Tariff Uncertainty Drives U.S. Businesses To Cut Costs

Table of Contents

Impact of Tariff Uncertainty on Supply Chains

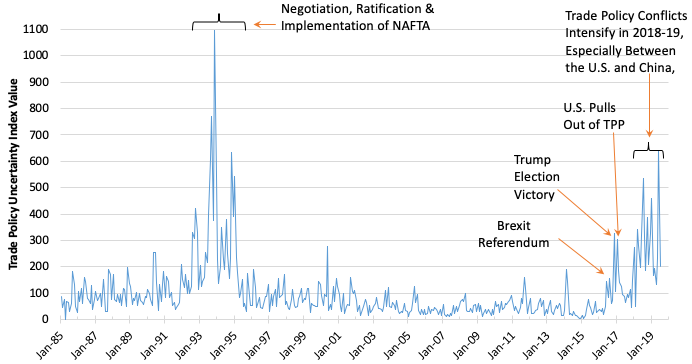

The unpredictable nature of tariffs is severely disrupting established supply chains, creating significant challenges for U.S. businesses. This economic uncertainty necessitates proactive strategies to mitigate the risks.

Disrupted Global Trade

Unpredictable tariffs lead to significant disruptions in global trade, resulting in increased costs and delays. This uncertainty makes long-term planning extremely difficult.

- Increased shipping costs: Tariffs directly increase the cost of imported goods, and the uncertainty surrounding future tariffs makes it difficult to accurately predict these costs.

- Sourcing difficulties: Businesses are struggling to find reliable and cost-effective sources of goods, as tariffs can suddenly make previously viable suppliers too expensive.

- Reliance on domestic suppliers: Many companies are turning to domestic suppliers, but this often comes with higher production costs and potentially lower quality.

- Negotiation complexities with international partners: The unpredictability makes negotiating long-term contracts with international partners significantly more complex and risky.

Reshoring and Nearshoring Initiatives

In response to tariff uncertainty and the desire for greater supply chain control, many companies are exploring reshoring (bringing manufacturing back to the U.S.) and nearshoring (relocating manufacturing to nearby countries).

- Increased production costs in the US: While reshoring offers benefits such as greater control and potentially improved quality, it often comes with significantly higher labor and production costs compared to overseas manufacturing.

- Advantages and disadvantages of nearshoring: Nearshoring offers a compromise, reducing transportation costs and lead times compared to distant suppliers while still potentially offering lower costs than domestic production. However, finding suitable locations and navigating different regulatory environments presents unique challenges.

- Government incentives for reshoring: The US government has implemented various incentives and programs to encourage reshoring, but the effectiveness of these incentives remains a subject of debate.

- Impact on job creation: While reshoring and nearshoring can create jobs in the U.S. and neighboring countries, it's crucial to assess the overall net impact on employment considering potential job losses in other sectors.

Cost-Cutting Strategies Employed by Businesses

Faced with increased input costs and reduced demand, U.S. businesses are resorting to aggressive cost-cutting measures to maintain profitability. These strategies impact various aspects of their operations and can have long-term implications.

Reducing Labor Costs

One of the most common responses to increased import costs is a reduction in labor costs. This can involve a range of measures, some more drastic than others.

- Hiring freezes: Companies are delaying or canceling hiring plans to avoid increasing their payroll.

- Layoffs: In more severe cases, companies are resorting to layoffs to reduce their workforce and associated costs.

- Automation of processes: Businesses are investing in automation to replace human labor, increasing efficiency and reducing personnel costs. This can lead to job displacement.

- Wage freezes: Freezing wages, or even implementing pay cuts, is another way to reduce labor expenses, but this can impact employee morale and productivity.

- Outsourcing: Companies may choose to outsource certain functions to lower-cost providers, whether domestically or internationally.

Optimizing Operations and Efficiency

Beyond labor cost reductions, businesses are actively seeking ways to optimize their operations and improve efficiency.

