U.S. Dollar Performance: A Troubling First 100 Days Compared To Nixon Era

Table of Contents

The Current State of U.S. Dollar Performance (First 100 Days)

Inflationary Pressures and the USD

Current inflation rates remain stubbornly high, significantly impacting the U.S. dollar's purchasing power and overall value. The Consumer Price Index (CPI) continues to exceed the Federal Reserve's target, eroding the value of savings and impacting consumer confidence.

- Impact on Purchasing Power: Rising inflation reduces the amount of goods and services that can be purchased with a single dollar, effectively lowering its real value.

- Federal Reserve Response: The Federal Reserve has responded with aggressive interest rate hikes, aiming to curb inflation by slowing economic growth. However, this approach carries the risk of triggering a recession.

- Future Inflation Scenarios: The path of future inflation remains uncertain, with potential scenarios ranging from a soft landing to a prolonged period of high inflation or even stagflation.

Interest Rate Hikes and Their Effect

The Federal Reserve's recent interest rate hikes, while intended to combat inflation, have also impacted the U.S. dollar performance. Higher interest rates typically attract foreign investment, strengthening the dollar. However, this can also stifle economic growth domestically.

- Interest Rates and Currency Value: Higher interest rates make U.S. assets more attractive to international investors, increasing demand for the dollar and thus strengthening its value.

- Impact on Borrowing Costs: Increased interest rates raise borrowing costs for businesses and consumers, potentially hindering investment and spending.

- Recessionary Risks: Aggressive interest rate hikes increase the risk of triggering a recession, potentially undermining the dollar's long-term strength.

Geopolitical Factors Affecting the USD

Global geopolitical events exert significant influence on the U.S. dollar's performance. The ongoing war in Ukraine, strained relations with China, and other international conflicts contribute to economic uncertainty.

- Specific Geopolitical Events: The war in Ukraine, for instance, has disrupted global supply chains, contributing to inflationary pressures and impacting global trade, thus affecting the dollar. Tensions with China introduce uncertainty into global markets.

- Safe-Haven Demand: During periods of global uncertainty, the U.S. dollar often sees increased demand as investors seek a safe haven for their assets. This can temporarily boost its value.

- Impact on International Trade: Geopolitical instability can disrupt international trade flows, negatively affecting the U.S. economy and the dollar's overall performance.

