The Magnificent Seven's 2024 Decline: A $2.5 Trillion Market Value Loss

Table of Contents

Rising Interest Rates and Their Impact on Tech Valuations

The inverse relationship between interest rates and tech stock valuations is a crucial factor in the Magnificent Seven's decline. Higher interest rates increase the cost of borrowing, making it more expensive for tech companies to fund expansion, research and development, and acquisitions. This directly impacts future growth projections, a key driver of tech valuations. Companies like Amazon, heavily reliant on capital investment for infrastructure and expansion, are particularly vulnerable. Nvidia, a growth-focused company, also sees its potential future earnings discounted more heavily in a higher interest rate environment.

- Reduced investor appetite for high-growth, future-oriented stocks: Investors are shifting towards more immediate returns, favoring less speculative investments.

- Increased cost of capital for expansion and acquisitions: Higher borrowing costs make it more challenging for tech giants to pursue aggressive growth strategies.

- Shift in investor preference towards more stable, dividend-paying stocks: In times of uncertainty, investors seek the relative safety of established companies offering dividend payouts.

Inflation and its Role in Eroding Consumer Spending

Rampant inflation significantly impacts consumer spending power. This has a direct knock-on effect on the revenues of tech companies, especially those heavily reliant on consumer discretionary spending. Amazon's retail arm, for example, has experienced a slowdown in sales growth as consumers tighten their belts. Furthermore, the increased operational costs associated with inflation erode profit margins across the board. Meta and Alphabet, reliant on advertising revenue, also feel the pinch as businesses cut back on marketing budgets in a challenging economic climate.

- Decreased demand for discretionary tech products and services: Consumers are prioritizing essential spending, reducing purchases of non-essential tech gadgets and subscriptions.

- Impact on advertising revenues for companies like Alphabet and Meta: Reduced marketing spending by businesses directly translates to lower advertising revenue for these tech giants.

- Pressure on profit margins due to increased operational costs: Higher input costs, from energy to raw materials, squeeze profit margins, forcing companies to cut costs or raise prices.

Geopolitical Uncertainty and its Effect on Global Markets

Geopolitical instability significantly impacts investor sentiment, leading to increased risk aversion. Global conflicts and economic uncertainty create a volatile market environment, disproportionately affecting growth-oriented tech stocks. The Magnificent Seven are not immune to the disruptions caused by supply chain issues, trade wars, and regulatory uncertainty. These factors contribute to a climate of fear and uncertainty, prompting investors to seek safer havens.

- Supply chain disruptions affecting production and distribution: Global disruptions affect the availability of components, leading to delays and increased costs.

- Increased regulatory scrutiny and potential trade wars: Uncertainty surrounding government regulations and potential trade conflicts add to the overall risk.

- Uncertainty about future global economic growth: Concerns about a potential recession or prolonged economic slowdown weigh heavily on investor confidence.

Overvaluation and the Market Correction

The sharp decline in the Magnificent Seven's market value can be partly attributed to overvaluation in the preceding period. Some analysts argued that certain companies were trading at unsustainable price-to-earnings ratios (P/E ratios) and other valuation metrics, considering their projected future growth. The market correction represents a necessary adjustment to bring valuations back to more sustainable levels, reflecting a more realistic assessment of risk and future profitability. This correction is a natural market mechanism to eliminate unsustainable pricing bubbles.

- Analysis of price-to-earnings ratios and other valuation metrics: A comparative analysis reveals discrepancies between market capitalization and fundamental performance.

- Comparison to historical valuation levels: Analyzing historical data highlights the deviation from long-term averages.

- Discussion of potential future growth and its impact on valuations: The market reevaluates growth prospects based on the current macroeconomic environment.

The Future of the Magnificent Seven: Predictions and Opportunities

The outlook for the remainder of 2024 remains cautious. While a full recovery is possible, several factors suggest a prolonged period of volatility. However, the long-term prospects of these tech giants are not necessarily bleak. The continued development and adoption of artificial intelligence (AI), for instance, presents significant opportunities for growth and innovation. Smart investment strategies involve careful risk assessment and diversification.

- Potential catalysts for future growth (e.g., AI advancements): Breakthroughs in AI and related technologies could fuel renewed growth and innovation.

- Risks and challenges that remain: Geopolitical risks, inflation, and interest rates continue to pose challenges.

- Investment strategies for navigating market volatility: Diversification, careful stock selection, and risk management are key strategies.

Conclusion: Navigating the Aftershocks of the Magnificent Seven's Decline

The $2.5 trillion market value loss of the Magnificent Seven is a complex issue stemming from a combination of rising interest rates, persistent inflation, geopolitical uncertainty, and potential overvaluation. While the future remains uncertain, these tech giants possess significant resources and innovative capabilities. However, investors must carefully assess the risks and opportunities before making investment decisions. Stay informed on the Magnificent Seven and navigate the market effectively! Learn more about mitigating risk in the face of a volatile Magnificent Seven market by researching investment strategies and staying updated on macroeconomic trends.

Featured Posts

-

Ny Times Reporting On January 29th Dc Air Disaster A Critical Analysis

Apr 29, 2025

Ny Times Reporting On January 29th Dc Air Disaster A Critical Analysis

Apr 29, 2025 -

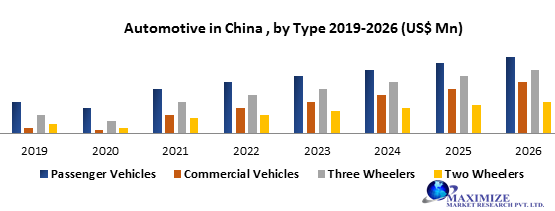

Chinas Automotive Market Challenges For Premium Brands Like Bmw And Porsche

Apr 29, 2025

Chinas Automotive Market Challenges For Premium Brands Like Bmw And Porsche

Apr 29, 2025 -

Us Researcher Exodus How Countries Are Competing For Talent After Funding Cuts

Apr 29, 2025

Us Researcher Exodus How Countries Are Competing For Talent After Funding Cuts

Apr 29, 2025 -

Family Appeals For Help In Finding Missing Paralympian Sam Ruddock Las Vegas

Apr 29, 2025

Family Appeals For Help In Finding Missing Paralympian Sam Ruddock Las Vegas

Apr 29, 2025 -

The Post Roe Shift Exploring The Implications Of Over The Counter Birth Control

Apr 29, 2025

The Post Roe Shift Exploring The Implications Of Over The Counter Birth Control

Apr 29, 2025