Trade War Concerns Drive Shift In European Stock Market Strategy

Table of Contents

Increased Volatility and Risk Aversion in the European Stock Market

The uncertainty surrounding global trade has injected significant volatility into the European stock market. Tariff announcements, retaliatory measures, and the constant threat of further escalation create a climate of fear and uncertainty, directly impacting investor behavior. This heightened volatility makes predicting market movements significantly more challenging, demanding a more cautious and adaptive approach to investment.

- Increased market fluctuations: Daily index movements reflect the dramatic shifts in investor sentiment. Announcements regarding new tariffs or trade negotiations can trigger sharp upward or downward swings, making it difficult for investors to accurately time their entries and exits.

- Heightened investor anxiety and risk-averse behavior: The uncertainty surrounding future trade policies is leading to a general increase in risk aversion. Investors are becoming more cautious, pulling back from riskier assets and seeking safer alternatives. This capital flight impacts market liquidity and can exacerbate downward pressure on stock prices.

- Increased demand for safe-haven assets: Government bonds and other low-risk investments are experiencing increased demand as investors seek to preserve capital in the face of market uncertainty. This flight to safety can further depress equity markets.

The impact on investor confidence and sentiment is undeniable. Surveys consistently show a decline in optimism about future economic growth in Europe, directly linked to the ongoing trade disputes. For instance, the latest investor confidence index from [insert reputable source and data here] shows a significant drop compared to pre-trade war levels. This decline reflects a palpable sense of unease and uncertainty among market participants.

Sector-Specific Impacts: Winners and Losers in the Trade War

The impact of the trade war is far from uniform across European sectors. Some industries are disproportionately affected, while others experience relative resilience or even benefit from the changing circumstances. Understanding these sector-specific impacts is crucial for effective portfolio management within the current European stock market strategy.

- Export-oriented sectors (e.g., automotive, manufacturing): These sectors are particularly vulnerable to tariffs and trade restrictions. Companies heavily reliant on exports to the US or other affected regions are facing reduced demand, lower profits, and increased operational costs. The automotive industry, for example, has been significantly impacted by tariffs imposed on European car exports.

- Import-dependent sectors (e.g., technology, consumer goods): Companies in these sectors rely heavily on imported components or raw materials. Tariffs and trade barriers increase their input costs, squeezing profit margins and potentially impacting competitiveness. The electronics and technology sectors are particularly sensitive to disruptions in global supply chains.

- Domestic-focused sectors (e.g., utilities, healthcare): These sectors, less exposed to international trade, are often seen as more resilient in times of global trade uncertainty. Increased domestic consumption, driven by a shift away from foreign goods, can benefit these sectors.

Examples abound. [Insert examples of specific companies and their performance within affected sectors]. This highlights the need for a granular understanding of individual company exposure to trade-related risks.

Shifting Investment Strategies: Adapting to the New Landscape

The trade war necessitates a reassessment of traditional investment strategies. Investors are adopting new approaches to navigate the heightened uncertainty and capitalize on emerging opportunities. This shift in European stock market strategy emphasizes diversification, risk mitigation, and a focus on companies less susceptible to global trade disruptions.

- Increased diversification across geographical regions and asset classes: Investors are increasingly diversifying their portfolios to reduce exposure to any single market or sector. This includes allocating funds to regions less affected by the trade war and expanding into different asset classes.

- Focus on companies with strong domestic demand and less exposure to international trade: Companies with a strong domestic focus and limited reliance on exports are seen as relatively safer investments in this climate. Their earnings are less vulnerable to fluctuations in international trade.

- Greater emphasis on ESG (environmental, social, and governance) factors in investment decisions: Investors are increasingly incorporating ESG considerations into their investment strategies. This reflects a growing awareness of the long-term implications of climate change and other social and environmental factors on company performance.

- Increased use of hedging strategies to mitigate risk: Sophisticated investors are employing hedging strategies, such as options or futures contracts, to protect their portfolios from the adverse effects of market volatility.

The choice between active and passive investment management is also undergoing reevaluation. Active managers are striving to identify undervalued opportunities and navigate sector-specific risks. However, passive strategies might offer a simpler, less costly approach for investors seeking broad market exposure with reduced risk management demands.

