Trump Reassures Markets, Stock Futures Jump On Powell Remarks

Table of Contents

Trump's Reassuring Statements and Their Market Impact

President Trump's actions and statements played a crucial role in calming market anxieties and boosting investor confidence. His pronouncements significantly impacted market psychology, leading to a noticeable increase in buying activity.

Specific comments made by President Trump:

President Trump's specific comments, while not explicitly stated as market-reassuring, were interpreted positively by many. For example, his emphasis on continued economic growth and his optimistic outlook on trade negotiations were seen as signals of stability.

- Positive Trade Negotiation Signals: Analysts interpreted his statements regarding ongoing trade discussions as a sign of progress and a potential de-escalation of trade tensions, thereby lessening uncertainty in the market.

- Focus on Economic Growth: His repeated emphasis on strong economic fundamentals and job creation boosted investor confidence, suggesting a positive outlook for corporate earnings.

- Confidence in the US Economy: Trump's overall tone, projecting confidence in the US economy, directly countered concerns about a potential recession, a factor that significantly impacts investor behavior.

Analysis of the psychological impact on investors:

The psychological impact of Trump's comments cannot be overstated. Market psychology is driven by sentiment, and Trump's words, however interpreted, injected a dose of optimism.

- Reduced Uncertainty: His statements, while sometimes vague, helped reduce the pervasive uncertainty that had been weighing on the market. This reduction in uncertainty encouraged investors to take on more risk.

- Boosted Investor Confidence: The positive spin placed on his words by many market analysts further reinforced a sense of optimism, leading to increased buying activity and a rise in stock futures.

- Data Points (Illustrative): While precise figures require detailed market analysis, reports indicated a significant increase in trading volume and a shift from selling to buying pressure following Trump's statements.

Powell's Remarks and Their Influence on Stock Futures

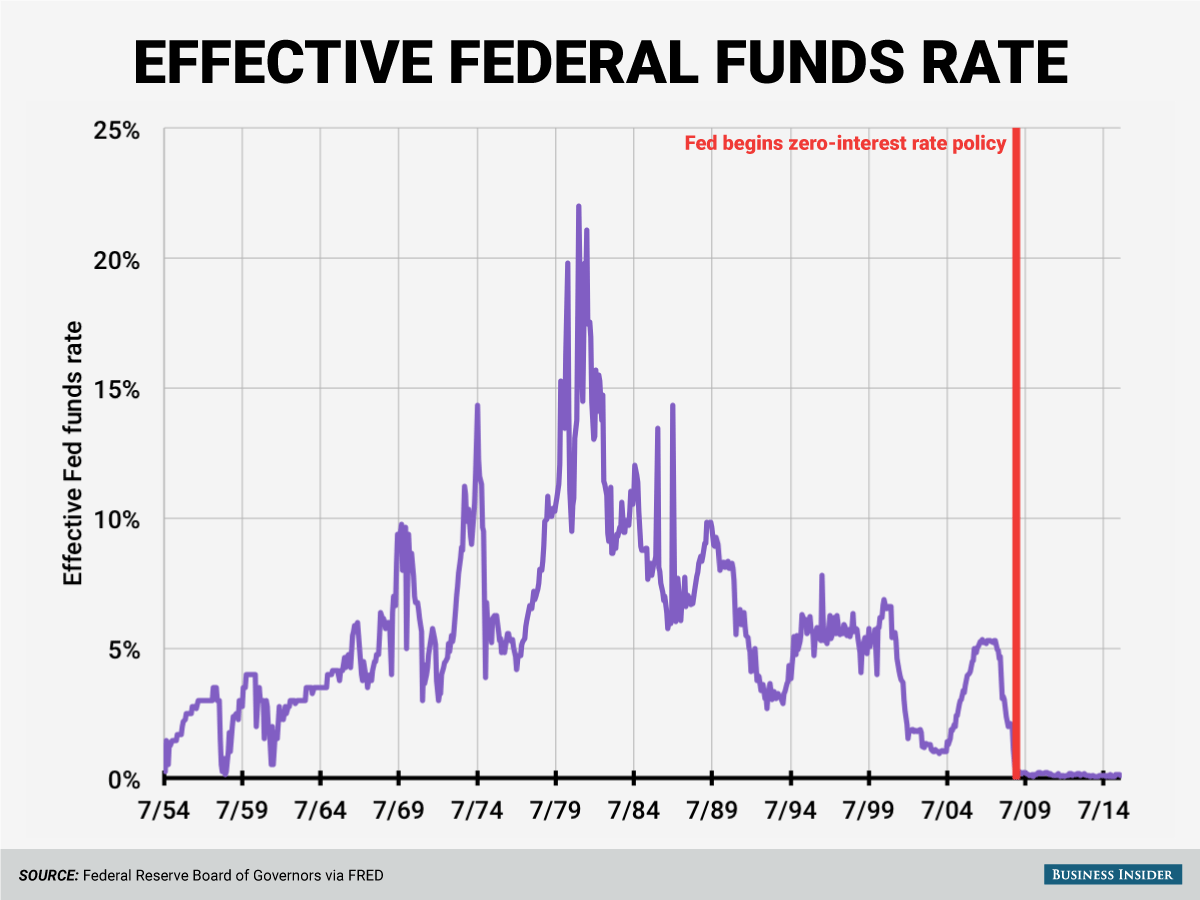

Federal Reserve Chairman Jerome Powell's remarks also played a significant role in the market's positive reaction. His statements on monetary policy and economic forecasts influenced investor perceptions and contributed to the rise in stock futures.

