To Buy Or Not To Buy Palantir Stock Before May 5th? A Detailed Look

Table of Contents

Palantir's Recent Performance and Market Sentiment

Q4 2022 Earnings and Revenue Growth

Palantir Technologies Inc. (PLTR) reported its Q4 2022 earnings, revealing a mixed bag for investors. While the company exceeded expectations on revenue, reaching [insert actual revenue figure], representing a [insert percentage]% year-over-year growth, concerns remain regarding profitability. The adjusted operating margin was [insert actual margin], [higher/lower] than the previous quarter.

- Key Metrics: Revenue growth exceeded expectations, but profitability remains a focus.

- Customer Acquisition: Palantir added [insert number] new customers, demonstrating continued growth in its customer base. This is crucial for long-term Palantir stock value.

- Analyst Reactions: Post-earnings, analysts revised their price targets for Palantir stock, with some expressing optimism while others remained cautious. [Insert range of price target predictions and source].

Stock Price Volatility and Market Trends

Palantir's stock price has experienced significant volatility over the past year, mirroring broader trends in the tech sector. Interest rate hikes by the Federal Reserve have negatively impacted growth stocks, including Palantir. Geopolitical instability and global economic uncertainty also contribute to the fluctuations in Palantir stock prices.

- Stock Price Performance (Past Year): [Insert chart showing Palantir stock price performance over the past year, ideally from a reputable financial source].

- Factors Impacting Volatility: News regarding large contract wins or losses, regulatory changes affecting government contracts, and competitive pressures from other big data analytics companies all significantly impact Palantir's share price.

Upcoming Catalysts and Potential Risks

May 5th Earnings Report Expectations

The May 5th earnings report is a crucial catalyst for Palantir stock. Investors will be closely watching key metrics, including revenue growth, operating margins, and guidance for the upcoming quarters. Any significant deviation from expectations could lead to substantial price movements.

- Key Metrics to Watch: Revenue growth, operating margin, customer acquisition costs, and forward guidance are the key areas investors will be focusing on for the Palantir stock price movement.

- Potential Scenarios: Exceeding expectations on revenue and providing positive guidance could drive the Palantir stock price up. Conversely, falling short of expectations could trigger a sell-off.

Long-Term Growth Prospects and Strategic Initiatives

Palantir's long-term growth potential hinges on its ability to expand its customer base beyond government contracts and successfully penetrate the commercial sector. Its flagship products, Foundry and Gotham, are crucial for this expansion. However, challenges remain, including intense competition and concerns about its valuation.

- Competitive Advantages: Palantir's data integration and analytics capabilities, especially its expertise in complex data sets, provide a competitive edge.

- Potential Risks: Competition from established tech giants and the risk of failing to secure major commercial contracts pose significant threats to Palantir's growth trajectory. Valuation concerns also impact the Palantir stock.

Alternative Investment Strategies

Buy and Hold vs. Short-Term Trading

For Palantir stock, a buy-and-hold strategy requires a long-term perspective, accepting short-term volatility in exchange for potential long-term growth. Short-term trading involves attempting to profit from short-term price fluctuations, carrying higher risk.

- Buy and Hold: Lower risk, but requires patience and belief in Palantir's long-term vision.

- Short-Term Trading: Higher risk, higher potential rewards, but requires significant market knowledge and timing skills.

Diversification and Portfolio Allocation

Investing solely in Palantir stock is risky. Diversification across different asset classes and sectors is crucial for mitigating risk. Palantir should be part of a well-diversified portfolio, not its entirety.

- Alternative Investments: Consider investments in other tech companies, bonds, real estate, or other asset classes to reduce overall portfolio volatility.

- Risk Management: Thoroughly understand your risk tolerance before investing in Palantir stock or any other volatile stock.

Conclusion

The decision of whether to buy Palantir stock before May 5th depends on a careful assessment of recent performance, upcoming earnings, long-term growth potential, and your personal risk tolerance. While Palantir demonstrates growth potential, considerable volatility and inherent risks are present. The May 5th earnings report will be a key factor influencing the Palantir stock price in the short term. Remember that investing in Palantir stock involves risk.

Call to Action: Before making any investment decision regarding Palantir stock, conduct thorough due diligence, consider your own investment goals, and consult with a qualified financial advisor. Understanding your risk tolerance is paramount before buying Palantir stock or any other security. Don't rely solely on this analysis; your own research is vital for making informed investment decisions related to Palantir stock.

Featured Posts

-

Ve Day Speech Taiwans Lai Highlights Growing Totalitarian Risks

May 10, 2025

Ve Day Speech Taiwans Lai Highlights Growing Totalitarian Risks

May 10, 2025 -

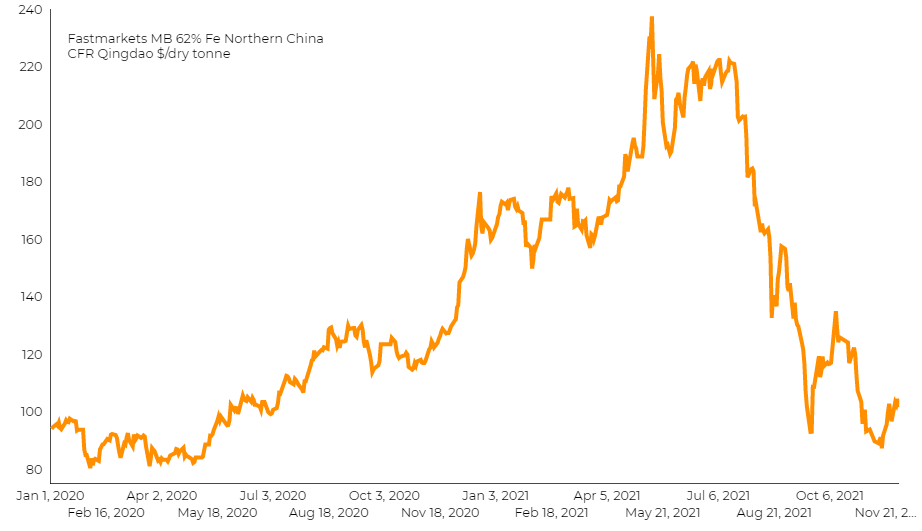

Iron Ore Falls As China Curbs Steel Output Market Impact Analysis

May 10, 2025

Iron Ore Falls As China Curbs Steel Output Market Impact Analysis

May 10, 2025 -

Strictly Scandal Leads To Wynne Evans Go Compare Departure

May 10, 2025

Strictly Scandal Leads To Wynne Evans Go Compare Departure

May 10, 2025 -

Abrz Laeby Krt Alqdm Aldhyn Eanwa Mn Altdkhyn

May 10, 2025

Abrz Laeby Krt Alqdm Aldhyn Eanwa Mn Altdkhyn

May 10, 2025 -

New Uk Visa Policy Implications For Nigerians And Pakistanis

May 10, 2025

New Uk Visa Policy Implications For Nigerians And Pakistanis

May 10, 2025