The Taiwan Dollar's Ascent And The Need For Economic Overhaul

Table of Contents

Factors Contributing to the Taiwan Dollar's Appreciation

Several key factors have propelled the Taiwan dollar's appreciation. Understanding these dynamics is crucial to developing effective economic policies.

Robust Export Performance

Taiwan's exceptional export performance, largely driven by its dominant position in the global semiconductor industry, is a primary driver of the Taiwan dollar's strength. The world's reliance on Taiwanese technology, particularly from companies like TSMC, creates immense demand for the Taiwan dollar. This high demand, coupled with consistent foreign direct investment (FDI) flowing into the tech sector, further strengthens the currency.

- Specific Export Data: In 2022, Taiwan's semiconductor exports accounted for X% of total exports, reaching a value of Y billion USD (insert actual data). This robust performance consistently outpaces growth in other export sectors.

- Foreign Direct Investment (FDI): The influx of FDI into the tech sector, particularly from major international players, significantly increases demand for the Taiwan dollar, bolstering its value.

High Savings Rate and Low Inflation

Taiwan's historically high savings rate plays a significant role in supporting the Taiwan dollar. This high savings rate provides a substantial pool of capital, increasing demand for the currency and contributing to its appreciation. Furthermore, Taiwan's relatively low inflation rate, compared to many other economies, makes it an attractive destination for investors seeking stability and preserving capital.

- Savings Rate Comparison: Taiwan's savings rate consistently ranks among the highest in Asia, significantly exceeding the average rate in countries like [insert comparison countries and data].

- Monetary Policy Impact: The Central Bank of the Republic of China (Taiwan)'s monetary policy, focused on maintaining price stability, has contributed to low inflation and further supported the Taiwan dollar's value.

Safe-Haven Status

Geopolitical instability in the Asia-Pacific region has inadvertently boosted the Taiwan dollar's status as a safe-haven currency. During times of uncertainty, investors often seek refuge in stable, relatively low-risk assets, driving up demand for the Taiwan dollar.

- Geopolitical Impact: The ongoing tensions in the Taiwan Strait and broader regional uncertainties have increased investor demand for the Taiwan dollar as a safe haven.

- Comparison to Other Safe Havens: While the US dollar and Japanese yen remain dominant safe havens, the Taiwan dollar has shown increasing resilience and appeal during periods of global market turmoil.

Challenges Posed by a Strong Taiwan Dollar

While a strong Taiwan dollar reflects economic strength, its appreciation presents several significant challenges that require careful management.

Impact on Export Competitiveness

The appreciation of the Taiwan dollar makes Taiwanese exports more expensive in international markets, thereby reducing their competitiveness against rivals from countries with weaker currencies. This can lead to a decline in export volume and negatively impact overall economic growth.

- Market Share Loss: A stronger Taiwan dollar could lead to the loss of market share to competitors in countries with weaker currencies, particularly in price-sensitive markets.

- Sectoral Impact: Sectors like electronics and textiles, which rely heavily on exports, are particularly vulnerable to the negative effects of a strong Taiwan dollar.

Increased Import Costs

While a strong Taiwan dollar makes imports cheaper for consumers, this can also lead to increased reliance on foreign goods and stifle the growth of domestic industries. This can harm local businesses and potentially lead to job losses.

- Inflationary Pressure: While imports become cheaper, a sudden surge in imports might create inflationary pressure in certain sectors.

- Support for Domestic Industries: Government policies are needed to support domestic industries and help them compete with cheaper imports.

Potential for Economic Slowdown

The combined effects of reduced export competitiveness and increased import costs can create a headwind for economic growth, potentially leading to a slowdown in GDP growth. This highlights the need for proactive measures to mitigate these risks.

- Economic Diversification: A diversified economy is crucial to reduce reliance on exports and mitigate the impact of currency fluctuations.

- GDP Growth Scenarios: Various economic models suggest that sustained appreciation of the Taiwan dollar, without appropriate countermeasures, could significantly reduce Taiwan's potential GDP growth.

The Need for Economic Overhaul

Addressing the challenges presented by the strong Taiwan dollar requires a comprehensive economic overhaul focused on several key areas.

Diversification of the Economy

Taiwan's heavy reliance on the technology sector, while a source of strength, also presents a vulnerability. Diversifying the economy by promoting growth in other sectors like tourism, agriculture, and advanced manufacturing is crucial.

- Policy Recommendations: Government initiatives to support non-tech sectors through subsidies, tax breaks, and infrastructure development are essential for economic diversification.

- Innovation Investment: Increased investment in research and development across diverse sectors will foster innovation and enhance competitiveness.

Investment in Infrastructure and Human Capital

Investing in modern infrastructure and human capital development is paramount to enhance productivity and attract foreign investment. Improvements in transportation, energy, and digital infrastructure are critical.

- Infrastructure Projects: Targeted investments in high-speed rail, advanced logistics networks, and renewable energy infrastructure will bolster economic competitiveness.

