The 2025 BigBear.ai (BBAI) Stock Market Dip: What Investors Need To Know

Table of Contents

Analyzing Potential Causes of a BBAI Stock Dip in 2025

Several factors could contribute to a hypothetical decline in BigBear.ai's (BBAI) stock price in 2025. Understanding these potential causes is vital for informed investment decisions.

Macroeconomic Factors

Broad economic conditions significantly impact stock market performance. A downturn in the overall market can drag down even the strongest performers.

- High Inflation and Interest Rate Hikes: Persistent inflation and subsequent interest rate increases by central banks can curb economic growth, reducing investor appetite for riskier growth stocks like BBAI. Higher borrowing costs also increase the cost of expansion for companies.

- Recessionary Fears: Concerns about a looming recession often lead to a flight to safety, with investors moving away from growth stocks and into more conservative investments like government bonds. This could negatively impact BBAI's valuation.

- Geopolitical Instability: Global uncertainty, conflicts, or trade wars can create market volatility and negatively affect investor sentiment towards technology companies, including BBAI. Supply chain disruptions and reduced consumer spending are possible consequences.

Company-Specific Challenges

Internal factors within BigBear.ai itself could also lead to a stock price decline.

- Missed Earnings Expectations: Failure to meet or beat analysts' earnings expectations can trigger a sell-off, as investors may question the company's growth trajectory.

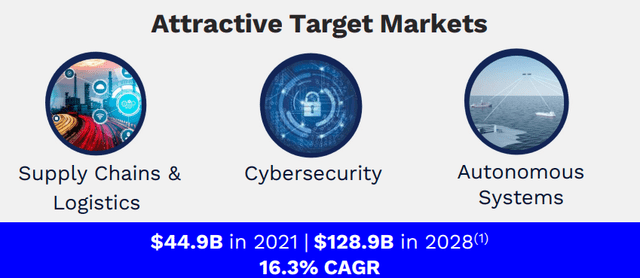

- Increased Competition: The AI and big data analytics market is highly competitive. The emergence of stronger competitors or innovative solutions could erode BBAI's market share and impact its profitability.

- Integration Challenges: Difficulties integrating recently acquired companies or scaling operations efficiently can strain resources and negatively affect performance, potentially leading to a stock price drop.

- Negative News or Controversies: Negative publicity, data breaches, or ethical concerns surrounding BBAI's products or practices could severely damage investor confidence and lead to a significant decline in the stock price.

Sector-Specific Trends

Trends within the broader artificial intelligence sector will also influence BBAI's performance.

- Regulatory Changes: Government regulations on AI development and data privacy could create uncertainty and impact BBAI's operations and growth prospects.

- Shifting Investor Preferences: Investor sentiment towards specific AI sub-sectors (e.g., generative AI vs. data analytics) can shift, leading to changes in valuations within the sector.

- Disruptive Technologies: The emergence of entirely new AI technologies could render BBAI's current offerings obsolete, creating a significant competitive disadvantage.

Strategies for Navigating a BBAI Stock Dip

While predicting market dips is impossible, investors can employ strategies to mitigate potential losses and capitalize on opportunities during periods of market volatility.

Risk Management Techniques

Several risk management techniques can help investors protect their portfolios during a BBAI stock dip.

- Diversification: Spreading investments across different asset classes and sectors reduces the overall risk. Over-reliance on a single stock like BBAI is highly risky.

- Dollar-Cost Averaging: Investing a fixed amount of money at regular intervals, regardless of the stock price, reduces the impact of volatility. This strategy helps average out the purchase price.

- Stop-Loss Orders: Setting stop-loss orders can limit potential losses by automatically selling the stock when it reaches a predetermined price.

Long-Term Investment Perspective

A long-term investment strategy is crucial for weathering short-term market fluctuations.

- Fundamental Analysis: Thoroughly analyze BBAI's long-term growth potential, its competitive advantages, and its financial health. Focus on the company's underlying fundamentals rather than short-term price movements.

- Market Outlook: Consider the overall trajectory of the AI market and BBAI's position within it. Is the company well-positioned for future growth?

Monitoring Key Performance Indicators (KPIs)

Continuously monitoring BBAI's key performance indicators is vital for informed decision-making.

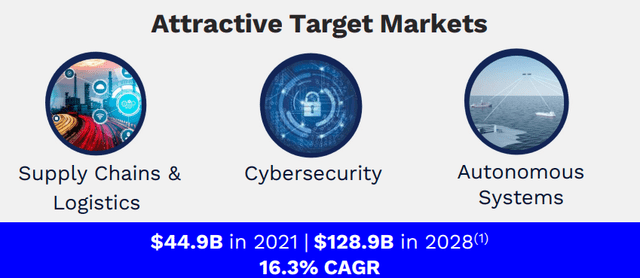

- Financial Performance: Track revenue growth, profitability, and cash flow to assess the company's financial health.

- Market Position: Monitor BBAI's market share and competitive position within the AI sector.

- Investor Sentiment: Pay attention to analyst ratings, news articles, and overall investor sentiment towards BBAI.

Conclusion

Understanding the potential for a BigBear.ai (BBAI) stock market dip requires a comprehensive analysis of macroeconomic factors, company-specific challenges, and sector-specific trends. Employing effective risk management techniques, adopting a long-term investment perspective, and closely monitoring key performance indicators are crucial for navigating such a scenario. Remember that diversification is key to mitigating risk. Before investing in BBAI or any other stock, conduct thorough due diligence, understanding the potential for a BigBear.ai (BBAI) stock market dip and managing your BigBear.ai (BBAI) investment risk allows for making informed decisions about BigBear.ai (BBAI) stock. Remember to stay informed about BBAI's performance and the factors that influence its stock price.

Featured Posts

-

Canadian Tire Hudsons Bay Merger Opportunities And Challenges

May 21, 2025

Canadian Tire Hudsons Bay Merger Opportunities And Challenges

May 21, 2025 -

Review Of Gangsta Granny David Walliams Hilarious Childrens Book

May 21, 2025

Review Of Gangsta Granny David Walliams Hilarious Childrens Book

May 21, 2025 -

Showbiz Rift David Walliams And Simon Cowells Relationship Breakdown

May 21, 2025

Showbiz Rift David Walliams And Simon Cowells Relationship Breakdown

May 21, 2025 -

Images Exclusives Le Theatre Tivoli A Clisson Laureat Du Loto Du Patrimoine 2025

May 21, 2025

Images Exclusives Le Theatre Tivoli A Clisson Laureat Du Loto Du Patrimoine 2025

May 21, 2025 -

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal Process

May 21, 2025

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal Process

May 21, 2025