Trump's Economic Policies And The Difficulties For The Incoming Fed Chair

Table of Contents

The Legacy of Trump's Tax Cuts

Trump's 2017 tax cuts, the most significant since the Reagan era, represent a cornerstone of his economic legacy. While delivering a short-term economic boost, they also sowed the seeds of long-term challenges.

Short-Term Stimulus vs. Long-Term Debt

The tax cuts, which significantly reduced corporate and individual income tax rates, initially spurred economic activity. Businesses experienced increased profits, leading to some job growth and investment. However, this short-term stimulus came at a considerable cost.

- Increased deficit spending: The tax cuts dramatically increased the national debt, adding trillions to the federal deficit. This surge in borrowing raises concerns about future economic stability and the government's ability to fund essential programs.

- Potential inflationary pressures: The increased money supply resulting from deficit financing could lead to inflationary pressures, eroding purchasing power and potentially necessitating tighter monetary policy by the Fed.

- Impact on future government spending: The rising national debt limits the government's fiscal flexibility to respond to future economic downturns or invest in critical infrastructure and social programs. This constraint adds another layer of complexity for the incoming Fed Chair.

Impact on Corporate Investment and Job Growth

While corporate tax cuts were intended to stimulate investment and job growth, the results have been mixed.

- Increased corporate profits: Many corporations did see increased profits, leading to some shareholder payouts and stock buybacks.

- Repatriation of overseas funds: The tax cuts incentivized companies to repatriate funds held overseas, providing a temporary boost to the economy.

- Impact on small businesses: The benefits of the tax cuts were not evenly distributed, with smaller businesses often experiencing less of an impact than large corporations.

- Wage growth: Despite increased corporate profits, wage growth remained relatively stagnant for many workers, fueling concerns about income inequality.

Navigating Trade Wars and Protectionism

Trump's trade policies, characterized by tariffs and trade wars, significantly impacted the global economy and created considerable uncertainty for businesses.

Uncertainty and Volatility in Global Markets

The imposition of tariffs on goods from various countries led to significant disruptions in global supply chains.

- Supply chain disruptions: Businesses faced increased costs and delays due to tariffs and retaliatory measures from other nations.

- Increased costs for consumers: Tariffs ultimately increased the prices of many imported goods, impacting consumer spending.

- Retaliatory tariffs: Trump's trade policies triggered retaliatory tariffs from other countries, further escalating trade tensions and harming US businesses.

- Impact on specific industries: Certain industries, such as agriculture and manufacturing, were disproportionately affected by the trade wars, leading to job losses and economic hardship in some regions.

The Challenge of Predicting Economic Impacts

Forecasting the long-term economic effects of Trump's protectionist trade policies is exceptionally difficult.

- Unpredictability of trade negotiations: The unpredictable nature of Trump's trade negotiations made it hard for businesses to plan for the future and invest confidently.

- Difficulty modeling the effects of tariffs: The complex interactions between tariffs, global supply chains, and consumer behavior make accurately modeling the economic effects a significant challenge.

- Potential for long-term damage to international relations: Trump's aggressive trade tactics strained relationships with key trading partners, potentially leading to long-term damage to international cooperation and economic stability.

Deregulation and its Economic Consequences

Trump's administration pursued a policy of deregulation across various sectors, aiming to reduce the burden on businesses and stimulate economic growth. However, this approach also carries significant risks.

Impact on Financial Stability and Consumer Protection

Deregulation can lead to increased risk-taking by financial institutions and weaken consumer protections.

- Increased risk-taking by financial institutions: Reduced regulatory oversight can encourage excessive risk-taking, potentially leading to financial instability and crises.

- Impact on environmental regulations: Relaxing environmental regulations can lead to increased pollution and environmental damage, with long-term economic consequences.

- Consumer protection laws: Weakening consumer protection laws can leave consumers vulnerable to fraud and exploitation.

- Potential for market instability: Deregulation can increase the volatility of financial markets, creating uncertainty and potentially harming investors.

The Fed's Role in Maintaining Financial Stability

The Fed must balance promoting economic growth with ensuring financial stability in a less regulated environment.

- Monetary policy challenges: The Fed faces the challenge of using monetary policy effectively to manage economic fluctuations in a less regulated environment.

- Increased risk of financial crises: Deregulation increases the risk of financial crises, requiring the Fed to be more vigilant in monitoring financial institutions and markets.

- Need for proactive regulation: Even in a deregulated environment, the Fed needs to advocate for proactive regulation where necessary to mitigate systemic risk.

- Supervision of financial institutions: The Fed needs to strengthen its supervision of financial institutions to prevent excessive risk-taking and ensure financial stability.

Conclusion

The economic legacy of Trump's policies presents a formidable challenge for the incoming Fed Chair. Balancing the short-term gains of tax cuts with the long-term risks of increased debt, navigating the uncertainty caused by trade wars, and addressing the consequences of deregulation all require careful consideration and skillful maneuvering. The next Fed Chair must develop a robust and adaptable monetary policy strategy to effectively manage the complexities created by Trump's economic policies and ensure sustained economic growth while mitigating potential risks. Understanding the intricacies of Trump's economic policies is crucial for anyone seeking to understand the current state of the US economy. Further research into the specific impacts of each policy on various sectors is recommended to fully grasp the implications of Trump's economic legacy.

