The Trade War's Impact On Crypto: One Cryptocurrency That Could Still Thrive

Table of Contents

The Trade War's Impact on Global Markets

Trade wars, characterized by escalating tariffs and trade barriers, inflict considerable damage on global markets. These disputes disrupt established supply chains, leading to increased prices for consumers and reduced economic activity. The uncertainty surrounding trade policies creates a climate of fear, eroding investor confidence and triggering market downturns. This negative sentiment often translates into decreased investment in various asset classes.

- Decreased global trade volumes: Tariffs and sanctions directly reduce the volume of goods and services exchanged internationally.

- Increased import tariffs and trade barriers: Higher tariffs increase the cost of imported goods, impacting both businesses and consumers.

- Reduced investor confidence leading to market downturns: Uncertainty about future trade relations discourages investment and slows economic growth.

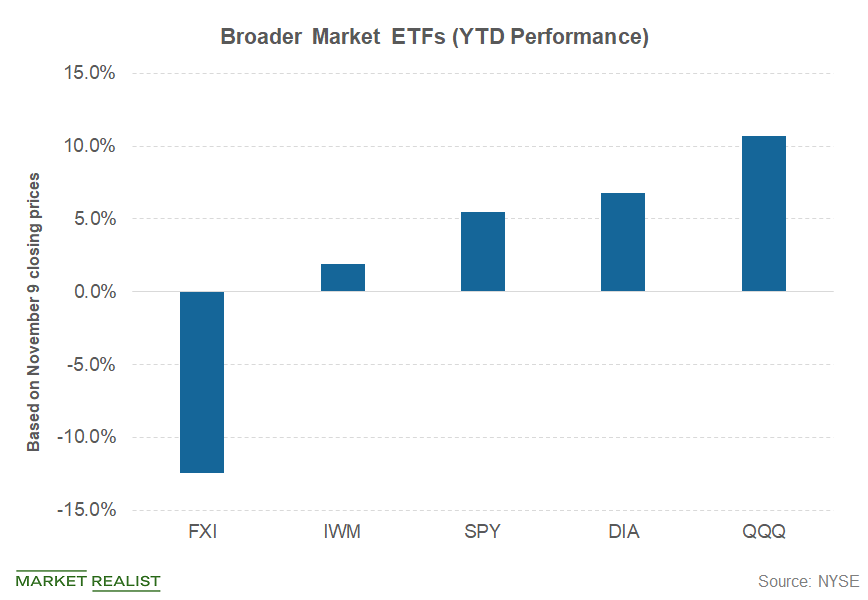

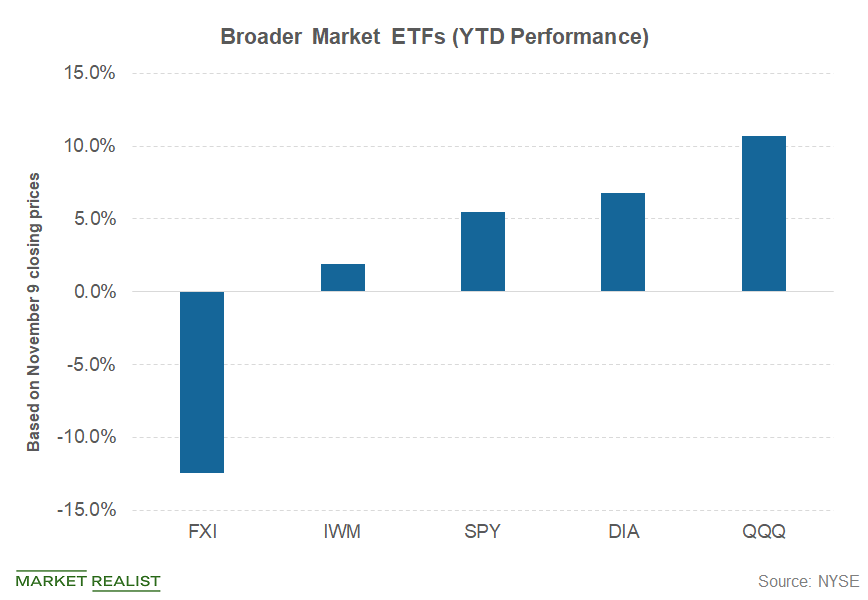

- Increased volatility in traditional asset classes (stocks, bonds): Trade war anxieties create instability, leading to significant price swings in traditional markets.

Crypto's Correlation with Traditional Markets

Cryptocurrencies, particularly Bitcoin, have historically shown a degree of correlation with traditional markets. This means that when stock markets fall, cryptocurrency prices often follow suit. This correlation is driven by investor sentiment; negative news affecting stocks often spills over into the crypto market as investors seek to reduce overall risk. During periods of heightened uncertainty, like those caused by trade wars, this correlation can amplify the negative impacts on crypto prices.

