Will Trump's Policies Push Bitcoin Above $100,000? A Price Prediction Analysis

Table of Contents

Trump's Economic Policies and Their Impact on the Crypto Market

Trump's economic policies, characterized by significant fiscal spending and a focus on deregulation, have profound implications for the cryptocurrency market, and specifically for Bitcoin's potential to reach $100,000.

Fiscal Policy and Inflation:

Trump's fiscal policies, including significant tax cuts and increased government spending, contributed to concerns about potential inflation. High inflation erodes the purchasing power of fiat currencies, pushing investors to seek alternative stores of value. Bitcoin, with its limited supply and decentralized nature, is often seen as an inflation hedge.

- Data Point: During periods of high inflation historically, alternative assets like gold and Bitcoin have seen increased demand.

- Expert Opinion: Many financial analysts believe that sustained inflation could drive significant capital into Bitcoin, potentially pushing its price upwards.

- Keywords: inflation hedge, Bitcoin price prediction, fiscal policy, Trump administration, Bitcoin inflation hedge.

Regulatory Uncertainty and Bitcoin's Price:

Trump's administration had a somewhat ambiguous stance on cryptocurrency regulation. While there was no outright ban, the lack of clear regulatory frameworks created uncertainty. This regulatory uncertainty can impact investor confidence. A clear regulatory framework, while potentially limiting some aspects of the market, can increase institutional investment and overall stability, potentially benefiting Bitcoin's price in the long run. Conversely, unpredictable regulations could cause volatility.

- Positive Scenario: Clear regulations could attract institutional investors, increasing Bitcoin's legitimacy and driving up demand.

- Negative Scenario: Unpredictable or overly restrictive regulations could stifle innovation and scare off investors, potentially depressing Bitcoin's price.

- Keywords: cryptocurrency regulation, regulatory uncertainty, Bitcoin investment, Trump's impact on crypto, Bitcoin regulation.

Trade Wars and Geopolitical Instability:

Trump's trade policies and confrontational geopolitical stances created global uncertainty. During times of economic and political instability, investors often seek safe haven assets. Bitcoin, due to its decentralized nature and independence from traditional financial systems, can act as a safe haven, attracting capital during turbulent times.

- Example: The initial COVID-19 pandemic caused significant market volatility, leading to a surge in Bitcoin's price as investors sought refuge from traditional markets. Similar effects could be observed under periods of high geopolitical tension.

- Keywords: safe haven asset, Bitcoin volatility, geopolitical risks, Trump's trade policies, Bitcoin safe haven.

Bitcoin's Fundamental Factors and $100,000 Target

Beyond the influence of Trump's policies, Bitcoin's inherent characteristics also contribute to its price potential.

Adoption Rate and Market Demand:

The growing adoption of Bitcoin by institutions and individuals is a significant factor in its price appreciation. Increased demand naturally pushes prices higher.

- Data Point: The increasing number of companies holding Bitcoin on their balance sheets reflects growing institutional adoption.

- Future Scenario: Widespread adoption by governments and central banks could trigger a massive surge in Bitcoin's price.

- Keywords: Bitcoin adoption, institutional investors, market capitalization, Bitcoin price analysis, Bitcoin adoption rate.

Bitcoin's Scarcity and Limited Supply:

Bitcoin's fixed supply of 21 million coins is a crucial factor. Scarcity drives value; as demand increases and the supply remains fixed, the price naturally rises. This is a core principle of economics.

- Comparison: Compare Bitcoin's fixed supply to the potentially inflationary nature of fiat currencies.

- Keywords: Bitcoin scarcity, limited supply, price appreciation, deflationary asset, Bitcoin supply.

