The Thames Water Case: Executive Bonuses And Corporate Responsibility

Table of Contents

The Scale of the Problem: Thames Water's Performance and Environmental Impact

Thames Water's performance has been far from exemplary, raising serious concerns about its operational efficiency and environmental impact. The sheer magnitude of water leakages is staggering, leading to millions of liters of treated water lost annually. This inefficiency not only represents a significant financial loss for the company but also has severe environmental consequences. The constant loss of water places considerable strain on already stressed local ecosystems, impacting biodiversity and potentially leading to water scarcity in certain areas.

Furthermore, despite the poor service and substantial water loss, customers continue to face high water bills. This disparity between poor performance and high costs has severely eroded customer trust and satisfaction. The regulatory penalties and fines imposed on Thames Water, while a step towards accountability, do little to address the underlying systemic issues within the company.

- Millions of liters of water lost annually: This represents a colossal waste of a precious resource.

- High customer bills despite poor service: A major source of public anger and frustration.

- Negative environmental impact on local ecosystems: Damaging to wildlife and potentially impacting water availability.

- Regulatory penalties and fines imposed: While punitive, these measures are often insufficient to effect real change.

The Controversy Surrounding Executive Bonuses at Thames Water

The payment of substantial Thames Water executive bonuses amidst this backdrop of poor performance and environmental damage has sparked widespread outrage. While the exact figures are subject to scrutiny and debate, reports suggest significant payouts to senior executives, despite the company's failures. The company's justification for these bonuses, often citing performance metrics that ignore environmental and social considerations, has been met with widespread criticism. The public outcry and negative media coverage highlight a profound disconnect between executive reward and corporate responsibility.

- Specific figures for executive bonuses paid: Transparency regarding these figures is crucial for public accountability.

- Comparison with performance metrics and shareholder returns: A clear lack of correlation between bonuses and genuine performance.

- Analysis of the bonus structure and its flaws: The current system clearly incentivizes short-term gains over long-term sustainability.

- Public reaction and calls for accountability: Demands for greater transparency and stricter regulations are mounting.

Failure of Regulatory Oversight and Corporate Governance

The Thames Water case also exposes the shortcomings of regulatory oversight and corporate governance. Ofwat, the water regulator, has faced criticism for its perceived inability to effectively hold Thames Water accountable for its poor performance. The company's internal corporate governance structures have also come under scrutiny, with accusations of a lack of transparency and weak accountability mechanisms. The absence of meaningful shareholder engagement has further exacerbated the problem, allowing questionable practices to persist.

- Criticisms of Ofwat's regulatory powers: Calls for increased regulatory authority and stronger enforcement mechanisms are growing.

- Weaknesses in Thames Water's internal control mechanisms: A lack of robust internal checks and balances allowed the issues to fester.

- Lack of effective shareholder engagement: A lack of pressure from investors contributed to the crisis.

- Need for stricter corporate governance guidelines: Reform is needed to ensure alignment between executive compensation and genuine corporate performance.

Ethical Implications and the Wider Context of Corporate Responsibility

The Thames Water scandal highlights the crucial importance of incorporating Environmental, Social, and Governance (ESG) factors into business decision-making. The prioritizing of shareholder primacy over stakeholder capitalism has led to a situation where short-term profits are prioritized over long-term sustainability and social responsibility. This case demonstrates the long-term consequences of neglecting ESG considerations, including reputational damage, loss of investor confidence, and increased regulatory scrutiny.

- Examples of good corporate citizenship in other companies: Contrasting examples demonstrate how companies can prioritize both profit and sustainability.

- The importance of long-term sustainability strategies: A shift away from short-term profit maximization is essential for long-term success.

- The role of ethical leadership in preventing similar scandals: Strong ethical leadership is critical in fostering a culture of responsibility.

- The impact on investor confidence and brand reputation: The scandal has severely damaged Thames Water’s reputation and investor trust.

Conclusion

The Thames Water case serves as a stark warning regarding the dangers of unchecked executive compensation and a lack of corporate responsibility. The substantial Thames Water executive bonuses paid despite the company's poor performance and environmental damage expose significant flaws in both corporate governance and regulatory oversight. This situation underscores the urgent need for stronger regulatory frameworks and a fundamental shift towards prioritizing ESG factors and stakeholder interests. We must demand greater transparency and accountability from companies like Thames Water, ensuring that executive compensation is directly linked to genuine performance that considers environmental and social impacts. Only through robust reforms in corporate governance and a renewed focus on ethical leadership can we prevent similar scandals involving Thames Water executive bonuses and ensure a more responsible and sustainable future for businesses.

Featured Posts

-

A Deep Dive Into Demnas Designs At Gucci

May 25, 2025

A Deep Dive Into Demnas Designs At Gucci

May 25, 2025 -

Rethinking Middle Management Their Critical Role In Modern Organizations

May 25, 2025

Rethinking Middle Management Their Critical Role In Modern Organizations

May 25, 2025 -

Amsterdam 2025 How Orchestration At Camunda Con Will Optimize Your Ai And Automation Roi

May 25, 2025

Amsterdam 2025 How Orchestration At Camunda Con Will Optimize Your Ai And Automation Roi

May 25, 2025 -

How To Monitor The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 25, 2025

How To Monitor The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 25, 2025 -

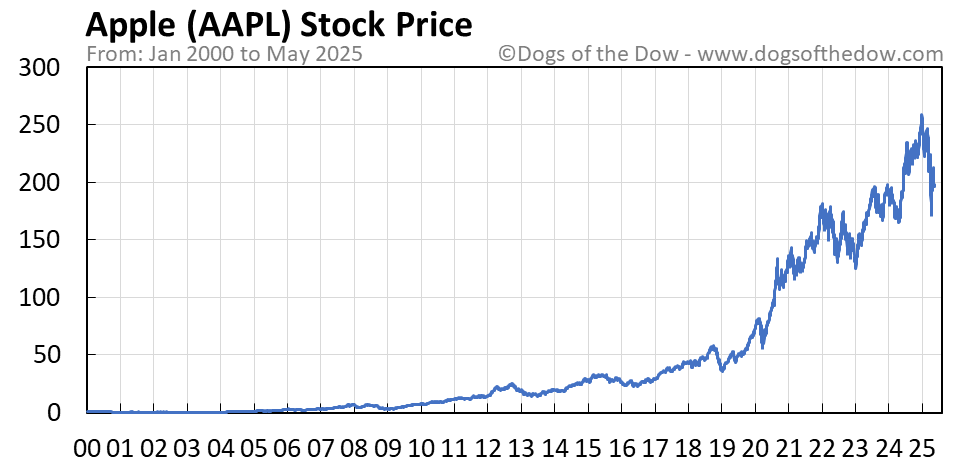

Forecasting Apple Stock Aapl Price Important Levels To Consider

May 25, 2025

Forecasting Apple Stock Aapl Price Important Levels To Consider

May 25, 2025