The Rise of Defensive Investing Strategies in the European Union

Defensive investing strategies, such as investing in bonds, high-dividend-yielding stocks, and other relatively low-risk assets, are experiencing a surge in popularity. This shift reflects a growing desire for capital preservation in the face of market uncertainty. Investors are prioritizing income generation over aggressive capital appreciation in this turbulent environment.

The reasoning behind this shift is clear: defensive stocks offer a degree of insulation from the economic shocks associated with the trade war. Their consistent dividend payouts provide a steady stream of income, offering comfort in unpredictable times. Examples of suitable defensive investment vehicles include high-quality corporate bonds, utility stocks, and consumer staples. This strategic approach aims for stability and income generation rather than substantial growth. The long-term implications remain to be seen, but this trend suggests a preference for safety and predictability.

Conclusion

The ongoing trade war is fundamentally reshaping the European stock market strategy. Increased volatility, sector-specific impacts, and a shift towards more defensive and diversified portfolios are defining characteristics of this new landscape. Investors are adapting by focusing on companies less exposed to international trade and prioritizing risk mitigation strategies. Understanding the nuances of this evolving market is crucial for navigating the complexities of a global trade war. Develop a robust European stock market strategy that considers these challenges and opportunities. Consult with a financial advisor to tailor your investment approach to the current climate and ensure your portfolio is well-positioned to succeed in this dynamic environment. Don't hesitate to refine your European stock market strategy based on evolving trade developments.

Featured Posts

-

Singer Benson Boone Denies Copying Harry Styles

Apr 26, 2025

Singer Benson Boone Denies Copying Harry Styles

Apr 26, 2025 -

Increased Security Measures Implemented For Ajax Az Game Following Fan Violence Fears

Apr 26, 2025

Increased Security Measures Implemented For Ajax Az Game Following Fan Violence Fears