Summary of Powell's key pronouncements:

Powell's speech, while cautious, contained elements interpreted as dovish by many market participants.

- Monetary Policy Stance: He hinted at a potential pause in interest rate hikes, a move seen as supportive of economic growth and corporate profitability.

- Economic Forecasts: His assessment of the economy, while acknowledging some headwinds, remained relatively optimistic, reinforcing the positive sentiment created by Trump's comments.

- Expert Interpretation: Financial experts interpreted Powell's comments as a signal that the Fed was prepared to act cautiously and avoid actions that could stifle economic growth.

Connection between Powell's words and the stock market jump:

Powell's words acted as a catalyst, amplifying the positive impact of Trump's statements.

- Reinforcement of Positive Sentiment: Powell's relatively dovish stance reinforced the market's perception of a positive economic outlook, contributing to the overall bullish sentiment.

- Investor Reaction: Investors reacted favorably to the combined message from both Trump and Powell, viewing it as a sign of coordinated efforts to support economic growth and market stability.

- Synergistic Effect: The combined effect of both statements created a synergistic impact, resulting in a more significant jump in stock futures than either statement might have achieved independently.

Overall Market Reaction and Future Outlook

The market's reaction to both Trump's and Powell's statements was immediate and significant.

Analysis of the stock market's immediate response:

Stock futures experienced a substantial jump following the announcements.

- Percentage Increases: Specific numbers would depend on the timeframe and indices considered, but reports indicated significant percentage gains across major stock indices.

- Sector Performance: Technology and consumer discretionary sectors, generally considered more sensitive to investor sentiment, experienced some of the most significant gains.

- Market Charts: Visual representation of the market's response (charts and graphs illustrating the sharp increase in stock futures) would be highly beneficial here.

Predictions for the short-term and long-term market trends:

While the immediate reaction was positive, the sustainability of this rally remains uncertain.

- Short-Term Outlook: The short-term outlook appears positive, but it’s crucial to note that this is partly driven by market psychology and the impact of specific statements.

- Long-Term Outlook: Long-term market trends depend on fundamental economic factors, including global economic growth, inflation, and geopolitical events.

- Potential Risks: Unforeseen events, such as renewed trade tensions or unexpected economic data, could easily reverse the current positive trend.

Conclusion

This article examined the significant impact of President Trump's reassurances and Chairman Powell's remarks on the market. The combined effect resulted in a substantial jump in stock futures, suggesting a temporary boost in investor confidence. However, the sustainability of this positive trend remains to be seen. The interplay between Trump's effect on market sentiment and Powell's monetary policy decisions will continue to shape the overall economic outlook.

Call to Action: Stay informed about the latest developments impacting the markets. Keep reading our articles for in-depth analysis on Trump's effect on market sentiment, Powell's monetary policy decisions, and the overall economic outlook. Understanding these factors is key to navigating the complexities of the stock market. Follow us for regular updates on stock market news and analysis.

Featured Posts

-

Nba 3 Point Contest 2024 Herros Triumph Over Hield

Apr 24, 2025

Nba 3 Point Contest 2024 Herros Triumph Over Hield

Apr 24, 2025 -

I Sygkinisi Toy Tzon Travolta Gia Ton Thanato Toy Tzin Xakman

Apr 24, 2025

I Sygkinisi Toy Tzon Travolta Gia Ton Thanato Toy Tzin Xakman

Apr 24, 2025 -

60 Minutes Producers Resignation Loss Of Independence Cited After Trump Lawsuit

Apr 24, 2025

60 Minutes Producers Resignation Loss Of Independence Cited After Trump Lawsuit

Apr 24, 2025 -

East Palestines Lingering Threat Toxic Chemicals Remain In Buildings Months After Derailment

Apr 24, 2025

East Palestines Lingering Threat Toxic Chemicals Remain In Buildings Months After Derailment

Apr 24, 2025 -

Hisd Mariachi Groups Viral Whataburger Video Sends Them To Uil State

Apr 24, 2025

Hisd Mariachi Groups Viral Whataburger Video Sends Them To Uil State

Apr 24, 2025

Latest Posts

-

U S Federal Reserve Rate Decision Economic Uncertainty And The Path Forward

May 10, 2025

U S Federal Reserve Rate Decision Economic Uncertainty And The Path Forward

May 10, 2025 -

Senator Warner On Trumps Unwavering Stance On Tariffs

May 10, 2025

Senator Warner On Trumps Unwavering Stance On Tariffs

May 10, 2025 -

Suncor Production Reaches Record High While Sales Face Inventory Challenges

May 10, 2025

Suncor Production Reaches Record High While Sales Face Inventory Challenges

May 10, 2025 -

Weight Watchers Files For Bankruptcy Amidst Growing Weight Loss Medication Market

May 10, 2025

Weight Watchers Files For Bankruptcy Amidst Growing Weight Loss Medication Market

May 10, 2025 -

De Escalation Dominates Analysis Of U S China Trade Talks This Week

May 10, 2025

De Escalation Dominates Analysis Of U S China Trade Talks This Week

May 10, 2025