High Stock Valuations: A BofA Analyst Explains Why Investors Shouldn't Panic

Table of Contents

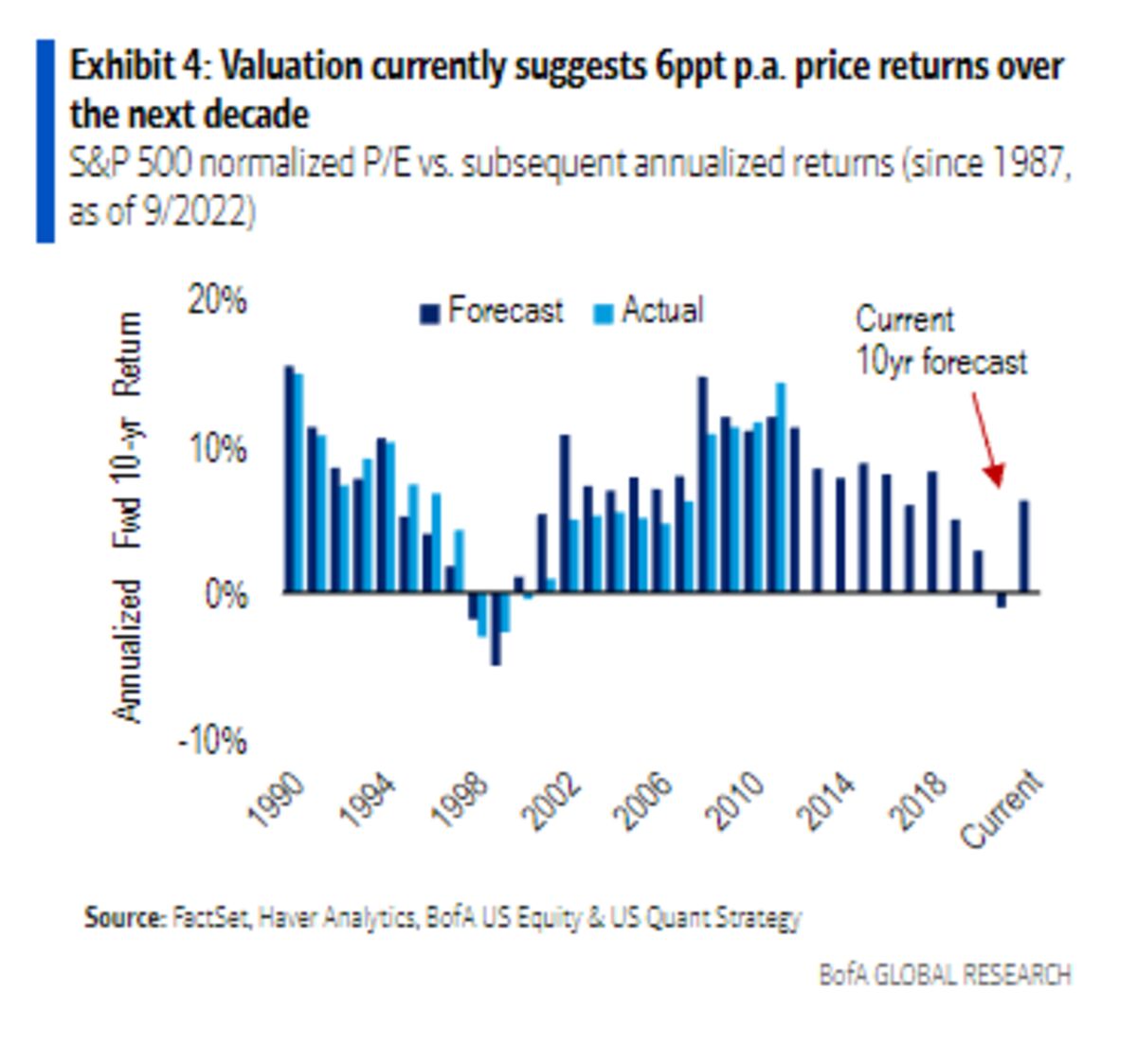

Understanding Current High Stock Valuations: A Deeper Look

Several factors contribute to the current landscape of high stock valuations. Understanding these nuances is crucial before making any rash investment decisions.

