Time Interview Reveals Trump's Support For Ban On Congressional Stock Trading

Table of Contents

Keywords: Congressional stock trading, stock trading ban, Trump stock trading ban, ethics in government, congressional ethics reform, Time interview Trump, political corruption, insider trading, conflict of interest.

A bombshell revelation from a recent Time interview with former President Donald Trump has ignited a renewed debate on Capitol Hill: Trump's surprising endorsement of a ban on congressional stock trading. This unexpected stance throws a spotlight on the long-standing ethical concerns surrounding lawmakers' financial dealings and the potential for conflicts of interest. This article delves into the details of Trump's statement, explores the arguments for and against such a ban, and analyzes its potential impact on the political landscape.

Trump's Stance and its Significance

The Time Interview Quotes

In a surprising turn of events, the Time interview featured former President Trump explicitly stating his support for a ban on congressional stock trading. While the exact wording requires verification from the official transcript, reports indicate he expressed concern about the appearance of impropriety and the potential for insider trading influencing legislative decisions. He reportedly stated (and this needs verification from the official transcript) that such a ban would restore public trust and improve the image of Congress. This departure from previous, less clear statements on the issue is what makes this revelation so significant.

Shift in Political Discourse

Trump's support for a congressional stock trading ban dramatically alters the political narrative. Previously, the debate was largely confined to the fringes of political discourse, often dismissed as partisan maneuvering. However, with Trump – a key figure in the Republican party – voicing his support, the issue now commands far greater attention and potentially shifts the momentum towards legislative action. This is particularly notable considering his past actions and statements, which hadn't previously shown a clear commitment to ethics reform in this specific area.

-

Highlighting the potential impact on Republican lawmakers: Republican lawmakers who previously opposed such legislation may now face immense pressure from within their own party to reconsider their stance, potentially leading to a bipartisan push for reform.

-

Implications for future elections and campaign finance: Trump's endorsement could become a significant campaign talking point, influencing voters' choices and potentially impacting future election outcomes. Candidates may now be compelled to publicly state their positions on this issue.

-

Unexpected alliances: This unexpected shift creates the potential for unlikely political alliances, as those from across the political spectrum could unite in support of a congressional stock trading ban.

Arguments For and Against a Congressional Stock Trading Ban

Proponents' Arguments

Proponents of a ban argue that it is a crucial step towards improving ethical standards in government.

-

Reduce conflicts of interest and the appearance of impropriety: The potential for conflicts of interest is undeniable when lawmakers profit from their positions. A ban minimizes this risk and enhances public trust.

-

Increase public trust and confidence in government: Public cynicism towards government is pervasive. A ban on congressional stock trading could significantly restore faith in the integrity of the legislative process.

-

Prevent insider trading and unfair advantage: Lawmakers' access to non-public information creates an inherent potential for insider trading, providing them with an unfair advantage over the average citizen. A ban directly addresses this concern.

-

Promote fairer and more transparent governance: Transparency is fundamental to a well-functioning democracy. A ban adds a layer of transparency, ensuring that legislative decisions aren't influenced by personal financial gain.

Opponents' Arguments

Opponents raise several counterarguments against a congressional stock trading ban.

-

Infringes on lawmakers' personal financial freedom: They argue that prohibiting stock trading represents an unwarranted intrusion into lawmakers' personal lives and financial decisions.

-

May deter qualified individuals from seeking public office: Some suggest that a ban might discourage highly successful individuals from entering politics, reducing the pool of potential candidates.

-

Could be difficult to enforce effectively: The complexity of financial disclosures and the potential for loopholes make effective enforcement a significant challenge.

-

Existing disclosure laws are sufficient: Critics argue that current disclosure laws, while imperfect, provide adequate transparency and accountability.

Current Legislative Efforts and Potential Outcomes

Existing Bills and Proposals

Several bills addressing congressional stock trading are currently under consideration in Congress. These bills vary in scope and approach, with some proposing a complete ban while others suggest stricter disclosure requirements or limitations on certain types of trades. The specifics of these bills, and their current status, require ongoing research from reputable news sources.

Potential Impact of Trump's Endorsement

Trump's unexpected endorsement of a ban could significantly impact the legislative process. His influence within the Republican party could sway wavering lawmakers and increase the likelihood of bipartisan support. This support could lead to increased pressure on undecided lawmakers and accelerate the pace of legislative action.

-

Specific Senators/Representatives pushing for reform: Identifying key figures championing this cause is crucial for understanding the ongoing political dynamics.

-

Bipartisan support (or lack thereof): The level of bipartisan support will be a critical factor in determining the fate of any proposed legislation.

-

Likelihood of a ban being enacted: Assessing the probabilities requires analyzing the political landscape, including the composition of Congress and the strength of lobbying efforts from both sides of the debate.

Conclusion

Former President Trump's surprising support for a ban on congressional stock trading marks a pivotal moment in the ongoing debate regarding ethics in government. His endorsement shifts the political dynamics, potentially creating a bipartisan push for legislative action. While strong arguments exist both for and against a ban, the potential benefits of increased public trust and reduced conflicts of interest are significant. The current status of related legislation remains fluid, demanding continuous monitoring.

Call to Action: Stay informed about the ongoing debate on banning congressional stock trading. Follow reputable news sources for updates on this crucial issue and learn more about the efforts to improve ethics and transparency in government. The fight for reform regarding congressional stock trading continues – stay engaged!

