Trump's Tariff Increase Sends Amsterdam Stock Exchange Down 2%

Table of Contents

H2: The Immediate Impact of the Tariff Increase on the AEX Index

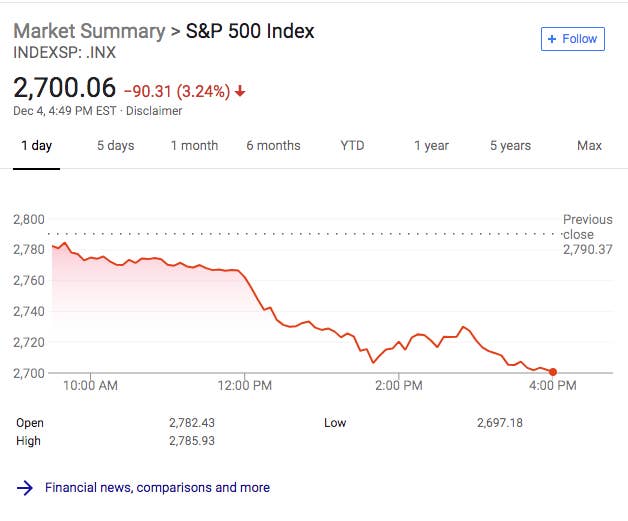

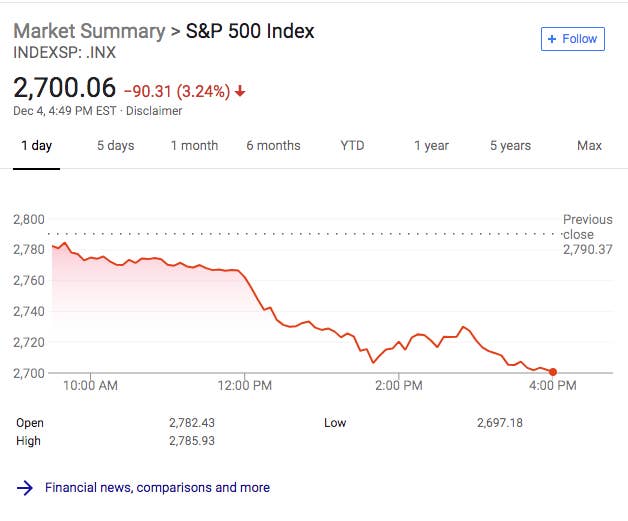

The announcement of Trump's tariff increase triggered an immediate and noticeable 2% plunge in the AEX index, Amsterdam's benchmark stock market index. This sharp AEX index drop reflects the vulnerability of the Dutch economy, particularly export-oriented sectors, to international trade disputes. The immediate market reaction was swift and severe, leading to significant trading volume fluctuations throughout the day.

- Sectors Most Affected: The impact wasn't uniform across all sectors. Export-oriented industries, including technology companies heavily reliant on global supply chains, and those with significant US trade, suffered the most.

- Technology companies saw a disproportionate decline due to their reliance on global supply chains and the potential for increased import costs.

- Companies heavily involved in exporting to the US experienced a significant drop in their share prices due to reduced demand and potential increased trade barriers.

- Trading Volume: Trading volume on the Amsterdam Stock Exchange surged dramatically following the announcement, indicating heightened investor anxiety and a rush to adjust portfolios in response to the increased market volatility.

- AEX Index Calculation: The AEX index, calculated based on the 25 largest companies listed on Euronext Amsterdam, serves as a key indicator of the overall health of the Dutch economy. Its decline underscores the gravity of the situation. The weighting of different sectors within the AEX also contributed to the overall decline; sectors more sensitive to tariffs were more heavily represented.

H2: Global Market Reactions and Ripple Effects

The negative impact wasn't confined to Amsterdam. The news of Trump's tariff increase rippled through other major European stock exchanges. London, Frankfurt, and Paris all experienced noticeable declines, albeit less pronounced than in Amsterdam, reflecting the interconnected nature of global financial markets. This global market reaction underscores the systemic risk associated with protectionist trade policies.

- European Stock Market Decline: The interconnectedness of European economies resulted in a widespread, albeit varied, response to the news. While the AEX experienced the most significant drop, the contagion effect was clearly visible across the continent.

- International Response: International organizations such as the IMF and World Bank expressed concerns about the potential negative impact of escalating trade wars on global economic growth. They warned of the risks of further market volatility and called for a de-escalation of trade tensions. These concerns highlight the global economic impact of this specific tariff increase, extending beyond mere stock market fluctuations.

