Tesla's Board Under Fire: State Treasurers Question Musk's Strategic Direction

Table of Contents

State Treasurers' Concerns: Financial Risks and ESG Performance

State treasurers, responsible for managing billions of dollars in public funds, are expressing significant unease regarding Tesla's trajectory. Their concerns extend beyond mere stock performance, encompassing deeper issues of financial health and ESG (Environmental, Social, and Governance) performance. These concerns represent a significant challenge to Tesla's reputation and long-term sustainability.

-

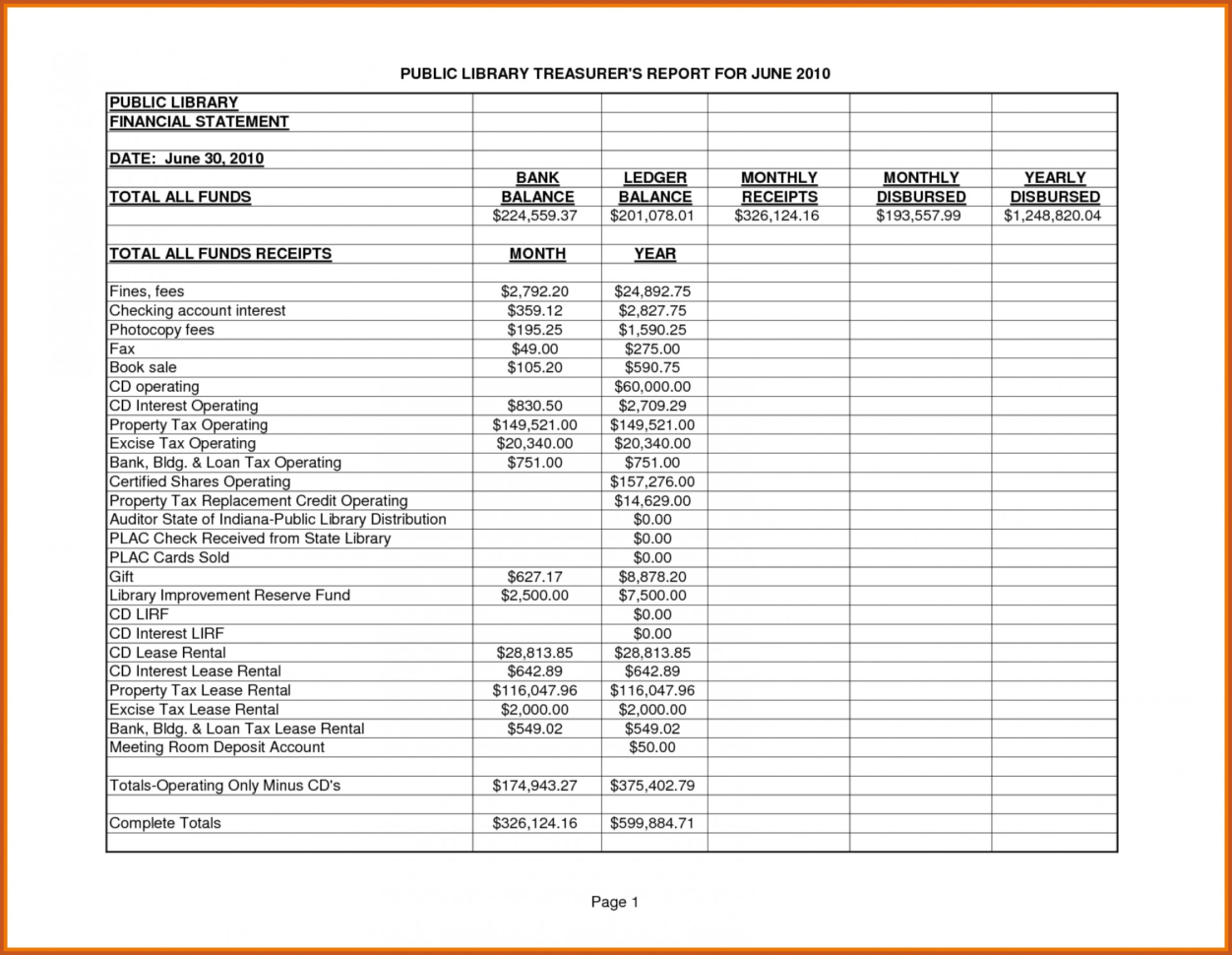

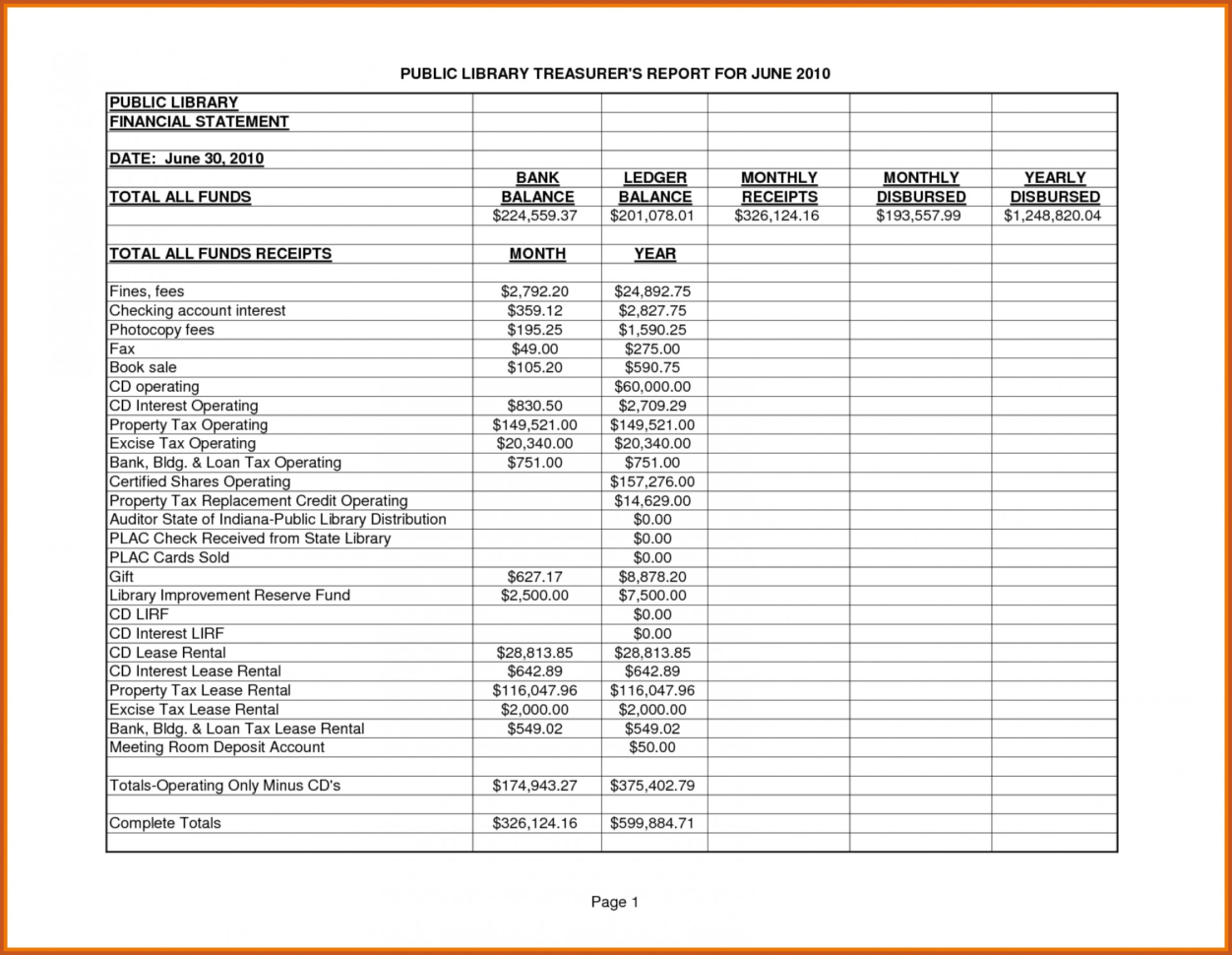

Concerns about Tesla's debt levels and profitability: Several state treasurers have voiced apprehension about Tesla's high debt-to-equity ratio and its fluctuating profitability, particularly in light of Musk's ambitious expansion plans and significant capital expenditures. The question of long-term financial viability looms large.

-

Criticisms of Tesla's workplace environment and labor practices: Reports of demanding working conditions and alleged labor violations at Tesla's factories have drawn criticism from some state treasurers. This impacts Tesla's ESG score and reflects poorly on its social responsibility commitments.

-

Questions surrounding Tesla's commitment to sustainable practices: While marketed as a leader in sustainable transportation, Tesla's environmental practices have faced scrutiny. Concerns exist regarding the sourcing of raw materials for batteries and the environmental impact of its manufacturing processes. These concerns directly challenge Tesla’s green image.

