The Potential Of A 10x Bitcoin Multiplier: A Chart-Based Perspective

Table of Contents

Historical Bitcoin Price Analysis: Identifying Past Growth Patterns

Understanding Bitcoin's past performance is crucial for predicting future potential. By examining previous bull runs and applying technical analysis, we can gain valuable insights into the possibility of a 10x Bitcoin multiplier.

Examining Previous Bull Runs and Their Implications:

Bitcoin's history is punctuated by periods of explosive growth. Analyzing these bull runs reveals patterns that can inform our understanding of a potential 10x multiplier:

- 2010-2011: Bitcoin's early days saw a remarkable price increase from mere cents to over $30, representing a massive surge for early adopters.

- 2013-2014: This period witnessed a significant price jump from under $10 to over $1,000, driven by increasing media attention and growing adoption.

- 2017-2018: This bull run saw Bitcoin reach its all-time high of nearly $20,000, fueled by mainstream media hype and significant institutional interest. This surge, while not a 10x from the previous cycle's low, still demonstrates the potential for rapid growth.

These periods were characterized by:

- Increased media coverage: Positive news stories and mainstream adoption fueled increased demand.

- Technological advancements: Network upgrades and improvements in scalability boosted confidence.

- Regulatory developments (or lack thereof): In some cases, a relatively hands-off regulatory approach allowed for rapid growth.

Analyzing the time it took to reach these milestones is also key. The speed and intensity of these bull runs varied considerably, highlighting the unpredictable nature of the cryptocurrency market.

