Today's Market: Dow Futures, Gold Prices, And Key Economic Indicators

Table of Contents

Dow Futures: A Gauge of Market Sentiment

Dow Futures contracts represent agreements to buy or sell the Dow Jones Industrial Average at a specific price on a future date. They act as a leading indicator, offering a glimpse into the likely direction of the stock market before the actual opening bell. Understanding Dow Futures is key to successful stock market trading.

Understanding Dow Futures Contracts

- Mechanics: Dow Futures are traded on exchanges like the CME Group, allowing investors to speculate on the future performance of the Dow Jones Industrial Average without directly owning the underlying stocks.

- Leverage: Trading Dow Futures involves leverage, magnifying both potential profits and losses. A small price movement can result in significant gains or substantial losses. This is a double-edged sword and risk management is crucial.

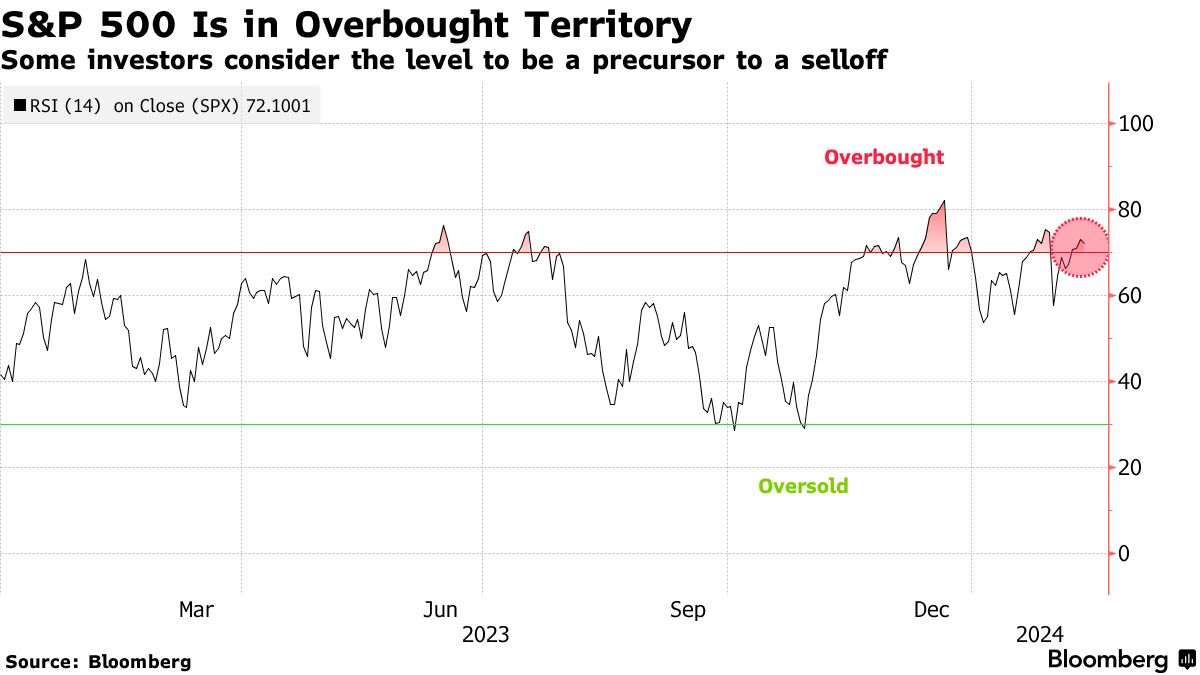

- Interpreting Charts: Analyzing Dow Futures charts, using technical indicators like moving averages and relative strength index (RSI), can help identify trends and potential trading opportunities. Looking for patterns and support/resistance levels is essential.

Factors Influencing Dow Futures

Numerous factors influence daily Dow Futures fluctuations:

- Economic News: Announcements about inflation, interest rates, and GDP growth directly impact investor sentiment and Dow Futures prices.

- Corporate Earnings: Strong or weak corporate earnings reports can cause significant price swings. Positive news tends to boost Dow Futures, while negative news can push them down.

- Geopolitical Events: International conflicts, political instability, and major global events can create uncertainty and volatility in Dow Futures.

- Algorithmic Trading: High-frequency trading algorithms and automated trading systems significantly influence the speed and volume of Dow Futures trading, contributing to market fluctuations.

