U.S. Tariff Pause Sends Euronext Amsterdam Stocks Up 8%

Table of Contents

The Impact of the U.S. Tariff Pause on Specific Sectors

The U.S. Tariff Pause had a disproportionate impact across different sectors listed on Euronext Amsterdam. Let's examine the key areas:

Technology Sector Gains

The technology sector experienced significant gains following the announcement of the U.S. tariff pause. Many technology companies listed on Euronext Amsterdam rely heavily on US-based components or access to the American market. The easing of trade tensions significantly reduced their operational uncertainty.

- Specific Company Examples:

- Company A: Experienced a 12% increase in share price.

- Company B: Saw a 9% rise in its stock value.

- Company C: Recorded a more modest 5% increase.

The long-term implications for this sector remain positive, provided the tariff pause remains in effect and further trade agreements are reached. Reduced tariffs could lead to increased profitability and further investment in research and development.

Energy Sector Response

The energy sector's response to the U.S. Tariff Pause was more nuanced. While some energy companies benefited from increased global demand, others experienced more moderate growth. The sector's performance is intricately linked to global energy markets and the price of oil, which are significantly influenced by US policies.

- Specific Company Examples:

- Company D: Showed a 7% increase, likely due to increased demand.

- Company E: Experienced a smaller 3% increase.

- Company F: Remained relatively unchanged, highlighting the sector's varied response.

The future of the energy sector remains volatile. Sustained growth hinges on continued global demand and the stability of US trade policy.

Financial Sector Performance

The financial sector, highly sensitive to global economic shifts, displayed a mixed response to the U.S. Tariff Pause. While some financial institutions benefited from increased market activity, others saw more modest gains or even slight declines. The interconnectedness of global financial markets means that the impact of trade policies is multifaceted and not uniformly positive.

- Specific Company Examples:

- Bank G: Reported a 4% increase in its stock price.

- Investment Firm H: Saw a marginal 1% increase.

- Bank I: Remained largely unaffected.

Overall, the financial sector demonstrated resilience, showing the sector's capacity to adapt to shifts in global trade policy. However, continued uncertainty surrounding future tariff adjustments could introduce further volatility.

Analyst Reactions and Market Predictions Following the Tariff Pause

Financial analysts have offered mixed reactions to the temporary U.S. tariff pause. Some are optimistic, predicting sustained growth, while others caution against premature celebrations.

"The tariff pause is a positive development, but we need to see concrete long-term changes in US trade policy before we can declare victory," stated Analyst J from a leading investment bank.

Short-term predictions are largely positive, with many analysts expecting further gains in Euronext Amsterdam stocks. However, long-term predictions remain cautious, highlighting the potential for future tariff adjustments or unexpected geopolitical events. Risks include potential retaliatory tariffs or a renewed escalation of trade tensions.

The Broader Geopolitical Context of the U.S. Tariff Pause

The U.S. Tariff Pause is not an isolated event but rather a significant development within the broader context of global trade relations. It reflects a shifting landscape of international trade agreements and negotiations. The pause could indicate a potential softening of US trade protectionism, although the long-term implications remain uncertain. Businesses and consumers, both in the US and Europe, are carefully watching for further policy shifts. The impact on supply chains and consumer prices could be substantial, depending on the duration and the future direction of US trade policy.

Conclusion: Understanding the Significance of the U.S. Tariff Pause on Euronext Amsterdam

The temporary U.S. tariff pause has resulted in a significant 8% increase in Euronext Amsterdam stocks, with varying impacts across different sectors. While the technology sector experienced substantial gains, the energy and financial sectors showed more mixed results. Analysts remain cautiously optimistic, highlighting both the potential for continued growth and the significant risks inherent in the current geopolitical climate. To stay updated on U.S. tariff impacts and monitor Euronext Amsterdam stock performance, it’s crucial to remain informed. Subscribe to our newsletter for regular updates, follow reputable financial news sources, and consider consulting with a financial advisor for personalized investment guidance to learn more about the U.S. tariff pause's influence on your portfolio.

Featured Posts

-

Retour Du Ces Unveiled A Amsterdam Decouvrez Les Innovations Europeennes

May 24, 2025

Retour Du Ces Unveiled A Amsterdam Decouvrez Les Innovations Europeennes

May 24, 2025 -

U S Tariff Pause Sends Euronext Amsterdam Stocks Up 8

May 24, 2025

U S Tariff Pause Sends Euronext Amsterdam Stocks Up 8

May 24, 2025 -

Alnmw Alqwy Ldaks Ma Aldhy Ydem Artfae Mwshr Alashm Alalmany

May 24, 2025

Alnmw Alqwy Ldaks Ma Aldhy Ydem Artfae Mwshr Alashm Alalmany

May 24, 2025 -

Seattles Green Space A Womans Pandemic Refuge

May 24, 2025

Seattles Green Space A Womans Pandemic Refuge

May 24, 2025 -

Legendas F1 Motorral Felszerelt Porsche Reszletes Bemutatas

May 24, 2025

Legendas F1 Motorral Felszerelt Porsche Reszletes Bemutatas

May 24, 2025

Latest Posts

-

The Future Of Ai Hardware Open Ais Potential Partnership With Jony Ive

May 24, 2025

The Future Of Ai Hardware Open Ais Potential Partnership With Jony Ive

May 24, 2025 -

Open Ai And Jony Ive The Rumored Ai Hardware Acquisition

May 24, 2025

Open Ai And Jony Ive The Rumored Ai Hardware Acquisition

May 24, 2025 -

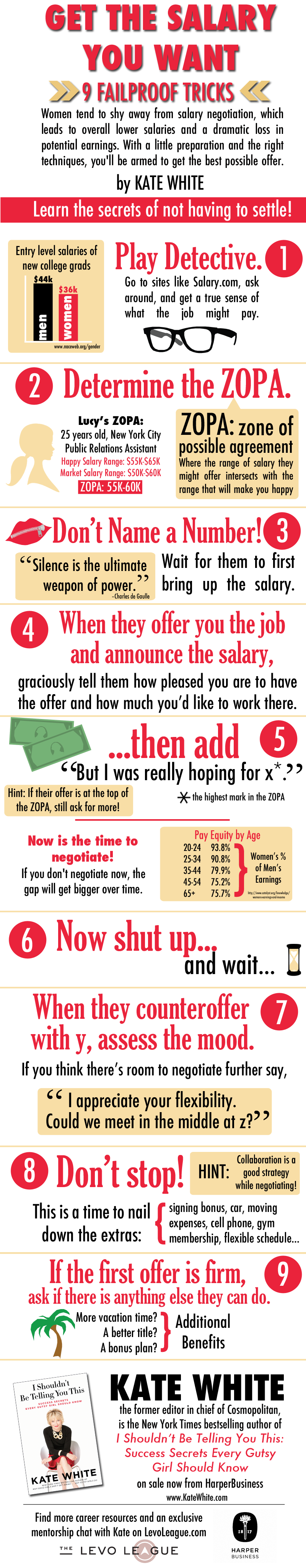

Getting More Than The Best And Final Job Offer A Practical Guide

May 24, 2025

Getting More Than The Best And Final Job Offer A Practical Guide

May 24, 2025 -

Is Open Ai Acquiring Jony Ives Ai Startup Analysis And Implications

May 24, 2025

Is Open Ai Acquiring Jony Ives Ai Startup Analysis And Implications

May 24, 2025 -

Beyond The Best And Final Offer Tips For Successful Salary Negotiation

May 24, 2025

Beyond The Best And Final Offer Tips For Successful Salary Negotiation

May 24, 2025