- Skills Development: Investing in education and training programs to equip the workforce with skills needed for a diversified economy is vital.

Targeted Fiscal and Monetary Policies

Well-calibrated fiscal and monetary policies are needed to manage the exchange rate and mitigate the negative impacts of currency appreciation. This might involve measures to manage capital flows or targeted interventions to support specific industries.

- Fiscal Policy: Strategic fiscal measures can stimulate domestic demand and support industries affected by currency appreciation.

- Monetary Policy: The Central Bank's monetary policy should carefully consider the impact of exchange rate movements on inflation and economic growth.

Conclusion:

The appreciation of the Taiwan dollar reflects a robust economy but also presents significant challenges. To maintain competitiveness and prevent economic stagnation, Taiwan needs a multifaceted economic overhaul. This requires diversification beyond the technology sector, significant investment in infrastructure and human capital, and carefully implemented fiscal and monetary policies. Ignoring these critical needs risks undermining the very strengths that have fueled the Taiwan dollar's ascent. Understanding the complexities of the Taiwan dollar's strength and acting decisively on needed reforms is paramount to securing Taiwan's long-term economic success. We urge policymakers to prioritize strategic management of the Taiwan dollar and implement comprehensive economic reforms to ensure sustainable economic growth and prosperity.

Featured Posts

-

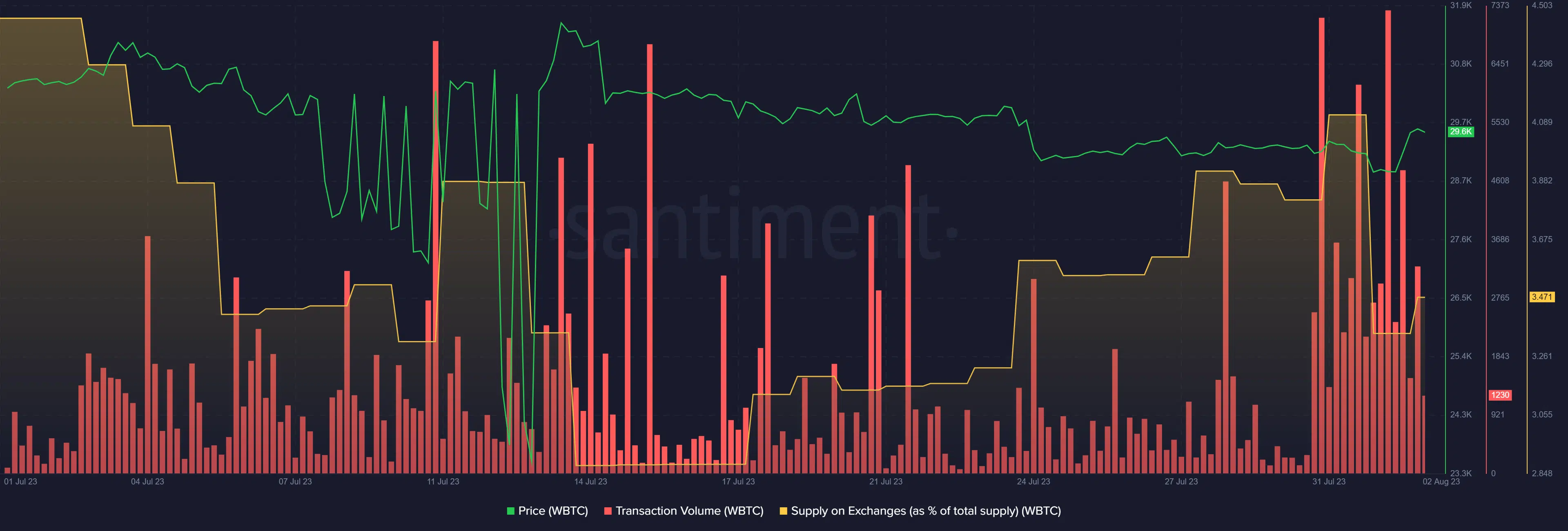

Ethereum Transaction Volume Spikes Nearly 10 Growth In Two Days

May 08, 2025

Ethereum Transaction Volume Spikes Nearly 10 Growth In Two Days

May 08, 2025 -

Kenya Uber Improves Earnings For Drivers And Couriers Offers Customer Cashback

May 08, 2025

Kenya Uber Improves Earnings For Drivers And Couriers Offers Customer Cashback

May 08, 2025 -

Recent Crypto Market Trends Dogecoin Shiba Inu And Suis Unexpected Rise

May 08, 2025

Recent Crypto Market Trends Dogecoin Shiba Inu And Suis Unexpected Rise

May 08, 2025 -

Open Ai Unveils New Tools For Voice Assistant Development

May 08, 2025

Open Ai Unveils New Tools For Voice Assistant Development

May 08, 2025 -

Winning Numbers Lotto And Lotto Plus Saturday April 12 2025

May 08, 2025

Winning Numbers Lotto And Lotto Plus Saturday April 12 2025

May 08, 2025