- Lean manufacturing principles: Implementing lean manufacturing principles helps minimize waste and improve overall productivity.

- Process automation: Automating repetitive tasks can significantly improve efficiency and reduce manual labor costs.

- Technology upgrades: Investing in new technologies can streamline processes, improving speed and efficiency.

- Waste reduction: Identifying and reducing waste in all aspects of the business is crucial for cost optimization.

- Inventory management: Effective inventory management techniques can help minimize storage costs and prevent spoilage or obsolescence.

Price Increases and Reduced Product Lines

Many businesses are responding to increased costs by passing them onto consumers through price increases or streamlining their product offerings.

- Consumer impact of price increases: Price increases reduce consumer purchasing power and can lead to decreased demand.

- Shrinking product variety: Eliminating less profitable or less popular products helps focus resources on core offerings.

- Strategic product elimination: Companies might discontinue products with high input costs or low margins to maintain profitability.

Long-Term Economic Implications of Tariff Uncertainty

The widespread cost-cutting measures employed by businesses in response to tariff uncertainty have significant long-term economic implications for the U.S.

Impact on Economic Growth

The cumulative effect of cost-cutting measures can significantly dampen economic growth.

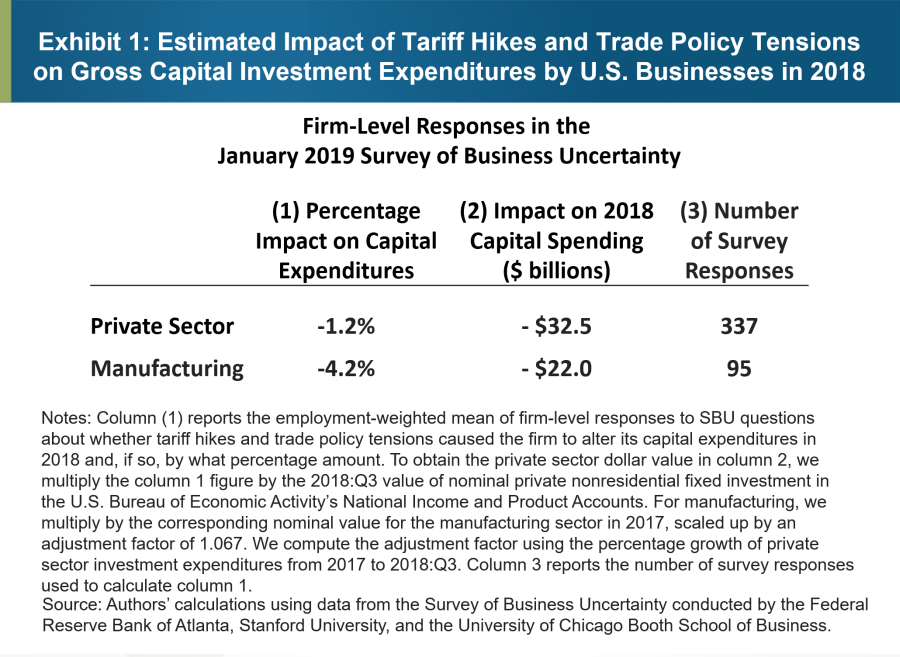

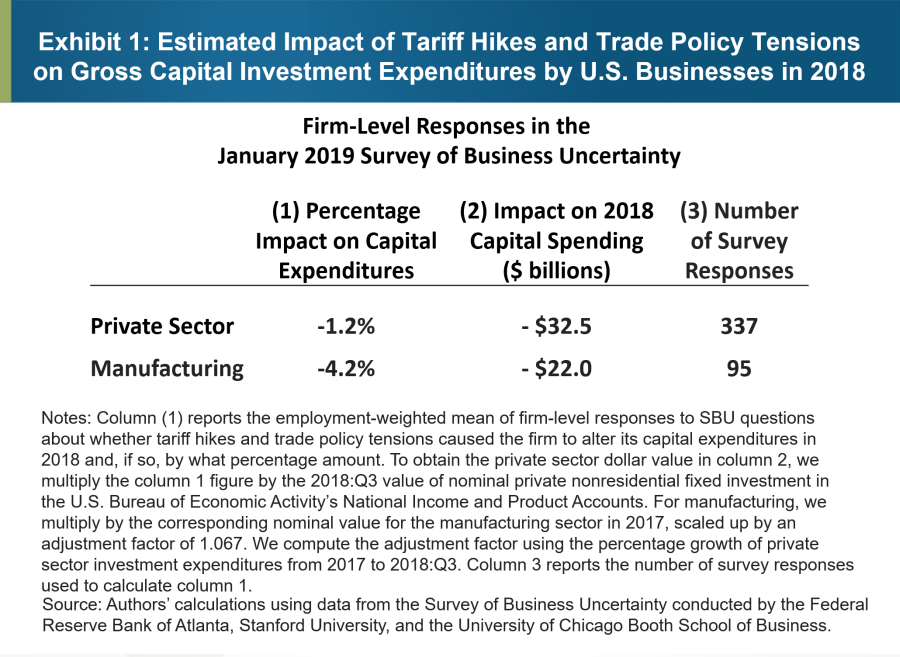

- Reduced investment: Uncertainty makes businesses hesitant to invest in expansion or new technologies, hindering growth.

- Decreased consumer spending: Higher prices and job losses reduce consumer spending, further slowing economic activity.

- Job losses in certain sectors: Cost-cutting measures, particularly layoffs, lead to job losses, negatively impacting employment rates.

- Potential for recession: The combined effect of reduced investment, decreased consumer spending, and job losses increases the risk of a recession.

Increased Inflation

As businesses pass on increased costs to consumers, there's a potential for increased inflation.

