The Falling Dollar: A Disruptive Force In Asian Currency Markets

Table of Contents

Causes of the Falling Dollar

Several interconnected factors contribute to the weakening of the US dollar. Understanding these underlying causes is crucial to navigating the current market volatility.

US Economic Factors

Weakening economic indicators within the United States play a significant role in the falling dollar. High inflation, slower-than-expected GDP growth, and adjustments to Federal Reserve monetary policy all contribute to a decline in investor confidence and a subsequent weakening of the currency. Geopolitical uncertainties also exert downward pressure.

- Inflation: Persistent inflation erodes the purchasing power of the dollar, making it less attractive to foreign investors. For example, the recent inflation rate of X% significantly exceeds the Federal Reserve's target, impacting the dollar's value.

- GDP Growth: Slower-than-anticipated GDP growth signals a weakening US economy, reducing investor confidence and driving down the dollar. A projected GDP growth of only Y% for the next quarter further fuels concerns.

- Federal Reserve Policy: The Federal Reserve's actions, such as interest rate hikes or quantitative easing, directly influence the dollar's value. Recent decisions to increase interest rates, while aiming to curb inflation, have had a mixed impact on the dollar's strength.

- Geopolitical Events: Global political instability and uncertainty can lead to a flight to safety, potentially weakening the dollar as investors seek refuge in other perceived safer assets. The ongoing conflict in Z significantly adds to this uncertainty.

Global Economic Shifts

The falling dollar isn't solely a US phenomenon; global economic shifts significantly contribute to its decline.

- Rise of Other Currencies: The strengthening of other major currencies, such as the Euro and the Yen, creates a relative weakening of the dollar. The recent surge in the value of the Euro, driven by strong economic performance in the Eurozone, directly impacts the dollar-euro exchange rate.

- Global Trade Imbalances: Persistent trade deficits in the US contribute to a lower demand for dollars, further weakening the currency. The ongoing trade imbalance between the US and China is a key factor.

- Global Investment Flows: Shifting global investment patterns, with investors diversifying away from dollar-denominated assets, contribute to the downward pressure on the dollar. Increased investment in emerging markets has drawn capital away from the US.

- Key Global Economic Events: Major global events, such as significant changes in oil prices or major shifts in global supply chains, can heavily influence currency values, including the dollar.

Impact on Asian Currencies

The falling dollar creates a ripple effect across Asian currency markets, leading to both appreciation and depreciation in various currencies.

Currency Appreciation in Asia

Several Asian economies experience currency appreciation against the falling dollar.

- Japan, South Korea, and China: These nations see their currencies strengthen relative to the dollar, impacting their exports and imports. The appreciation of the Japanese Yen, for example, makes Japanese exports more expensive globally.

- Implications for Exports and Imports: A stronger currency can make exports more expensive and imports cheaper, impacting trade balances. South Korea's increased export costs due to a stronger Won highlight this challenge.

- Impact on Tourism and Foreign Investment: Currency appreciation can attract tourists and foreign investment, boosting domestic economies. The increase in Chinese tourism to Japan, driven by a stronger Yen, exemplifies this benefit.

- Specific Examples: The Japanese Yen has appreciated by X%, the South Korean Won by Y%, and the Chinese Yuan by Z% against the dollar in the last quarter.

Currency Depreciation in Asia

Conversely, some Asian economies with weaker fundamentals experience currency depreciation.

- Weaker Economies: Nations with weaker economies and higher debt levels see their currencies depreciate further against the dollar. This impacts their ability to service debts and can fuel inflation.

- Implications for Inflation and Debt Repayment: Depreciation makes imports more expensive, increasing inflationary pressures and making debt repayment more difficult for countries with significant US dollar-denominated debt.

- Impact on Domestic Industries: Depreciation can provide a temporary boost to domestic industries by making exports cheaper, but it can also lead to higher import costs.

