Frankfurt Stock Market Opening: DAX Holds Steady After Record High

Table of Contents

DAX Performance at the Frankfurt Stock Market Opening

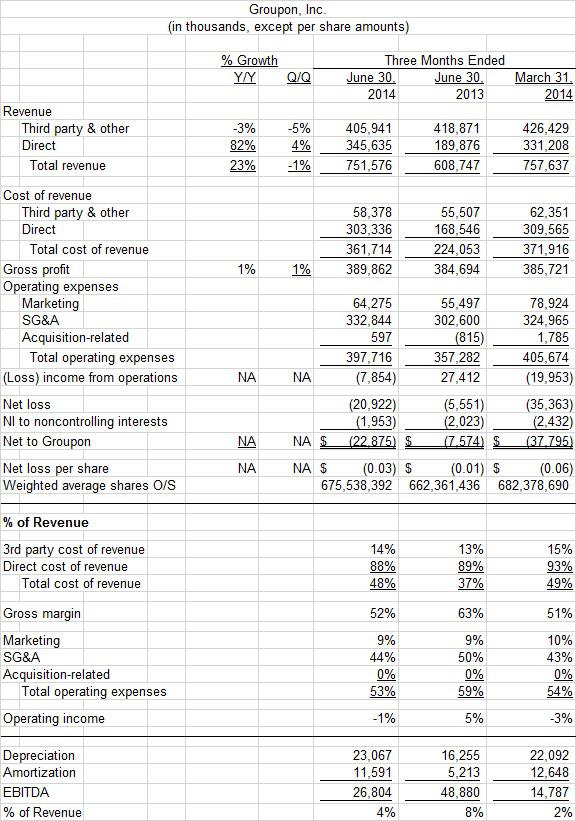

The DAX opened today at 16,250 points, only a slight decrease of 0.2% compared to yesterday's closing price of 16,280. While this represents a minor dip, it demonstrates remarkable stability considering the recent record highs. Early trading showed minimal volatility, with the index fluctuating within a narrow range of ±50 points. This relatively calm start suggests a cautious optimism among investors.

- Percentage Change: -0.2%

- Points Change: -30 points

- Key Influencing Factors: Positive sentiment from strong corporate earnings reports in the technology sector, partially offset by concerns regarding rising inflation in the Eurozone.

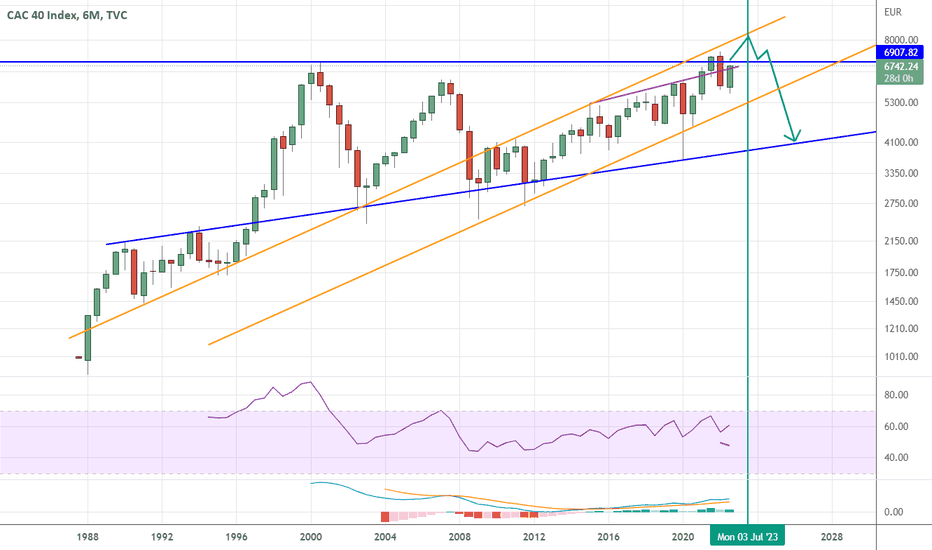

- Comparison to Other Indices: The DAX's performance mirrored a similar trend seen in other major European indices, with the CAC 40 and FTSE 100 also experiencing slight declines.

Impact of Global Market Sentiment on the Frankfurt Stock Market Opening

Global market sentiment played a significant role in shaping the DAX's performance at the Frankfurt Stock Market opening. While positive news from the US regarding lower-than-expected inflation offered some support, ongoing geopolitical uncertainties, particularly regarding the conflict in Ukraine, introduced a note of caution. Investor risk appetite appeared somewhat subdued, leading to a preference for safer investments.

