Trump's Houthi Truce: Shippers Remain Doubtful

Table of Contents

The Truce's Uncertain Terms and Enforcement

The agreement itself is shrouded in ambiguity, lacking the clear, concrete terms necessary to inspire confidence. Enforcement presents an even greater challenge. Monitoring a ceasefire in the complex and often chaotic landscape of the Yemeni conflict is a Herculean task, particularly given the lack of a robust, independent verification mechanism. This leaves the truce vulnerable to violations and potential escalations, casting a long shadow over its future.

- Lack of independent verification mechanisms: The absence of neutral observers makes it difficult to objectively assess compliance with the truce.

- Potential for violations and escalation: Past experience with broken agreements in Yemen suggests the potential for renewed hostilities remains high.

- Difficulties in securing humanitarian aid delivery: Even with a truce, the delivery of vital humanitarian aid remains hampered by logistical hurdles and security concerns.

- Past broken agreements: A history of failed peace initiatives in Yemen fuels skepticism about the current truce's sustainability.

Shippers' Concerns Regarding Red Sea Navigation

The Red Sea is a critical artery for global shipping, a vital conduit for trade connecting Asia, Africa, and Europe. The Houthis' history of targeting vessels in this strategic waterway has understandably raised serious concerns amongst shippers. The potential for renewed attacks, even under a truce, poses significant risks, threatening to disrupt global supply chains and send shockwaves through the global economy.

- Increased insurance premiums and transit costs: The perceived increased risk translates to higher insurance premiums and transportation costs for shippers.

- Route diversions and delays: Shippers might be forced to use longer, more expensive routes, leading to significant delays in delivery times.

- Potential for cargo losses and damage: Attacks on vessels could result in the loss or damage of valuable cargo, incurring substantial financial losses for businesses.

- Impact on global oil prices: Disruptions to oil shipments through the Red Sea could have a ripple effect on global oil prices, impacting various sectors.

Geopolitical Implications and Regional Instability

The Yemeni conflict is deeply intertwined with regional geopolitical dynamics, making the truce's success intricately linked to the broader political landscape. The involvement of regional powers like Saudi Arabia and Iran, as well as international actors like the United Nations, adds layers of complexity to the peace process. Internal divisions within Yemen itself further complicate matters, increasing the potential for the conflict to escalate, jeopardizing the truce and the stability of the Red Sea region.

- Influence of Saudi Arabia and Iran: The proxy conflict between Saudi Arabia and Iran casts a long shadow over the Yemeni conflict and the peace process.

- Role of the United Nations: The UN's involvement in mediating the truce is crucial, but its effectiveness depends on the cooperation of all parties involved.

- Internal divisions within Yemen: The fractured political landscape within Yemen creates internal conflicts that can easily destabilize any peace agreement.

- Potential for proxy conflicts: The risk of renewed proxy warfare between regional powers threatens to undermine the truce and reignite hostilities.

Alternative Routes and Mitigation Strategies

If the Red Sea becomes impassable due to renewed conflict, shippers will need to explore alternative routes, though this comes at a significant cost. Mitigation strategies, including enhanced security measures, are crucial to minimizing risks. The economic implications of these alternatives must be carefully considered.

- Increased distance and fuel consumption: Alternative routes often involve significantly longer distances, resulting in increased fuel consumption and higher transportation costs.

- Higher transportation costs: The overall cost of shipping will increase due to longer routes, higher insurance premiums, and enhanced security measures.

- Investment in security technology: Shippers might need to invest in advanced security technologies to protect their vessels and cargo from potential attacks.

- Diversification of supply chains: Diversifying supply chains to reduce reliance on the Red Sea route is a long-term strategy to mitigate risk.

Conclusion

Trump's Houthi truce remains a precarious agreement, fraught with uncertainty and skepticism within the shipping industry. The potential negative impact on global shipping is substantial, with significant economic consequences that cannot be ignored. Shippers must carefully assess the risks associated with the Red Sea route and develop robust contingency plans should the truce fail. Continued monitoring of the situation surrounding Trump's Houthi truce is paramount, along with further research into alternative routes and mitigation strategies to ensure supply chain resilience. Proactive planning is essential to navigate the complexities of this volatile region and protect the flow of global trade.

Featured Posts

-

Oilers Vs Kings Expert Predictions For Game 1 Of The Nhl Playoffs

May 10, 2025

Oilers Vs Kings Expert Predictions For Game 1 Of The Nhl Playoffs

May 10, 2025 -

L Ombre De Melanie Dijon Revele Le Role De La Mere De Gustave Eiffel

May 10, 2025

L Ombre De Melanie Dijon Revele Le Role De La Mere De Gustave Eiffel

May 10, 2025 -

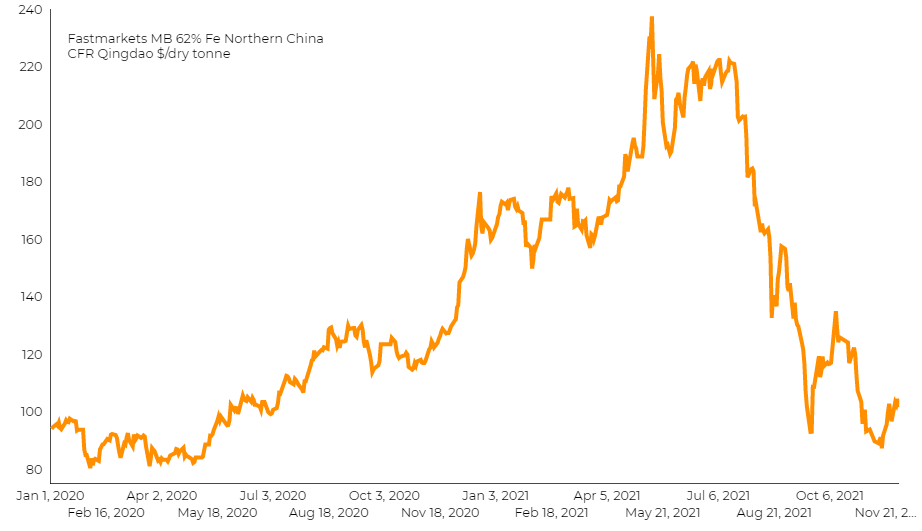

Iron Ore Falls As China Curbs Steel Output Market Impact Analysis

May 10, 2025

Iron Ore Falls As China Curbs Steel Output Market Impact Analysis

May 10, 2025 -

The Luis Enrique Era A Winning Chapter For Paris Saint Germain

May 10, 2025

The Luis Enrique Era A Winning Chapter For Paris Saint Germain

May 10, 2025 -

Harry Styles Response To A Hilariously Bad Snl Impression

May 10, 2025

Harry Styles Response To A Hilariously Bad Snl Impression

May 10, 2025