Public-Private Merger: BRB's Banco Master Acquisition Reshapes Brazil's Banking Competition

Table of Contents

BRB's Strategic Rationale Behind the Banco Master Acquisition

BRB's acquisition of Banco Master represents a strategic move to bolster its position within the competitive Brazilian banking market. The motivations behind this merger are multifaceted, stemming from a desire to expand market share, access new customer segments, and synergize operations for increased efficiency. The two banks complement each other significantly.

- Expansion and Market Share: The merger allows BRB to significantly increase its market share, particularly in regions where Banco Master held a strong presence. This provides immediate scale and reach.

- New Customer Segments: Banco Master brought a diverse customer base, including small and medium-sized enterprises (SMEs) and high-net-worth individuals – segments BRB could now tap into more effectively.

- Synergies and Enhanced Offerings: The combination of BRB's established infrastructure and Banco Master's technological capabilities and customer base creates powerful synergies. This integration leads to a broader and more diversified range of financial products and services.

Key Synergies:

- Increased market share in key regions of Brazil.

- Access to a new customer base, including SMEs and high-net-worth individuals.

- Diversification of product offerings to cater to a wider range of customer needs.

- Strengthened technological infrastructure leading to improved efficiency and customer experience.

- Cost synergies achieved through optimized operations and streamlined processes.

Impact on Brazil's Banking Landscape

The BRB-Banco Master merger will undoubtedly impact Brazil's banking landscape, although the precise extent of this influence remains to be seen. While some argue that it will lead to reduced competition, others point to the potential for innovation and improved services.

- Market Concentration: The merger will inevitably lead to increased market concentration, potentially impacting the competitive dynamics of the Brazilian banking sector. Regulatory bodies will closely monitor this aspect.

- Interest Rates and Fees: The long-term effect on interest rates and banking fees for consumers is a key area of concern. While increased efficiency might lead to lower costs, the potential for reduced competition could have the opposite effect.

- Response from Competitors: Other banks operating within Brazil may respond to this merger by pursuing their own mergers or acquisitions, leading to further consolidation within the sector. This is a classic example of competitive response in a dynamic market.

- Regulatory Scrutiny: The merger is under intense scrutiny by regulatory bodies, such as the Central Bank of Brazil (Banco Central do Brasil), to ensure it doesn't stifle competition or negatively impact consumers.

Regulatory Aspects and Approvals

The successful completion of the BRB-Banco Master merger hinged on securing necessary regulatory approvals, a process involving a rigorous review of compliance with antitrust regulations and other relevant legislation.

- Antitrust Compliance: The merger had to pass muster with Brazil's antitrust authorities, demonstrating that it wouldn't lead to undue market dominance or harm to competition.

- Central Bank Oversight: The Banco Central do Brasil played a crucial role in overseeing the entire process, ensuring compliance with all banking regulations and protecting the interests of consumers and the financial system's stability.

- Conditions Imposed: Regulatory bodies might have imposed specific conditions on the merger to mitigate potential negative consequences, such as divestments or operational restrictions.

- Approval Timeline: The time taken for regulatory approval, often a lengthy process, significantly impacted the merger's overall timeline and implementation strategy.

Long-Term Implications and Future Outlook

The long-term implications of the BRB-Banco Master merger are profound, suggesting a potential trend toward further consolidation within Brazil's banking sector.

- Further Mergers and Acquisitions: This merger could trigger a wave of similar deals, leading to a more concentrated banking landscape in the coming years.

- Financial Stability: The merger's long-term impact on financial stability will depend on several factors, including the effectiveness of regulatory oversight and the overall health of the Brazilian economy.

- Evolution of the Banking Landscape: The merger signifies a significant shift in the Brazilian banking landscape, potentially leading to increased efficiency, innovation, and new service offerings.

- Public-Private Partnerships: The success or failure of this public-private partnership will likely influence future collaborations between public and private entities within the Brazilian financial industry.

Conclusion: Public-Private Mergers and the Future of Brazilian Banking

The BRB-Banco Master merger marks a pivotal moment in the evolution of the Brazilian banking sector. This public-private merger has reshaped the competitive landscape, with significant implications for market share, customer offerings, and the future trajectory of the financial industry. The regulatory scrutiny and potential for further consolidation underscore the complexities and challenges inherent in such large-scale transactions. To stay informed about the continuing impact of this merger and other developments within the dynamic Brazilian banking sector, including further public-private mergers, continue to engage with this publication for in-depth analysis and updates on the Brazilian financial sector. Understanding the implications of public-private mergers is critical for navigating the evolving landscape of Brazilian banking.

