Stock Market Valuation Concerns: BofA's Perspective And Recommendations

Table of Contents

BofA's Assessment of Current Market Valuations

BofA's analysis paints a complex picture of the current market, highlighting several key areas of concern regarding stock market valuations.

Elevated Price-to-Earnings Ratios

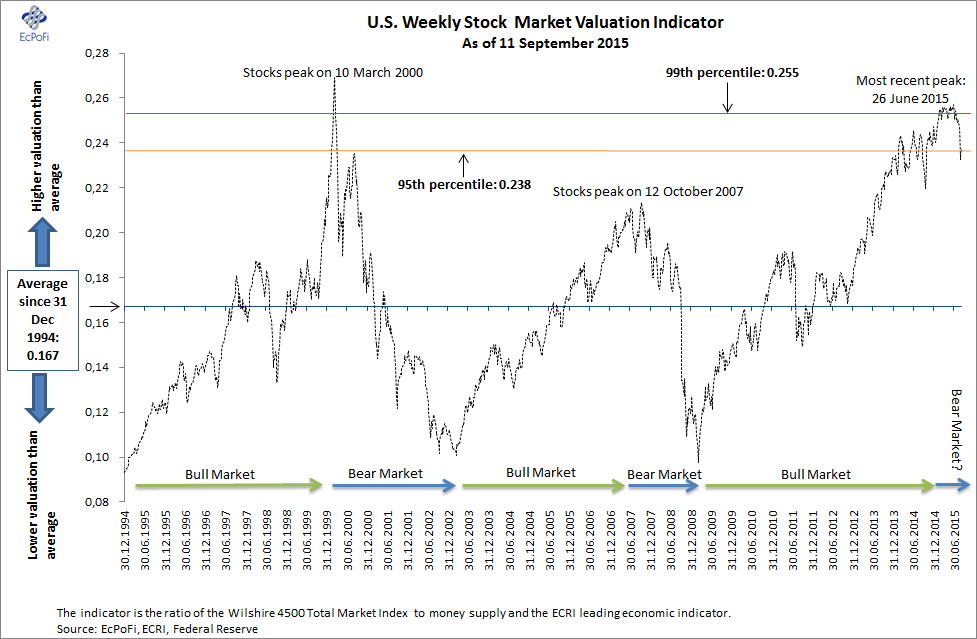

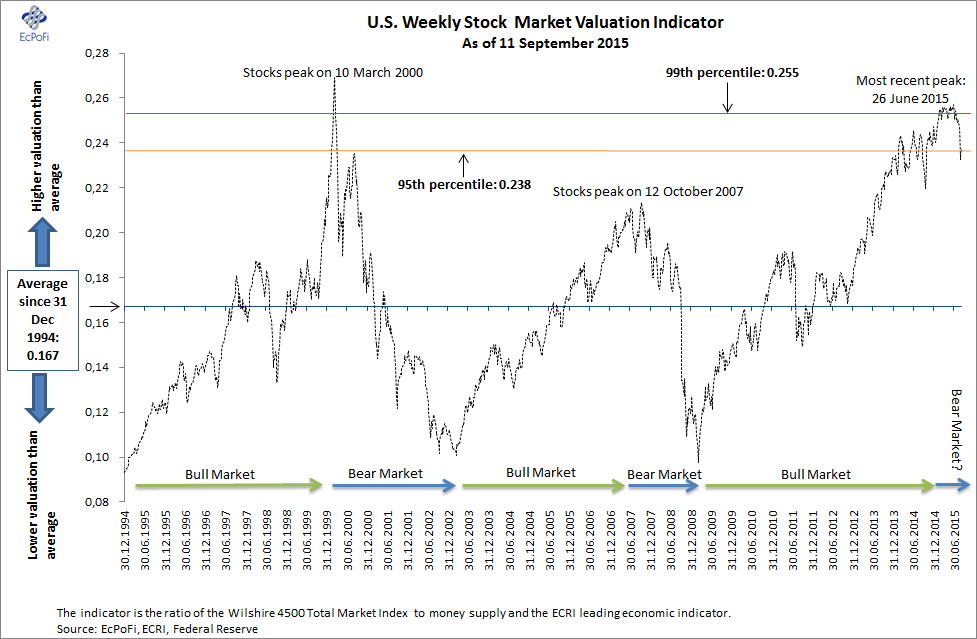

One of BofA's primary concerns revolves around elevated price-to-earnings (P/E) ratios. Many sectors and indices are showing P/E ratios significantly higher than historical averages. This suggests that stocks may be priced at a premium relative to their earnings potential.

- Specific examples: Certain technology stocks and growth companies exhibit exceptionally high P/E ratios, reflecting investor optimism about future growth. However, these valuations are vulnerable if growth expectations fail to materialize.

