Understanding Stock Market Valuations: BofA's Rationale For Investor Calm

Table of Contents

BofA's Key Arguments for a Stable Market

BofA's recent reports suggest a relatively stable market outlook, despite several economic uncertainties. Their arguments are underpinned by a careful assessment of various economic indicators and the application of sophisticated financial models. They maintain that while challenges exist, the current stock market valuations aren't drastically overvalued, justifying a degree of investor calm.

- Strong Corporate Earnings: BofA points to robust corporate earnings as a significant factor supporting their positive outlook. Many companies have exceeded expectations, demonstrating resilience in the face of economic headwinds. (Source: BofA Global Research, Q3 2023 Earnings Report – insert specific citation here if available).

- Controlled Inflation: While inflation remains a concern, BofA's analysis suggests that the rate of increase is moderating, indicating potential for further stabilization. They cite declining inflation rates and the Federal Reserve's monetary policy as contributing factors. (Source: Insert specific BofA report citation here).

- Resilient Consumer Spending: Consumer spending, a key driver of economic growth, remains relatively strong, providing further support for BofA's stable market prediction. (Source: Insert specific BofA report citation here).

BofA's analysis leverages sophisticated econometric models that incorporate these and other variables to project future market performance. The models consider factors such as interest rate sensitivity, inflation expectations, and geopolitical risks, among others.

Understanding Different Valuation Metrics

Several key metrics are crucial for understanding stock market valuations. Let's examine three commonly used metrics:

Price-to-Earnings Ratio (P/E)

- Definition: The P/E ratio measures a company's stock price relative to its earnings per share (EPS). It indicates how much investors are willing to pay for each dollar of a company's earnings.

- Strengths: Easy to calculate and widely used, providing a benchmark for comparing companies within the same sector.

- Weaknesses: Can be distorted by accounting manipulations or one-time events. Doesn't consider future growth potential.

Price-to-Sales Ratio (P/S)

- Definition: The P/S ratio compares a company's market capitalization to its revenue. It's particularly useful for valuing companies with negative earnings or those in rapidly growing sectors.

- Strengths: Less susceptible to accounting manipulation than P/E ratio; useful for valuing young, high-growth companies.

- Weaknesses: Doesn't account for profitability or expenses.

Price-to-Book Ratio (P/B)

- Definition: The P/B ratio compares a company's market capitalization to its book value (assets minus liabilities). It’s often used to assess the value of asset-heavy companies.

- Strengths: Useful for valuing companies with significant tangible assets. Provides a measure of how much investors are paying for a company’s net asset value.

- Weaknesses: Book value can be outdated and may not reflect the true market value of assets.

Analyzing BofA's Valuation Models and Forecasts

BofA employs a multi-faceted approach to valuation, incorporating various metrics and forecasting models. Their analysis often involves discounted cash flow (DCF) models, which project future cash flows and discount them back to their present value. They also incorporate macroeconomic factors and sector-specific analyses into their projections. (For specific details on their models, refer to BofA's publicly available research reports).