Featured Posts

-

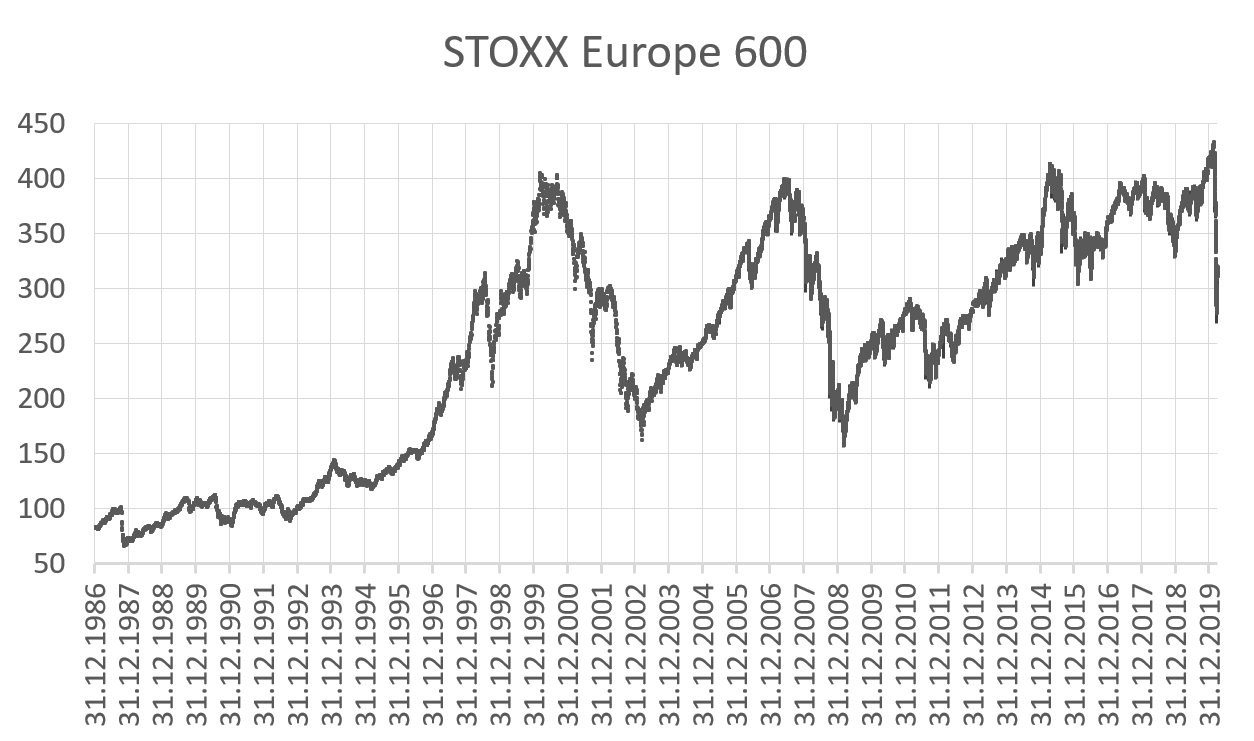

Avrupa Borsalari Duesueste Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 24, 2025

Avrupa Borsalari Duesueste Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 24, 2025 -

