PBOC Daily Yuan Support Below Estimates: First Time In 2024

Table of Contents

Analysis of the PBOC's Reduced Intervention

Lowering the Daily Support: Reasons Behind the Decision

The PBOC's decision to reduce its daily Yuan support likely stems from a confluence of factors. Several theories are circulating among analysts:

- Increased Market Confidence: A strengthening belief in the Yuan's inherent value might have emboldened the PBOC to lessen its intervention. A more stable and self-regulating market could be the desired outcome.

- Shift in Monetary Policy: The PBOC might be subtly shifting its monetary policy approach, moving away from direct intervention towards a more market-driven mechanism for managing the CNY exchange rate. This could be part of a broader strategy to foster greater market efficiency and resilience.

- Assessment of External Factors: Global economic conditions, particularly the strength of the US dollar and the overall health of the global economy, significantly influence the Yuan's value. The PBOC may have assessed these external factors and decided that less direct intervention is necessary at this time.

Data supporting these reasons needs to be gathered from credible sources such as the PBOC's official publications, reports from the International Monetary Fund (IMF), and analyses from reputable financial news organizations. The precise reasons behind the PBOC's decision will likely become clearer with time and further analysis. Keywords relevant to this section include: PBOC policy, Yuan intervention, monetary policy China, CNY exchange rate fluctuation.

Impact on the Yuan's Exchange Rate: Volatility and Market Reaction

The reduced daily Yuan support has already led to increased volatility in the CNY exchange rate. The immediate impact is visible in the fluctuations against major currencies like the USD, EUR, and JPY. The market reaction has been diverse, with some investors expressing concerns about potential instability while others view it as a sign of a healthier, self-correcting market. Trading volumes have likely increased as investors navigate this new landscape of uncertainty.

Financial analysts offer varying predictions, with some forecasting further volatility in the short term, while others anticipate a stabilization of the Yuan's value in the medium to long term. The actual trajectory will depend on several interacting factors, including global economic growth, trade flows, and future PBOC policy decisions. Keywords used in this section include: CNY volatility, currency exchange rates, forex market, Yuan forecast.

Implications for the Chinese Economy

Effect on Imports and Exports

A weaker Yuan could boost exports by making Chinese goods cheaper for international buyers, potentially improving the China trade balance. However, it could also make imports more expensive, potentially leading to higher inflation. Conversely, a stronger Yuan could improve purchasing power for imported goods, but might hurt export competitiveness. The net effect on Chinese businesses involved in international trade depends heavily on the Yuan's ultimate trajectory and the elasticity of demand for both imports and exports. Keywords for this section include: China trade balance, import-export, Yuan devaluation, economic impact.

Wider Economic Consequences: Inflation, Investment, Growth

The PBOC's decision has broader implications for the Chinese economy. A significant change in the Yuan's value can influence inflation, attracting or deterring foreign direct investment (FDI), and impacting overall GDP growth. The PBOC and other governmental bodies may respond with further policy adjustments, such as interest rate changes or other fiscal measures to mitigate any negative consequences. The full economic consequences are still unfolding and require further monitoring. Relevant keywords for this section include: Chinese economy, economic growth, inflation China, FDI China.

Comparison with Previous Years and Market Expectations

Historical Context: Yuan Support Trends in Previous Years

In previous years, the PBOC has employed various strategies to manage the Yuan's exchange rate, often involving a significant level of daily support. A review of these historical patterns reveals shifts in policy over time, reflecting the changing economic landscape and the PBOC's evolving approach to currency management. Examining this historical context provides a benchmark against which to compare the recent changes. Keywords for this section are: PBOC historical data, Yuan support history, currency management China.

Deviation from Analyst Forecasts: Market Surprise and Reaction

The PBOC's decision to reduce daily Yuan support deviated substantially from many analyst forecasts. This unexpected move generated significant surprise and immediate market reactions. Analyzing the discrepancies between forecasts and actual outcomes provides insights into the limitations of predictive models and highlights the challenges of forecasting in complex and dynamic economic environments. Keywords include: Market forecast error, analyst predictions, Yuan market sentiment.

Conclusion: PBOC Daily Yuan Support and the Future of the CNY

The reduction in PBOC daily Yuan support represents a significant development with potentially far-reaching consequences for the Chinese economy and the global financial system. The underlying reasons remain subject to further scrutiny, but the impact on the CNY exchange rate and the wider economy is already evident. The PBOC's future actions will be crucial in shaping the Yuan's trajectory and determining the overall impact on China's economic growth. Staying informed about this evolving situation is paramount for investors and businesses alike. Follow the PBOC's Yuan policy, monitor CNY exchange rate movements, and understand the impact of daily Yuan support to make informed decisions in this changing landscape.

