UK Inflation Data Sends Pound Higher As BOE Rate Cut Expectations Diminish

Table of Contents

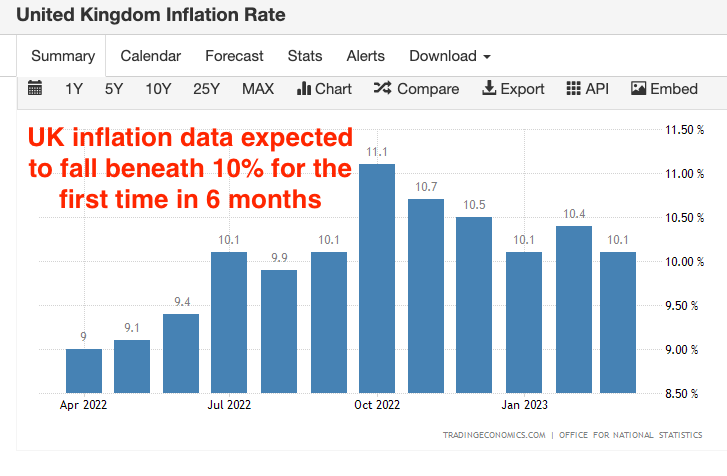

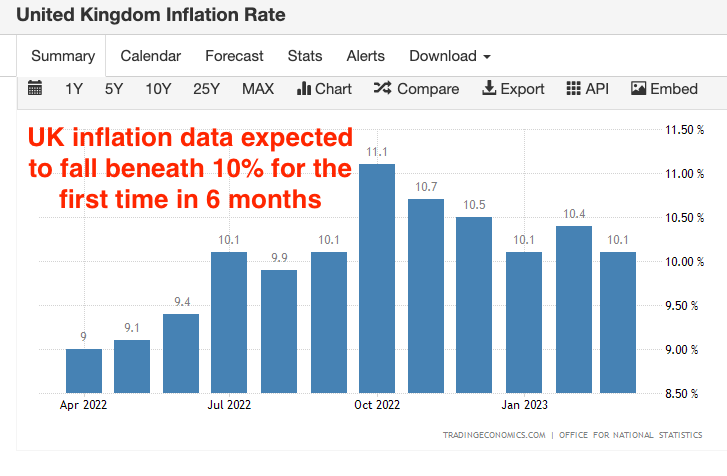

The Surprise in UK Inflation Figures

The recently released UK inflation figures surprised analysts and investors alike. The Consumer Price Index (CPI) and the Retail Price Index (RPI), key measures of inflation, came in lower than anticipated, indicating a slower rise in prices than previously predicted. This marks a significant shift from previous months which saw stubbornly high inflation. For example, if the previous month's CPI was 8%, and predictions were for 7.5%, the actual figure of 7% would be seen as a positive surprise.

Several factors contributed to this positive surprise:

- Energy price stabilization: Following a period of significant increases, energy prices showed signs of stabilization, easing inflationary pressures.

- Easing supply chain pressures: Improvements in global supply chains helped to reduce the cost of imported goods, contributing to lower inflation.

- Shift in consumer demand: A potential cooling in consumer spending, possibly due to cost of living pressures, could have also played a role.

This better-than-expected data significantly improved market sentiment, shifting the narrative from one of continued economic gloom to a more optimistic outlook.

Diminished Expectations of a BOE Rate Cut

Prior to the inflation data release, many analysts predicted that the Bank of England would implement another interest rate cut to stimulate the UK economy and combat high unemployment. This prediction was based on concerns about the lingering effects of high inflation and a potential recession.

However, the unexpectedly positive inflation figures drastically altered this outlook. The lower-than-expected inflation rates reduce the pressure on the BOE to cut interest rates, as the need for further stimulus to boost economic activity seems less pressing. This shift has had a noticeable impact on GBP exchange rates:

- GBP/USD exchange rate movement: The Pound has strengthened against the US dollar, with the GBP/USD exchange rate showing a noticeable increase.