- Specific Examples: The currency of Country A has depreciated by X% against the dollar, impacting its import costs and increasing inflationary pressures.

Increased Volatility and Uncertainty

The falling dollar introduces increased volatility and uncertainty into Asian currency markets.

- Increased Volatility: Rapid fluctuations in exchange rates create significant risks for businesses involved in international trade and investment.

- Impact on Currency Trading and Hedging Strategies: Currency traders need to adjust their strategies to cope with the increased volatility and uncertainty. Sophisticated hedging techniques become crucial in mitigating risks.

- Challenges for Businesses Managing Foreign Exchange Risk: Businesses face increased challenges in managing foreign exchange risk due to unpredictable fluctuations in exchange rates. Proper risk management strategies become paramount.

- Examples of Market Volatility: The recent sharp swings in the value of the Thai Baht against the dollar illustrate the increased volatility in Asian currency markets.

Implications and Future Outlook

The falling dollar presents both opportunities and challenges for Asian economies.

Opportunities for Asian Economies

A weaker dollar can create opportunities for several Asian nations.

- Benefits for Exporting Nations: A weaker dollar can boost exports from Asian countries, making their goods more competitive in global markets.

- Opportunities for Foreign Direct Investment: A weaker dollar can attract foreign direct investment into Asian economies.

- Potential for Regional Economic Integration: The changing dynamics could accelerate regional economic integration within Asia.

- Specific Examples: Vietnam's export sector has benefited from the weaker dollar, seeing increased demand for its goods.

Challenges for Asian Economies

However, a falling dollar also presents significant challenges.

- Potential Inflationary Pressures: A weaker dollar can fuel inflationary pressures as import costs rise.

- Risks Associated with Increased Debt Burdens: A falling dollar can increase the debt burden for countries with significant US dollar-denominated debt.

- Potential Challenges to Economic Stability: The increased volatility and uncertainty can pose significant challenges to economic stability in the region.

- Specific Examples: Indonesia is facing rising inflation due to higher import costs resulting from the weaker dollar.

Strategies for Navigating the Changing Landscape

Effective strategies are needed to navigate the complexities of the falling dollar.

- Hedging Strategies for Businesses: Businesses need to implement effective hedging strategies to protect themselves from exchange rate fluctuations.

- Investment Strategies for Investors: Investors need to carefully consider the implications of the falling dollar when making investment decisions.

- Policy Responses from Asian Governments: Governments need to develop appropriate policy responses to mitigate the negative impacts of the falling dollar while harnessing potential opportunities.

- Examples of Effective Strategies: Diversification of investment portfolios and strategic currency hedging are vital for mitigating risks.

Conclusion: Understanding the Falling Dollar's Impact on Asian Markets

The falling dollar is a multifaceted phenomenon with diverse impacts on Asian economies. Understanding the causes – from US economic factors to global economic shifts – is crucial. The consequences range from currency appreciation in some nations to depreciation in others, leading to increased market volatility and requiring careful navigation by businesses and investors. Staying informed about the dynamics of the falling dollar is paramount for making sound economic decisions. Stay ahead of the curve by closely monitoring the falling dollar and its effects on Asian currency markets. Understanding these dynamics is crucial for successful navigation in this volatile economic landscape.

Featured Posts

-

Analysis Of Westpac Wbc Financial Performance Declining Profits Amidst Margin Squeeze

May 06, 2025

Analysis Of Westpac Wbc Financial Performance Declining Profits Amidst Margin Squeeze

