Tech Billionaires' $194 Billion Losses: 100-Day Post-Inauguration Analysis

Table of Contents

H2: Impact of Inauguration Policies on Tech Sector Valuation

The inauguration of a new administration often brings significant policy shifts, and the tech sector, with its considerable influence and wealth, is rarely immune. The resulting changes can directly impact tech billionaires' net worth.

H3: Regulatory Scrutiny and Antitrust Concerns:

The new administration's focus on antitrust enforcement and data privacy has significantly impacted major tech companies. This increased regulatory scrutiny has translated into:

- Increased antitrust investigations: Several major tech companies faced intensified scrutiny regarding monopolistic practices, leading to legal challenges and uncertainty. This uncertainty can depress stock prices, directly affecting the net worth of shareholders, including tech billionaires.

- Stringent data privacy regulations: New data privacy regulations have increased compliance costs and changed business models, impacting profitability and valuations. This regulatory burden has particularly affected companies with significant data-driven operations.

- Examples: For instance, [Insert example of a specific company and how it was affected – e.g., "Company X faced a major antitrust lawsuit, leading to a significant drop in its stock price and a substantial reduction in the net worth of its CEO, Billionaire Y"].

H3: Changes in Tax Policies and Their Effect on Tech Wealth:

Changes in tax policies, such as increased capital gains taxes or corporate tax rates, can substantially reduce the wealth of tech billionaires.

- Capital Gains Tax Increases: Higher capital gains taxes directly reduce the returns on investments, impacting the net worth of those heavily invested in the tech sector. For example, [Insert example – e.g., "An increase in the capital gains tax rate by X% could have reduced Billionaire Z's wealth by Y billion dollars"].

- Corporate Tax Rate Changes: Increased corporate tax rates reduce company profits, potentially impacting stock prices and consequently the wealth of major shareholders.

H2: Market Volatility and the Broader Economic Landscape

Beyond specific policy changes, broader economic factors significantly influenced tech billionaires' losses post-inauguration.

H3: Global Economic Uncertainty and its Ripple Effect:

Global economic uncertainty, including inflation, supply chain disruptions, and geopolitical instability, can create market volatility. This volatility disproportionately affects the tech sector, which is often seen as a bellwether of economic health.

- Inflationary Pressures: Rising inflation can erode the value of assets and reduce consumer spending, negatively affecting tech companies' revenues and stock valuations.

- Supply Chain Disruptions: Disruptions to global supply chains can increase production costs and hinder growth, impacting the profitability of tech companies.

- Geopolitical Instability: Geopolitical events can create uncertainty and risk aversion in the markets, leading to a sell-off in tech stocks.

H3: Investor Sentiment and Market Corrections:

Shifts in investor sentiment and market corrections play a crucial role in the valuation of tech companies.

- Market Corrections: Market downturns can significantly reduce the value of tech stocks, leading to substantial losses for high-net-worth individuals heavily invested in the sector.

- Investor Confidence: Negative news or changing economic forecasts can decrease investor confidence, triggering a sell-off and impacting stock prices.

H2: Company-Specific Performance and Strategic Challenges

Beyond external factors, individual company performance and internal strategic challenges significantly impacted the wealth of tech billionaires.

H3: Individual Company Struggles and Their Impact:

Several tech giants experienced challenges impacting their stock prices and the net worth of their owners.

- Slowing Growth: Some companies experienced slower-than-expected revenue growth, leading to decreased investor confidence and lower stock valuations.

- Increased Competition: Intensified competition from new entrants or existing rivals can erode market share and profitability.

- Product Failures: Failed product launches or significant setbacks can negatively impact company valuation.

H3: Technological Disruptions and Shifting Market Dynamics:

Rapid technological advancements and shifting market dynamics can disrupt established tech giants, influencing the fortunes of their owners.

Conclusion: Understanding the Post-Inauguration Losses of Tech Billionaires – A Call to Action

The $194 billion loss experienced by tech billionaires in the 100 days following the inauguration is a complex phenomenon. It's a result of the interplay of several factors: policy changes that increased regulatory scrutiny and altered the tax landscape, broader market volatility stemming from global economic uncertainty and shifting investor sentiment, and company-specific challenges related to growth, competition, and technological disruptions. These factors highlight the vulnerability of even the most successful tech companies and their founders to external forces and internal strategic miscalculations. Stay informed about the evolving relationship between government policy and tech billionaires' wealth. Continue your research on the impact of specific policies on the tech sector and follow us for further analysis on tech billionaires' losses post-inauguration.

Featured Posts

-

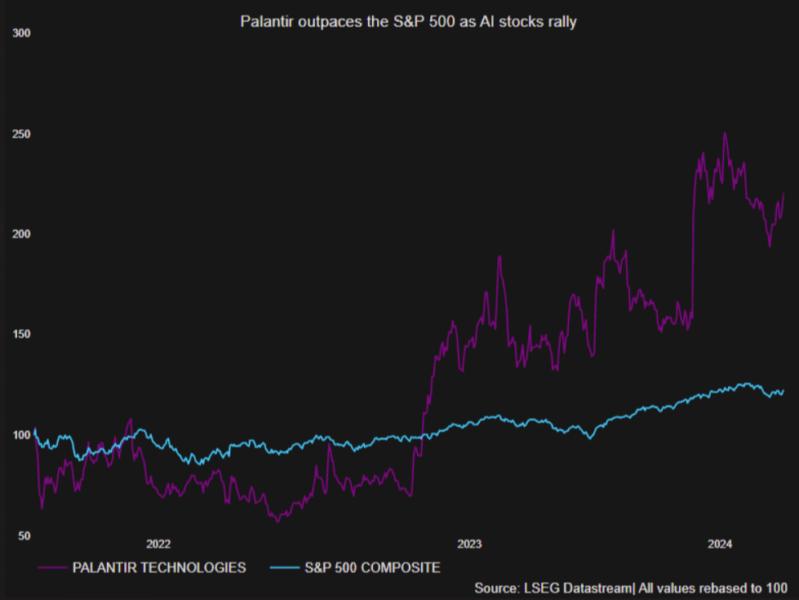

Should You Buy Palantir Stock In 2024

May 10, 2025

Should You Buy Palantir Stock In 2024

May 10, 2025 -

Wynne Evans New Evidence To Clear Name After Strictly Scandal

May 10, 2025

Wynne Evans New Evidence To Clear Name After Strictly Scandal

May 10, 2025 -

Ohio Derailment Investigation Into Lingering Toxic Chemicals In Buildings

May 10, 2025

Ohio Derailment Investigation Into Lingering Toxic Chemicals In Buildings

May 10, 2025 -

Nyt Strands Solutions Tuesday March 4th Game 366

May 10, 2025

Nyt Strands Solutions Tuesday March 4th Game 366

May 10, 2025 -

L Ombre De Melanie Dijon Revele Le Role De La Mere De Gustave Eiffel

May 10, 2025

L Ombre De Melanie Dijon Revele Le Role De La Mere De Gustave Eiffel

May 10, 2025