Stock Market Valuations: BofA's Argument Against Investor Concern

Table of Contents

BofA's Key Arguments Against Overvaluation

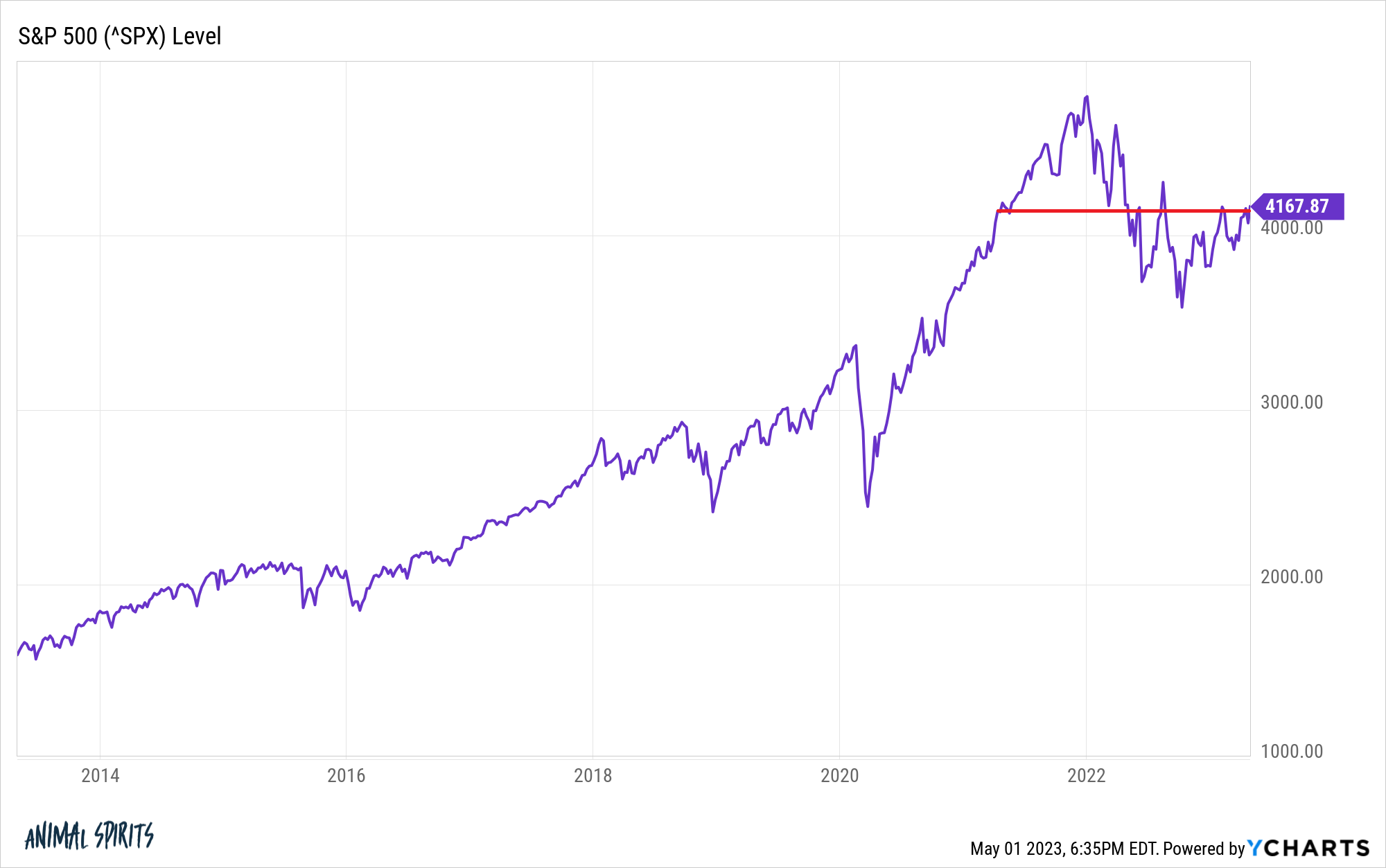

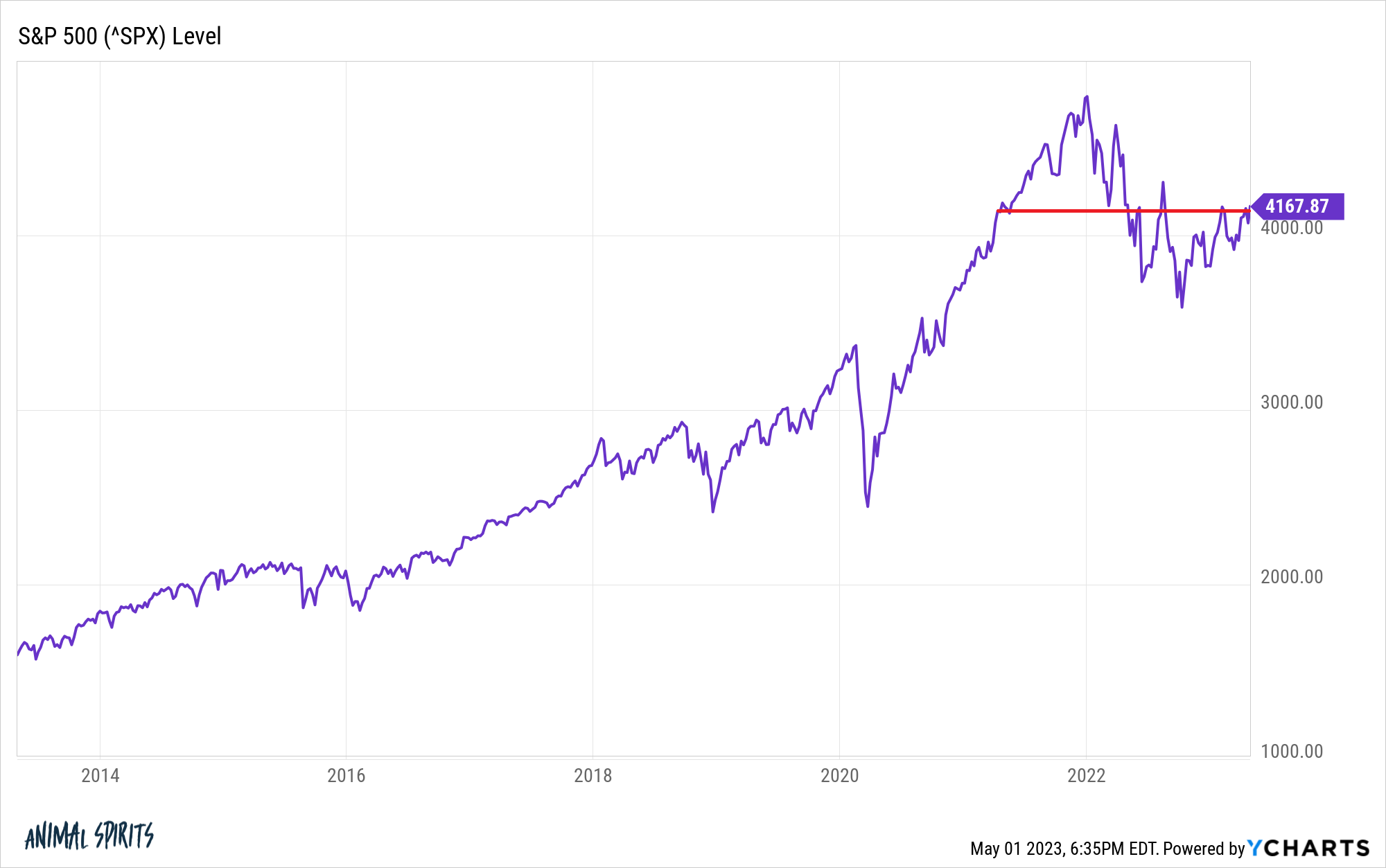

BofA's assessment of current stock market valuations rests on several key pillars. They argue that seemingly high valuations are justified by a confluence of factors, rather than representing an impending market crash. Let's examine their central arguments:

The Role of Low Interest Rates

Historically low interest rates play a significant role in BofA's argument. These low rates fundamentally shift the investment landscape, making equities comparatively more attractive.

- Low borrowing costs make equities more attractive relative to bonds. When bond yields are low, the relatively higher returns offered by stocks become more appealing, driving up demand and, consequently, valuations.

- Companies can reinvest profits more easily due to cheap debt, fueling growth. Access to inexpensive capital allows companies to expand operations, invest in research and development, and ultimately boost earnings, supporting higher price-to-earnings (P/E) ratios.

- This impacts valuation metrics like the Price-to-Earnings Ratio (P/E). A higher P/E ratio, often used as a valuation metric, doesn't necessarily signify overvaluation when interest rates are exceptionally low. The discounted cash flow model, a core valuation tool, is significantly impacted by the discount rate (related to interest rates). Lower discount rates lead to higher present values and thus higher valuations.

Strong Corporate Earnings Growth

BofA's analysis highlights robust corporate earnings growth as another justification for current valuations. Their projections suggest continued earnings expansion, supporting the current market levels.

