Trade War Fears Weigh On Markets: Dow Futures And Dollar Decline – Live Updates

Table of Contents

Dow Futures Plummet Amidst Trade War Uncertainty

The escalating trade war fears have triggered a significant drop in Dow Futures, reflecting a growing sense of unease among investors. This correlation between rising trade tensions and market declines is becoming increasingly apparent.

- Specific percentage drop in Dow Futures: As of [Insert Current Time], Dow Futures are down by [Insert Percentage]%, indicating a substantial loss of investor confidence.

- Mention specific sectors most affected (e.g., technology, manufacturing): The technology and manufacturing sectors are particularly vulnerable, experiencing steeper declines due to their heavy reliance on global trade and supply chains. These sectors are directly impacted by tariff increases and trade restrictions.

- Quote from a market analyst regarding the impact of trade war fears on investor confidence: "[Insert Quote from a reputable market analyst about the impact of trade war fears on investor confidence and market volatility]. This uncertainty is driving risk aversion and impacting investment decisions."

- Link to a relevant chart showing the Dow Futures decline: [Insert Link to a relevant chart]

Impact on Investor Sentiment and Volatility

The uncertainty surrounding trade war fears has fueled increased market volatility and risk aversion. Investors are becoming increasingly cautious, leading to significant shifts in investment strategies.

- Increased demand for safe-haven assets like gold: Investors are flocking to safe-haven assets such as gold, a traditional hedge against economic uncertainty and geopolitical risks. This reflects a flight to quality driven by trade war concerns.

- Decreased trading volumes in some sectors: Trading volumes have decreased in several sectors as investors adopt a wait-and-see approach, hesitant to make significant commitments amidst the uncertainty.

- Mention potential flight to quality observed in the market: A noticeable flight to quality is evident, with investors shifting their focus towards lower-risk investments like government bonds and blue-chip stocks.

- Explain how uncertainty surrounding trade policies creates volatility: The lack of clarity surrounding future trade policies creates a significant source of volatility. Sudden policy shifts or unexpected announcements can trigger sharp market swings.

Weakening Dollar Reflects Trade War Concerns

The US dollar is weakening against major currencies, exhibiting an inverse correlation with escalating trade war fears. This trend reflects growing concerns about the potential negative impacts of trade disputes on the US economy.

- Percentage drop in the dollar against major currencies (e.g., Euro, Yen): The dollar has fallen by [Insert Percentage]% against the Euro and [Insert Percentage]% against the Yen, highlighting the growing anxieties surrounding trade tensions.

- Explain the impact of a weaker dollar on US exports and imports: A weaker dollar can boost US exports by making them cheaper for foreign buyers, but it also increases the cost of imports. This can lead to inflationary pressures within the US economy.

- Discuss the implications for global trade balances: The weakening dollar has broader implications for global trade balances, affecting the competitiveness of different economies and potentially exacerbating existing trade imbalances.

- Quote from a currency analyst on the dollar's weakening trend: "[Insert Quote from a reputable currency analyst on the reasons behind the dollar's decline and its relationship to trade war fears]."

Global Market Reactions to Escalating Trade Tensions

The impact of trade war fears extends far beyond US borders. Major global markets are experiencing varying degrees of negative impact, reflecting the interconnectedness of the global economy.

- Mention specific indices and their performance: Asian markets, particularly those heavily reliant on exports to the US, have seen significant declines in indices like the Shanghai Composite and the Nikkei. European markets also show signs of slowing growth.

- Highlight any regional differences in market reactions: Market reactions vary depending on regional exposure to US trade policies and the specific sectors affected. Some regions are more vulnerable than others to the disruption caused by trade conflicts.

- Discuss the interconnectedness of global markets and the ripple effect of trade disputes: Trade disputes have a ripple effect, impacting global supply chains, impacting businesses and consumers worldwide. The interconnected nature of global markets magnifies the impact of trade wars.

- Link to relevant news sources reporting on international market reactions: [Insert links to relevant news sources].

Potential Future Scenarios and Mitigation Strategies

Predicting the future course of the trade war is challenging, but several potential scenarios and mitigation strategies can be considered.

- Discuss possible scenarios: de-escalation, further escalation, or a negotiated settlement: The trade war could de-escalate through negotiated settlements, continue to escalate with further tariffs and restrictions, or reach a stalemate.

