The Current State Of CoreWeave Stock: Opportunities And Risks

Table of Contents

CoreWeave's Business Model and Competitive Advantage

CoreWeave distinguishes itself by offering a specialized cloud computing platform built on a foundation of high-performance graphics processing units (GPUs). Unlike general-purpose cloud providers like AWS, Google Cloud, and Azure, CoreWeave focuses intently on providing superior infrastructure for computationally intensive tasks. Its target market is primarily comprised of organizations involved in artificial intelligence (AI), machine learning (ML), and high-performance computing (HPC). This niche focus allows for a deep understanding of client needs and tailored solutions.

CoreWeave's competitive advantages stem from several key factors:

- Superior performance for AI workloads: CoreWeave's infrastructure is optimized for the demanding computational requirements of AI and ML, delivering faster processing speeds and improved efficiency compared to general-purpose cloud platforms. This translates to quicker model training times and reduced operational costs for clients.

- Cost-effective solutions for GPU computing: By specializing in GPU-based infrastructure, CoreWeave can often offer more competitive pricing for GPU-intensive workloads compared to larger, more diversified cloud providers. This makes its services accessible to a wider range of businesses and research institutions.

- Focus on specific niche markets: This targeted approach allows CoreWeave to develop deep expertise and strong relationships within the AI/ML/HPC communities, fostering customer loyalty and attracting top talent.

- Strong partnerships and strategic alliances: CoreWeave actively cultivates partnerships with leading hardware and software vendors to ensure its platform remains at the cutting edge of technology and offers seamless integration with other industry solutions.

Growth Potential and Market Outlook

The market for GPU-accelerated cloud computing is experiencing explosive growth, driven by the increasing demand for AI and ML capabilities across various sectors. This presents a significant opportunity for CoreWeave. The company's potential market share hinges on its ability to continue innovating, expanding its customer base, and maintaining its competitive edge.

Several factors contribute to CoreWeave's growth potential:

- Increasing demand for AI and machine learning capabilities: The widespread adoption of AI and ML across industries is a major tailwind for CoreWeave, as businesses increasingly rely on these technologies for data analysis, automation, and innovation.

- Growth in the high-performance computing sector: Advancements in scientific research, engineering, and other computationally intensive fields continue to drive demand for high-performance computing resources, a key area of focus for CoreWeave.

- Potential for international expansion: CoreWeave can significantly expand its reach by targeting international markets with growing demand for GPU cloud computing services.

- Opportunities for strategic acquisitions: Acquiring smaller, complementary companies could enhance CoreWeave's capabilities and accelerate its growth trajectory.

