Student Loan Payment Problems: Protecting Your Credit Score

Table of Contents

Understanding the Impact of Missed Student Loan Payments on Your Credit

Late or missed student loan payments have significant consequences for your creditworthiness. These missed payments negatively affect your credit score, a crucial number lenders use to assess your risk. Your FICO score, the most widely used credit scoring model, will take a substantial hit, potentially impacting your ability to access credit in the future.

The repercussions extend beyond a lower score:

- Negative impact on credit reports (Equifax, Experian, TransUnion): Missed payments are recorded on your credit reports from the three major credit bureaus, remaining there for seven years.

- Increased interest rates on future loans (auto, mortgage, etc.): A lower credit score translates to higher interest rates on all types of loans, costing you significantly more money over time. This can make achieving major financial goals, such as buying a home, much harder.

- Difficulty securing credit cards or other forms of credit: Lenders will be hesitant to offer you credit if your credit score is low due to student loan payment problems. This can limit your access to essential financial tools.

- Potential wage garnishment in severe cases: While a last resort, consistent failure to make student loan payments can lead to wage garnishment, where a portion of your paycheck is directly seized to repay the debt.

Strategies for Avoiding Student Loan Payment Problems

Proactive planning is key to avoiding student loan payment problems and safeguarding your credit score. Here are several strategies to implement:

Budgeting and financial planning for loan repayments: The first step is creating a realistic budget that incorporates your student loan payments. Track your income and expenses meticulously to ensure you have enough money to meet your obligations. Consider using budgeting apps or spreadsheets to streamline this process.

Exploring income-driven repayment plans (IDR): If you're struggling to make your monthly payments, explore IDR plans offered by the federal government. These plans adjust your monthly payments based on your income and family size, making them more manageable for those facing financial hardship. Common IDR plans include IBR (Income-Based Repayment), PAYE (Pay As You Earn), and REPAYE (Revised Pay As You Earn).

Deferment and forbearance options: Deferment and forbearance temporarily postpone your student loan payments. However, it's crucial to understand that interest may still accrue during these periods, potentially increasing your overall loan balance. These options should be viewed as short-term solutions while you develop a long-term repayment strategy. They are not a solution to long-term student loan payment problems.

- Create a realistic budget that includes loan payments.

- Research and apply for suitable IDR plans (IBR, PAYE, REPAYE).

- Understand the implications of deferment and forbearance on your credit. While they may prevent immediate negative marks, they don't erase the underlying debt.

- Communicate with your loan servicer proactively. Open communication is crucial. Reach out to your servicer early if you anticipate payment difficulties. They may be able to offer solutions you haven't considered.

Recovering from Missed Student Loan Payments

Even if you've already missed student loan payments, there are steps you can take to repair your credit:

Strategies for repairing credit after missed payments: The first step is to contact your loan servicer immediately. Explain your situation and explore repayment options such as repayment plans or consolidation.

Dispute errors on credit reports: Carefully review your credit reports from Equifax, Experian, and TransUnion. If you find any errors regarding your student loan payments, dispute them immediately.

Consider credit counseling services: Non-profit credit counseling agencies can offer guidance on managing your debt and improving your financial situation. They can help you create a budget and develop a debt management plan.

- Contact your loan servicer to discuss repayment options. They may be able to work with you to create a payment plan that fits your budget.

- Review your credit reports for accuracy and dispute any errors. Incorrect information can significantly impact your credit score.

- Seek professional help from credit counselors. They can provide valuable advice and support.

- Prioritize timely payments moving forward. Consistent on-time payments are crucial for rebuilding your credit.

Preventing Future Student Loan Payment Issues

Preventing future student loan payment issues requires proactive measures:

Setting up automatic payments: Automating your student loan payments ensures you never miss a payment due to oversight. This simple step can significantly reduce your risk.

Monitoring your account regularly: Regularly check your student loan account balance and payment due date to stay informed and prevent surprises.

Creating an emergency fund: An emergency fund can provide a buffer against unexpected expenses that could otherwise lead to missed student loan payments. Aim to save 3-6 months' worth of living expenses.

- Automate loan payments to avoid late fees.

- Regularly check your account balance and payment due date.

- Establish an emergency fund to cover unexpected expenses.

- Build a strong financial safety net. This includes having a stable job, a budget, and emergency savings.

Conclusion

Navigating student loan payment problems requires proactive planning and a clear understanding of the potential impact on your credit score. By implementing the strategies outlined above, you can protect your financial health and build a strong credit future. Don't let student loan payment problems damage your credit score. Take control of your finances today! Explore income-driven repayment plans, create a budget, and communicate with your loan servicer to find solutions. Learn more about managing your student loan payments and protecting your credit.

Featured Posts

-

Top Rated Bitcoin Online Casino Jack Bit In 2025

May 17, 2025

Top Rated Bitcoin Online Casino Jack Bit In 2025

May 17, 2025 -

Top 3 Reasons To Consider The Ultraviolette Tesseract Electric Scooter

May 17, 2025

Top 3 Reasons To Consider The Ultraviolette Tesseract Electric Scooter

May 17, 2025 -

75 Million Gift To Transform Healthcare In West Valley U Of Us New Hospital Project

May 17, 2025

75 Million Gift To Transform Healthcare In West Valley U Of Us New Hospital Project

May 17, 2025 -

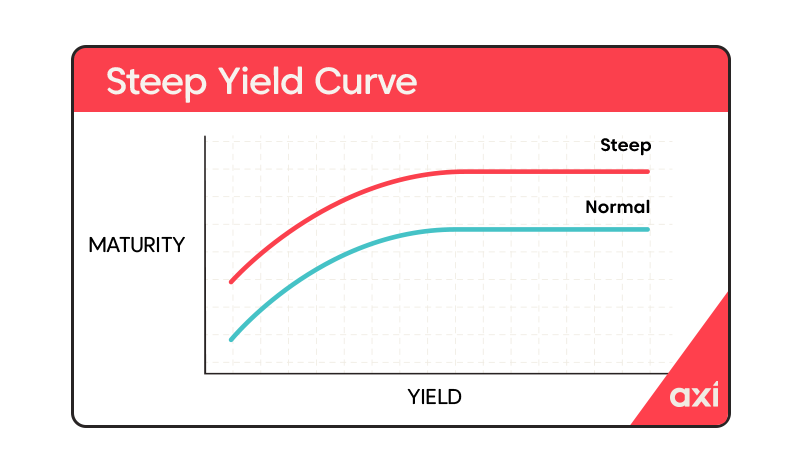

Japans Steep Bond Curve A Challenge For Monetary Policy

May 17, 2025

Japans Steep Bond Curve A Challenge For Monetary Policy

May 17, 2025 -

Wnba Rookie Advice Angel Reeses Insights For Hailey Van Lith

May 17, 2025

Wnba Rookie Advice Angel Reeses Insights For Hailey Van Lith

May 17, 2025