Apr 26, 2025 -

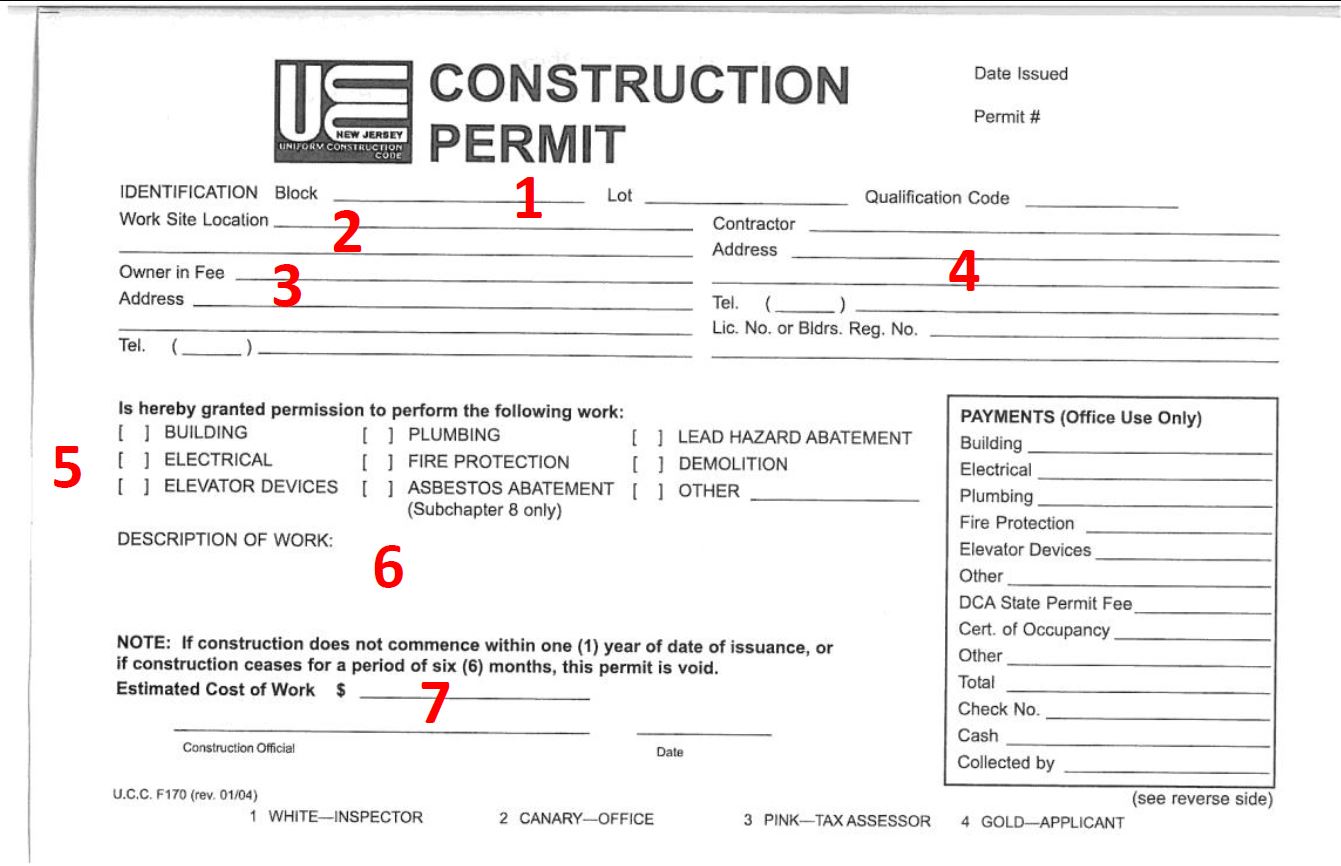

Recent Building Permits Issued In Macon County

Apr 26, 2025

Recent Building Permits Issued In Macon County

Apr 26, 2025 -

Photo 5137807 Benson Boone At The I Heart Radio Music Awards 2025

Apr 26, 2025

Photo 5137807 Benson Boone At The I Heart Radio Music Awards 2025

Apr 26, 2025 -

Department Of Justice Recommends 87 Month Sentence In George Santos Case

Apr 26, 2025

Department Of Justice Recommends 87 Month Sentence In George Santos Case

Apr 26, 2025

Latest Posts

-

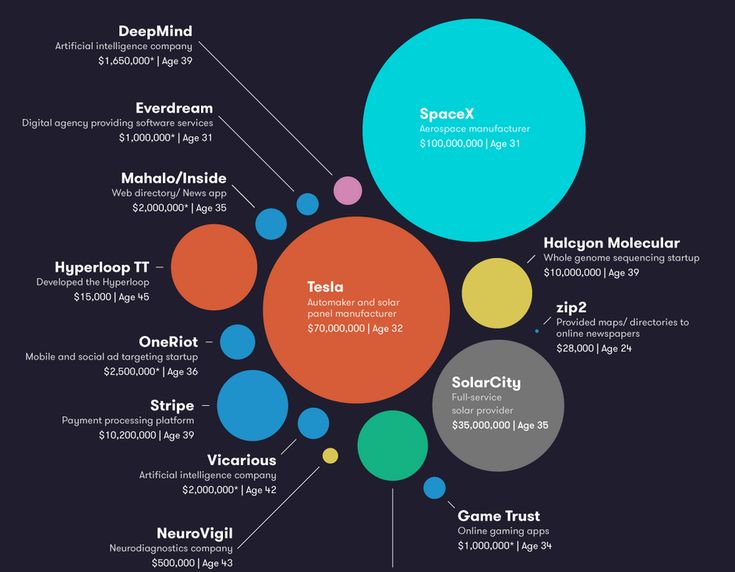

Hurun Global Rich List 2025 Elon Musks Net Worth Drops By Over 100 Billion But Remains Top Spot

May 10, 2025

Hurun Global Rich List 2025 Elon Musks Net Worth Drops By Over 100 Billion But Remains Top Spot

May 10, 2025 -

Analyzing Elon Musks Net Worth The Role Of The Us Economy

May 10, 2025

Analyzing Elon Musks Net Worth The Role Of The Us Economy

May 10, 2025 -

How Us Politics And Economics Shape Elon Musks Billions

May 10, 2025

How Us Politics And Economics Shape Elon Musks Billions

May 10, 2025 -

Elon Musks Fortune Examining The Influence Of Us Economic Factors

May 10, 2025

Elon Musks Fortune Examining The Influence Of Us Economic Factors

May 10, 2025 -

The Correlation Between Us Economic Power And Elon Musks Wealth

May 10, 2025

The Correlation Between Us Economic Power And Elon Musks Wealth

May 10, 2025