Financial Performance and Valuation

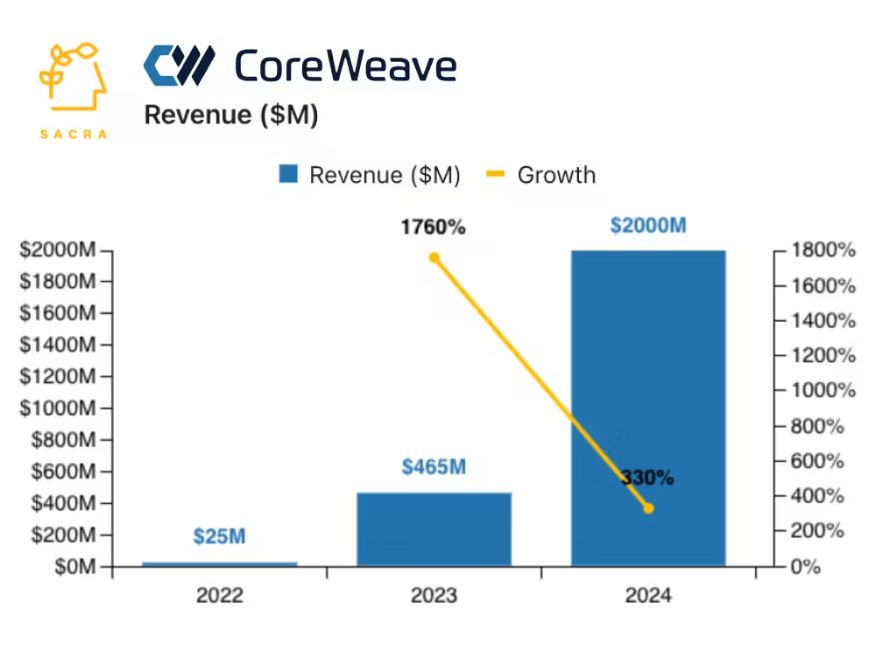

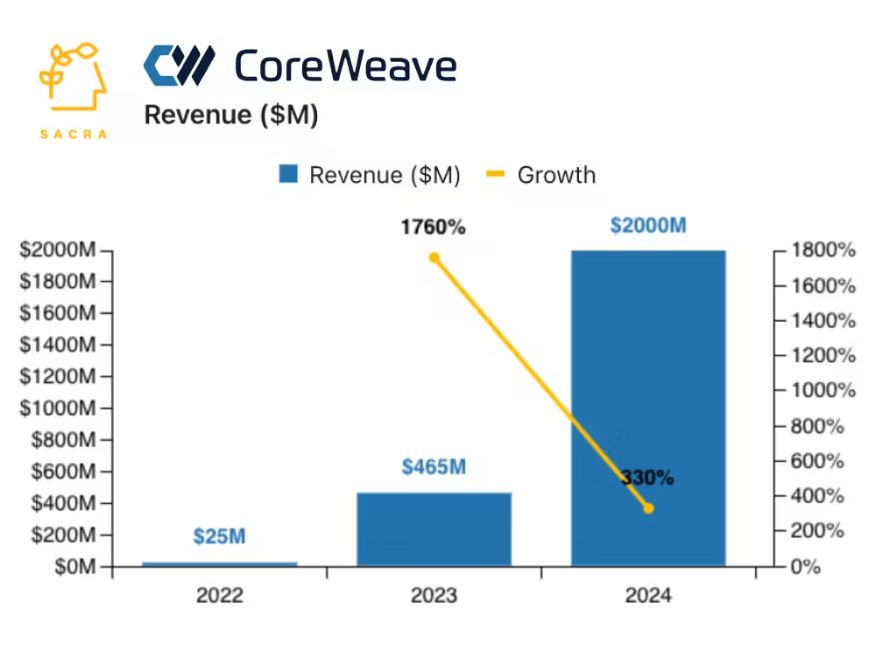

While specific financial details may not be publicly available for a privately held company, analyzing publicly available information (when it becomes available) will be crucial for assessing CoreWeave's financial health. Key metrics to watch include:

- Revenue growth projections: Sustained and robust revenue growth will be a key indicator of CoreWeave's success.

- Profitability margins: Analyzing profitability will reveal the efficiency of CoreWeave's operations and its ability to generate profits from its services.

- Cash flow analysis: A strong positive cash flow will demonstrate CoreWeave's financial stability and its capacity for reinvestment and future growth.

- Debt-to-equity ratio: This ratio will help determine the company's financial risk profile. A lower ratio indicates lower financial risk.

Risks and Challenges Facing CoreWeave

Despite its considerable potential, CoreWeave faces several challenges:

- Competition from established cloud providers: Major players like AWS, Google Cloud, and Azure are constantly expanding their GPU offerings, creating intense competition for CoreWeave.

- Technological obsolescence risks: The rapid pace of technological change in the cloud computing sector necessitates ongoing investment in infrastructure and software to maintain a competitive edge.

- Economic sensitivity of the AI market: The demand for AI and ML services can be sensitive to economic downturns, potentially impacting CoreWeave's revenue.

- Regulatory hurdles and compliance: Navigating complex data privacy regulations and compliance requirements poses a significant challenge for CoreWeave.

Conclusion

CoreWeave stock presents a compelling investment opportunity for those interested in the burgeoning GPU cloud computing market. Its innovative business model and strong growth potential are attractive, but investors must carefully weigh the inherent risks. A thorough understanding of its financial performance (when available), competitive landscape, and market outlook is crucial before making any investment decisions. Conduct thorough due diligence and consult with a financial advisor before investing in CoreWeave stock or any other similar high-growth technology company. Remember, careful consideration of the opportunities and risks associated with CoreWeave stock is essential for informed investing.

Featured Posts

-

Cau Ma Da Du An Trong Diem Ket Noi Dong Nai Binh Phuoc Khoi Cong Thang 6

May 22, 2025

Cau Ma Da Du An Trong Diem Ket Noi Dong Nai Binh Phuoc Khoi Cong Thang 6

May 22, 2025 -

Netflix Unveils New Drama Sexy Darkly Funny Series Starring White Lotus Star And Oscar Winner

May 22, 2025

Netflix Unveils New Drama Sexy Darkly Funny Series Starring White Lotus Star And Oscar Winner

May 22, 2025 -

No Es El Arandano Descubre El Superalimento Para Un Envejecimiento Saludable Y La Prevencion De Enfermedades Cronicas

May 22, 2025

No Es El Arandano Descubre El Superalimento Para Un Envejecimiento Saludable Y La Prevencion De Enfermedades Cronicas

May 22, 2025 -

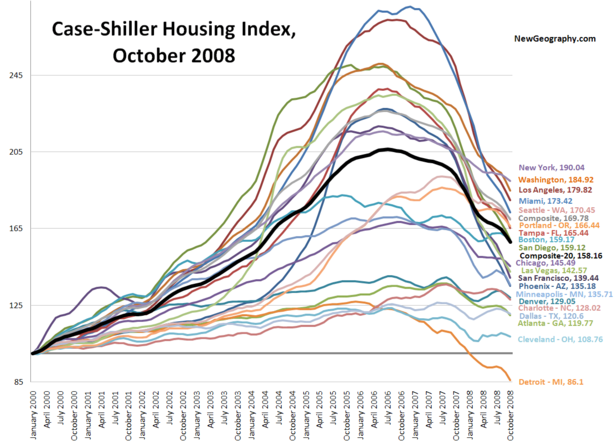

Posthaste Understanding The Potential For A Canadian Housing Price Correction

May 22, 2025

Posthaste Understanding The Potential For A Canadian Housing Price Correction

May 22, 2025 -

Dexter Original Sin Steelbook Blu Ray Complete Your Collection

May 22, 2025

Dexter Original Sin Steelbook Blu Ray Complete Your Collection

May 22, 2025