The Role of Low Interest Rates

Historically low interest rates play a significant role in inflating stock valuations. When bond yields are low, investors seek higher returns elsewhere, driving up demand for stocks and consequently, their prices. This makes stocks appear relatively more attractive compared to bonds, even if their inherent value hasn't necessarily increased proportionally.

- Mechanics: Low interest rates reduce the discount rate used in discounted cash flow (DCF) models, increasing the present value of future earnings and leading to higher valuations.

- Example: A company with projected future earnings remains the same, but with lower interest rates, the present value of those future earnings increases, resulting in a higher stock price.

- Data Point: The inverse relationship between bond yields (e.g., 10-year Treasury yield) and P/E ratios across the market is a common observation during periods of low interest rates.

The Impact of Inflation and Economic Growth

Inflation and economic growth projections significantly impact stock prices and valuations. High inflation can erode purchasing power, potentially impacting future earnings, while strong economic growth can justify higher valuations based on anticipated future earnings. However, the interplay between these factors is complex and subject to different interpretations.

- Contrasting Views: Some analysts believe that moderate inflation can be beneficial for stocks, stimulating economic activity. Others express concerns about the erosive effect of high inflation on corporate profits and stock valuations.

- Earnings Projections: Valuations are fundamentally linked to expectations of future earnings. If companies can consistently meet or exceed these projections, high valuations might be justified. However, if earnings fail to materialize, valuations can become unsustainable.

- Discounted Cash Flow (DCF): DCF analysis is a key tool for assessing whether current stock prices accurately reflect a company's future cash flow potential, considering the impact of inflation and economic growth.

The Influence of Technological Advancements

Technological advancements are a primary driver of high stock valuations, particularly in certain sectors. Companies pioneering disruptive technologies often command premium valuations due to their growth potential and market dominance.

- Growth Stocks: Many technology companies with high valuations are considered "growth stocks," reflecting investor expectations of substantial future revenue and earnings growth.

- Examples: Companies leading in artificial intelligence, cloud computing, and biotechnology often exhibit high valuations due to their perceived potential for long-term growth and market disruption.

- Sector-Specific Valuations: It's crucial to consider that high valuations are not uniform across all sectors. Some sectors may exhibit higher valuations than others due to their exposure to technological innovation and growth opportunities.

Why a Measured Approach is Preferred Over Panic Selling

While high stock valuations are a legitimate concern, panicking and selling off your entire portfolio is rarely the optimal response. A more measured approach based on long-term strategies is usually more prudent.

Long-Term Investing Perspective

The stock market is inherently volatile. Short-term fluctuations are normal, and focusing on a long-term investment strategy helps weather these storms.

- Market Corrections: History shows that market corrections and even crashes are inevitable. However, long-term investors who avoid impulsive decisions have historically recovered from these periods.

- Buy-and-Hold Strategy: A buy-and-hold strategy can be highly effective for long-term growth, minimizing the impact of short-term market fluctuations.

- Risk Tolerance: Understanding and managing your own risk tolerance is paramount to successful long-term investing. High valuations shouldn't automatically trigger fear if your investment timeline aligns with long-term growth prospects.

Diversification and Risk Management

Diversification is crucial to mitigating risks associated with high valuations in specific sectors. A well-diversified portfolio reduces reliance on any single asset or sector.

- Asset Allocation: A strategic asset allocation across various asset classes (stocks, bonds, real estate, etc.) helps balance risk and return.

- Sector Diversification: Avoid overexposure to any single sector, especially those showing exceptionally high valuations. Diversify across different sectors to reduce the impact of sector-specific downturns.

- Risk Management: Regularly review and adjust your portfolio based on changing market conditions and your own financial goals.