- Comparison to historical averages: A comparison of current P/E ratios with historical averages across major indices reveals a notable divergence, indicating a potentially overvalued market compared to past trends.

- Potential implications: High P/E ratios increase the risk of significant price corrections if earnings fail to meet expectations or if interest rates rise. This makes understanding stock market valuation metrics crucial.

Impact of Interest Rate Hikes

BofA emphasizes the significant impact of rising interest rates on stock market valuations. Higher interest rates generally lead to lower stock prices through several mechanisms.

- Inverse relationship: Higher interest rates increase the discount rate used in stock market valuation models, reducing the present value of future earnings. This makes investing in bonds, which offer a higher yield, more attractive relative to stocks.

- Discount rates: The discount rate is a critical component of valuation models. Higher interest rates directly increase this discount rate, leading to lower valuations for companies with high future earnings expectations.

- Impact on future earnings: Increased borrowing costs for companies can also negatively affect future earnings, further dampening stock valuations. The interplay between interest rates and future earnings significantly influences stock market valuation concerns.

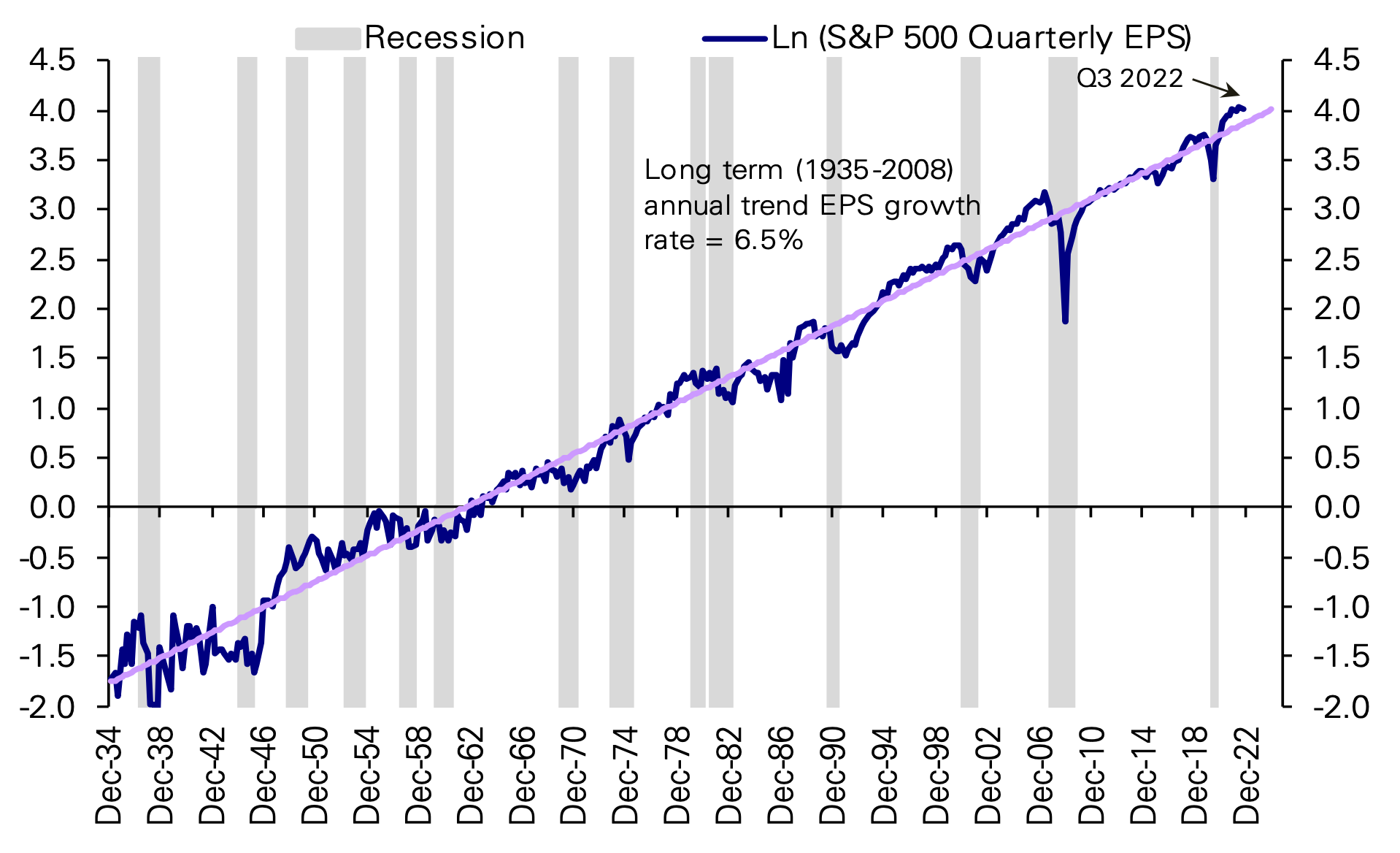

Growth Expectations vs. Reality

BofA highlights a concerning disparity between projected growth and actual corporate earnings. Many companies are struggling to meet ambitious growth targets.

