Apple Stock And Tariffs: A Look At Buffett's Position

Table of Contents

Buffett's Significant Apple Stock Holdings

Berkshire Hathaway's investment in Apple is monumental, representing a substantial portion of their overall portfolio. This significant holding reflects Buffett's confidence in the company's long-term prospects, even amidst external challenges like tariffs.

- Bullet Point 1: Berkshire Hathaway owns billions of dollars worth of Apple stock, representing a significant percentage (currently over 40%) of their equity portfolio. This makes Apple one of Berkshire's largest holdings.

- Bullet Point 2: This investment has grown significantly since its inception, demonstrating substantial returns for Berkshire Hathaway. The growth reflects Apple's consistent performance and market dominance.

- Bullet Point 3: Buffett’s investment strategy is centered around identifying companies with strong brands, loyal customer bases, and robust competitive advantages. Apple’s powerful brand and ecosystem perfectly align with this philosophy.

Analyzing the Long-Term Perspective

Buffett is renowned for his long-term value investing approach. This strategy emphasizes identifying undervalued companies with strong fundamentals and holding them for the long haul, regardless of short-term market fluctuations. His Apple investment exemplifies this philosophy.

- Bullet Point 1: Value investing focuses on intrinsic value, not short-term market sentiment. Buffett believes Apple's intrinsic value significantly outweighs any short-term negative impact from tariffs.

- Bullet Point 2: Unlike short-term traders focused on quick profits, Buffett's approach prioritizes sustainable, long-term growth. He views temporary setbacks, like tariff impacts, as minor compared to the company's overall trajectory.

- Bullet Point 3: While tariffs might temporarily affect Apple's profit margins, Buffett likely anticipates Apple’s ability to adapt and maintain its long-term growth trajectory. His continued investment suggests a belief in Apple's resilience.

The Impact of Tariffs on Apple

Tariffs significantly impact Apple's business model. Many of Apple's products are assembled in China, making them subject to tariffs imposed by the US and other countries. These tariffs increase production costs, impacting Apple's profitability and potentially consumer prices.

- Bullet Point 1: Specific tariffs on components sourced from China directly increase the cost of manufacturing iPhones, iPads, and other Apple products. These increased costs trickle down the supply chain.

- Bullet Point 2: To offset these increased costs, Apple might absorb some of the tariff impact, reducing profit margins, or pass on the increased costs to consumers through higher prices.

- Bullet Point 3: Apple has actively sought to mitigate the effects of tariffs by diversifying its manufacturing base and exploring alternative supply chains. This strategic diversification reduces reliance on any single region.

Apple's Response to Trade Wars

Apple, like many multinational corporations, actively engages in lobbying efforts to influence trade policies. They've issued public statements advocating for reduced trade barriers and fair trade practices. Their actions highlight the significant impact of global trade policies on their business.

Buffett's Continued Investment Despite Tariffs

Despite the challenges posed by tariffs, Buffett's continued investment in Apple demonstrates unwavering confidence in the company's long-term prospects.

- Bullet Point 1: Apple's strong brand loyalty and robust ecosystem create significant barriers to entry for competitors. This brand strength helps cushion the impact of tariffs on demand.

- Bullet Point 2: Apple's considerable financial resources and efficient operations likely allow it to absorb a degree of tariff-related cost increases without significantly impacting profitability.

- Bullet Point 3: Buffett’s continued investment suggests a belief in Apple's ability to adapt and overcome these challenges, capitalizing on long-term growth opportunities.

Conclusion

Buffett's substantial investment in Apple stock highlights his belief in the company's enduring strength. While tariffs undeniably pose challenges to Apple's profitability, Buffett's continued confidence suggests a long-term perspective that sees these challenges as surmountable. His sustained investment offers a valuable insight into assessing the impact of global trade policies on Apple stock and similar technology investments.

Call to Action: Understanding the complexities of Apple stock and tariff impacts is crucial for any investor. Continue your research into Apple stock tariffs and Buffett's investment strategy to make informed decisions about your own portfolio. Learn more about how global trade policies influence Apple stock and similar tech investments.