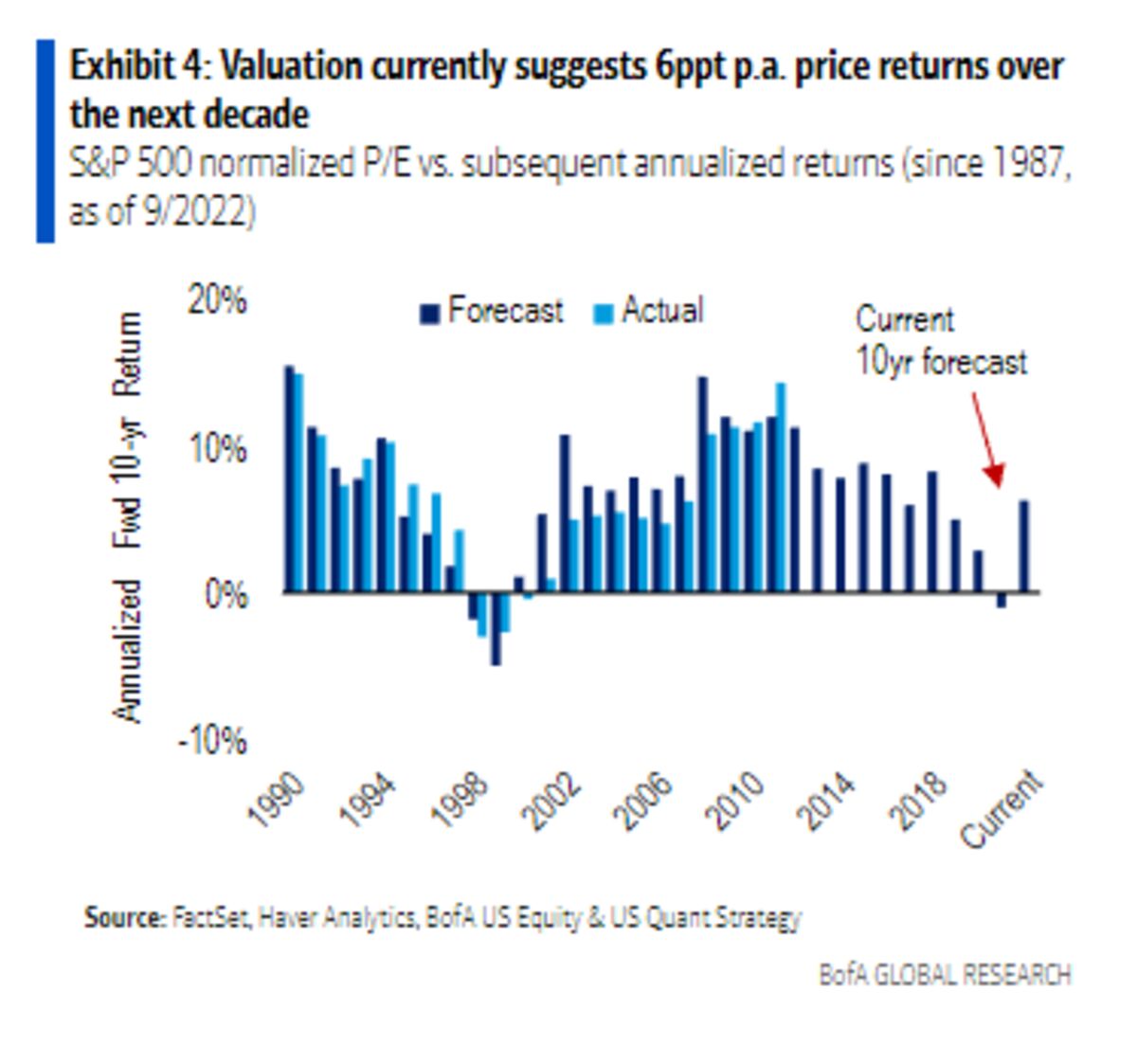

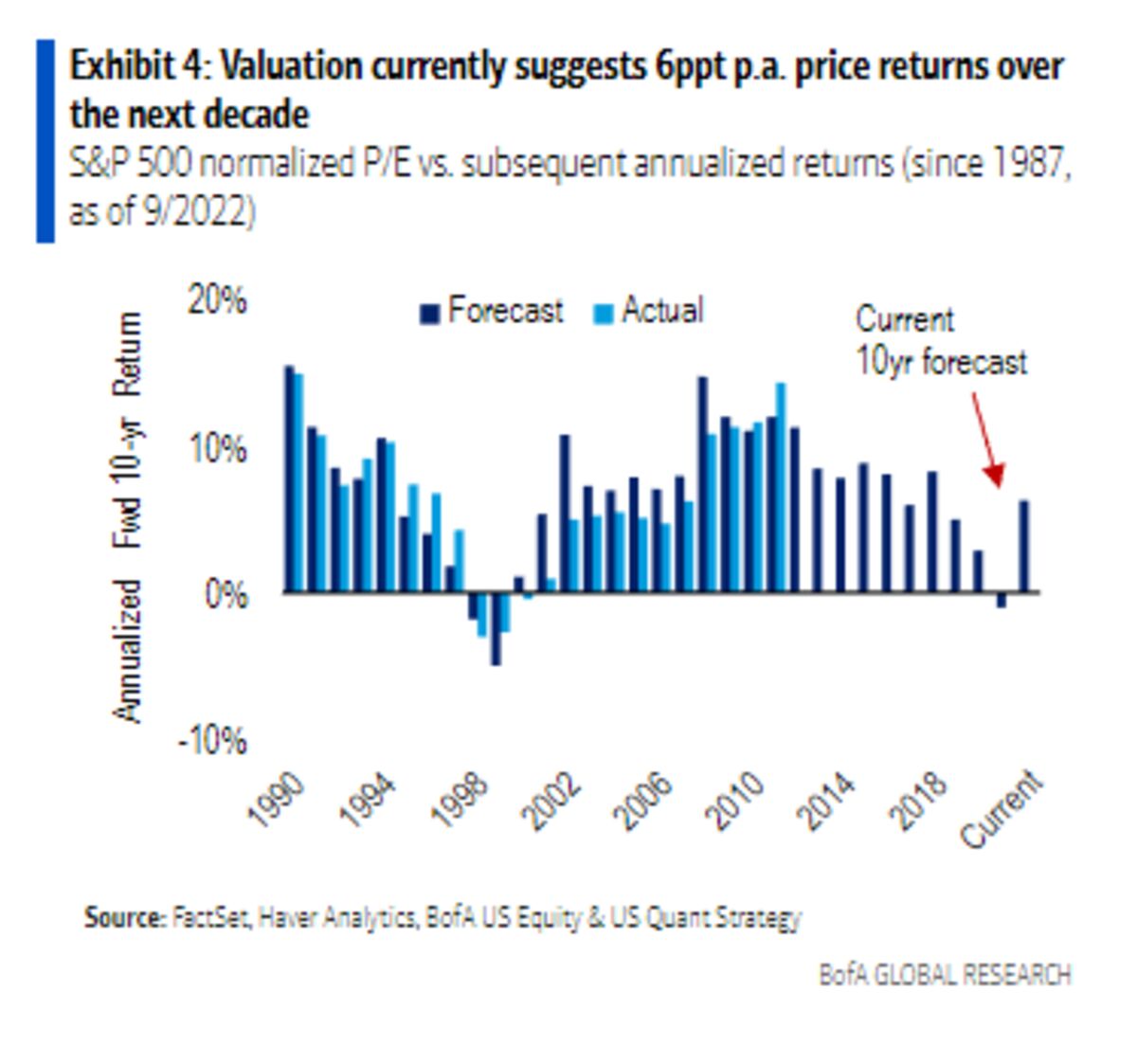

The BofA Analyst's Viewpoint

The BofA analyst (or similar source), in their recent report, highlighted the importance of maintaining a long-term perspective and avoiding impulsive reactions to high stock valuations. They emphasized the need for careful analysis of individual companies and sectors, suggesting that a selective approach to buying opportunities could be beneficial. They stated (paraphrased): "While valuations are elevated, the long-term growth potential of many companies, particularly in technology, justifies continued investment for patient, long-term investors." (Source: Insert Source Here)