- Companies failing expectations: Several high-profile companies have recently reported earnings that fell short of analyst expectations, triggering sell-offs and illustrating the challenges of maintaining elevated stock market valuations in a slowing economy.

- Potential economic slowdown: Concerns about a potential economic slowdown are further contributing to the uncertainty surrounding growth expectations and impacting investor sentiment. This uncertainty directly feeds into stock market valuation analysis.

- Impact on investor sentiment: The combination of unmet growth expectations and economic uncertainty can lead to a significant shift in investor sentiment, potentially triggering further downward pressure on stock prices.

BofA's Recommendations for Investors

Given these stock market valuation concerns, BofA offers investors several crucial recommendations to navigate the current climate.

Portfolio Diversification Strategies

BofA strongly advocates for portfolio diversification to mitigate the risks associated with overvalued sectors.

- Asset classes to consider: Diversifying across different asset classes, such as bonds, real estate, and alternative investments, can help to reduce overall portfolio volatility and protect against potential losses in the equity market.

- Risk mitigation: Diversification is a cornerstone of risk management in investing, effectively spreading risk across different asset classes and reducing the impact of any single asset's underperformance.

- Examples: A diversified portfolio might include a mix of large-cap and small-cap stocks, international equities, and fixed-income securities, adjusting the allocation according to one's risk tolerance and investment goals. This reflects best practices in stock market investment strategies.

Sector-Specific Investment Opportunities

While some sectors appear overvalued, BofA identifies others with relatively attractive valuations or strong growth potential.

- Promising sectors: BofA's analysis may highlight sectors such as energy or certain defensive sectors as potentially undervalued, offering stock market investment opportunities with better risk-reward profiles.

- Rationale: The rationale behind BofA's sector-specific recommendations is typically based on factors such as future earnings growth potential, competitive landscape, and macroeconomic trends.

- Risks and rewards: Investors should carefully assess the potential risks and rewards associated with investing in any sector, considering factors like regulatory changes, industry competition, and cyclical economic forces. Identifying undervalued stocks requires thorough due diligence.

Importance of Long-Term Investing

BofA emphasizes the importance of maintaining a long-term investing perspective despite short-term market volatility.

- Benefits of long-term approach: A long-term strategy allows investors to ride out market fluctuations and benefit from the long-term growth potential of the market. This strategy is often referred to as a buy and hold strategy.

- Managing volatility: Strategies for managing volatility include regular rebalancing and avoiding emotional decision-making based on short-term market movements.

- Patience and discipline: Successful long-term investing requires patience and discipline to withstand periods of market downturn and maintain a focused investment strategy. Understanding stock market volatility and your personal risk tolerance is key to a successful long-term investing approach.

Conclusion

This article explored BofA's insights on current stock market valuation concerns, highlighting elevated P/E ratios, the impact of interest rate hikes, and the divergence between projected growth and actual earnings. BofA's recommendations emphasize portfolio diversification, strategic sector selection, and the importance of long-term investing to navigate this uncertain market environment. Understanding and addressing stock market valuation concerns is crucial for informed investment decisions. Stay informed about BofA's ongoing analysis and adapt your investment strategy accordingly to effectively manage your portfolio in light of these ongoing stock market valuation concerns.

Featured Posts

-

Gold Market Update Back To Back Weekly Declines For 2025

May 06, 2025

Gold Market Update Back To Back Weekly Declines For 2025

May 06, 2025 -

Anadolu Ajansi Gazze Deki Kanalizasyon Krizinin Boyutlari

May 06, 2025

Anadolu Ajansi Gazze Deki Kanalizasyon Krizinin Boyutlari

May 06, 2025 -

Spike Lees Super Bowl Nod To Samuel L Jackson Revisiting A Decade Of Friendship

May 06, 2025

Spike Lees Super Bowl Nod To Samuel L Jackson Revisiting A Decade Of Friendship

May 06, 2025 -

Popovichs Spurs Future Uncertain Espn Reports Coach Unlikely To Return This Season

May 06, 2025

Popovichs Spurs Future Uncertain Espn Reports Coach Unlikely To Return This Season

May 06, 2025 -

Haciosmanoglu Nun Macaristan Ziyareti Detaylar Ve Sonuclar

May 06, 2025

Haciosmanoglu Nun Macaristan Ziyareti Detaylar Ve Sonuclar

May 06, 2025