Top Payday Loans For Bad Credit: Direct Lender Guaranteed Approval Process

Table of Contents

Understanding Payday Loans for Bad Credit

Payday loans are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next payday. They are typically due within two to four weeks. However, securing a payday loan with bad credit presents significant challenges. Lenders view a low credit score as a higher risk, making approval less likely and potentially resulting in higher interest rates.

This is where direct lenders become crucial. Direct lenders provide loans directly to the borrower, eliminating the need for intermediaries. This avoids extra fees charged by third-party brokers and reduces the risk of scams. While direct lenders might still consider your credit score, they often assess other factors, increasing your chances of approval.

- Definition: Payday loans are small, short-term loans typically repaid on your next payday.

- Credit Score Impact: A low credit score significantly impacts loan approval and interest rates.

- Direct Lender Advantages: Direct lenders offer transparency, lower fees, and potentially higher approval rates compared to brokers.

- Risks: Payday loans carry high-interest rates and can lead to a debt cycle if not managed responsibly.

Finding Reputable Direct Lenders for Guaranteed Approval

Finding a trustworthy direct lender is critical. Remember, "guaranteed approval" doesn't mean approval regardless of your financial situation. Responsible lenders still assess your ability to repay. Look for lenders who prioritize responsible lending practices.

To identify reputable lenders, consider these factors:

- Licensing and Registration: Ensure the lender is licensed and registered in your state.

- Transparent Fees: Check for clearly stated fees and interest rates – avoid hidden charges.

- Online Reviews and Testimonials: Read independent reviews to gauge the lender's reputation and customer service.

- Contact Information: Verify that the lender provides clear and accessible contact information.

- Responsible Lending: Beware of lenders promising "guaranteed approval" without assessing your repayment ability. They may be predatory lenders.

Key Factors to Consider When Choosing a Lender

Choosing the right lender involves comparing several key factors:

-

Interest Rates and APR: Compare APRs (Annual Percentage Rates) from multiple lenders to find the most competitive rates. High APRs can significantly increase the total cost of the loan.

-

Loan Terms and Repayment Schedule: Understand the loan term (repayment period) and the repayment schedule to ensure you can comfortably afford the payments.

-

Application Process and Required Documentation: Look for a simple and straightforward application process. Familiarize yourself with the required documents (ID, proof of income, bank statements).

-

Customer Service and Support: Reliable customer support is vital. Choose a lender with multiple contact options (phone, email, online chat) for easy assistance.

- Interest Rate Comparison: Use online tools to compare interest rates from various direct lenders.

- Loan Term Flexibility: Some lenders offer flexible repayment options; explore these possibilities.

- Required Documents: Typically, you'll need a government-issued ID, proof of income, and bank account details.

- Customer Support Accessibility: Prioritize lenders with responsive and readily available customer service.

The Application Process for Payday Loans with Bad Credit

Applying for a payday loan online is generally straightforward:

- Gather Documents: Collect your government-issued ID, proof of income (pay stubs, bank statements), and bank account information.

- Complete the Application: Fill out the online application form accurately and completely. Inaccurate information can delay or prevent approval.

- Review Loan Terms: Carefully read and understand the loan terms, including interest rates, fees, and repayment schedule, before accepting.

- Understand Repayment: Familiarize yourself with the repayment process and the consequences of defaulting on the loan.

Alternatives to Payday Loans for Bad Credit

While payday loans might seem like a quick solution, exploring alternatives is crucial. High-interest rates can create a debt trap. Consider these options:

- Personal Loans: Banks and credit unions offer personal loans with potentially lower interest rates than payday loans, but they often require better credit scores.

- Loans from Family or Friends: Borrowing from trusted individuals can offer more flexible terms, but it's essential to have a clear agreement.

- Credit Builder Loans: These loans help improve your credit score, but they often require small deposits and may have limited loan amounts.

- Debt Consolidation Programs: If you have multiple debts, a debt consolidation program can simplify repayments and potentially lower interest rates.

Conclusion

This guide provided insights into finding top payday loans for bad credit through direct lenders offering a guaranteed approval process. We stressed the importance of responsible borrowing and highlighted key factors to consider when choosing a lender. Remember, while "guaranteed approval" is attractive, it's crucial to understand the terms and avoid predatory lending practices. Always explore alternative financing options if payday loans don't seem suitable for your situation.

Need quick cash? Start your search for reputable payday loans for bad credit from direct lenders today. Carefully compare options and make informed decisions to secure the best financing solution for your needs. Don't hesitate to explore alternative financing options like personal loans or credit builder loans if payday loans aren't the right fit.

