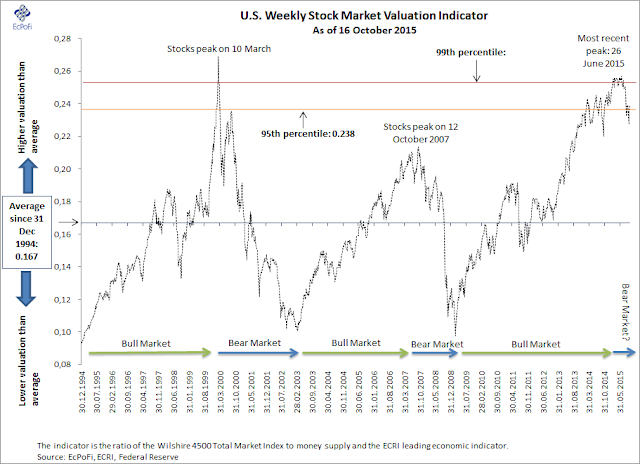

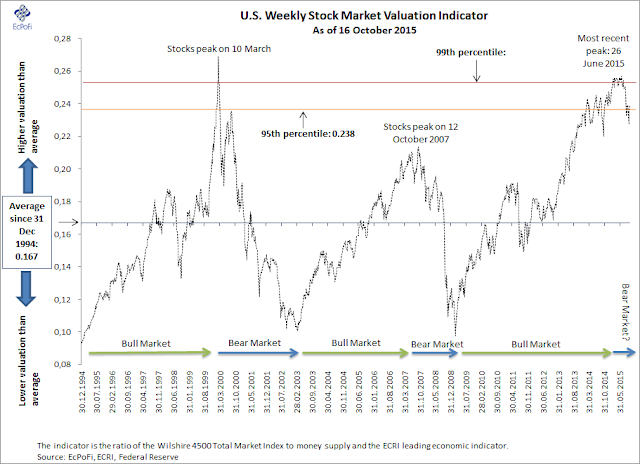

Methodology: BofA employs a multifaceted approach to assess valuations, drawing upon several established methods. This includes fundamental analysis such as examining price-to-earnings ratios (P/E ratios) and discounted cash flow (DCF) analysis. They also incorporate macroeconomic factors and investor sentiment into their overall valuation assessment. Understanding their methodology enhances the credibility and context of their conclusions.

-

Sector-Specific Analysis: BofA's analysis often identifies specific sectors that are considered overvalued or undervalued relative to their intrinsic worth. For example, (insert specific examples from recent BofA reports, if available, e.g., "BofA may suggest the technology sector is currently overvalued due to high P/E ratios compared to historical averages, while the energy sector may be undervalued given current market conditions"). This granular view helps investors make informed decisions regarding sector allocation within their portfolios.

-

Caveats and Limitations: It's crucial to acknowledge any limitations or caveats associated with BofA's analysis. Market conditions are constantly changing, and even the most sophisticated models have inherent uncertainties. BofA's reports typically include disclaimers highlighting these limitations, emphasizing the importance of independent research and risk assessment.

Factors Influencing Stock Market Valuations

Several interconnected factors significantly influence stock market valuations. Understanding these factors is vital for navigating market uncertainty and making informed investment decisions.

-

Interest Rates: Interest rate hikes by central banks, like the Federal Reserve, directly impact stock valuations. Higher interest rates increase borrowing costs for companies, potentially reducing profitability and slowing economic growth, leading to lower stock prices. Conversely, lower interest rates can stimulate economic activity and boost stock valuations.

-

Inflation: Inflation erodes the purchasing power of money and affects future corporate earnings. High inflation often leads to higher interest rates, creating a double whammy for stock valuations. BofA's analysis incorporates inflation expectations and their impact on discounted future cash flows.

-

Economic Growth: Strong economic growth typically leads to higher corporate earnings and increased investor confidence, boosting stock valuations. Conversely, economic slowdowns or recessions can significantly impact market performance and lead to lower valuations. BofA assesses the overall economic outlook to gauge its effect on stock prices.

-

Geopolitical Risk: Geopolitical events like wars, trade disputes, and political instability create uncertainty in the market, impacting investor confidence and valuations. BofA's analysis incorporates geopolitical risks and their potential impact on various sectors and the market as a whole.

