Stock Market Valuation Concerns? BofA Offers Reassurance

Table of Contents

BofA's Key Arguments for a Less Ominous Market Outlook

BofA's analysis counters the prevailing pessimism surrounding current stock market valuations. Their core argument rests on a combination of valuation metrics, economic indicators, and an assessment of potential risks.

-

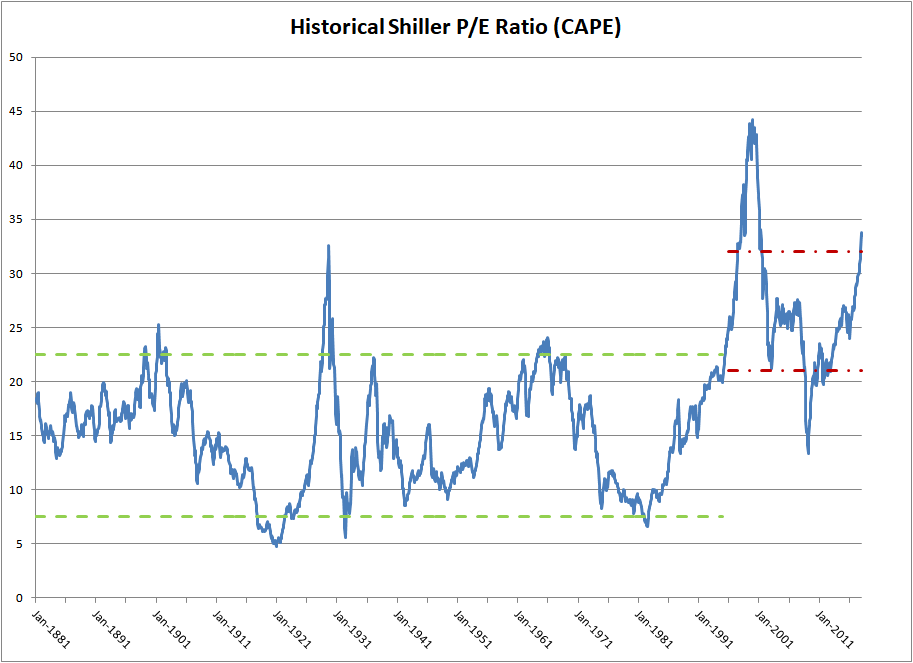

Valuation Metrics: BofA's analysis doesn't solely rely on one metric. They consider a range, including the Price-to-Earnings (P/E) ratio and the cyclically adjusted price-to-earnings ratio (Shiller PE), acknowledging the limitations of any single indicator. They contend that while valuations are not historically cheap, they aren't excessively overvalued either, considering the broader economic context.

-

Economic Indicators: BofA points to continued corporate earnings growth, albeit at a potentially slower pace, as a key factor supporting their outlook. Furthermore, their inflation projections, while acknowledging persistent inflationary pressures, suggest a gradual moderation, benefiting corporate profitability and ultimately stock valuations. They also consider the impact of interest rate hikes and their effect on the economy and market sentiment.

-

Interest Rate Impacts: While acknowledging the impact of rising interest rates on borrowing costs and potentially slowing economic growth, BofA emphasizes that these increases are partly a response to a strong economy and that the current rate environment is not necessarily indicative of an impending recession. They argue that current valuations already reflect many of these concerns, resulting in a more balanced perspective on the risks.

-

Addressing Counterarguments: BofA acknowledges the potential for further market corrections and geopolitical risks. However, their analysis suggests that these risks are already partially priced into the market, thus tempering the overall negative outlook.

Understanding the Factors Driving BofA's Reassurance

BofA's optimistic outlook is underpinned by several key factors:

-

Technological Advancements: BofA highlights the transformative power of technological innovation, suggesting that long-term growth prospects remain robust despite short-term headwinds. This technological disruption, from AI to renewable energy, promises sustained innovation and market expansion.

-

Robust Corporate Balance Sheets: Many corporations boast strong balance sheets, capable of weathering potential economic slowdowns. This financial resilience is seen as a buffer against potential market shocks. Their ability to manage debt and maintain profitability is considered a stabilizing force.

-

Potential for Market Corrections: BofA acknowledges the possibility of further market corrections, viewing them as a natural part of the market cycle. They emphasize that such corrections present opportunities for strategic investors to acquire undervalued assets.

-

Geopolitical Factors: While acknowledging the uncertainty associated with geopolitical events, BofA assesses that many such risks are already factored into current stock market valuations. They emphasize the importance of ongoing monitoring and adapting strategies as situations evolve.

Practical Implications for Investors Based on BofA's Analysis

BofA's analysis suggests a measured approach for investors:

-

Investment Strategies: BofA's outlook might encourage a focus on long-term growth opportunities. Sector-specific analysis is crucial, with opportunities potentially emerging in technology, healthcare, and renewable energy, based on the factors previously discussed.

-

Diversification: BofA's message underscores the importance of diversification across different asset classes and sectors to mitigate risk. A balanced portfolio, accounting for both growth and stability, is recommended.

-

Risk Management: Despite BofA's reassurance, risk management remains paramount. Investors should carefully assess their individual risk tolerance and financial goals before making any investment decisions.

-

Personal Financial Goals: The implications of BofA's analysis should be viewed within the context of individual financial objectives. Long-term investors might find the current market environment less alarming than those with shorter time horizons.

Conclusion

BofA's analysis provides a degree of reassurance regarding current stock market valuation concerns, highlighting the importance of considering a range of valuation metrics, economic indicators, and potential risks. While acknowledging the possibility of further market corrections, their overall message emphasizes the importance of long-term perspectives and strategic investment choices. Remember, assess your stock market valuations carefully, understand BofA's reassurance within the context of your personal risk tolerance, and manage your stock market investments wisely. Conduct further research, consult with a qualified financial advisor, and make informed decisions based on a comprehensive understanding of your financial goals and the current market landscape.

Featured Posts

-

Databricks India Expansion Hundreds Of Ai Jobs Created

Apr 25, 2025

Databricks India Expansion Hundreds Of Ai Jobs Created

Apr 25, 2025 -

Cowboys Draft Insiders Shocking List Of Potential Picks

Apr 25, 2025

Cowboys Draft Insiders Shocking List Of Potential Picks

Apr 25, 2025 -

Caso Arrayanes Familia Recibe Oferta De G 1 250 Millones Tras Homicidio

Apr 25, 2025

Caso Arrayanes Familia Recibe Oferta De G 1 250 Millones Tras Homicidio

Apr 25, 2025 -

Cool Sculpting Side Effects Linda Evangelistas Story Of Recovery From A Botched Procedure

Apr 25, 2025

Cool Sculpting Side Effects Linda Evangelistas Story Of Recovery From A Botched Procedure

Apr 25, 2025 -

High Stock Market Valuations Bof As Analysis And Investor Guidance

Apr 25, 2025

High Stock Market Valuations Bof As Analysis And Investor Guidance

Apr 25, 2025