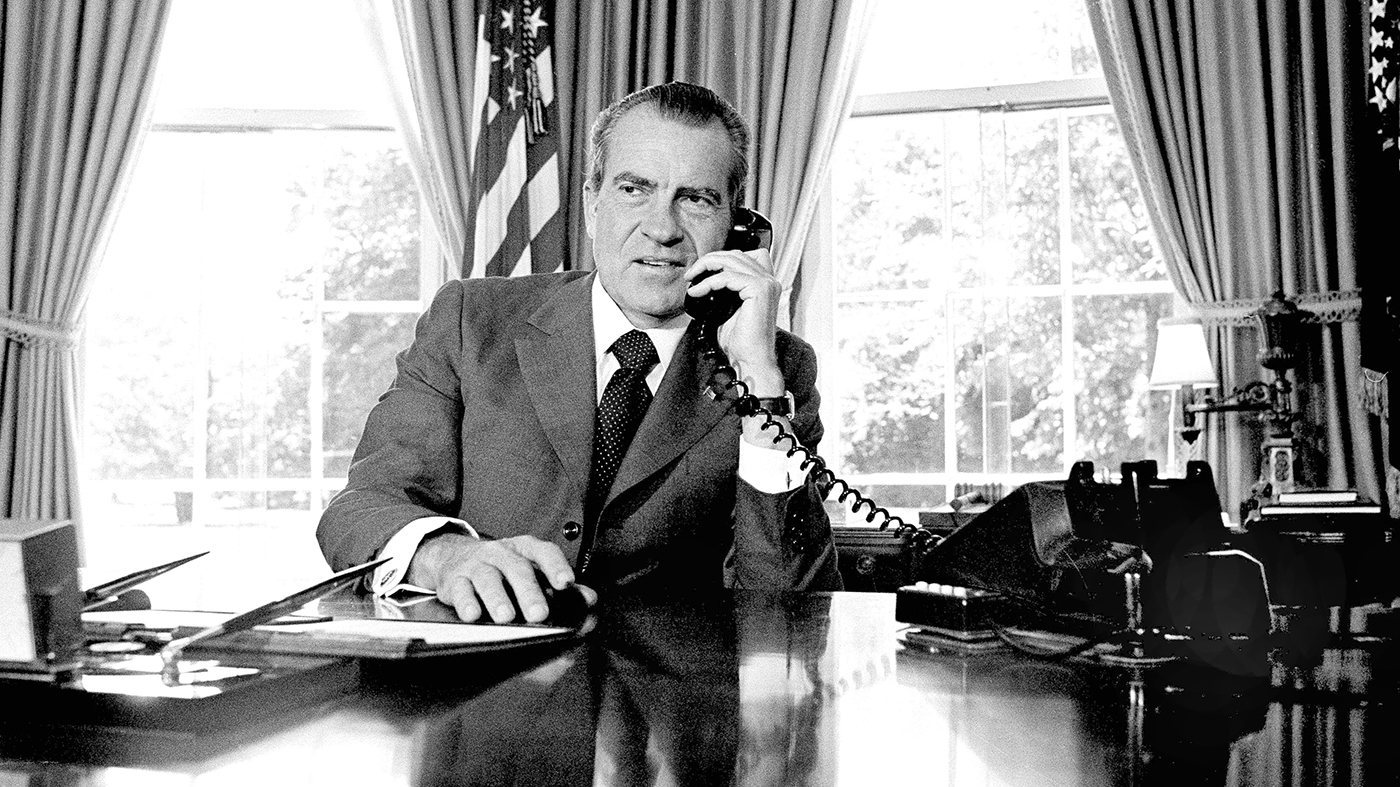

The Nixon Shock and its Long-Term Effects on U.S. Dollar Performance

Closing the Gold Window

President Nixon's decision in 1971 to close the gold window, severing the direct link between the U.S. dollar and gold, marked a watershed moment in global monetary history.

- The Bretton Woods System: This decision ended the Bretton Woods system, which had established a fixed exchange rate regime based on the convertibility of the dollar to gold.

- Consequences of the Gold Window Closure: The closure led to increased currency volatility and the eventual shift to a floating exchange rate system.

- Fiat Currency System: The U.S. dollar transitioned to a fiat currency, meaning its value is no longer directly tied to a physical commodity like gold.

Inflation and the Dollar in the 1970s

The period following the Nixon shock was characterized by significant inflation, often referred to as stagflation (a combination of stagnation and inflation).

- Stagflation of the 1970s: This era saw high inflation coupled with slow economic growth and high unemployment, significantly eroding the dollar's purchasing power.

- Impact on Global Trade and Economic Stability: The volatile economic conditions undermined global trade and economic stability.

- Comparing Inflation Rates: Comparing inflation rates from the 1970s to today reveals both similarities and differences, highlighting the complexities of managing inflationary pressures.

Long-Term Consequences for the Global Economy

The Nixon shock had profound and long-lasting consequences for the global economy.

- Rise of Floating Exchange Rates: The move away from fixed exchange rates led to a more flexible, but also more volatile, international monetary system.

- Long-Term Impact on Currency Volatility: Currency volatility became a defining characteristic of the post-Nixon era, requiring new strategies for managing international financial risks.

- Emergence of New Global Economic Powers: The shift in the global monetary system contributed to the rise of new economic powers, altering the balance of global influence.

Comparing the Current Situation to the Nixon Era

Similarities and Differences

Comparing the current economic climate to the post-Nixon era reveals both striking similarities and crucial differences.

- Comparing Inflation Rates: While the current inflation rate is lower than at its peak in the 1970s, the sustained period of high inflation presents a similar challenge.

- Comparing Interest Rate Policies: The Federal Reserve's aggressive interest rate hikes mirror the efforts undertaken in the 1970s, though the specific circumstances and tools differ.

- Comparing Geopolitical Factors: Geopolitical uncertainties today, while different in specifics, are just as significant in influencing global economic conditions and the U.S. dollar's value as those in the 1970s.

Potential Parallels and Future Outlook

Based on the analysis, certain parallels emerge between the two periods, prompting consideration of potential future scenarios.

- Potential Risks and Opportunities: The current situation presents both significant risks (e.g., recession, persistent inflation) and opportunities (e.g., potential for dollar strength amidst global instability).

- Predictions for the Dollar's Value: Predicting the future value of the dollar remains challenging, but understanding historical trends offers valuable context.

- Potential Policy Responses: The effectiveness of policy responses will depend heavily on the evolution of inflation, geopolitical events, and global economic conditions.

Conclusion

The current state of U.S. dollar performance presents some troubling parallels to the period following the Nixon shock. While the specific circumstances differ, the persistent inflationary pressures and the challenges of managing a globalized economy echo the difficulties faced in the 1970s. Understanding the historical context of the Nixon era provides crucial perspective for assessing the current economic landscape. By carefully monitoring U.S. dollar performance and global economic indicators, we can better navigate the complexities of this evolving environment. Stay informed about U.S. dollar performance and global economic trends – subscribe to our newsletter for regular updates and insights. The future of the U.S. dollar and the global economy depends on informed decision-making.

