Taiwanese Investors' US Bond ETF Pullback: Analyzing The Recent Trend

Table of Contents

Rising US Interest Rates and Their Impact

The inverse relationship between bond prices and interest rates is a fundamental principle of finance. As the Federal Reserve (Fed) continues its aggressive interest rate hikes to combat inflation, US Treasury yields have risen considerably. This directly impacts the attractiveness of US bond ETFs for Taiwanese investors.

Higher yields mean existing bond holdings are worth less, potentially resulting in capital losses. Furthermore, the increased opportunity cost of holding lower-yielding US bonds makes alternative investments more appealing.

- Increased opportunity cost of holding US bonds: With higher yields available elsewhere, the return on US bonds becomes comparatively less attractive.

- Potential capital losses on existing holdings: Rising interest rates lead to a decrease in the market value of fixed-income securities.

- Shift towards higher-yielding alternatives: Taiwanese investors are increasingly looking towards assets offering better returns in the current environment. This includes both domestic and international alternatives.

The Strengthening US Dollar and Currency Fluctuations

The strengthening US dollar presents another challenge for Taiwanese investors in US bond ETFs. Any gains made in USD terms are reduced when converted back to Taiwanese dollars (TWD). Exchange rate volatility further complicates investment decisions, introducing an additional layer of risk.

Many Taiwanese investors employ hedging strategies to mitigate currency risk, but these strategies come with their own costs and complexities.

- Impact of USD/TWD exchange rate on overall returns: A stronger USD diminishes the returns when converted to TWD, potentially negating any gains from bond appreciation.

- Increased hedging costs: Strategies like currency forwards or options to protect against exchange rate fluctuations can be expensive.

- Diversification strategies to minimize currency risk: Diversifying into assets denominated in multiple currencies can help reduce exposure to USD fluctuations.

Geopolitical Concerns and Global Market Uncertainty

Geopolitical tensions, particularly those involving US-China relations, significantly influence investor sentiment. Global uncertainty increases risk aversion, prompting investors to shift away from riskier assets like US bonds towards safer havens. The recent market volatility has undoubtedly played a role in the Taiwanese investors' US bond ETF pullback.

- Impact of trade wars and political instability: Uncertainty surrounding international trade and political relations can deter investment in foreign assets.

- Increased risk aversion among investors: In times of uncertainty, investors tend to favor less volatile, more secure investments.

- Shift towards safer haven assets: This often involves a move towards government bonds of stable economies or other low-risk assets.

Alternative Investment Opportunities for Taiwanese Investors

The decreased appeal of US bond ETFs has led Taiwanese investors to explore alternative investment opportunities. These include:

- Taiwanese equities: Investing in the domestic stock market offers a more direct exposure to the Taiwanese economy's growth.

- Real estate: Real estate remains a popular investment option, offering potential for capital appreciation and rental income.

- Other international bonds: Investors might explore bonds issued by other countries or international organizations with higher yields and potentially less currency risk.

The relative attractiveness of these alternatives depends on risk tolerance, investment goals, and market conditions.

- Higher potential returns from alternative assets: While carrying greater risk, these alternatives can offer higher potential returns compared to currently low-yielding US bonds.

- Diversification benefits of a broader investment portfolio: Spreading investments across different asset classes mitigates overall risk.

- Considerations of risk tolerance and investment goals: Individual circumstances should guide investment choices.

Conclusion: Understanding the Taiwanese Investors' US Bond ETF Pullback and Future Outlook

The decline in Taiwanese investment in US bond ETFs is a multifaceted phenomenon driven by rising US interest rates, a strengthening US dollar, and global geopolitical uncertainty. This has led to a shift towards alternative investments offering potentially higher returns or reduced risk.

The future trajectory of Taiwanese investment in US bond ETFs remains uncertain. It will depend on future developments in interest rate policy, exchange rates, and geopolitical stability. Continued monitoring of these factors is crucial for both Taiwanese investors and those analyzing global capital flows. Further research into the Taiwanese Investors' US Bond ETF Pullback is crucial for making informed investment decisions and adapting portfolio strategies accordingly.

Featured Posts

-

Rogues Team Affiliation A Marvel Re Evaluation

May 08, 2025

Rogues Team Affiliation A Marvel Re Evaluation

May 08, 2025 -

Desetta Pobeda Za Vesprem Shokantna Pobeda Nad Ps Zh

May 08, 2025

Desetta Pobeda Za Vesprem Shokantna Pobeda Nad Ps Zh

May 08, 2025 -

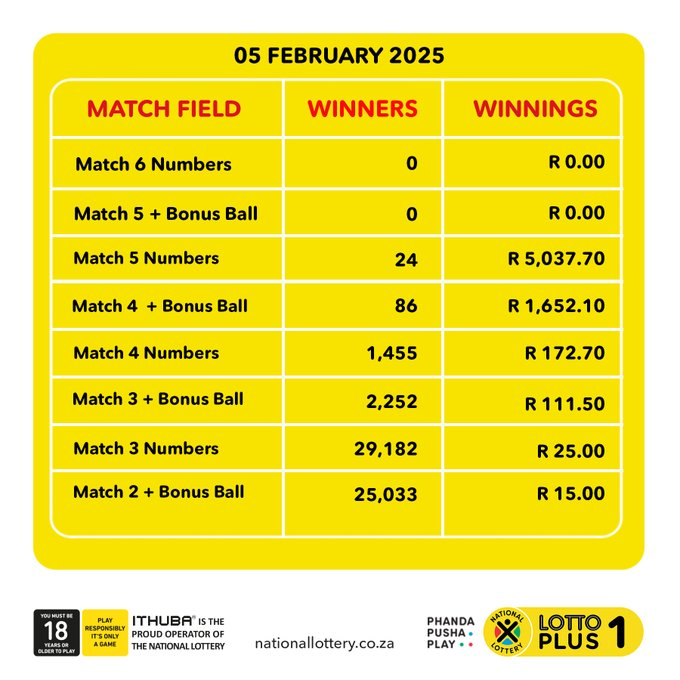

Where To Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Numbers

May 08, 2025

Where To Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Numbers

May 08, 2025 -

Test Your Nba Expertise A Quiz On Playoffs Triple Doubles Leaders

May 08, 2025

Test Your Nba Expertise A Quiz On Playoffs Triple Doubles Leaders

May 08, 2025 -

Will Trumps Policies Push Bitcoin Above 100 000 A Price Prediction Analysis

May 08, 2025

Will Trumps Policies Push Bitcoin Above 100 000 A Price Prediction Analysis

May 08, 2025