- Analyze potential long-term effects on global economic growth: Prolonged trade disputes could significantly hinder global economic growth, potentially leading to reduced investment, slower job creation, and increased consumer prices.

- Suggest strategies for businesses to navigate trade uncertainty (e.g., diversification, hedging): Businesses can mitigate the risks by diversifying their supply chains, hedging against currency fluctuations, and exploring new markets.

- Mention the role of government intervention and international cooperation: Government intervention and international cooperation are crucial in managing the risks associated with trade conflicts. International agreements and diplomatic efforts can help de-escalate tensions and foster more stable trade relations.

Conclusion

The escalating trade war fears are undeniably weighing heavily on global markets, causing significant declines in indices like the Dow Futures and weakening the US dollar. The uncertainty surrounding future trade policies is driving volatility and prompting investors to seek safer havens. Staying informed on the latest developments is crucial for navigating this challenging period. Continue to monitor our live updates for the latest information on trade war fears and their impact on the markets. Understanding these trade war fears is key to making informed investment decisions. Regularly check back for more insights on how trade war fears are shaping the global economic landscape.

Featured Posts

-

Anchor Brewings Closure 127 Years Of Brewing History Concludes

Apr 22, 2025

Anchor Brewings Closure 127 Years Of Brewing History Concludes

Apr 22, 2025 -

Overcoming The Hurdles Automating Nike Sneaker Manufacturing

Apr 22, 2025

Overcoming The Hurdles Automating Nike Sneaker Manufacturing

Apr 22, 2025 -

Turning Poop Into Podcast Gold An Ai Powered Approach To Repetitive Documents

Apr 22, 2025

Turning Poop Into Podcast Gold An Ai Powered Approach To Repetitive Documents

Apr 22, 2025 -

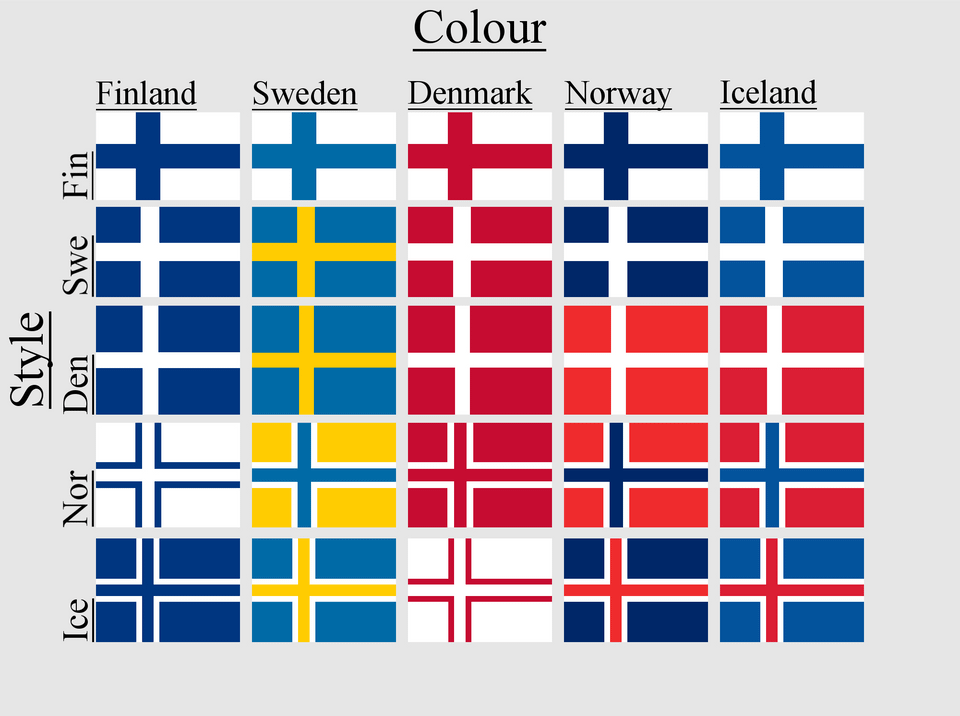

The Pan Nordic Army How Sweden And Finland Complement Each Other

Apr 22, 2025

The Pan Nordic Army How Sweden And Finland Complement Each Other

Apr 22, 2025 -

Higher Bids Higher Risks Stock Investors Facing Market Uncertainty

Apr 22, 2025

Higher Bids Higher Risks Stock Investors Facing Market Uncertainty

Apr 22, 2025