- Discussion of specific sectors driving earnings growth. BofA likely points to specific sectors, such as technology or healthcare, experiencing particularly strong growth, contributing significantly to overall earnings.

- Analysis of earnings revisions and forward-looking estimates. BofA's argument will likely incorporate analyses of upward revisions to earnings estimates, indicating continued confidence in corporate profitability.

- Comparison of current earnings growth to historical trends. The bank likely benchmarks current growth against historical averages to demonstrate its strength and sustainability within a broader economic context.

The Impact of Inflation and its Management by Central Banks

Inflation is a crucial factor influencing stock valuations. BofA's assessment likely considers the current inflationary environment and the actions taken by central banks to manage it.

- How central bank actions influence inflation expectations and market sentiment. Central bank policies, such as interest rate adjustments, significantly impact inflation expectations and overall market sentiment, directly affecting stock valuations.

- Analysis of inflation's potential impact on corporate profitability. BofA's analysis would assess how inflation might affect corporate profitability, considering factors like rising input costs and consumer spending habits.

- Discussion of potential scenarios and their effects on stock valuations. A comprehensive analysis would include various inflationary scenarios and their likely impact on different sectors and overall market valuations.

Counterarguments and Potential Risks

While BofA presents a compelling case, it's essential to acknowledge potential counterarguments and risks. A balanced perspective is crucial for informed investment decisions.

Addressing Criticisms of BofA's Analysis

Several criticisms could be leveled against BofA's optimistic outlook. It is important to consider these alternative viewpoints.

- Discussion of potential overestimation of earnings growth. Critics might argue that BofA's earnings growth projections are overly optimistic and may not fully account for potential economic slowdowns or unforeseen events.

- Analysis of potential risks related to interest rate hikes and inflation. Even if current interest rates are low, potential future hikes could negatively impact stock valuations, altering the attractiveness of equities relative to bonds. Uncontrolled inflation poses a considerable risk to corporate profits and market stability.

- Addressing concerns about specific valuation metrics like the Shiller P/E ratio. The cyclically adjusted price-to-earnings ratio (CAPE or Shiller P/E ratio) considers long-term earnings averages to provide a smoother picture of valuation. BofA’s argument needs to address why this, and other, metrics might not signal overvaluation.

Factors to Consider Before Investing Based on BofA's Assessment

Even with BofA's insights, investors must conduct thorough due diligence and consider their personal risk tolerance.

- Emphasizes the need for diversified investment strategies. Diversification remains crucial to mitigate risk and protect against market fluctuations.

- Importance of monitoring economic indicators and market trends. Continuous monitoring of key economic indicators and market trends is vital to make well-informed decisions.

- Cautionary advice against relying solely on one analyst's viewpoint. Investors should consider multiple perspectives and conduct independent research before making investment decisions. BofA's viewpoint is only one piece of the puzzle.

Conclusion

BofA's analysis of current stock market valuations provides a compelling perspective, suggesting that concerns about overvaluation may be premature, considering factors like low interest rates and strong earnings growth projections. However, it's crucial to acknowledge potential risks, such as the possibility of overestimated earnings growth or unforeseen inflationary pressures, and conduct thorough research before making investment decisions. Don't let fear dictate your choices; instead, understand the nuances of stock market valuations and make informed decisions. Keep abreast of current market analysis and continue to monitor stock market valuations to navigate the complexities of the financial markets effectively. Understanding the arguments surrounding stock market valuations is key to successful investing.

Featured Posts

-

Analyzing Chaplins Impact On Ipswich Towns Wins

May 11, 2025

Analyzing Chaplins Impact On Ipswich Towns Wins

May 11, 2025 -

Jessica Simpson Debatten Om Ormsperma Fortsaetter

May 11, 2025

Jessica Simpson Debatten Om Ormsperma Fortsaetter

May 11, 2025 -

John Wick 4 A Critical Underdog Examining Its Rotten Tomatoes Score And Audience Reception

May 11, 2025

John Wick 4 A Critical Underdog Examining Its Rotten Tomatoes Score And Audience Reception

May 11, 2025 -

Debat M6 Un Animateur Populaire Donne Son Avis Sur L Arrivee De Cyril Hanouna

May 11, 2025

Debat M6 Un Animateur Populaire Donne Son Avis Sur L Arrivee De Cyril Hanouna

May 11, 2025 -

Lily Collins Steamy Calvin Klein Ads A Look At The Images

May 11, 2025

Lily Collins Steamy Calvin Klein Ads A Look At The Images

May 11, 2025