Featured Posts

-

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Its Net Asset Value Nav

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Its Net Asset Value Nav

May 24, 2025 -

Porsche Now

May 24, 2025

Porsche Now

May 24, 2025 -

Escape To The Country Dream Homes Under 1 Million

May 24, 2025

Escape To The Country Dream Homes Under 1 Million

May 24, 2025 -

The Day Mia Farrows Ex Husband Crashed Michael Caines Sex Scene

May 24, 2025

The Day Mia Farrows Ex Husband Crashed Michael Caines Sex Scene

May 24, 2025 -

Posthumous Honor For Alfred Dreyfus French Parliament Debates Symbolic Act Of Rehabilitation

May 24, 2025

Posthumous Honor For Alfred Dreyfus French Parliament Debates Symbolic Act Of Rehabilitation

May 24, 2025

Latest Posts

-

Understanding The Controversy Surrounding Thames Waters Executive Bonuses

May 24, 2025

Understanding The Controversy Surrounding Thames Waters Executive Bonuses

May 24, 2025 -

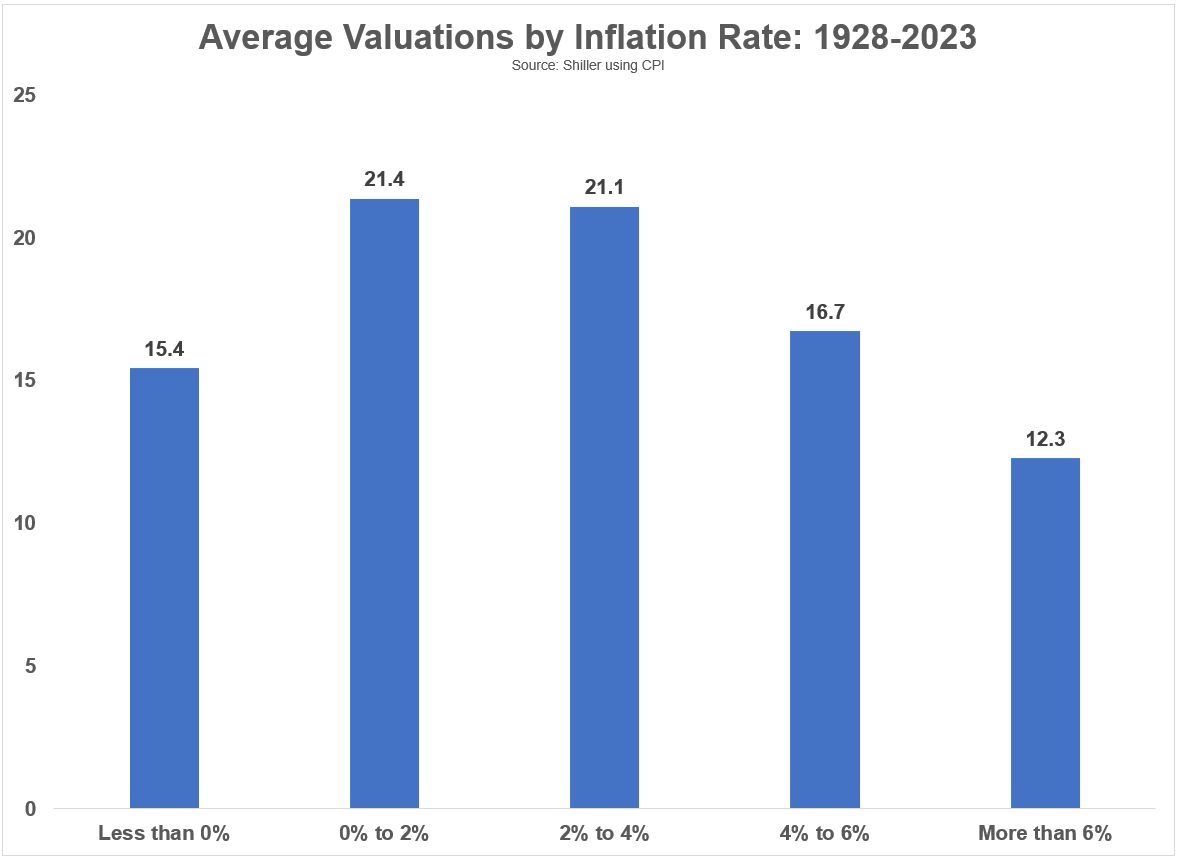

Are Elevated Stock Market Valuations Justified Bof As Take

May 24, 2025

Are Elevated Stock Market Valuations Justified Bof As Take

May 24, 2025 -

Thames Waters Executive Bonuses A Look At The Financial Implications

May 24, 2025

Thames Waters Executive Bonuses A Look At The Financial Implications

May 24, 2025 -

Bof A Reassures Investors Understanding Current Stock Market Valuations

May 24, 2025

Bof A Reassures Investors Understanding Current Stock Market Valuations

May 24, 2025 -

Addressing Investor Concerns Bof A On Stretched Stock Market Valuations

May 24, 2025

Addressing Investor Concerns Bof A On Stretched Stock Market Valuations

May 24, 2025