-

Specific State Treasurers Involved: While the exact list of involved state treasurers may evolve, news reports have highlighted the involvement of treasurers from states like California, New York, and Illinois, among others. These states represent a significant portion of Tesla’s investor base.

Musk's Controversial Actions and Their Impact on Tesla's Stock

Elon Musk's flamboyant personality and often controversial actions have significantly influenced Tesla's public image and market valuation. His pronouncements on Twitter, his business decisions, and his overall demeanor have created volatility that concerns many investors.

-

Examples of controversial tweets or statements by Musk: Musk's frequent and sometimes erratic social media activity, including controversial tweets about Tesla's stock price and other sensitive matters, have sent shockwaves through the market. This constant noise undermines trust and investor confidence.

-

Discussion of controversial business decisions made by Musk and their consequences: Decisions such as the acquisition of Twitter and subsequent cost-cutting measures have been questioned by financial analysts and raised concerns regarding the potential distraction from Tesla's core business. The impact of diverting resources and attention away from Tesla’s EV focus needs scrutiny.

-

Analysis of the correlation between Musk's actions and Tesla's stock performance: There's a clear correlation between Musk's public actions and Tesla’s stock volatility. Periods of heightened controversy often coincide with drops in Tesla’s stock price. This instability is a major concern for long-term investors.

