Stock Market Valuation Concerns: BofA Offers A Reason For Calm

Table of Contents

BofA's Key Arguments for a Less Bearish Outlook

BofA's analysis presents a more optimistic market outlook than some of its counterparts. Their core arguments center around several key factors impacting stock market predictions and the overall economic forecast. While acknowledging the risks, BofA points to underlying strengths suggesting the current market isn't as overvalued as some fear.

-

Inflation Outlook: BofA acknowledges current inflation remains elevated but forecasts a gradual decline throughout the year. They believe the Federal Reserve's monetary policy tightening, alongside easing supply chain pressures, will contribute to this cooling. This, in turn, should alleviate pressure on corporate profit margins and support stock market valuation.

-

Corporate Earnings Growth: Despite potential economic slowdowns, BofA projects robust corporate earnings growth in specific sectors. Their analysis suggests companies are demonstrating resilience, effectively managing costs, and maintaining healthy profit margins even in a challenging environment. This positive economic forecast underpins their less bearish stock market predictions.

-

Resilient Sectors: BofA identifies several sectors, particularly technology and healthcare, as particularly well-positioned to withstand economic headwinds and continue to experience growth. This sector-specific resilience mitigates some of the broader stock market valuation concerns.

-

Geopolitical Risk Assessment: While acknowledging the ongoing geopolitical uncertainties, BofA's assessment suggests that markets have largely priced in many of these risks. Unexpected escalations remain a possibility, but they aren't factoring in significant new negative developments at this time.

Addressing Common Stock Market Valuation Concerns

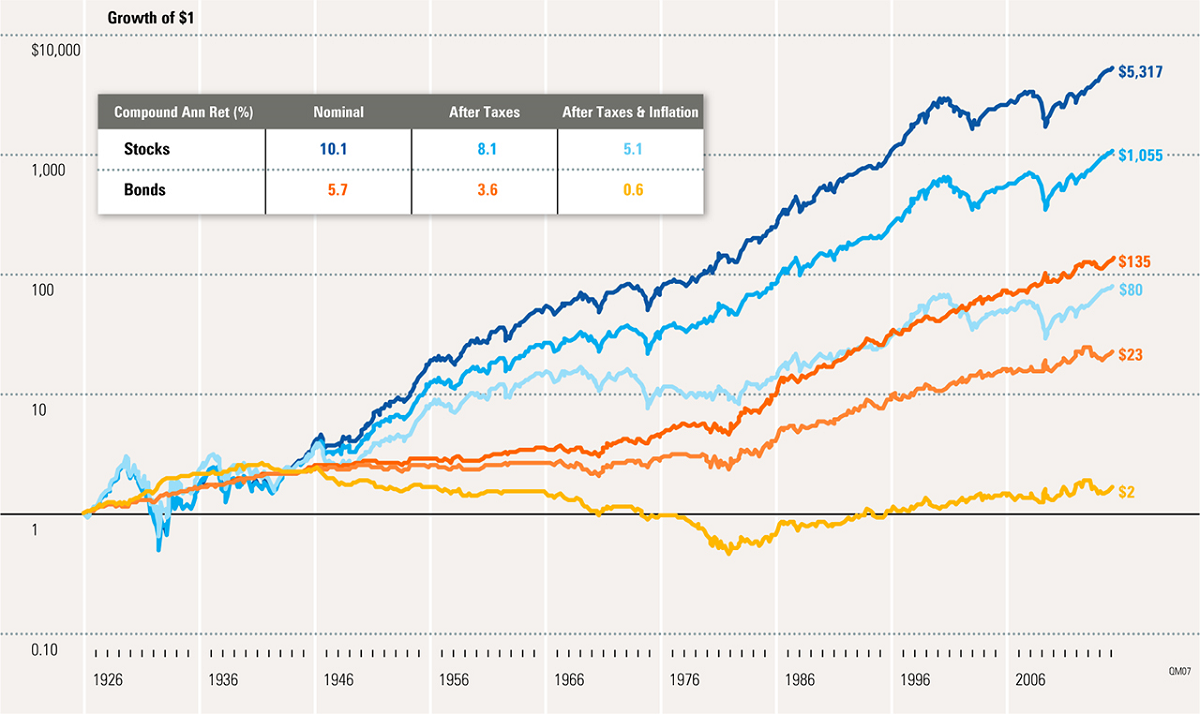

High price-to-earnings ratios (P/E) and elevated market capitalization are frequently cited as reasons for concern regarding current stock market valuation. Many investors worry about the potential for a significant market correction.