Featured Posts

-

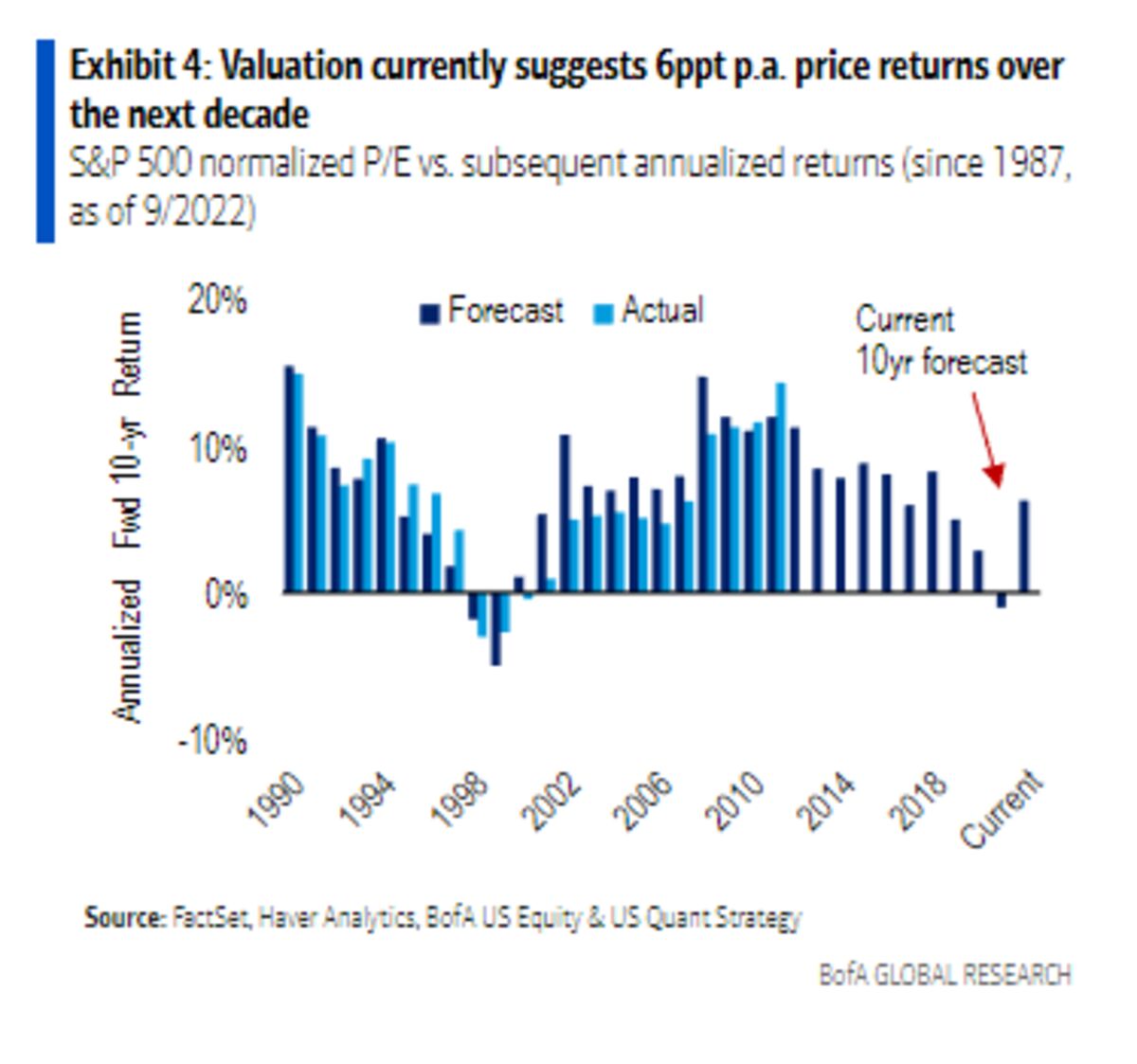

High Stock Valuations A Bof A Analyst Explains Why Investors Shouldnt Panic

Apr 26, 2025

High Stock Valuations A Bof A Analyst Explains Why Investors Shouldnt Panic

Apr 26, 2025 -

Het Raadsel Van Het Zoete Nederlandse Broodje

Apr 26, 2025

Het Raadsel Van Het Zoete Nederlandse Broodje

Apr 26, 2025 -

The Trump Effect Uniting Canadians Before The Election

Apr 26, 2025

The Trump Effect Uniting Canadians Before The Election

Apr 26, 2025 -

New York Giants Shedeur Sanders As A Potential Solution

Apr 26, 2025

New York Giants Shedeur Sanders As A Potential Solution

Apr 26, 2025 -

80

Apr 26, 2025

80

Apr 26, 2025

Latest Posts

-

Apples Ai Future Innovate Or Fall Behind

May 10, 2025

Apples Ai Future Innovate Or Fall Behind

May 10, 2025 -

Apples Ai Crossroads A Race For Innovation

May 10, 2025

Apples Ai Crossroads A Race For Innovation

May 10, 2025 -

Is Figmas Ai The Future Of Design Software A Competitive Analysis

May 10, 2025

Is Figmas Ai The Future Of Design Software A Competitive Analysis

May 10, 2025 -

Ukraine Conflict Putin Announces Victory Day Ceasefire

May 10, 2025

Ukraine Conflict Putin Announces Victory Day Ceasefire

May 10, 2025 -

Open Ai 2024 New Tools For Streamlined Voice Assistant Development

May 10, 2025

Open Ai 2024 New Tools For Streamlined Voice Assistant Development

May 10, 2025