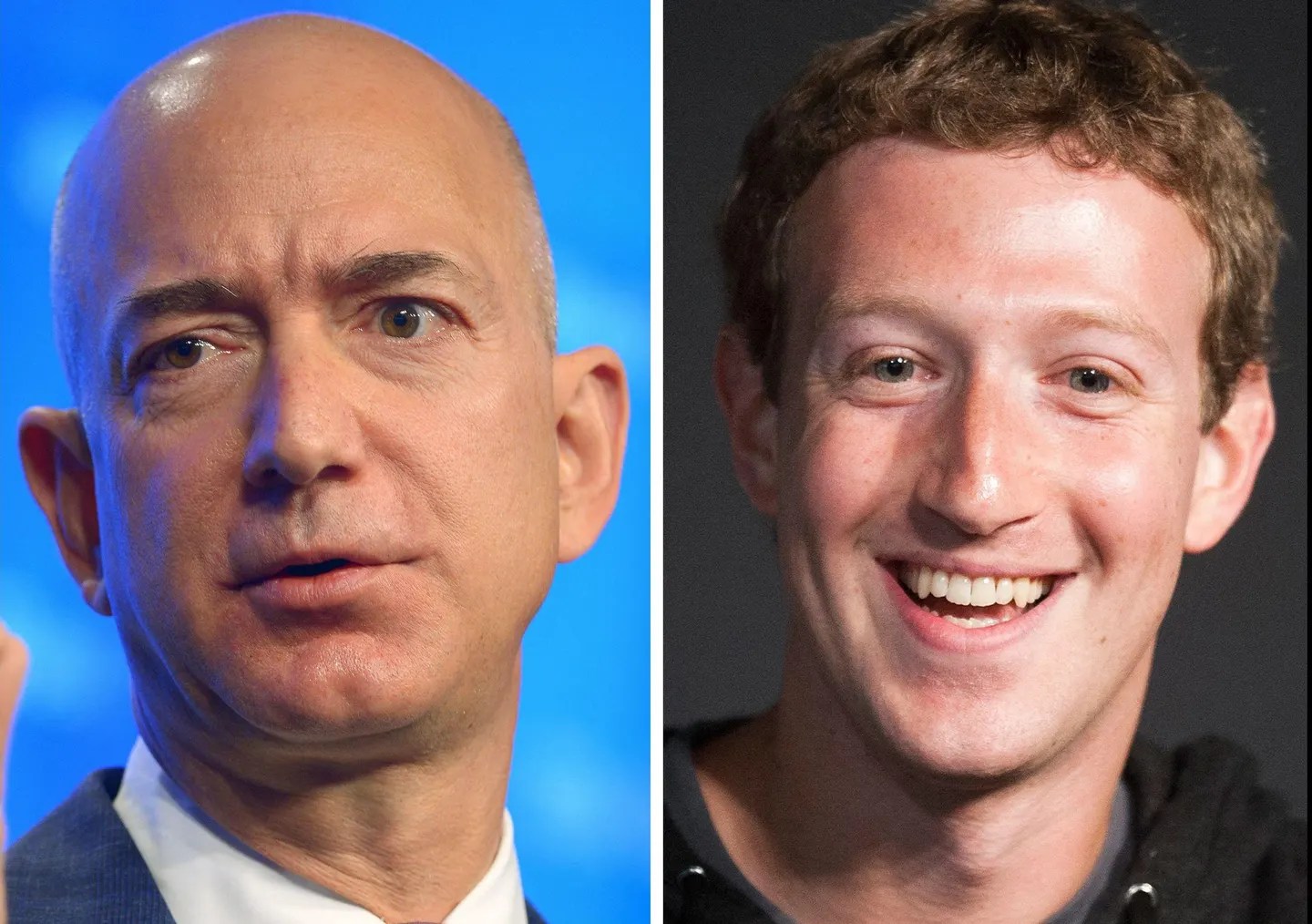

The Financial Impact Of Donald Trump's Presidency On Elon Musk, Jeff Bezos, And Mark Zuckerberg

Table of Contents

Donald Trump's presidency (2017-2021) profoundly reshaped the American economic landscape, triggering a ripple effect across various sectors, including the technology industry. This article delves into the financial implications of Trump's economic policies—specifically tax cuts, deregulation, and trade wars—on three prominent tech CEOs: Elon Musk (Tesla, SpaceX), Jeff Bezos (Amazon), and Mark Zuckerberg (Meta). We'll analyze how these policies influenced their companies' valuations, stock prices, and personal wealth, revealing the intricate relationship between political decisions and the financial fortunes of tech giants.

The Impact of Tax Cuts

Trump's administration enacted significant tax cuts, impacting both corporate and individual income. Let's explore their effects on our tech titans.