Planning Your Country Escape Location Lifestyle And Logistics

May 24, 2025

Planning Your Country Escape Location Lifestyle And Logistics

May 24, 2025 -

Porsche Macan Rafbill Fyrsta Utgafan I Smaatridum

May 24, 2025

Porsche Macan Rafbill Fyrsta Utgafan I Smaatridum

May 24, 2025 -

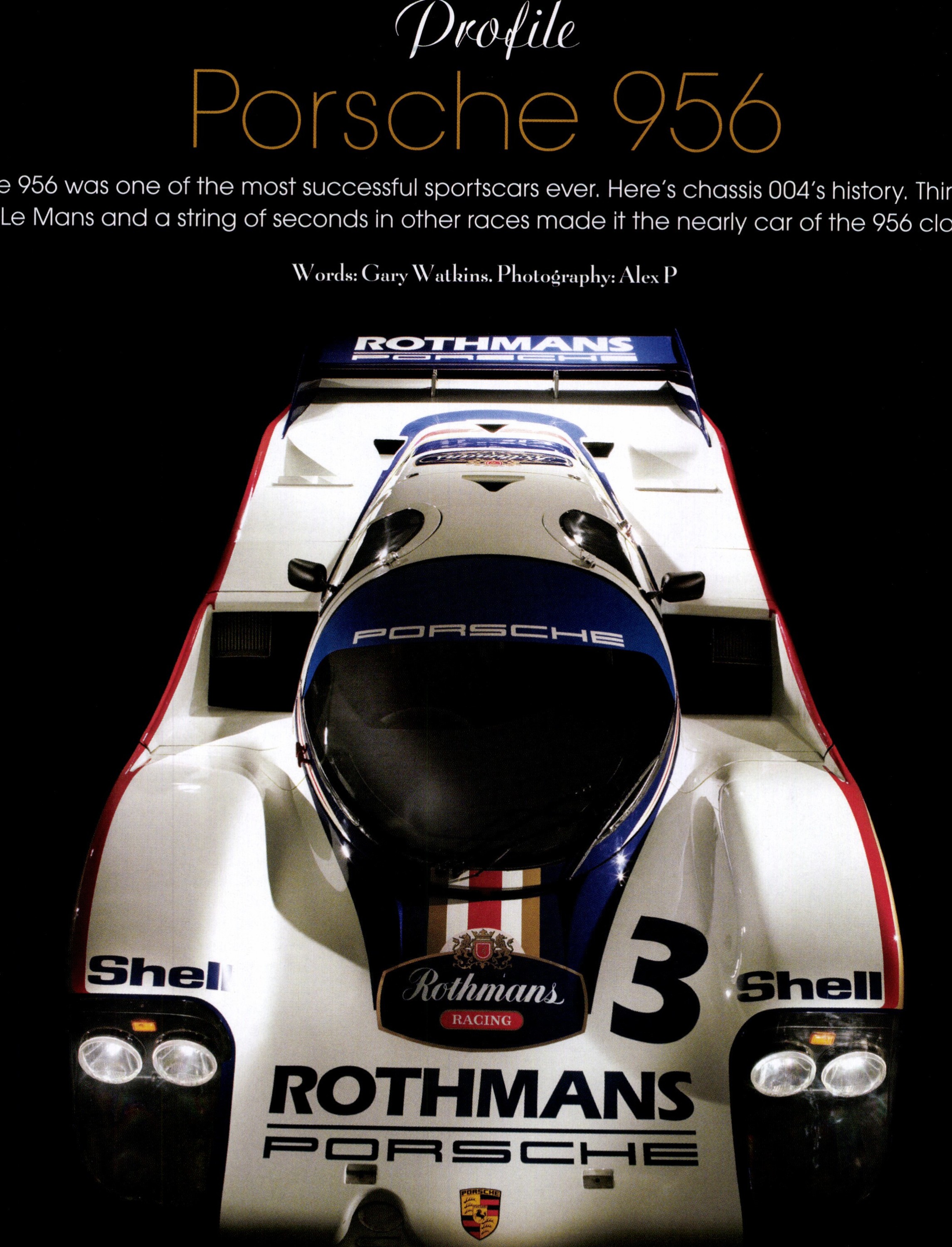

Porsche 956 Nin Havada Sergilenmesinin Arkasindaki Muehendislik

May 24, 2025

Porsche 956 Nin Havada Sergilenmesinin Arkasindaki Muehendislik

May 24, 2025 -

Escape To The Country Finding Your Perfect Country Home

May 24, 2025

Escape To The Country Finding Your Perfect Country Home

May 24, 2025

Latest Posts

-

Trump Tariffs And Apple Assessing The Risk To Buffetts Investment

May 24, 2025

Trump Tariffs And Apple Assessing The Risk To Buffetts Investment

May 24, 2025 -

Apple Stock Price Key Levels Breached Ahead Of Q2 Earnings

May 24, 2025

Apple Stock Price Key Levels Breached Ahead Of Q2 Earnings

May 24, 2025 -

Is Apple Vulnerable Analyzing The Impact Of Past Tariffs On Buffetts Holdings

May 24, 2025

Is Apple Vulnerable Analyzing The Impact Of Past Tariffs On Buffetts Holdings

May 24, 2025 -

Apple Stock And Tariffs A Look At Buffetts Position

May 24, 2025

Apple Stock And Tariffs A Look At Buffetts Position

May 24, 2025 -

Investing In Aapl Identifying Crucial Price Levels For Apple Stock

May 24, 2025

Investing In Aapl Identifying Crucial Price Levels For Apple Stock

May 24, 2025