Strategic Actions for Investors Facing High Stock Valuations

Instead of panicking, investors should consider strategic actions to navigate this challenging environment.

Reassessing Your Investment Strategy

Reviewing your investment goals, risk tolerance, and time horizon is a crucial step.

- Investment Goals: Are your current investments aligned with your long-term financial goals? If not, make necessary adjustments.

- Risk Tolerance: Has your risk tolerance changed due to recent market developments? If so, adjust your portfolio accordingly.

- Time Horizon: Remember your investment time horizon. If your timeframe is long-term, short-term market volatility shouldn't unduly influence your investment decisions.

Opportunities for Selective Buying

Even amidst high valuations, opportunities exist for selectively buying undervalued stocks or sectors.

- Fundamental Analysis: Conduct thorough fundamental analysis to identify companies with strong fundamentals and potential for long-term growth, even if their current valuations seem high relative to the broader market.

- Stock Picking: Focus on stock picking rather than broad market indexes. Identify undervalued companies or sectors with strong growth prospects.

- Sector Rotation: Consider sector rotation – shifting investments from overvalued sectors to those that appear undervalued based on fundamental analysis.

Navigating High Stock Valuations: A Call to Action

High valuations are a factor to consider, but not a reason for immediate panic. A balanced, informed approach, emphasizing long-term strategies and careful analysis, is key. The BofA analyst's (or similar source's) perspective underscores the importance of a measured response, focusing on long-term growth potential and diversification. Don't let high stock valuations trigger panic selling; instead, use this as an opportunity to refine your investment strategy. Conduct thorough research, diversify your portfolio, and make informed decisions based on your individual risk tolerance and investment goals. For further resources on investment strategies and risk management, [link to relevant resources].

Featured Posts

-

Trump Administration To Tighten Federal Disaster Aid Eligibility

Apr 26, 2025

Trump Administration To Tighten Federal Disaster Aid Eligibility

Apr 26, 2025 -

Stock Market Update Dow Futures Rise Positive Week End In Sight

Apr 26, 2025

Stock Market Update Dow Futures Rise Positive Week End In Sight

Apr 26, 2025 -

Damen Csd 650 Engineer Soltan Kazimov On The Inaugural Sea Trial

Apr 26, 2025

Damen Csd 650 Engineer Soltan Kazimov On The Inaugural Sea Trial

Apr 26, 2025 -

Anna Wongs Analysis The Coming Threat Of Empty Store Shelves

Apr 26, 2025

Anna Wongs Analysis The Coming Threat Of Empty Store Shelves

Apr 26, 2025 -

The Bof A View Why Stretched Stock Market Valuations Are Not A Cause For Alarm

Apr 26, 2025

The Bof A View Why Stretched Stock Market Valuations Are Not A Cause For Alarm

Apr 26, 2025

Latest Posts

-

Credit Suisse To Pay Whistleblowers 150 Million A Landmark Settlement

May 10, 2025

Credit Suisse To Pay Whistleblowers 150 Million A Landmark Settlement

May 10, 2025 -

Credit Suisse Whistleblower Case A 150 Million Settlement

May 10, 2025

Credit Suisse Whistleblower Case A 150 Million Settlement

May 10, 2025 -

Credit Suisse Whistleblower Payout Up To 150 Million

May 10, 2025

Credit Suisse Whistleblower Payout Up To 150 Million

May 10, 2025 -

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025 -

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025