-

Valuation Metrics: BofA addresses these concerns by comparing current valuation multiples to historical averages, acknowledging that some metrics appear high. However, they argue that strong earnings growth and low interest rates (relatively speaking) can justify higher valuations in certain sectors.

-

Interest Rates: BofA notes the significant impact of interest rates on stock valuations. While rising rates typically put downward pressure on valuations, they contend that the current rate environment, while higher than recent years, remains supportive of continued growth.

-

Potential Economic Slowdown: The bank acknowledges the risk of an economic slowdown, emphasizing that a recession isn't their base-case scenario. However, they admit a mild slowdown could impact earnings growth and, subsequently, valuations. They maintain, however, that the impact would likely be short-term.

-

Diversification: BofA consistently stresses the importance of portfolio diversification to manage risk. A well-diversified portfolio can reduce the impact of any single sector or market downturn.

The Importance of Long-Term Investment Strategies

Assessing stock market valuation requires a long-term perspective. Short-term market volatility should not dictate long-term investment decisions. Focusing on a long-term horizon allows investors to ride out temporary fluctuations.

-

Investment Strategies: Investors should tailor their investment strategy to their individual risk tolerance and investment horizon. Options range from conservative passive investing to more aggressive active investing.

-

Dollar-Cost Averaging: Dollar-cost averaging, a strategy involving consistent investments regardless of market fluctuations, is highlighted as a useful tool for mitigating risk and achieving long-term growth.

-

Diversification: Again, a well-diversified portfolio spread across asset classes minimizes risk and maximizes potential returns over the long term.

Beyond BofA's View: Other Factors to Consider

While BofA's analysis provides valuable insights, it's crucial to remember that it's just one perspective. A comprehensive understanding of stock market valuation requires considering various factors.

-

Economic Indicators: Investors should monitor other key economic indicators, such as unemployment rates, consumer spending, and manufacturing output, to gauge the overall health of the economy.

-

Alternative Perspectives: It's advisable to consult the analyses of other prominent financial institutions and economists to gain a broader understanding of the market outlook. Different firms may have different market analysis and interpretations.

-

Independent Research: Ultimately, responsible investing involves conducting your own thorough research and understanding your own risk tolerance.

Conclusion

While stock market valuation concerns are valid, BofA's analysis offers a more measured perspective, highlighting potential for growth despite current market volatility. By understanding the arguments presented and considering other relevant factors, including consulting other analyses and conducting independent research, investors can develop a more informed investment strategy. Remember, a long-term approach and a diversified portfolio are crucial for navigating market fluctuations and mitigating the risks associated with high stock market valuations. Don't let short-term market anxieties derail your long-term financial success. Stay informed about stock market valuation trends and consult with a financial advisor to create a personalized investment strategy that aligns with your risk tolerance and financial goals.

Featured Posts

-

Uber Kenya Boosts Customer Loyalty With Cashback Increases Driver And Courier Earnings

May 17, 2025

Uber Kenya Boosts Customer Loyalty With Cashback Increases Driver And Courier Earnings

May 17, 2025 -

Best Bitcoin Casinos For 2025 Easy Withdrawals Top Games And Exclusive Bonuses Revealed

May 17, 2025

Best Bitcoin Casinos For 2025 Easy Withdrawals Top Games And Exclusive Bonuses Revealed

May 17, 2025 -

Ontario Faces 14 6 Billion Deficit Analysis Of Tariff Effects

May 17, 2025

Ontario Faces 14 6 Billion Deficit Analysis Of Tariff Effects

May 17, 2025 -

Tony Bennett His Collaborations And Impact On Music

May 17, 2025

Tony Bennett His Collaborations And Impact On Music

May 17, 2025 -

Apple Tv Special Offer 3 Months Of Streaming For 3

May 17, 2025

Apple Tv Special Offer 3 Months Of Streaming For 3

May 17, 2025