Featured Posts

-

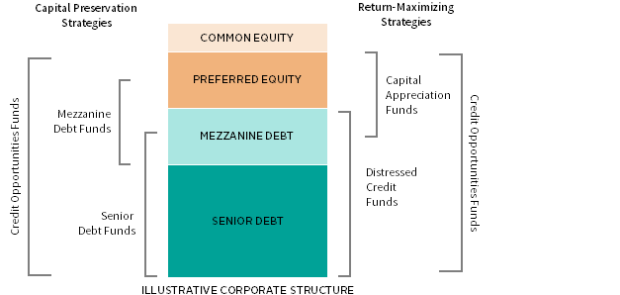

5 Key Dos And Don Ts To Succeed In The Private Credit Industry

May 16, 2025

5 Key Dos And Don Ts To Succeed In The Private Credit Industry

May 16, 2025 -

The Arcade Is Back Nhl 25s New Gameplay Mode

May 16, 2025

The Arcade Is Back Nhl 25s New Gameplay Mode

May 16, 2025 -

Golden State Warriors Jimmy Butler Leads Charge In Victory Against Houston Rockets

May 16, 2025

Golden State Warriors Jimmy Butler Leads Charge In Victory Against Houston Rockets

May 16, 2025 -

China And The Fentanyl Epidemic A Price To Pay

May 16, 2025

China And The Fentanyl Epidemic A Price To Pay

May 16, 2025 -

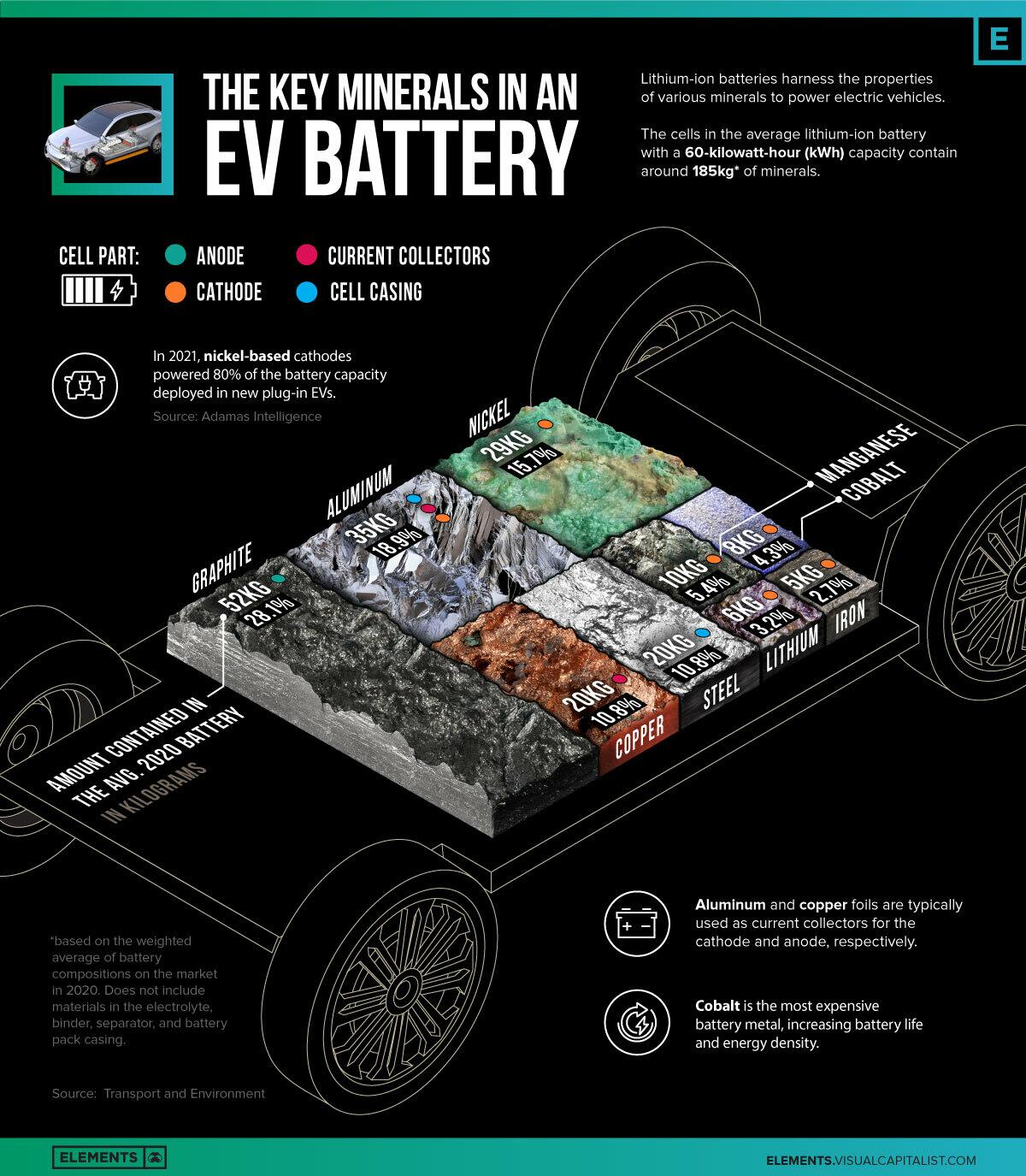

Congos Cobalt Export Ban Market Impact And The Awaiting Quota Plan

May 16, 2025

Congos Cobalt Export Ban Market Impact And The Awaiting Quota Plan

May 16, 2025