The Board's Response and Potential Consequences

Tesla's board of directors has faced mounting pressure to address the concerns raised by state treasurers and investors. While the board has yet to issue a comprehensive public response to each specific critique, its actions and potential responses will determine future consequences.

-

Tesla's official statement(s) regarding the criticisms: To date, Tesla has not issued a direct response to the concerns voiced by the state treasurers. Any official response and its tone will be crucial in determining the impact on public opinion and investor confidence.

-

Any actions taken by the board to address the concerns: The board's response may involve internal reviews of Tesla's financial practices, ESG performance, and corporate governance procedures. Actions to show a commitment to transparency and accountability are expected.

-

Potential legal or regulatory ramifications for Tesla and/or Musk: The ongoing scrutiny could lead to regulatory investigations and potentially shareholder lawsuits. Tesla might face penalties or sanctions depending on the findings of investigations.

-

Analysis of the potential long-term impact on Tesla's brand and market value: The ongoing controversy threatens Tesla's brand image and could negatively impact its market valuation in the long term, especially if it damages its reputation among environmentally conscious consumers.

Investor Sentiment and Future Outlook for Tesla

The controversy surrounding Tesla's board and Musk's leadership has significantly impacted investor sentiment. Uncertainty reigns, and the future outlook for Tesla remains unclear.

-

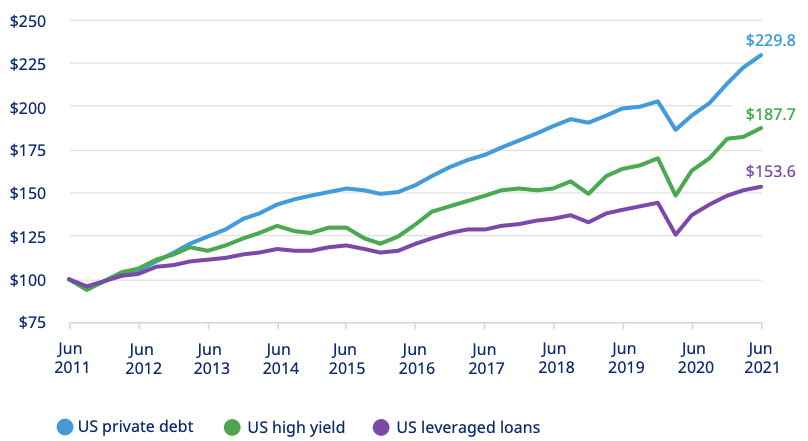

Analysis of recent trends in Tesla's stock price: Tesla's stock price has experienced considerable volatility following the rise of these controversies. A deeper analysis of these trends will provide insight into investors’ perception of the risk.

-

Opinions from financial analysts and industry experts: Financial analysts have offered varying opinions, with some expressing concerns about Tesla's long-term prospects while others maintain a more positive outlook. This divergence of opinion demonstrates uncertainty in the market.

-

Predictions for Tesla's future performance: Predictions for Tesla's future performance are highly dependent on the resolution of the current crisis and the company's ability to address the concerns regarding Musk’s leadership and the board’s governance.

-

Discussion of potential changes to Tesla's leadership or corporate strategy: Depending on the outcome, there is speculation of potential changes in Tesla's leadership structure or corporate strategies. This could involve changes to the board, adjustments in Musk's role, or a shift in the company's strategic direction.

Conclusion: The Future of Tesla's Board and Musk's Leadership Under Scrutiny

Tesla's board is undeniably under fire, facing intense scrutiny from state treasurers concerned about the company's financial health, ESG performance, and Elon Musk's leadership. The controversy has created significant uncertainty for investors and raised serious questions about Tesla's long-term viability. The board's response, potential regulatory action, and the impact on investor sentiment will determine the future trajectory of this electric vehicle giant. The ongoing saga of Tesla's leadership crisis demands careful monitoring. Share your thoughts on the situation and stay informed about further developments in this evolving controversy surrounding Tesla’s board and Elon Musk’s leadership. How will Tesla navigate this turbulent period and address the concerns surrounding its governance?

Featured Posts

-

Record Breaking 9 Homers Aaron Judge Leads Yankees Offensive Explosion In 2025

Apr 23, 2025

Record Breaking 9 Homers Aaron Judge Leads Yankees Offensive Explosion In 2025

Apr 23, 2025 -

Invesco And Barings Expand Private Credit Access For Everyday Investors

Apr 23, 2025

Invesco And Barings Expand Private Credit Access For Everyday Investors

Apr 23, 2025 -

Dramatic Ninth Inning D Backs Five Run Rally Beats Brewers

Apr 23, 2025

Dramatic Ninth Inning D Backs Five Run Rally Beats Brewers

Apr 23, 2025 -

Is William Contreras The Key To Brewers Success

Apr 23, 2025

Is William Contreras The Key To Brewers Success

Apr 23, 2025 -

Recovery Complete Yelich Hits First Home Run After Back Surgery

Apr 23, 2025

Recovery Complete Yelich Hits First Home Run After Back Surgery

Apr 23, 2025