-

Corporate Earnings: Corporate earnings reports are a crucial driver of stock valuations. Strong earnings generally support higher stock prices, while disappointing earnings can lead to price declines. BofA's valuation models incorporate earnings expectations and their impact on future growth prospects.

-

Investor Sentiment: Investor sentiment, or the overall mood of the market, plays a significant role in determining market volatility and valuation multiples. Periods of high optimism can lead to inflated valuations, while periods of pessimism can drive prices down. BofA's analysis considers investor sentiment as a key factor in their overall valuation assessment.

Strategies for Managing Stock Market Valuation Risks

Managing risk effectively is crucial in navigating the complexities of stock market valuation. Employing a balanced strategy can help mitigate potential downsides.

-

Portfolio Diversification: Diversifying across different asset classes (stocks, bonds, real estate, commodities) is essential to reduce overall portfolio risk. This approach helps mitigate losses in one sector by offsetting gains in another.

-

Risk Management: Implementing risk management strategies, such as hedging techniques, can help protect your portfolio from significant losses during market downturns.

-

Asset Allocation: Asset allocation involves strategically distributing your investment portfolio across different asset classes based on your risk tolerance and investment goals. A well-defined asset allocation strategy can significantly improve the long-term performance of your portfolio.

-

Long-Term Investment Strategy: Adopting a long-term investment strategy, focusing on the long-term growth potential of your investments, can help you weather short-term market fluctuations and valuation concerns.

-

Defensive Investing: Defensive investing strategies involve focusing on companies with stable earnings and low volatility, which can provide a degree of protection during market downturns.

-

Regular Portfolio Review: Regularly reviewing and rebalancing your portfolio ensures it remains aligned with your investment goals and risk tolerance. This allows you to adapt to changing market conditions and manage risk effectively.

The Role of Long-Term Investing in Navigating Valuation Concerns

Long-term investing is a crucial element in mitigating the impact of short-term valuation fluctuations.

-

Mitigating Short-Term Fluctuations: A long-term investment horizon allows you to ride out short-term market corrections and focus on the long-term growth potential of your investments. Short-term volatility becomes less significant when viewed within a longer timeframe.

-

Investment Styles: Different long-term investment styles exist, such as value investing (buying undervalued assets) and growth investing (buying companies with high growth potential). Choosing the appropriate style depends on your risk tolerance and investment goals.

-

Patience and Discipline: Long-term investing requires patience and discipline. It’s essential to avoid making impulsive decisions based on short-term market movements. Sticking to your investment strategy through market fluctuations is key to success.

Conclusion

BofA's perspective on current stock market valuation concerns reveals a complex interplay of factors—interest rates, inflation, economic growth, and geopolitical events all play significant roles. While some sectors may appear overvalued, a balanced approach is crucial. This involves incorporating diversification, robust risk management strategies, and, most importantly, adopting a long-term investment strategy. Don't let short-term market volatility derail your long-term financial goals.

Call to Action: Understanding stock market valuation concerns is vital for making informed investment decisions. Stay informed on BofA's ongoing analysis and adjust your investment strategy accordingly to navigate the complexities of the market. Learn more about BofA's market insights and develop a robust strategy to effectively address your stock market valuation concerns.

Featured Posts

-

Trumps Oil Price Preference Goldman Sachs Analyzes Social Media Posts

May 16, 2025

Trumps Oil Price Preference Goldman Sachs Analyzes Social Media Posts

May 16, 2025 -

Paddy Pimblett Addresses Criticism Following Successful Ufc 314 Fight Against Chandler

May 16, 2025

Paddy Pimblett Addresses Criticism Following Successful Ufc 314 Fight Against Chandler

May 16, 2025 -

Everton Vina Coquimbo Unido 0 0 Analisis Del Partido Y Resumen

May 16, 2025

Everton Vina Coquimbo Unido 0 0 Analisis Del Partido Y Resumen

May 16, 2025 -

High Bids Mark Kid Cudis Personal Items Auction

May 16, 2025

High Bids Mark Kid Cudis Personal Items Auction

May 16, 2025 -

Good News For Celtics Tatums X Rays Negative Following Flagrant Foul In 2025 Playoffs

May 16, 2025

Good News For Celtics Tatums X Rays Negative Following Flagrant Foul In 2025 Playoffs

May 16, 2025