Tariff Uncertainty? Why Microsoft Stock Might Be Your Best Bet

Table of Contents

Microsoft's Diversified Revenue Streams Mitigate Tariff Risks

The beauty of investing in Microsoft stock lies in its remarkably diversified revenue streams, effectively shielding it from the full impact of tariff fluctuations. This diversification is a key factor in its resilience.

H3: Cloud Computing Dominance: Microsoft's Azure cloud computing platform is a powerhouse, holding a significant share of the market and experiencing rapid growth. This lessens its dependence on hardware sales, a sector particularly vulnerable to tariffs.

- Azure's market share continues to climb, consistently outperforming expectations and demonstrating remarkable resilience against economic downturns.

- Its global reach ensures diversification across multiple markets, mitigating the impact of tariffs imposed on specific regions.

- Azure's diverse customer base, ranging from small businesses to multinational corporations, provides a stable and predictable revenue stream.

H3: Software and Services Portfolio: Microsoft's portfolio extends far beyond Azure. Its suite of software and services, including Office 365, Windows, and various enterprise solutions, generates substantial recurring revenue. This subscription model provides inherent stability against tariff impacts compared to companies reliant on one-time hardware sales.

- Office 365 boasts millions of subscribers globally, contributing significantly to Microsoft's recurring revenue stream.

- Windows, despite facing competition, remains a dominant force in the operating system market, securing a consistent revenue flow.

- Microsoft's enterprise software solutions cater to a vast and diverse customer base, creating a resilient revenue model less susceptible to tariff-induced shocks.

H3: Global Reach and Market Diversification: Microsoft's global presence is another crucial element in its resilience. Its revenue is not concentrated in any single region, making it less vulnerable to localized tariff impacts.

- Microsoft operates successfully in numerous key markets, including the US, Europe, and Asia, diversifying its revenue sources.

- This geographical diversification of revenue minimizes the risk associated with tariff increases in any particular region.

- This strategic global expansion positions Microsoft favorably to withstand global economic uncertainties.

Microsoft's Strong Brand and Market Position Provide Stability

Beyond its diversified revenue, Microsoft's strength lies in its powerful brand and dominant market position. This provides an additional layer of protection against market volatility.

H3: Brand Recognition and Customer Loyalty: Microsoft enjoys unparalleled brand recognition and customer loyalty, translating into a predictable and stable revenue base.

- Decades of brand building have cemented Microsoft's position as a trusted technology leader, fostering high customer retention rates.

- This unwavering loyalty ensures a steady flow of revenue, less susceptible to short-term economic fluctuations.

- Brand strength contributes to a stable and predictable customer base, providing a solid foundation for continued growth.

H3: Competitive Advantage and Innovation: Microsoft continuously invests in innovation across various sectors, including AI and gaming, maintaining a strong competitive advantage and fostering long-term growth.

- Investments in artificial intelligence (AI) position Microsoft at the forefront of technological advancements, driving future growth.

- Acquisitions of companies such as GitHub and LinkedIn demonstrate Microsoft's commitment to strategic expansion and innovation.

- Its continued innovation ensures Microsoft remains a dominant player in the tech landscape, mitigating the risks associated with market disruptions.

Microsoft Stock Valuation and Investment Potential

Analyzing Microsoft stock reveals compelling investment potential, especially during times of economic uncertainty.