May 06, 2025 -

Rihanna Launches Wedding Themed Lingerie With Savage X Fenty

May 06, 2025

Rihanna Launches Wedding Themed Lingerie With Savage X Fenty

May 06, 2025 -

Priyanka Chopra And Nick Jonas A Memorable Holi Celebration

May 06, 2025

Priyanka Chopra And Nick Jonas A Memorable Holi Celebration

May 06, 2025 -

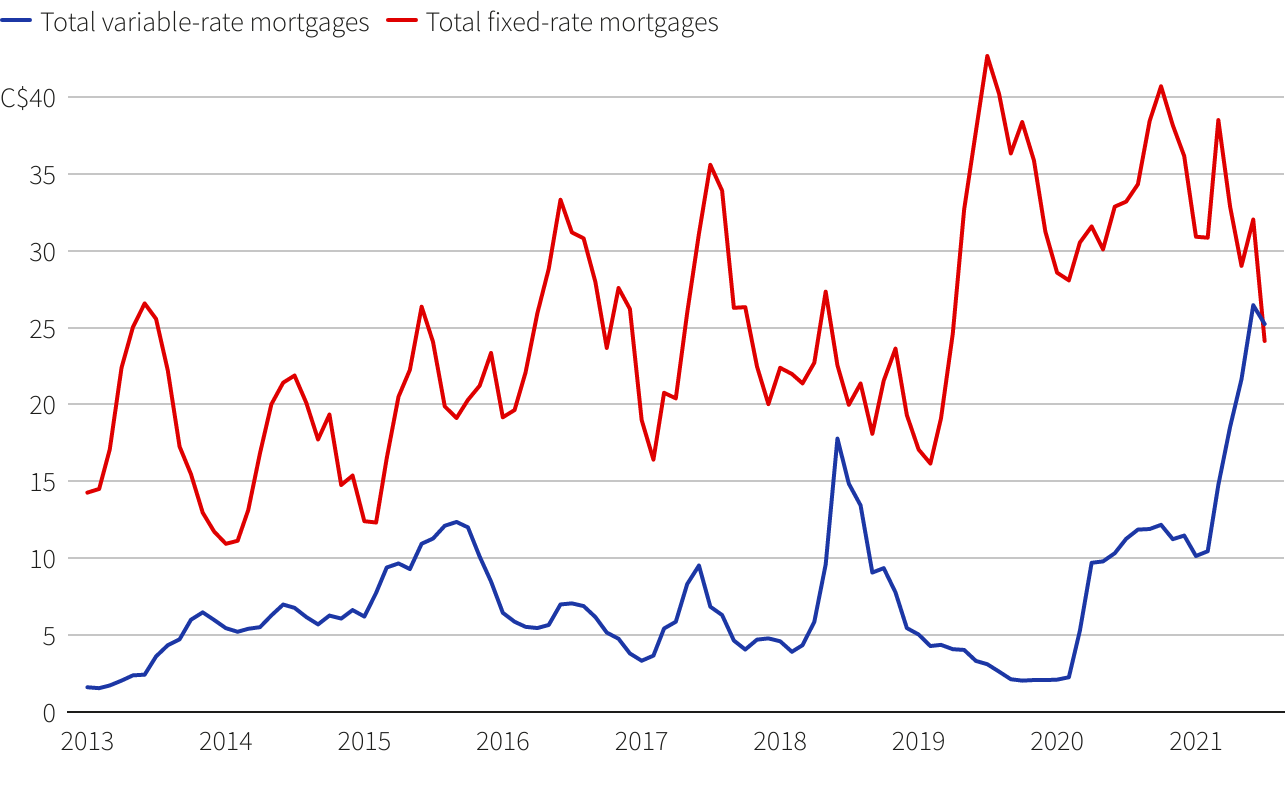

10 Year Mortgages In Canada Reasons For Limited Adoption

May 06, 2025

10 Year Mortgages In Canada Reasons For Limited Adoption

May 06, 2025 -

Albrnamj Alsewdy Ltnmyt Wiemar Alymn Yeqd Ajtmaea Lmjmwet Shrkae Alymn

May 06, 2025

Albrnamj Alsewdy Ltnmyt Wiemar Alymn Yeqd Ajtmaea Lmjmwet Shrkae Alymn

May 06, 2025