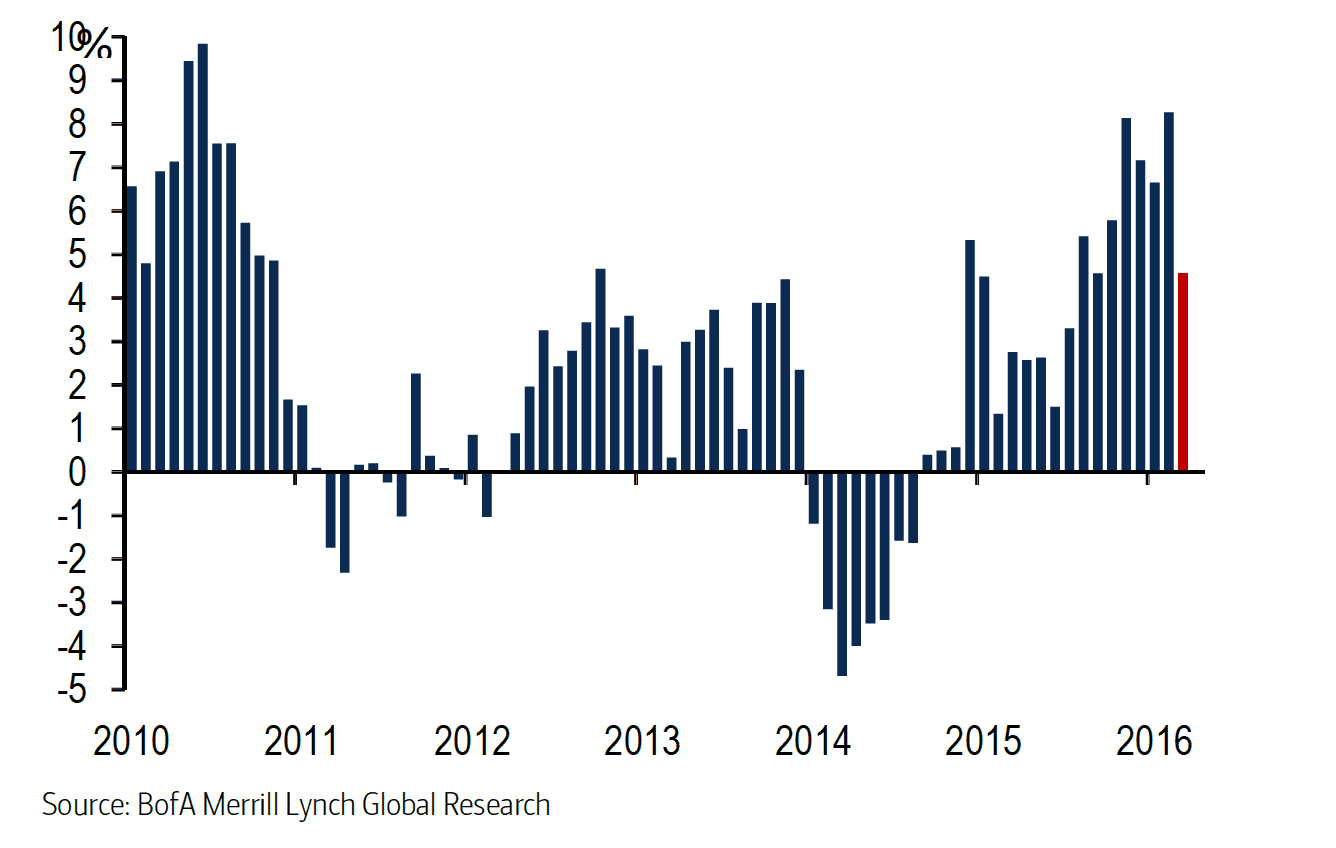

Chart Patterns and Technical Indicators:

Technical analysis offers valuable tools for predicting future price movements. By examining Bitcoin charts and key indicators, we can identify potential signals suggesting a future 10x multiplier.

- Moving Averages: Analyzing moving averages (e.g., 20-day, 50-day, 200-day) can reveal trends and potential support/resistance levels. A sustained break above key moving averages could signal a significant price increase.

- Relative Strength Index (RSI): The RSI helps identify overbought or oversold conditions, which can predict potential reversals. A low RSI reading could indicate a potential buying opportunity.

- Moving Average Convergence Divergence (MACD): The MACD helps identify momentum changes and potential trend reversals. A bullish crossover could suggest an upcoming price surge.

(Include visual examples of charts here, highlighting key indicators and their relation to past price surges.)

Factors Contributing to a Potential 10x Bitcoin Multiplier

Several factors could potentially contribute to a 10x Bitcoin price increase. These factors need careful consideration when analyzing a Bitcoin price prediction.

Increased Institutional Adoption and Investment:

The growing interest from institutional investors is a major driver of Bitcoin's price. Large-scale investments by corporations and investment funds can significantly impact price volatility. Data on institutional Bitcoin holdings, showing a steady increase, supports this trend. This institutional interest often acts as a catalyst, bringing more stability and legitimacy to the market.

Technological Advancements and Network Upgrades:

Improvements in Bitcoin's underlying technology are essential for its continued growth and adoption. Layer-2 scaling solutions, such as the Lightning Network, aim to improve transaction speed and reduce fees. These advancements make Bitcoin more efficient and user-friendly, potentially driving increased demand and, consequently, price appreciation. The continued development and implementation of these technologies are vital to Bitcoin’s long-term success and potential price growth.

Global Macroeconomic Factors and Safe-Haven Demand:

Geopolitical instability, inflation, and economic uncertainty can increase the demand for Bitcoin as a safe-haven asset. Investors seeking to protect their assets from inflation or market turmoil may turn to Bitcoin, driving up its price. This role as a store of value contributes significantly to Bitcoin's price appreciation, making it a crucial factor in considering a potential 10x Bitcoin multiplier.

Risks and Challenges Associated with a 10x Bitcoin Multiplier

While a 10x Bitcoin multiplier offers incredible potential, it's crucial to acknowledge the inherent risks:

Volatility and Market Corrections:

Bitcoin's price is notoriously volatile. Sharp price drops, even during bull runs, are common. Investors must employ robust risk management strategies, including diversification and careful position sizing, to mitigate potential losses. Understanding the cyclical nature of the market and preparing for corrections is essential.

Regulatory Uncertainty and Governmental Intervention:

Governmental regulations and potential bans pose significant risks to Bitcoin's price. Increased regulatory scrutiny or outright bans in major markets could negatively impact its price and adoption rate. Staying informed about regulatory developments is paramount for navigating this risk.

Competition from Other Cryptocurrencies:

The cryptocurrency market is competitive. The emergence of other cryptocurrencies with potentially superior technology or features could divert investment away from Bitcoin, limiting its price growth. Analyzing the competitive landscape is essential for understanding the potential for a 10x Bitcoin multiplier.