Gold Prices: A Safe Haven Asset in Times of Uncertainty

Gold has long been considered a safe haven asset, meaning its price often rises during times of economic uncertainty or geopolitical turmoil. This inverse relationship with the stock market makes it a valuable diversification tool in any investment portfolio.

Gold's Role as a Hedge

- Inflation Hedge: Gold prices tend to rise during periods of high inflation as it acts as a store of value, preserving purchasing power.

- Geopolitical Instability: Uncertainty and fear often drive investors towards the perceived safety of gold, boosting demand and pushing prices higher.

- Currency Fluctuations: Changes in currency exchange rates can also impact gold prices, as it's priced in US dollars globally. A weakening dollar generally supports gold prices.

- Interest Rate Changes: Higher interest rates increase the opportunity cost of holding non-yielding assets like gold, potentially putting downward pressure on prices. Conversely, lower rates can boost demand.

Analyzing Gold Price Trends

Analyzing gold price charts requires a combination of technical and fundamental analysis:

- Technical Indicators: Tools like moving averages, Bollinger Bands, and MACD can provide insights into potential price trends and momentum.

- Fundamental Analysis: Examining factors like inflation rates, interest rates, and geopolitical risks helps in understanding the underlying drivers of gold price movements.

- Supply and Demand: The interplay of global gold supply and demand significantly impacts prices. Increased demand relative to supply tends to drive prices higher.

Key Economic Indicators: Unveiling the Economic Landscape

Monitoring key economic indicators is vital for understanding the overall economic climate and its potential impact on both Dow Futures and Gold Prices.

Major Economic Indicators to Watch

- Inflation Rates (CPI, PPI): The Consumer Price Index (CPI) and Producer Price Index (PPI) measure the rate of inflation, giving insights into the purchasing power of money and influencing interest rate decisions.

- Interest Rates (Federal Funds Rate): The Federal Reserve's target interest rate impacts borrowing costs, investment decisions, and the overall economy, significantly affecting both stock and gold markets.

- Unemployment Rate: The unemployment rate provides an indication of the health of the labor market, influencing consumer spending and overall economic growth.

- GDP Growth: Gross Domestic Product (GDP) growth measures the overall economic output of a country, providing a key indicator of economic health.

- Consumer Confidence: Consumer confidence indices gauge consumer sentiment and spending patterns, providing insights into future economic activity.

Interpreting Economic Data

Interpreting economic data requires careful consideration:

- Context is Key: Consider the broader economic picture and the context of the data release. A single data point should not be interpreted in isolation.

- Market Reaction: Pay close attention to how the market reacts to economic data releases. Unexpectedly strong or weak data can cause significant market volatility.

- Predictive Power: While economic indicators offer valuable insights, they are not perfect predictors of future market movements.

Conclusion

Understanding the interplay between Dow Futures, Gold Prices, and key Economic Indicators is paramount for navigating today's dynamic market. Dow Futures provide a forward-looking perspective on the stock market, while Gold acts as a safe haven asset during uncertain times. Meanwhile, key Economic Indicators illuminate the broader economic landscape, guiding investment strategies. By monitoring these factors closely, investors can make more informed decisions and potentially mitigate risks. Stay ahead in today's dynamic market by consistently monitoring Dow Futures, Gold Prices, and key Economic Indicators. Continue your market research to make informed investment decisions.

Featured Posts

-

Ankara 3 Mart Pazartesi Iftar Ve Sahur Vakitleri 2024

Apr 23, 2025

Ankara 3 Mart Pazartesi Iftar Ve Sahur Vakitleri 2024

Apr 23, 2025 -

Son Dakika Erzurum Okullari Tatil Mi Degil Mi 24 Subat Bilgileri

Apr 23, 2025

Son Dakika Erzurum Okullari Tatil Mi Degil Mi 24 Subat Bilgileri

Apr 23, 2025 -

Usa Et Russie Course Aux Armements Selon Un Article De Usa Today

Apr 23, 2025

Usa Et Russie Course Aux Armements Selon Un Article De Usa Today

Apr 23, 2025 -

Rezultat Matchu Dinamo Obolon 18 Kvitnya Upl

Apr 23, 2025

Rezultat Matchu Dinamo Obolon 18 Kvitnya Upl

Apr 23, 2025 -

Understanding High Stock Market Valuations Insights From Bof A For Investors

Apr 23, 2025

Understanding High Stock Market Valuations Insights From Bof A For Investors

Apr 23, 2025