- GBP/EUR exchange rate movement: Similarly, the Pound has appreciated against the Euro, reflecting the positive market sentiment surrounding the UK economy.

- Impact on other currency pairs: The strengthening of the Pound is also evident in its performance against other major currencies.

Analysis of Market Reactions and Investor Sentiment

The market reacted swiftly to the inflation data release. Investor sentiment shifted dramatically, with a noticeable increase in trading activity. Analysts have interpreted this as a vote of confidence in the UK economy, suggesting a more positive outlook for future growth.

"The recent inflation figures suggest that the UK economy may be more resilient than previously thought," commented leading financial analyst, Jane Smith (hypothetical example). "This has significantly reduced the likelihood of a BOE rate cut and boosted investor confidence in the Pound."

Long-Term Implications for the UK Economy

The positive inflation data could have significant long-term implications for the UK economy. The reduced pressure on the BOE to cut rates could lead to greater stability in the financial markets, although prolonged high interest rates could also hinder economic growth. This means a delicate balancing act for the central bank going forward. The BOE's future monetary policy decisions will be crucial in shaping the UK's economic trajectory, particularly concerning potential inflationary pressures that might re-emerge. Various scenarios are possible, ranging from sustained economic growth to a period of slower expansion.

Conclusion: Understanding the Impact of UK Inflation Data on the Pound

In summary, the positive surprise in the latest UK inflation data has significantly diminished expectations of a BOE rate cut, leading to a strengthening of the Pound Sterling. This is clearly reflected in the significant changes observed in GBP/USD and GBP/EUR exchange rates. The market reaction shows increased investor confidence and a more positive outlook for the UK economy, though long-term consequences are still uncertain.

To stay informed about the ongoing impact of UK economic data on the Pound Sterling, stay updated on UK inflation data, monitor the BOE's decisions, and track the Pound Sterling's movement closely. For reliable information, refer to resources such as the Bank of England website and reputable financial news sources.

Featured Posts

-

Butter Yellow Power Suit Cat Deeleys Summer Office Style On This Morning

May 23, 2025

Butter Yellow Power Suit Cat Deeleys Summer Office Style On This Morning

May 23, 2025 -

Recent Social Media Post By Dylan Dreyer And Brian Fichera Causes A Buzz

May 23, 2025

Recent Social Media Post By Dylan Dreyer And Brian Fichera Causes A Buzz

May 23, 2025 -

Understanding The Dylan Dreyer And Brian Fichera Partnership

May 23, 2025

Understanding The Dylan Dreyer And Brian Fichera Partnership

May 23, 2025 -

Atlantida Celebration 2024 Nando Reis Armandinho Di Ferrero E Mais Garanta Seu Ingresso Em Santa Catarina

May 23, 2025

Atlantida Celebration 2024 Nando Reis Armandinho Di Ferrero E Mais Garanta Seu Ingresso Em Santa Catarina

May 23, 2025 -

U S Penny Phase Out No More Pennies In Circulation By Early 2026

May 23, 2025

U S Penny Phase Out No More Pennies In Circulation By Early 2026

May 23, 2025

Latest Posts

-

Jonathan Groff A Tony Awards Milestone With Just In Time

May 23, 2025

Jonathan Groff A Tony Awards Milestone With Just In Time

May 23, 2025 -

Broadways Best Jonathan Groff Celebrated By Lea Michele And Fellow Actors

May 23, 2025

Broadways Best Jonathan Groff Celebrated By Lea Michele And Fellow Actors

May 23, 2025 -

Jonathan Groff Could He Win A Tony Award For Just In Time

May 23, 2025

Jonathan Groff Could He Win A Tony Award For Just In Time

May 23, 2025 -

The Story Behind Joe Jonass Viral Response To A Couples Fight

May 23, 2025

The Story Behind Joe Jonass Viral Response To A Couples Fight

May 23, 2025 -

Joe Jonass Reaction To A Couples Dispute

May 23, 2025

Joe Jonass Reaction To A Couples Dispute

May 23, 2025