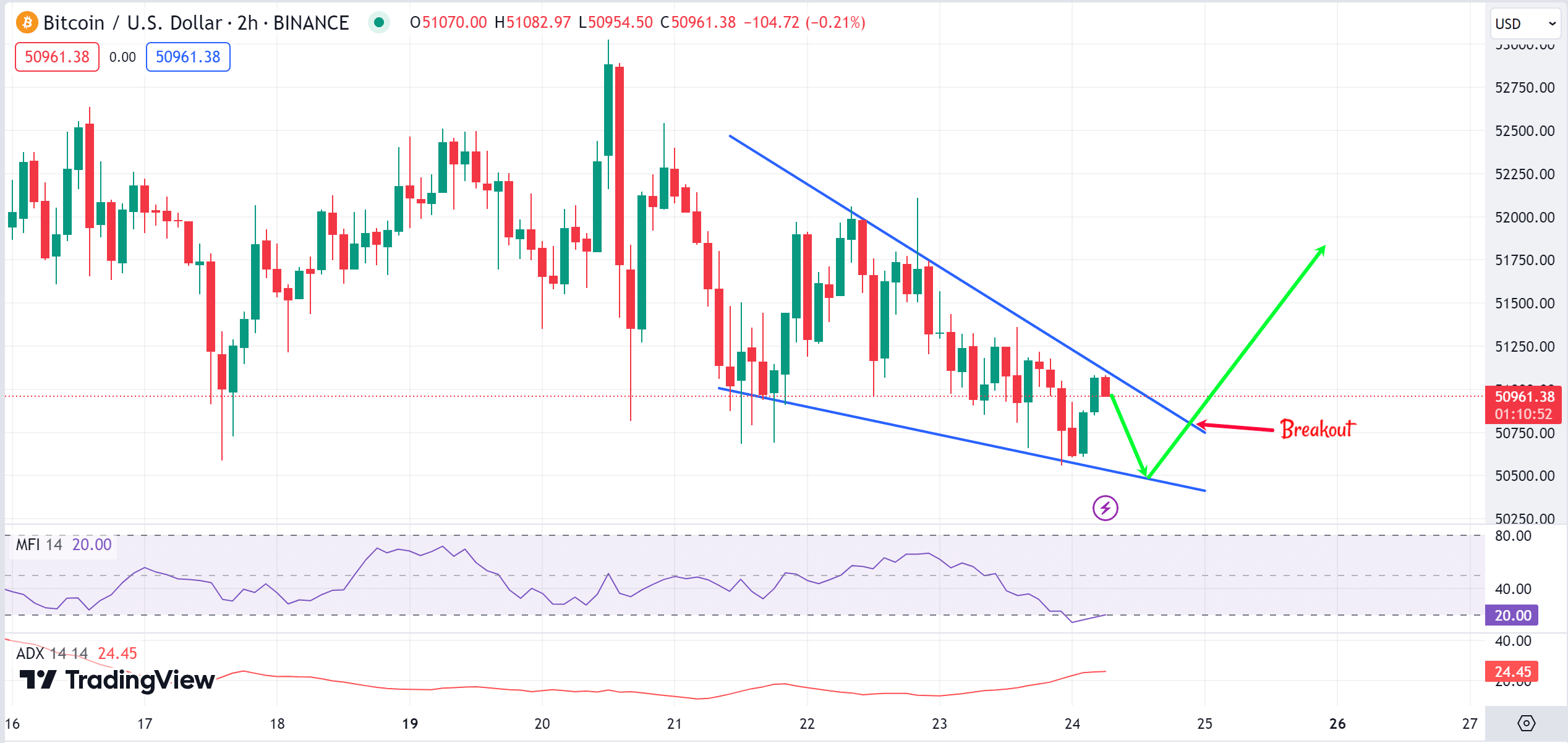

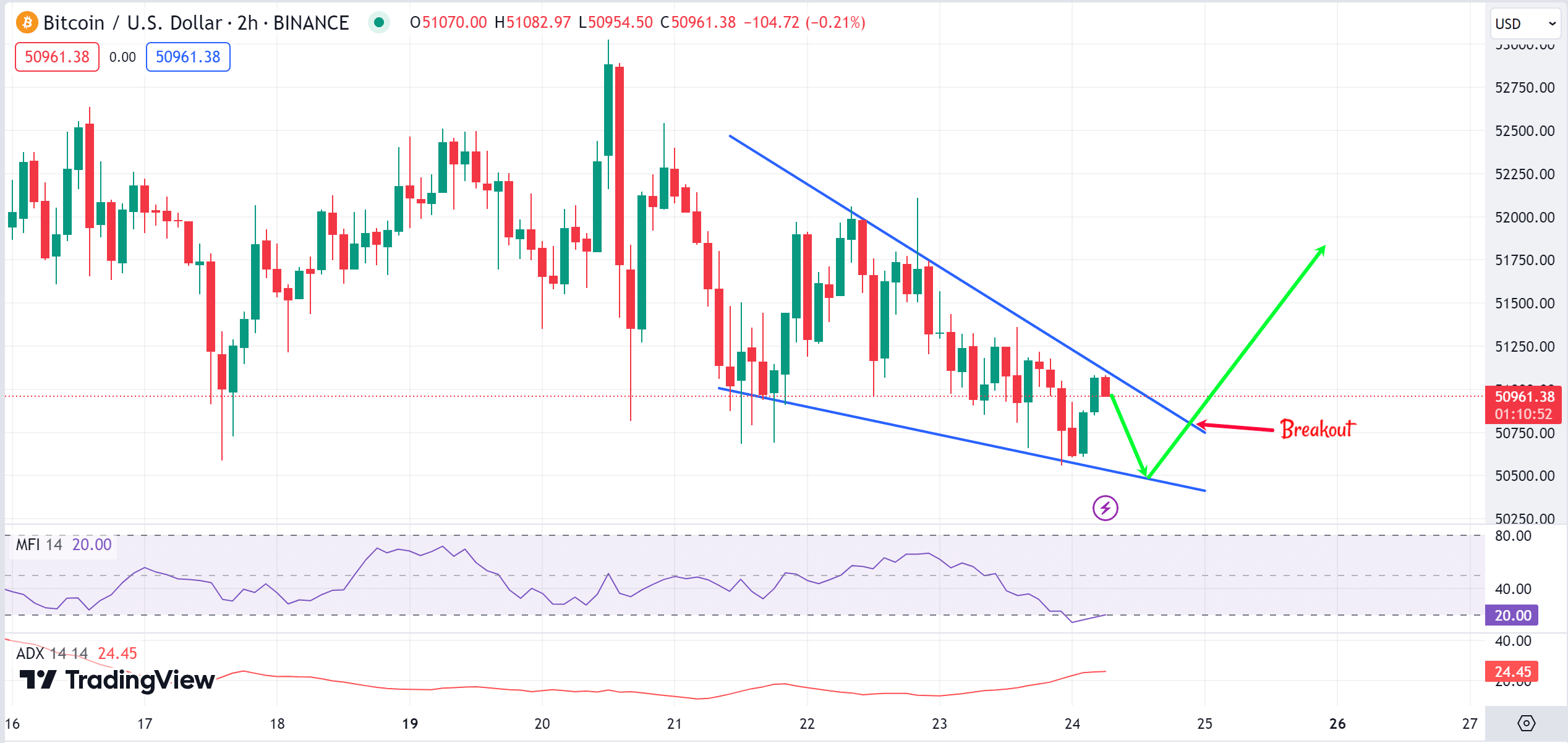

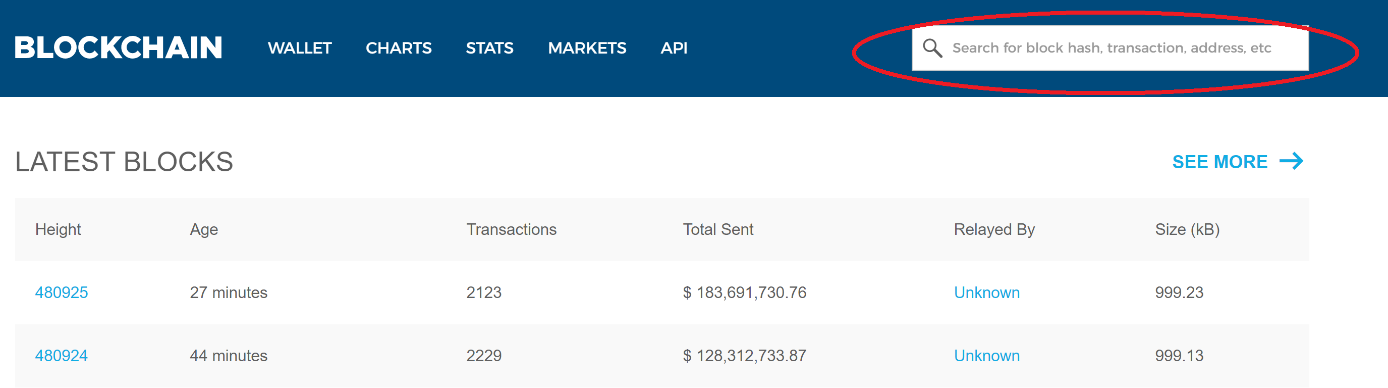

Technological Advancements and Network Effects:

Ongoing development of the Bitcoin network, including scaling solutions and upgrades, enhances its efficiency and functionality. The network effect, where the value of the network increases with the number of users, also contributes to Bitcoin's growth.

- Example: The Lightning Network improves transaction speeds and reduces fees, making Bitcoin more user-friendly.

- Keywords: Bitcoin technology, network effect, scaling solutions, Bitcoin upgrades, Bitcoin Lightning Network.

Counterarguments and Potential Risks

While the potential for Bitcoin to reach $100,000 under the influence of various factors, including those related to Trump's policies, is significant, several counterarguments and risks must be considered.

Regulatory Crackdowns: Stricter government regulations globally could significantly impact Bitcoin's price.