Corporate Tax Rate Reduction

The Tax Cuts and Jobs Act of 2017 slashed the federal corporate tax rate from 35% to 21%. This substantial reduction directly boosted the profitability of Tesla, Amazon, and Meta. While precise figures on tax savings for each company are not publicly available in complete detail due to complexities in accounting and reporting, it is widely acknowledged that the lower rate led to increased after-tax earnings. This allowed for increased investment in research and development, expansion projects, or stock buybacks, all potentially enhancing shareholder value.

- Tesla: The reduced tax burden likely contributed to Tesla's aggressive expansion into new markets and its investments in battery technology and renewable energy initiatives.

- Amazon: Amazon, already a massive corporation, may have leveraged the tax savings for infrastructure upgrades (fulfillment centers, cloud computing) and expansion of its e-commerce and cloud services (AWS).

- Meta (formerly Facebook): Meta likely used the additional revenue to fuel its ongoing investment in artificial intelligence, virtual reality (Metaverse projects), and social media platform improvements.

Individual Tax Cuts and CEO Compensation

Individual tax cuts also impacted the CEOs' personal finances. Lower tax rates potentially increased their after-tax income, potentially influencing charitable giving or personal investments. However, it's important to note that executive compensation is always a subject of debate, with scrutiny regarding its fairness and proportionality relative to employee wages. Any increased income from lower tax rates received by these CEOs during this period might have also fueled discussions about executive pay and wealth inequality.

The Effects of Deregulation

Trump's administration pursued a policy of deregulation across various sectors. This had both direct and indirect effects on our tech leaders.

Reduced Environmental Regulations

Relaxed environmental regulations could have indirectly benefited Tesla by potentially reducing compliance costs associated with its manufacturing processes. However, this aspect remains controversial given Tesla's public commitment to sustainability and its role as an electric vehicle pioneer. For Amazon, reduced regulations on logistics and transportation might have led to minor cost savings in its vast delivery network. However, the environmental impact of reduced regulations on both companies remains a subject of ongoing debate.

Antitrust Scrutiny (or Lack Thereof)

Trump's administration was arguably less aggressive in pursuing antitrust investigations against large tech companies compared to previous administrations. This relative lack of scrutiny could be viewed as beneficial to Amazon, given its dominance in e-commerce and cloud computing, as well as to other large tech corporations. However, less antitrust enforcement could also hinder competition and innovation in the long run, potentially stifling the emergence of new players and limiting consumer choice.

Trade Wars and Global Market Fluctuations

Trump's trade policies, particularly the trade war with China, introduced significant uncertainty into global markets.

Impact on Supply Chains

The trade war disrupted global supply chains for all three companies. Increased tariffs on goods imported from China affected manufacturing costs and product pricing. This forced companies to re-evaluate their sourcing strategies, potentially shifting production to other countries or exploring alternative supply chains to mitigate the impact of tariffs and trade disputes.

Stock Market Volatility

The trade war and associated economic uncertainty contributed to increased volatility in the stock market. While all three companies experienced fluctuations during this period, the precise impact varied depending on their specific business models and exposure to global trade. Analyzing stock price charts from this period reveals significant ups and downs reflecting investor sentiment and reactions to changing political and economic conditions. Overall investor confidence might have been impacted negatively due to trade uncertainty.

Conclusion

Donald Trump's presidency had a multifaceted financial impact on Elon Musk, Jeff Bezos, and Mark Zuckerberg. Tax cuts likely boosted corporate profits and, potentially, personal wealth. However, the effects of deregulation and trade wars were complex and varied significantly across these companies. This analysis highlights the intertwined nature of political and economic landscapes, demonstrating how presidential policies profoundly influence even the most powerful tech giants. The overall effect was a complex interplay of benefits and challenges, showing the unpredictable nature of political influence on these powerful corporations.

Call to Action: Understanding the financial impact of political decisions on leading tech companies like those of Elon Musk, Jeff Bezos, and Mark Zuckerberg is crucial for investors and policymakers alike. Further research into the long-term consequences of Trump's economic policies on the tech industry and the broader economy is needed. Continue to explore this critical intersection of politics and finance by reading more articles on this subject and engaging in further research on this important topic.

Featured Posts

-

Tesla Stock And Dogecoin A Look At The Recent Market Volatility Driven By Elon Musk

May 09, 2025

Tesla Stock And Dogecoin A Look At The Recent Market Volatility Driven By Elon Musk

May 09, 2025 -

2025 Investment Outlook Weighing Micro Strategy Stock Against Bitcoin

May 09, 2025

2025 Investment Outlook Weighing Micro Strategy Stock Against Bitcoin

May 09, 2025 -

Elizabeth City Vehicle Break Ins Police Seek Suspect Information

May 09, 2025

Elizabeth City Vehicle Break Ins Police Seek Suspect Information

May 09, 2025 -

194 Billion And Counting Tech Billionaires Losses Since Trump Inauguration

May 09, 2025

194 Billion And Counting Tech Billionaires Losses Since Trump Inauguration

May 09, 2025 -

Recent Instagram Post By Tatum Prompts Response From Kuzma

May 09, 2025

Recent Instagram Post By Tatum Prompts Response From Kuzma

May 09, 2025