Featured Posts

-

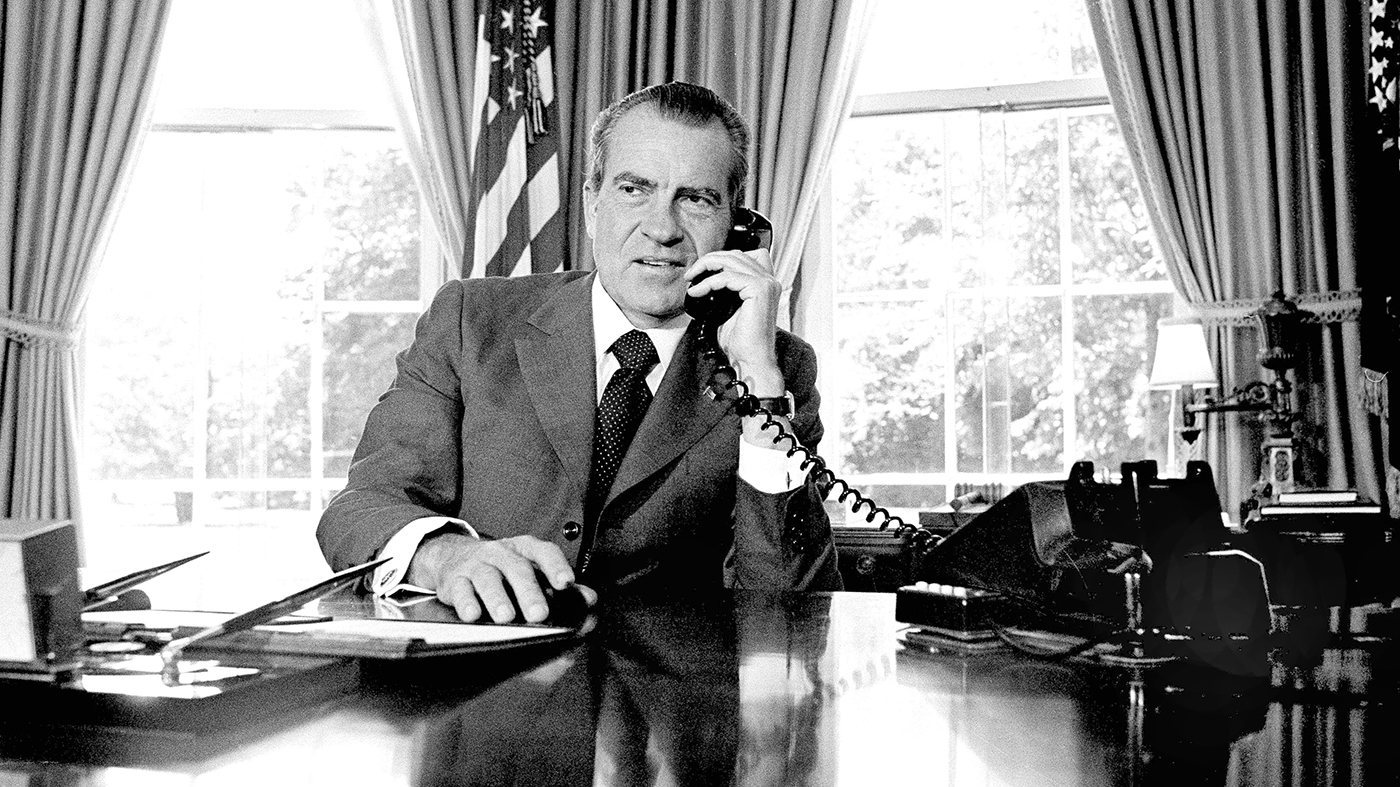

Are High Stock Market Valuations A Cause For Concern Bof A Weighs In

Apr 29, 2025

Are High Stock Market Valuations A Cause For Concern Bof A Weighs In

Apr 29, 2025 -

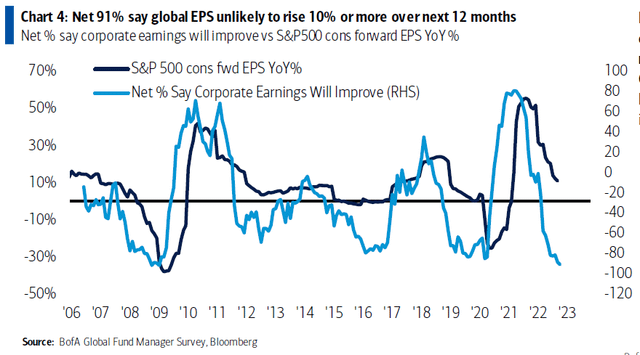

Adult Adhd Diagnosis Next Steps And Support

Apr 29, 2025

Adult Adhd Diagnosis Next Steps And Support

Apr 29, 2025 -

The Rise Of Older You Tube Users Trends And Implications

Apr 29, 2025

The Rise Of Older You Tube Users Trends And Implications

Apr 29, 2025 -

British Paralympian Vanishes In Las Vegas Hostel Belongings Found

Apr 29, 2025

British Paralympian Vanishes In Las Vegas Hostel Belongings Found

Apr 29, 2025 -

20 000 March For Trans Rights A Show Of Solidarity

Apr 29, 2025

20 000 March For Trans Rights A Show Of Solidarity

Apr 29, 2025