Market Manipulation: The possibility of large-scale market manipulation remains a risk.

Technological Risks: Vulnerabilities in the Bitcoin network, although rare, could negatively affect its price.

Alternative Cryptocurrencies: Competition from other cryptocurrencies could divert investment away from Bitcoin.

Conclusion: Will Trump's Legacy Influence Bitcoin's $100,000 Future?

The analysis suggests that Trump's policies could have both positive and negative impacts on Bitcoin's price. His fiscal policies might fuel inflation, driving investors towards Bitcoin as a hedge. However, regulatory uncertainty and geopolitical instability could also introduce volatility. Simultaneously, Bitcoin's inherent characteristics – scarcity, growing adoption, and technological advancements – contribute to its potential for significant price appreciation. Whether it reaches $100,000 remains uncertain, but the confluence of these factors makes it a plausible scenario.

The impact of Trump’s policies and Bitcoin’s future price remains a complex and evolving topic. We encourage you to continue researching this fascinating intersection of politics and finance and share your insights: What impact will Trump's legacy have on Bitcoin? Will Trump's policies ultimately drive Bitcoin to $100,000?

Featured Posts

-

How To Identify And Verify Reliable Crypto News

May 08, 2025

How To Identify And Verify Reliable Crypto News

May 08, 2025 -

Bitcoin Price Prediction Could Trumps 100 Day Speech Send Btc Past 100 000

May 08, 2025

Bitcoin Price Prediction Could Trumps 100 Day Speech Send Btc Past 100 000

May 08, 2025 -

Spk Dan Kripto Platformlarina Yeni Duezenleme Sermaye Ve Guevenlik Sartlari

May 08, 2025

Spk Dan Kripto Platformlarina Yeni Duezenleme Sermaye Ve Guevenlik Sartlari

May 08, 2025 -

Inter Milan Upsets Bayern Munich In Champions League Quarterfinal

May 08, 2025

Inter Milan Upsets Bayern Munich In Champions League Quarterfinal

May 08, 2025 -

Ethereum Price Prediction 2024 And Beyond A Comprehensive Analysis

May 08, 2025

Ethereum Price Prediction 2024 And Beyond A Comprehensive Analysis

May 08, 2025