H2: Analysis of the Underlying Causes and Contributing Factors

While the tariff increase was a major catalyst for the AEX index drop, several other underlying factors contributed to the decline. Investor sentiment played a crucial role, with pre-existing economic anxieties and geopolitical instability exacerbating the market reaction.

- Investor Sentiment: Negative investor sentiment, already fragile due to global economic uncertainty, was amplified by the news of the tariff increase, leading to a sell-off in stocks.

- Economic Uncertainty: Existing anxieties about global economic growth and potential recessions contributed to the market's negative response. The tariff increase added another layer of uncertainty.

- Geopolitical Risks: Geopolitical instability in various regions of the world also contributed to the overall risk-averse environment, leading to a heightened sensitivity to negative news.

- Expert Opinions: Financial analysts and economists largely attributed the AEX index drop to a combination of the tariff increase and pre-existing market vulnerabilities. Many warned of further potential declines if the trade war escalates.

H2: Potential Long-Term Consequences and Future Outlook

The long-term consequences of Trump's tariff increases on the Amsterdam Stock Exchange and the Dutch economy remain uncertain, but several potential scenarios exist. Further tariff escalations could lead to a more sustained decline, impacting Dutch exports and economic growth.

- Long-Term Market Outlook: The long-term outlook depends heavily on the future course of trade policy. A de-escalation of trade tensions could lead to a recovery, while further tariff increases could deepen the decline.

- Investment Strategies: Investors need to adopt risk mitigation strategies, such as diversifying portfolios and carefully assessing the vulnerability of their holdings to trade disputes.

- Future Tariff Implications: The possibility of further tariff increases adds a layer of uncertainty to the market. Investors need to closely monitor developments in the trade war and their potential implications for their investment portfolios.

- Dutch Economy: The Dutch economy, being highly dependent on international trade, is particularly vulnerable to trade wars. The potential for long-term economic damage is a significant concern.

3. Conclusion

Trump's tariff increase resulted in a significant 2% drop in the Amsterdam Stock Exchange's AEX index, triggering wider global market reactions and highlighting the interconnectedness of international finance. The decline was fueled not only by the tariffs themselves but also by pre-existing economic anxieties and geopolitical uncertainty. Understanding the impact of Trump's tariffs on global markets, particularly on the AEX index, is critical for investors and businesses. Stay updated on Trump's tariff impacts, monitor the AEX index closely, and understand the risks associated with Trump tariffs to invest wisely in this volatile market. Proactive risk mitigation strategies are essential for navigating this uncertain economic landscape.

Featured Posts

-

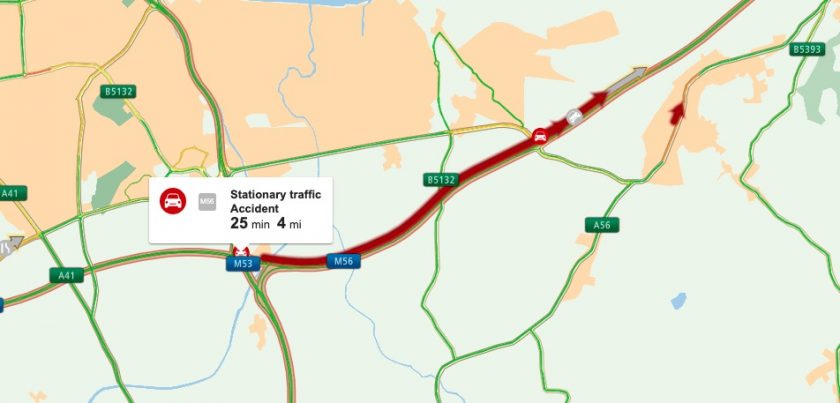

Significant M56 Congestion Cheshire Deeside Border Collision Impact

May 24, 2025

Significant M56 Congestion Cheshire Deeside Border Collision Impact

May 24, 2025 -

Frankfurt Stock Market Opening Dax Holds Steady After Record High

May 24, 2025

Frankfurt Stock Market Opening Dax Holds Steady After Record High

May 24, 2025 -

2025 Porsche Cayenne A Comprehensive Interior And Exterior Photo Gallery

May 24, 2025

2025 Porsche Cayenne A Comprehensive Interior And Exterior Photo Gallery

May 24, 2025 -

Kering Q1 Results Send Shares Down 6

May 24, 2025

Kering Q1 Results Send Shares Down 6

May 24, 2025 -

Uomini Piu Ricchi Del Mondo 2025 Musk Zuckerberg E Bezos Nella Classifica Forbes

May 24, 2025

Uomini Piu Ricchi Del Mondo 2025 Musk Zuckerberg E Bezos Nella Classifica Forbes

May 24, 2025

Latest Posts

-

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025 -

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025