The Bank Of England And QE: A Case For Moderation In Future Interventions

Table of Contents

The Effectiveness of Past QE Programs

The Bank of England's QE programs, implemented since the 2008 financial crisis and during the COVID-19 pandemic, have undoubtedly had a considerable impact on the UK economy. However, evaluating their effectiveness requires examining both the short-term benefits and the longer-term consequences.

Short-term benefits and market stabilization

QE programs injected liquidity into the financial system, aiming to lower borrowing costs and stimulate economic activity. The immediate effects were largely positive:

- Increased liquidity: QE increased the money supply, making credit more readily available.

- Reduced borrowing costs for businesses: Lower interest rates spurred investment and business expansion.

- Prevented a deeper recession: The infusion of capital helped prevent a more severe economic downturn during periods of crisis.

For example, the QE program implemented in 2009 following the global financial crisis saw a significant drop in UK government bond yields, making borrowing cheaper for the government and businesses. This helped stabilize markets and prevent a complete collapse of the financial system. Similar effects were observed during the COVID-19 pandemic, although the scale and speed of intervention were different.

Long-term economic impacts and potential drawbacks

While the short-term benefits of QE are undeniable, the long-term effects are more complex and potentially problematic:

- Asset inflation: The increased money supply contributed to rising asset prices, particularly in the housing market and equities, potentially widening the wealth gap.

- Increased inequality: The benefits of QE haven't been equally distributed, potentially exacerbating existing inequalities. Those with assets benefited disproportionately.

- Potential for future instability: The creation of asset bubbles through artificially low interest rates carries the risk of future market corrections and financial instability.

- Reduced bank lending incentives: Low interest rates may reduce the incentive for banks to lend, limiting the effectiveness of QE in stimulating the real economy.

Analyzing the long-term impact requires a detailed study of various economic indicators, comparing data from periods with and without substantial QE interventions. The potential for long-term inflation and the sustainability of the current economic growth fueled by QE remain key concerns.

Alternative Monetary Policy Tools

Over-reliance on QE presents risks. The Bank of England should consider a wider range of monetary policy tools to achieve its objectives:

Forward guidance and negative interest rates

These tools offer alternatives to large-scale asset purchases:

- Improved transparency: Clear communication of the Bank's intentions helps manage market expectations.

- Manages expectations: Forward guidance can influence inflation expectations and shape market behavior.

- Potentially stimulating lending: Negative interest rates, while controversial, could incentivize banks to lend more actively.

Several European central banks have experimented with negative interest rates, although their effectiveness remains a subject of ongoing debate. The Bank of England could carefully explore the potential benefits and drawbacks of these policies within the UK context.

Targeted lending programs and support for specific sectors

Instead of broad-based QE, targeted interventions may prove more efficient:

- Directs stimulus to areas needing it most: Focus on sectors facing specific challenges (e.g., SMEs, green technology).

- Avoids general inflation: Targeted lending avoids the inflationary pressures associated with general QE programs.

- Can be more effective at supporting specific industries: Tailored support can address the unique needs of particular economic sectors.

For example, government-backed loan schemes can provide targeted support to struggling businesses without the systemic risks of large-scale QE. This allows for a more nuanced response to specific economic challenges.

The Risks of Over-reliance on QE

The potential downsides of excessive reliance on QE warrant careful consideration:

Moral hazard and market distortions

QE can create unintended consequences:

- Creates dependency on government intervention: Businesses might become overly reliant on government support rather than adapting to market conditions.

- Encourages excessive risk-taking: Artificially low interest rates can incentivize excessive risk-taking by businesses and investors.

- Undermines market mechanisms: QE can distort market signals and hinder the efficient allocation of capital.

The risk of moral hazard increases significantly when QE is used repeatedly and without clear exit strategies. This can lead to a loss of market discipline and make future crises more likely.

Inflationary pressures and potential for future crises

QE's impact on inflation is a crucial concern:

- Increased money supply can lead to inflation: Excessive QE increases the money supply, which can fuel inflation, eroding purchasing power.

- Failure to unwind QE can create future challenges: Exiting a large QE program without causing market disruption is extremely challenging.

