Trade War Unfazed: Canadian Investors Pour Money Into US Stocks

Table of Contents

Attractive Valuation and Growth Opportunities in the US Market

The US stock market presents compelling opportunities for Canadian investors, driven primarily by attractive valuations and robust growth prospects. Two key factors contribute significantly:

Stronger US Dollar and Currency Exchange Rates

A stronger US dollar (USD) relative to the Canadian dollar (CAD) significantly impacts the attractiveness of US stocks for Canadian investors. A stronger USD means that Canadian investors can purchase US stocks for fewer Canadian dollars, effectively lowering the purchase cost. This translates into potentially higher returns when converting USD back to CAD, especially if the exchange rate shifts favorably during the investment period. For instance, a Canadian investor purchasing shares in a tech company like Apple during a period of USD strength could benefit significantly from both potential capital appreciation and favorable exchange rate movements.

- Lower purchase costs due to favorable exchange rates.

- Potential for higher returns when converting USD back to CAD.

- Hedging strategies can be employed to mitigate currency risk, further enhancing returns. Sophisticated investors often use forward contracts or options to lock in exchange rates, reducing uncertainty.

Access to a Larger and More Diversified Market

The sheer size and diversity of the US stock market are undeniable advantages. Compared to the Canadian market, the US offers a vastly broader range of investment opportunities across numerous sectors. This diversification reduces portfolio risk, protecting against downturns in specific Canadian industries. Canadian investors gain access to large-cap companies with established track records, as well as innovative startups and growth stocks not readily available in the Canadian market. Sectors like technology, pharmaceuticals, and consumer goods, all heavily represented in the US, attract considerable Canadian investment.

- Wider range of investment opportunities across various sectors, allowing for effective portfolio diversification.

- Reduced reliance on the performance of the Canadian economy.

- Better access to large-cap and innovative companies, offering a wider spectrum of investment choices.

Overcoming Trade War Concerns: Strategies and Resilience

While past trade wars might have caused some initial apprehension, Canadian investors have largely adopted long-term perspectives and sophisticated risk management techniques to mitigate concerns.

Long-Term Investment Horizon

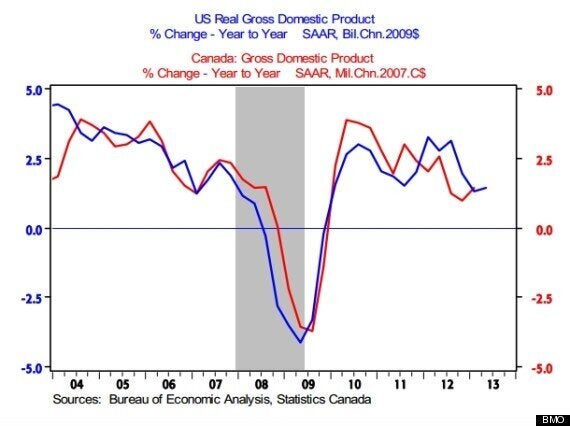

Most successful investors view trade wars as short-term market fluctuations rather than long-term threats. A long-term investment strategy, focused on fundamental company performance rather than short-term market noise, is crucial. Historically, the US stock market has shown remarkable resilience, recovering from various economic and geopolitical challenges over the long term.

- Focusing on fundamental company performance rather than short-term market volatility.

- Riding out temporary market corrections, understanding that these are normal parts of the market cycle.

- Rebalancing portfolios strategically to maintain desired asset allocations.

Sophisticated Risk Management Techniques

Professional investors employ a variety of strategies to mitigate risks associated with cross-border investments and trade tensions. Diversification across various sectors and geographies is a cornerstone, reducing exposure to any single market or industry. Hedging techniques, such as using derivatives, help insulate portfolios from currency fluctuations and other market risks.

- Diversifying across various sectors and geographies to reduce overall portfolio risk.

- Utilizing derivatives for hedging purposes, mitigating the impact of adverse market movements.

- Employing professional investment advisors to develop and manage tailored investment strategies.

The Role of Canadian Investment Firms and Advisors

Canadian financial institutions play a significant role in facilitating cross-border investments and promoting US stock investment among their clients.

Facilitating Cross-Border Investments

These firms provide streamlined investment processes, currency exchange services, and access to a wide range of US-listed securities. They also offer valuable investment advice tailored specifically to the intricacies of cross-border investing.

- Streamlined investment processes, making it easier for Canadian investors to access the US market.

- Currency exchange services, simplifying the process of converting CAD to USD and vice versa.

- Investment advice tailored to cross-border investing, helping investors navigate the complexities of international markets.

Marketing and Promotion of US Stock Investments

Investment firms actively market US stock investments to Canadian clients through various channels. Educational webinars and seminars demystify the process, while targeted advertising campaigns and personalized investment recommendations cater to individual needs and risk tolerance.

- Educational webinars and seminars to enhance understanding of US market opportunities.

- Targeted advertising campaigns to reach specific demographic segments of Canadian investors.

- Personalized investment recommendations based on individual financial goals and risk profiles.

Conclusion

Despite the challenges posed by past trade wars, Canadian investors continue to see significant value in the US stock market. Attractive valuations, robust growth prospects, and sophisticated risk management strategies contribute to this enduring confidence. The readily available support of Canadian investment firms further streamlines the process and mitigates potential risks.

Call to Action: Are you a Canadian investor seeking diversified growth opportunities? Don't let past trade war concerns deter you. Explore the potential benefits of investing in US stocks today. Contact a financial advisor to discuss a tailored investment strategy designed to maximize your returns with US stock investments and achieve your financial goals.

Featured Posts

-

Royals Crush Brewers 11 1 In Home Opener

Apr 23, 2025

Royals Crush Brewers 11 1 In Home Opener

Apr 23, 2025 -

Christian Yelichs First Homer Since Back Surgery A Milestone Reached

Apr 23, 2025

Christian Yelichs First Homer Since Back Surgery A Milestone Reached

Apr 23, 2025 -

Tina Knowles Breast Cancer Diagnosis The Importance Of Mammograms

Apr 23, 2025

Tina Knowles Breast Cancer Diagnosis The Importance Of Mammograms

Apr 23, 2025 -

Pierre Poilievres Collapse How A 20 Point Lead Vanished

Apr 23, 2025

Pierre Poilievres Collapse How A 20 Point Lead Vanished

Apr 23, 2025 -

Canadian Economists Predict Deeper Recession Despite Lower Tariffs

Apr 23, 2025

Canadian Economists Predict Deeper Recession Despite Lower Tariffs

Apr 23, 2025