Conclusion

A 10x Bitcoin multiplier is not guaranteed, but analyzing historical data, technical indicators, and contributing factors reveals the potential for significant price appreciation. While the rewards are potentially enormous, the risks are equally substantial. Understanding the historical trends and factors influencing Bitcoin's price, combined with a thorough understanding of risk management, is critical for navigating this dynamic market. Begin your research on the potential of a 10x Bitcoin multiplier and strategize your cryptocurrency investments today! Learn more about Bitcoin chart analysis and price prediction tools to make informed decisions.

Featured Posts

-

Top Crypto Narratives Inspiring Tales Of Success And Failure

May 08, 2025

Top Crypto Narratives Inspiring Tales Of Success And Failure

May 08, 2025 -

Canadian Dollar Overvalued Economists Urge Swift Action

May 08, 2025

Canadian Dollar Overvalued Economists Urge Swift Action

May 08, 2025 -

Consumer Rights Group Sues Lidl Regarding Its Plus App

May 08, 2025

Consumer Rights Group Sues Lidl Regarding Its Plus App

May 08, 2025 -

Agjenti Rrefen E Verteta Pas Transferimit 222 Milione Euro Te Neymar Te Psg

May 08, 2025

Agjenti Rrefen E Verteta Pas Transferimit 222 Milione Euro Te Neymar Te Psg

May 08, 2025 -

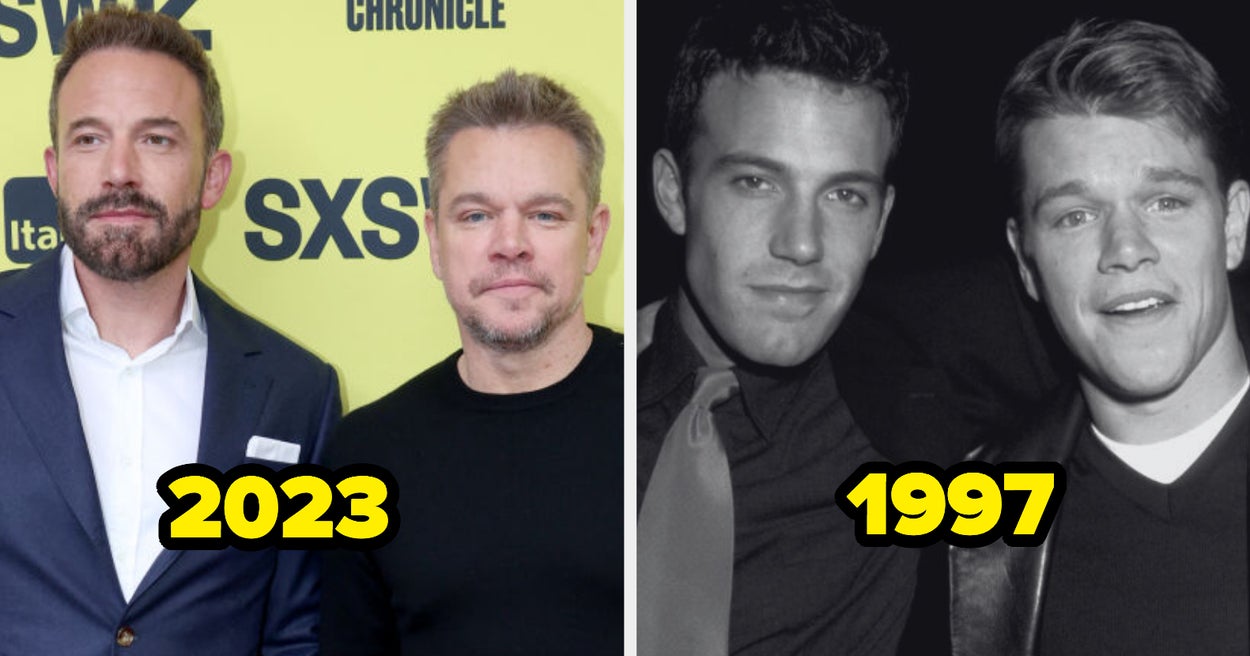

Ben Afflecks High Praise For Matt Damons Calculated Role Choices

May 08, 2025

Ben Afflecks High Praise For Matt Damons Calculated Role Choices

May 08, 2025