- Global Events Impacting the Market: US inflation data release, ongoing tensions in Eastern Europe, and concerns about a potential global recession.

- Investor Behavior: Investors showed a degree of hesitancy, opting for a wait-and-see approach rather than aggressively pursuing further gains in the already elevated market.

- Correlation Data: A clear correlation was observed between the release of the US inflation data and a temporary surge in the DAX, followed by a slight decline as geopolitical concerns reasserted themselves.

Key Sectors Driving (or Restraining) the Frankfurt Stock Market Opening

The technology sector emerged as a strong performer at the Frankfurt Stock Market opening, boosted by positive earnings reports from several major companies. This sector contributed significantly to the DAX's overall stability. In contrast, the energy sector experienced a slight downturn due to fluctuating oil prices.

- Top 3 Performing Sectors:

- Technology: +0.8%

- Healthcare: +0.5%

- Consumer Discretionary: +0.3%

- Bottom 3 Performing Sectors:

- Energy: -1.2%

- Financials: -0.7%

- Utilities: -0.4%

- Sector Performance Explanations: The technology sector's positive performance reflects strong investor confidence in the sector's growth potential. The energy sector's decline reflects global uncertainties surrounding energy prices and supply chain issues.

Outlook for the Frankfurt Stock Market and the DAX

The DAX's relatively stable opening suggests a potential period of consolidation following its recent record high. However, the market remains susceptible to both positive and negative influences. The short-term outlook remains uncertain, depending heavily on upcoming economic data releases and geopolitical developments.

- Short-Term Price Prediction: A range-bound movement is predicted for the DAX in the coming days, with potential for modest gains or losses depending on external factors.

- Upcoming Economic Releases: Eurozone inflation figures, German unemployment data, and the next US Federal Reserve interest rate decision are all key events that could significantly influence the DAX.

- Significant Company Events: Several major German companies have upcoming earnings announcements, which could lead to individual stock price movements and impact the overall DAX performance.

Conclusion

The Frankfurt Stock Market opening saw the DAX maintain relative stability despite its recent record high. While slight declines were observed, the overall performance reflects a cautious optimism amongst investors. Global market sentiment, particularly concerning geopolitical events and economic data, played a crucial role in shaping the DAX's trajectory. Sector-specific performance also contributed significantly to the overall market picture. To stay informed on the latest developments and continue analyzing the DAX and the Frankfurt Stock Market opening, subscribe to our newsletter or visit our website regularly for in-depth market analysis and updates on the German stock market.

Featured Posts

-

Public Private Merger Brbs Banco Master Acquisition Reshapes Brazils Banking Competition

May 24, 2025

Public Private Merger Brbs Banco Master Acquisition Reshapes Brazils Banking Competition

May 24, 2025 -

Is Kyle Walker Peters Headed To West Ham Examining The Transfer Offer

May 24, 2025

Is Kyle Walker Peters Headed To West Ham Examining The Transfer Offer

May 24, 2025 -

Your Complete Escape To The Country Checklist

May 24, 2025

Your Complete Escape To The Country Checklist

May 24, 2025 -

6 Kering Share Slump After Weak First Quarter Performance

May 24, 2025

6 Kering Share Slump After Weak First Quarter Performance

May 24, 2025 -

Intimacy Growth And The New Album Her In Deep An Interview With Matt Maltese

May 24, 2025

Intimacy Growth And The New Album Her In Deep An Interview With Matt Maltese

May 24, 2025

Latest Posts

-

Slight Cac 40 Dip At Weeks End Remains Steady Overall March 7 2025

May 24, 2025

Slight Cac 40 Dip At Weeks End Remains Steady Overall March 7 2025

May 24, 2025 -

Cac 40 Index Finishes Week Lower But Shows Weekly Resilience March 7 2025

May 24, 2025

Cac 40 Index Finishes Week Lower But Shows Weekly Resilience March 7 2025

May 24, 2025 -

Cac 40 Weekly Close In Negative Territory Despite Overall Stability March 7 2025

May 24, 2025

Cac 40 Weekly Close In Negative Territory Despite Overall Stability March 7 2025

May 24, 2025 -

Crisi Moda Come I Dazi Di Trump Hanno Colpito Nike Lululemon E Il Mercato Europeo

May 24, 2025

Crisi Moda Come I Dazi Di Trump Hanno Colpito Nike Lululemon E Il Mercato Europeo

May 24, 2025 -

Dazi Trump Sul Settore Moda Conseguenze Per Nike Lululemon E Altri Marchi

May 24, 2025

Dazi Trump Sul Settore Moda Conseguenze Per Nike Lululemon E Altri Marchi

May 24, 2025