The Bank of England needs to carefully monitor inflation and adjust its policies accordingly. A gradual and well-communicated unwinding of QE programs is essential to mitigate potential risks.

Conclusion

The Bank of England's use of QE has been a vital tool in navigating economic crises, but its future application demands a more nuanced approach. While QE can offer short-term benefits, the potential long-term risks associated with asset inflation, market distortions, and reduced effectiveness necessitate exploring alternative monetary policy tools. A moderate and targeted approach, supplementing QE with forward guidance, negative interest rates, and specific sector support, will be more effective in navigating future economic challenges. Moving forward, a careful and data-driven analysis of the potential impacts is vital to ensure that future uses of Bank of England Quantitative Easing are both effective and sustainable. Further research into the optimal balance between QE and alternative monetary tools is crucial for the long-term health of the UK economy.

Featured Posts

-

Go Delete Yourself From The Internet A Practical Guide

Apr 23, 2025

Go Delete Yourself From The Internet A Practical Guide

Apr 23, 2025 -

Brewers Fall To Diamondbacks In Dramatic Ninth Inning Finish

Apr 23, 2025

Brewers Fall To Diamondbacks In Dramatic Ninth Inning Finish

Apr 23, 2025 -

Swq Alktakyt Fy Msr Asear Alywm Alathnyn 14 Abryl 2025

Apr 23, 2025

Swq Alktakyt Fy Msr Asear Alywm Alathnyn 14 Abryl 2025

Apr 23, 2025 -

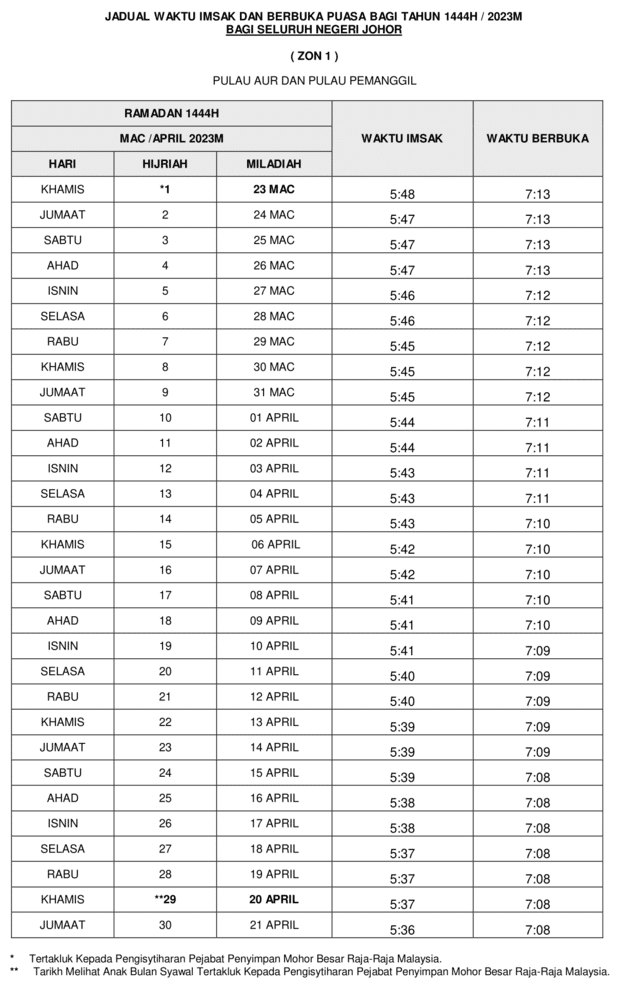

Program Tv Ramadan 2025 Siap Menemani Waktu Berbuka Dan Sahur Anda

Apr 23, 2025

Program Tv Ramadan 2025 Siap Menemani Waktu Berbuka Dan Sahur Anda

Apr 23, 2025 -

Milwaukee Brewers Secure Walk Off Victory On Turangs Bunt

Apr 23, 2025

Milwaukee Brewers Secure Walk Off Victory On Turangs Bunt

Apr 23, 2025