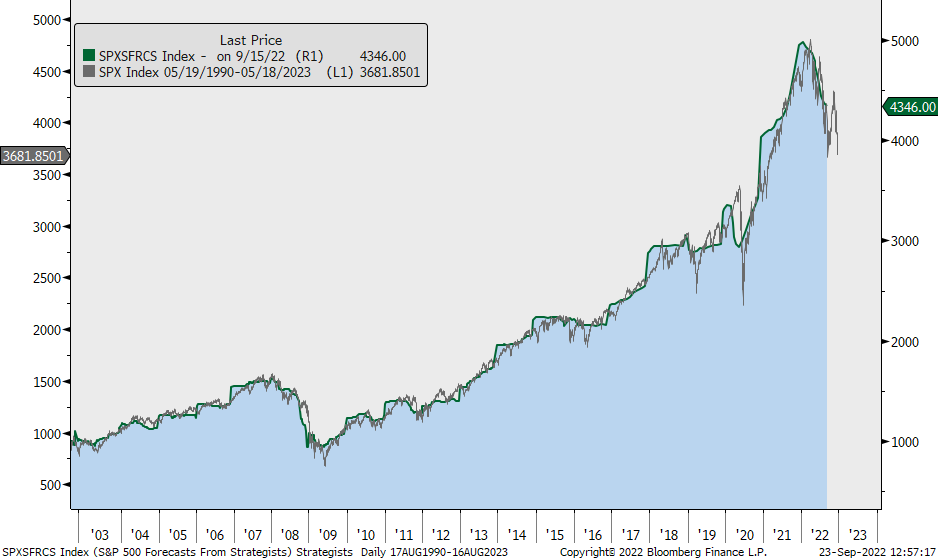

BofA's forecasts often highlight specific sectors they deem attractively or less attractively valued. For instance, (insert example from a BofA report if available, e.g., "they may identify the technology sector as potentially overvalued while highlighting opportunities in the energy sector"). These insights are supported by charts and graphs visualizing their projections (visuals would be inserted here if this were a published article).

Addressing Investor Concerns and Potential Risks

While BofA presents a relatively optimistic outlook, acknowledging potential risks is crucial. Several factors could impact market performance:

- Inflationary Pressures: Persistent high inflation could erode corporate profits and dampen consumer spending.

- Recessionary Risks: The possibility of a recession remains a concern, potentially impacting corporate earnings and stock prices.

- Geopolitical Instability: Global geopolitical events can introduce significant uncertainty and volatility into the market.

BofA addresses these concerns by incorporating them into their risk models. They may suggest strategies for mitigating these risks, such as diversification, hedging, or adjusting investment time horizons. These mitigations would be detailed further within BofA’s reports.

Maintaining Investor Calm Amidst Stock Market Valuations

BofA's analysis, while cautiously optimistic, emphasizes the importance of understanding stock market valuations. Their arguments, based on strong corporate earnings, controlled inflation, and resilient consumer spending, suggest reasons for investor calm. However, potential risks like inflation, recession, and geopolitical instability must be acknowledged. This article provided a framework for interpreting BofA's analysis and understanding key valuation metrics.

Call to Action: While this article summarizes BofA's perspective, it's crucial to conduct your own thorough research. Consider BofA's analysis alongside other viewpoints and develop a well-informed investment strategy based on a deep understanding of stock market valuations. Visit BofA's website for access to their research reports and further insights into their analysis of current market conditions and stock market valuations.

Featured Posts

-

Gambling On Catastrophe The Case Of The Los Angeles Wildfires

Apr 26, 2025

Gambling On Catastrophe The Case Of The Los Angeles Wildfires

Apr 26, 2025 -

De Zoete Nederlandse Broodje Dat Geen Zin Heeft

Apr 26, 2025

De Zoete Nederlandse Broodje Dat Geen Zin Heeft

Apr 26, 2025 -

Shedeur Sanders Nike Loyalty Following In Deion Sanders Footsteps

Apr 26, 2025

Shedeur Sanders Nike Loyalty Following In Deion Sanders Footsteps

Apr 26, 2025 -

Wga And Sag Aftra Strike A Complete Shutdown Of Hollywood Production

Apr 26, 2025

Wga And Sag Aftra Strike A Complete Shutdown Of Hollywood Production

Apr 26, 2025 -

European Stock Market Outlook Strategists Shift From Optimism Amidst Trumps Trade War

Apr 26, 2025

European Stock Market Outlook Strategists Shift From Optimism Amidst Trumps Trade War

Apr 26, 2025

Latest Posts

-

Bangkok Post The Fight For Transgender Equality Continues

May 10, 2025

Bangkok Post The Fight For Transgender Equality Continues

May 10, 2025 -

Discussions On Transgender Equality Intensify Bangkok Post Reports

May 10, 2025

Discussions On Transgender Equality Intensify Bangkok Post Reports

May 10, 2025 -

Experiences Of Transgender Individuals Under Trumps Executive Orders

May 10, 2025

Experiences Of Transgender Individuals Under Trumps Executive Orders

May 10, 2025 -

Bangkok Post Reports On The Mounting Pressure For Transgender Rights

May 10, 2025

Bangkok Post Reports On The Mounting Pressure For Transgender Rights

May 10, 2025 -

The Impact Of Trumps Presidency On Transgender Rights

May 10, 2025

The Impact Of Trumps Presidency On Transgender Rights

May 10, 2025