Featured Posts

-

De Zoete Nederlandse Broodje Dat Geen Zin Heeft

Apr 26, 2025

De Zoete Nederlandse Broodje Dat Geen Zin Heeft

Apr 26, 2025 -

The Worlds Tallest Abandoned Skyscraper A Decade Long Pause Ends

Apr 26, 2025

The Worlds Tallest Abandoned Skyscraper A Decade Long Pause Ends

Apr 26, 2025 -

Golds Record High Understanding The Trade War Impact On Bullion

Apr 26, 2025

Golds Record High Understanding The Trade War Impact On Bullion

Apr 26, 2025 -

The Impact Of Deion Sanders On Shedeur Sanders Nfl Trajectory

Apr 26, 2025

The Impact Of Deion Sanders On Shedeur Sanders Nfl Trajectory

Apr 26, 2025 -

Newsom Under Fire Dave Portnoys Harsh Critique

Apr 26, 2025

Newsom Under Fire Dave Portnoys Harsh Critique

Apr 26, 2025

Latest Posts

-

Credit Suisse To Pay Whistleblowers 150 Million A Landmark Settlement

May 10, 2025

Credit Suisse To Pay Whistleblowers 150 Million A Landmark Settlement

May 10, 2025 -

Credit Suisse Whistleblower Case A 150 Million Settlement

May 10, 2025

Credit Suisse Whistleblower Case A 150 Million Settlement

May 10, 2025 -

Credit Suisse Whistleblower Payout Up To 150 Million

May 10, 2025

Credit Suisse Whistleblower Payout Up To 150 Million

May 10, 2025 -

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025 -

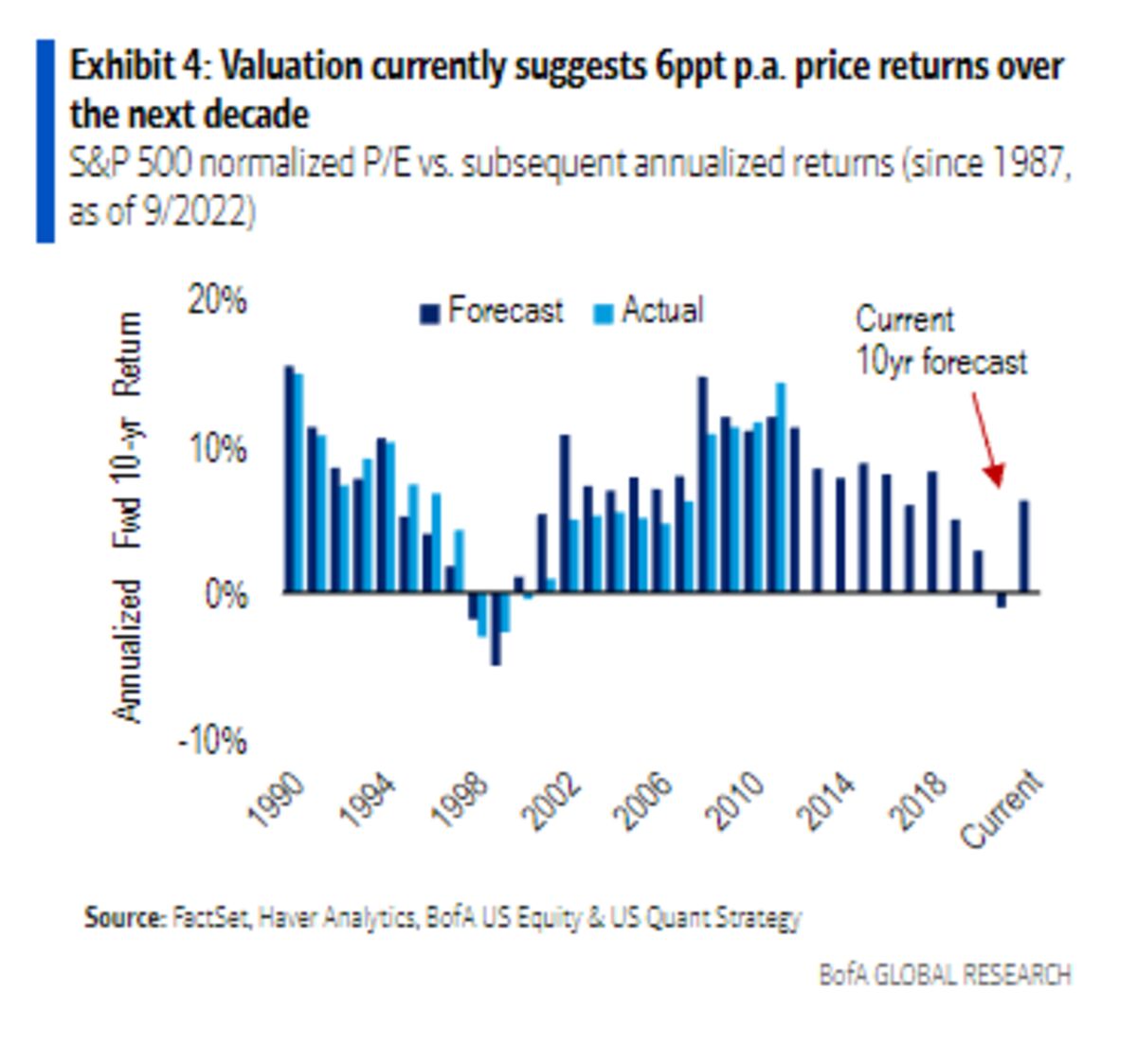

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025