Featured Posts

-

French Open 2024 Alcarazs Reign Vs Swiateks Uncertain Defense

May 28, 2025

French Open 2024 Alcarazs Reign Vs Swiateks Uncertain Defense

May 28, 2025 -

Psv Eindhoven Vs Arsenal Results From The Last Five Meetings

May 28, 2025

Psv Eindhoven Vs Arsenal Results From The Last Five Meetings

May 28, 2025 -

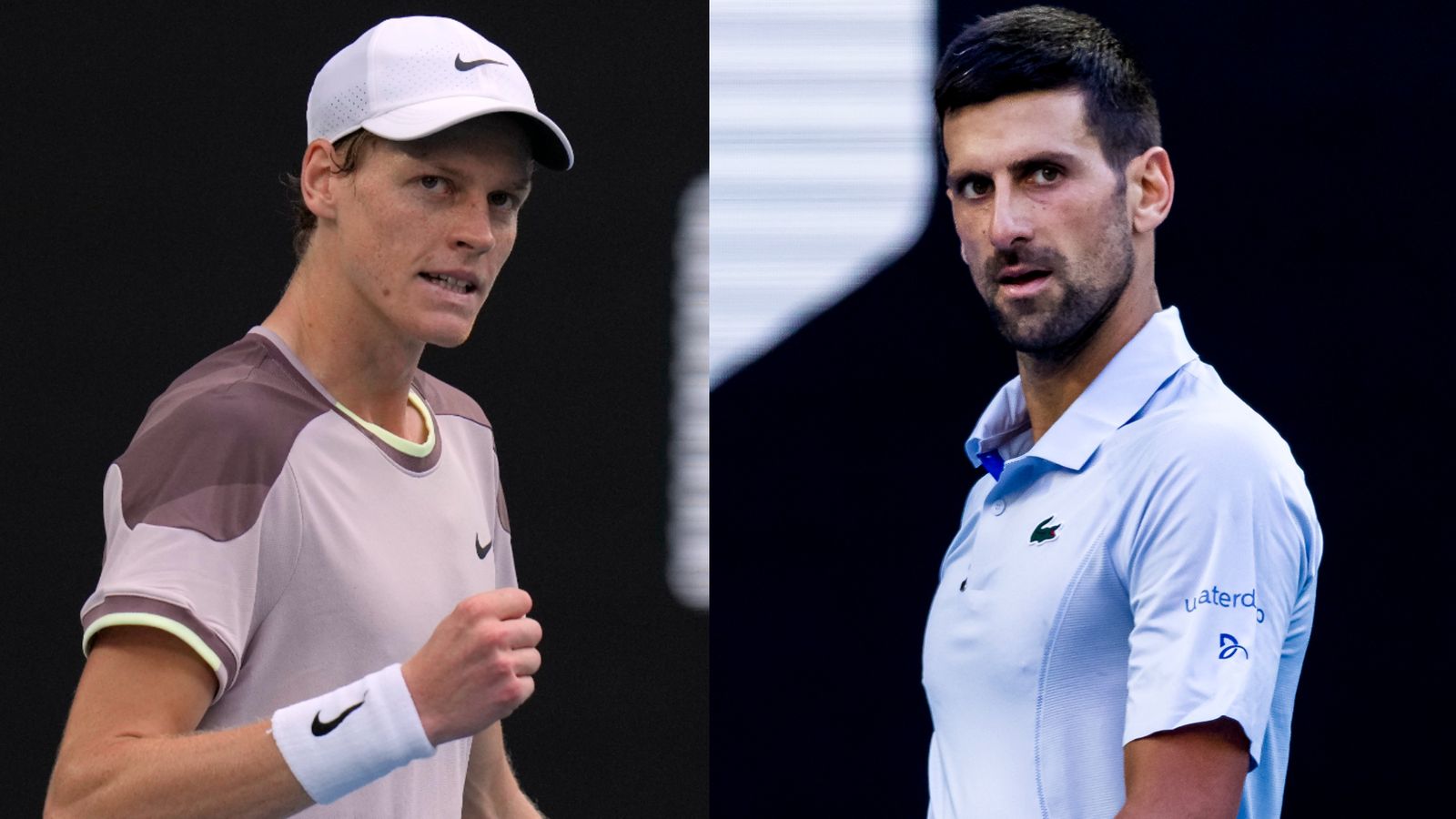

Photo Jannik Sinner Meets Pope Leo Xiv Italian Open Day Off

May 28, 2025

Photo Jannik Sinner Meets Pope Leo Xiv Italian Open Day Off

May 28, 2025 -

Pablo Picassos Groundbreaking Chicago Exhibition A Look Back

May 28, 2025

Pablo Picassos Groundbreaking Chicago Exhibition A Look Back

May 28, 2025 -

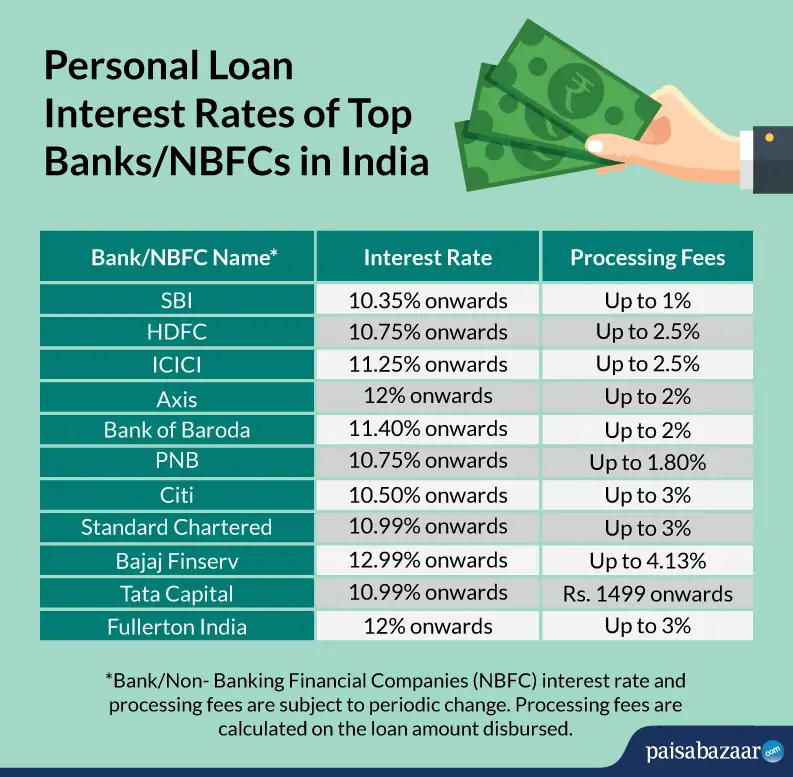

Understanding Todays Personal Loan Interest Rates

May 28, 2025

Understanding Todays Personal Loan Interest Rates

May 28, 2025