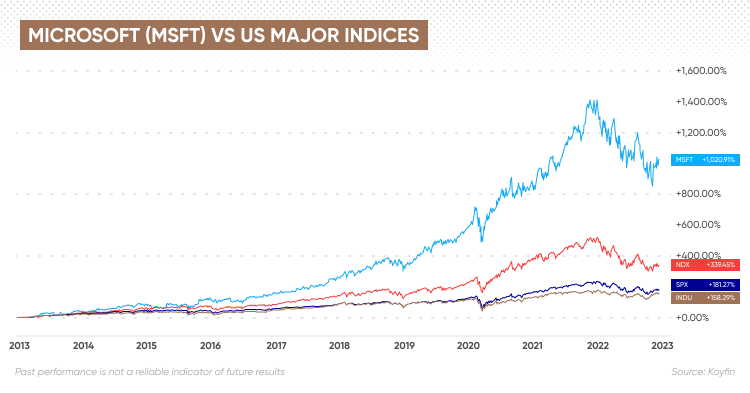

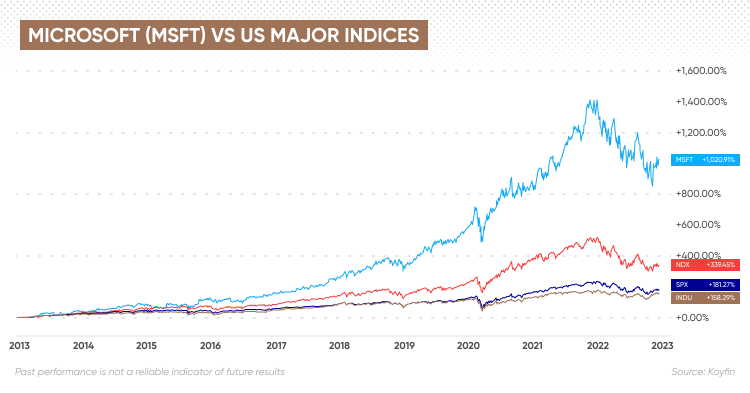

H3: Analyzing Microsoft's Stock Performance: Microsoft's historical stock performance demonstrates considerable resilience during periods of market volatility.

- Charts clearly show consistent growth despite various economic challenges, highlighting the stability of the stock.

- Regular dividend payouts further enhance the attractiveness of Microsoft stock as a reliable investment.

- Financial metrics such as the price-to-earnings ratio indicate a strong value proposition, making it an appealing investment opportunity.

H3: Comparing Microsoft Stock to Competitors: Compared to other tech companies more vulnerable to tariff impacts, Microsoft stock offers a relatively lower risk profile.

- Companies heavily reliant on hardware manufacturing are more susceptible to tariff-related disruptions than Microsoft, with its diversified business model.

- Microsoft's strong brand and market dominance offer a significant competitive advantage over companies with more niche offerings.

- This makes Microsoft stock a more attractive investment option during times of heightened uncertainty.

H3: Long-Term Growth Prospects: Analysts forecast continued growth for Microsoft, driven by its strong position in cloud computing, software, and services.

- Predictions indicate strong potential for market share expansion in key sectors, bolstering the long-term growth prospects of Microsoft stock.

- Continued innovation and strategic acquisitions will likely contribute to Microsoft's long-term success.

- This positive outlook strengthens the case for Microsoft stock as a solid, long-term investment.

Conclusion:

In summary, Microsoft stock presents a compelling investment opportunity despite the uncertainties surrounding tariffs. Its diversified revenue streams, strong brand, and impressive growth prospects make it a relatively safe haven during periods of economic volatility. The resilience of Microsoft stock, in the face of tariff uncertainty and broader economic challenges, is undeniable. Consider Microsoft stock as part of your diversified portfolio today! Remember to consult a financial advisor before making any investment decisions.

Featured Posts

-

Pboc Daily Yuan Support Below Estimates First Time In 2024

May 16, 2025

Pboc Daily Yuan Support Below Estimates First Time In 2024

May 16, 2025 -

The Trump Interview Goldberg Highlights Odd And Uncomfortable Exchanges

May 16, 2025

The Trump Interview Goldberg Highlights Odd And Uncomfortable Exchanges

May 16, 2025 -

Padres Rockies Matchup Predicting The Outcome

May 16, 2025

Padres Rockies Matchup Predicting The Outcome

May 16, 2025 -

Predicting The Giants Vs Padres Game Padres Victory Or One Run Difference

May 16, 2025

Predicting The Giants Vs Padres Game Padres Victory Or One Run Difference

May 16, 2025 -

Catch All The Action Your Complete Guide To Watching The Nhl Playoffs

May 16, 2025

Catch All The Action Your Complete Guide To Watching The Nhl Playoffs

May 16, 2025