- Impact on purchasing power: Higher prices erode consumer purchasing power, leading to decreased demand.

- Potential for wage-price spiral: If higher prices lead to demands for higher wages, this can create a wage-price spiral, further fueling inflation.

- Government response to inflation: The government may respond to inflation through monetary policy adjustments, which can have further economic consequences.

Conclusion

Tariff uncertainty remains a significant challenge for U.S. businesses, forcing widespread cost-cutting measures with potentially serious long-term economic consequences. The strategies implemented, from supply chain restructuring to workforce reductions, underscore the severity of the impact. The ripple effects of these measures are already visible, impacting consumer prices, employment levels, and overall economic growth.

Understanding the ramifications of tariff uncertainty is crucial for businesses to effectively navigate this complex economic landscape. Develop a robust strategy to mitigate the effects of tariff uncertainty on your business. Explore resources and support available to help you manage the challenges posed by fluctuating tariffs and protect your bottom line. Proactive planning and adaptability are essential for survival and success in this environment of persistent global trade uncertainty.

Featured Posts

-

Dc Crash Investigation Nyt Reveals Black Hawk Pilots Actions

Apr 29, 2025

Dc Crash Investigation Nyt Reveals Black Hawk Pilots Actions

Apr 29, 2025 -

Tariff Uncertainty Forces Us Companies To Prioritize Cost Reduction

Apr 29, 2025

Tariff Uncertainty Forces Us Companies To Prioritize Cost Reduction

Apr 29, 2025 -

Vancouver Filipino Festival Tragedy Nine Dead After Car Strikes Crowd

Apr 29, 2025

Vancouver Filipino Festival Tragedy Nine Dead After Car Strikes Crowd

Apr 29, 2025 -

Pw Cs Strategic Retreat Impact Of Withdrawal From Nine Sub Saharan African Markets

Apr 29, 2025

Pw Cs Strategic Retreat Impact Of Withdrawal From Nine Sub Saharan African Markets

Apr 29, 2025 -

Minnesota Faces Attorney General Pressure Over Trumps Transgender Sports Ban

Apr 29, 2025

Minnesota Faces Attorney General Pressure Over Trumps Transgender Sports Ban

Apr 29, 2025