- Bitcoin's price often mirrors trends in the stock market: A strong correlation exists, indicating a shared sensitivity to broader economic factors.

- Negative sentiment in traditional markets often spills over into the crypto market: Fear and uncertainty in traditional markets often lead to selling pressure in the crypto market as well.

- Increased risk aversion can lead to investors selling crypto assets: In times of economic uncertainty, investors tend to move towards safer, more predictable assets, leading to selling off riskier investments like crypto.

Cryptocurrencies as Safe Haven Assets

Despite the correlation observed in some instances, the decentralized and censorship-resistant nature of cryptocurrencies presents a compelling argument for their potential to act as safe haven assets during times of economic and political turmoil. Unlike traditional assets heavily influenced by government policies and regulations, cryptocurrencies offer a degree of insulation from such influences. This inherent resilience could drive investors towards digital assets as a hedge against uncertainty.

- Decentralized nature reduces reliance on government policies: Cryptocurrencies are not subject to the same political and economic risks as traditional assets.

- Potential for price appreciation during periods of economic instability: Increased demand for safe haven assets could drive up the value of certain cryptocurrencies.

- Portfolio diversification benefits through crypto investment: Adding cryptocurrencies to a portfolio can help mitigate risks associated with traditional investments.

One Cryptocurrency Poised to Thrive: Bitcoin

While many altcoins suffer during economic downturns, Bitcoin, with its established network effect and long-standing history, stands out as a potential candidate to thrive during a trade war. Its characteristics align well with the desire for a safe haven asset.

- Established network effect and brand recognition: Bitcoin is the most well-known and widely accepted cryptocurrency, benefiting from a significant network effect.

- Store of value proposition and limited supply: Bitcoin's fixed supply of 21 million coins positions it as a potential inflation hedge.

- Growing institutional adoption: Increased institutional investment signals growing confidence in Bitcoin's long-term viability.

- Potential for increased demand as a safe haven asset: During times of uncertainty, investors may flock to Bitcoin, driving up its price.

Bitcoin's role in DeFi

Bitcoin's role in the decentralized finance (DeFi) ecosystem is also expanding. Wrapped Bitcoin (WBTC) and other similar tokens allow Bitcoin to be used within DeFi protocols, increasing its utility and potential for growth, benefiting from the overall growth in the DeFi sector.

Risks and Considerations

Investing in cryptocurrencies, including Bitcoin, carries significant risk. Price volatility is inherent to the market, and regulatory uncertainty could significantly impact future growth. It's crucial to conduct thorough due diligence before investing and only invest what you can afford to lose.

- Price volatility remains a significant concern: Cryptocurrency prices are notoriously volatile, subject to rapid and significant price swings.

- Regulatory uncertainty could impact future growth: Government regulations can significantly impact the cryptocurrency market.

- Invest only what you can afford to lose: Cryptocurrency investments are inherently risky, and losses are possible.

Conclusion

The trade war's impact on global markets has undoubtedly created ripples in the cryptocurrency sector. While many cryptocurrencies have experienced downward pressure, certain characteristics make some, particularly Bitcoin, potentially resilient to these economic headwinds. Its decentralized nature and its growing adoption as a store of value might even lead to increased demand during times of uncertainty. Understanding the impact of the trade war on crypto is crucial for navigating this evolving market. Learn more about Bitcoin and how its unique properties could make it a valuable addition to your investment portfolio in this period of economic uncertainty. Research thoroughly and make informed decisions regarding your cryptocurrency investments.

Featured Posts

-

Xrps Rise Outpacing Bitcoin And Other Cryptocurrencies After Grayscale Etf News

May 08, 2025

Xrps Rise Outpacing Bitcoin And Other Cryptocurrencies After Grayscale Etf News

May 08, 2025 -

Dohas New Innovation Center Psg Labs Officially Opens

May 08, 2025

Dohas New Innovation Center Psg Labs Officially Opens

May 08, 2025 -

Partido Lyon Psg Victoria Visitante En Un Partido Tenso

May 08, 2025

Partido Lyon Psg Victoria Visitante En Un Partido Tenso

May 08, 2025 -

Path Of Exile 2 A Deep Dive Into Rogue Exiles And Their Role

May 08, 2025

Path Of Exile 2 A Deep Dive Into Rogue Exiles And Their Role

May 08, 2025 -

X Men Rogues New Cyclops Abilities Explained

May 08, 2025

X Men Rogues New Cyclops Abilities Explained

May 08, 2025