Understanding The Stealthy Wealthy: Their Strategies For Sustainable Wealth

Table of Contents

Diversification: The Cornerstone of Stealthy Wealth

The Stealthy Wealthy understand that a well-diversified portfolio is the bedrock of long-term financial health. This isn't about taking wild risks; it's about strategically spreading investments across various asset classes to mitigate risk and maximize potential returns. This core principle of portfolio diversification forms a cornerstone of their approach to sustainable wealth.

Asset Class Diversification

Spreading investments across different asset classes is crucial for weathering market fluctuations. A balanced portfolio typically includes:

- Stocks: Equity investments offering potential for high growth, but also higher risk.

- Bonds: Fixed-income investments providing stability and relatively lower risk.

- Real Estate: Tangible assets offering potential rental income and appreciation.

- Commodities: Raw materials like gold, oil, and agricultural products, acting as inflation hedges.

- Alternative Investments: Hedge funds, private equity, and other less traditional options.

The advantages of this approach to asset allocation are clear: reduced volatility, better risk management, and the potential for consistent, long-term growth. However, over-diversification can dilute returns and increase management complexity. Finding the right balance is key. Effective portfolio diversification is a core element in how the Stealthy Wealthy achieve sustainable wealth.

Geographic Diversification

The Stealthy Wealthy don’t limit their investments to a single country or region. Geographic diversification reduces exposure to the economic downturns of specific areas. By investing globally, they create a more resilient portfolio.

- International Stocks: Investing in companies located in various countries.

- Emerging Markets: Exposure to faster-growing economies, though with higher risk.

- Real Estate in Multiple Locations: Owning properties in diverse geographic areas.

Strategies for global investing involve careful consideration of currency risk and political stability in different regions. While international diversification offers significant benefits, it also presents challenges that require diligent research and potentially specialized financial advice. The Stealthy Wealthy understand these nuances and incorporate them into their long-term approach to building sustainable wealth.

Strategic Tax Planning: Minimizing Tax Burden for Long-Term Growth

Tax efficiency is paramount for the Stealthy Wealthy. They understand that minimizing tax liabilities allows more of their wealth to compound over time, contributing significantly to their long-term success. This careful approach to tax optimization is another crucial element of their strategies for sustainable wealth.

Tax-Efficient Investments

Utilizing tax-advantaged accounts and strategies is a core element of their approach.

- 401(k)s and IRAs: Retirement accounts offering tax deferral or tax-free growth.

- Tax-Loss Harvesting: Offsetting capital gains with capital losses.

- Municipal Bonds: Interest income often exempt from federal and state taxes.

Working with experienced tax professionals is crucial to navigate the complexities of tax laws and optimize tax strategies. Ignoring tax implications can significantly hinder long-term wealth accumulation. This proactive approach to tax planning is a key differentiator for the Stealthy Wealthy and their pursuit of sustainable wealth.

Estate Planning

The Stealthy Wealthy understand the importance of comprehensive estate planning to ensure wealth transfer and minimize inheritance taxes.

- Wills and Trusts: Legal documents specifying how assets will be distributed after death.

- Gifting Strategies: Transferring assets to heirs during one's lifetime to reduce estate taxes.

- Charitable Giving: Reducing taxable estate size through charitable donations.

Proactive estate planning not only protects the wealth accumulated but also ensures a smooth transition for future generations. This element of wealth preservation is frequently overlooked but is a hallmark of the Stealthy Wealthy’s approach to sustainable wealth.

Long-Term Vision and Patience: A Key Differentiator

The Stealthy Wealthy differentiate themselves through their unwavering commitment to long-term strategies. They resist the temptation of short-term gains and focus on building wealth steadily and sustainably. This long-term perspective is critical for achieving financial security.

Avoiding Short-Term Market Fluctuations

The Stealthy Wealthy avoid making impulsive decisions based on short-term market volatility.

- Long-Term Investment Horizon: Focusing on the long-term growth potential of investments.

- Value Investing: Identifying undervalued assets and holding them for extended periods.

- Buy and Hold Strategy: Minimizing trading to reduce transaction costs and emotional decision-making.

Emotional discipline is key to long-term investing success. Ignoring short-term market noise and maintaining a long-term outlook is a defining characteristic of the Stealthy Wealthy’s approach to building sustainable wealth.

Continuous Learning and Adaptation

The Stealthy Wealthy remain informed about market trends and adapt their investment strategies accordingly.

- Financial Literacy: Continuously expanding their understanding of financial markets.

- Seeking Professional Advice: Consulting with financial advisors and other experts.

- Staying Updated on Market Changes: Monitoring economic and market indicators.

Continuous learning and adaptation are vital for staying ahead of the curve and ensuring the long-term success of their investment strategies. This commitment to ongoing financial education is instrumental in the Stealthy Wealthy’s pursuit of sustainable wealth.

Conclusion

The strategies of the Stealthy Wealthy—diversification, strategic tax planning, and a long-term vision—are not about getting rich quick, but about building sustainable wealth that stands the test of time. By understanding and implementing these principles, you can embark on your journey towards building sustainable wealth and securing your financial future. Start your research today and discover how to become a more financially secure individual. Learn from the Stealthy Wealthy and develop your own strategies for building sustainable wealth and achieving long-term financial security.

Featured Posts

-

Financial Assistance For Sustainable Practices In Smes

May 19, 2025

Financial Assistance For Sustainable Practices In Smes

May 19, 2025 -

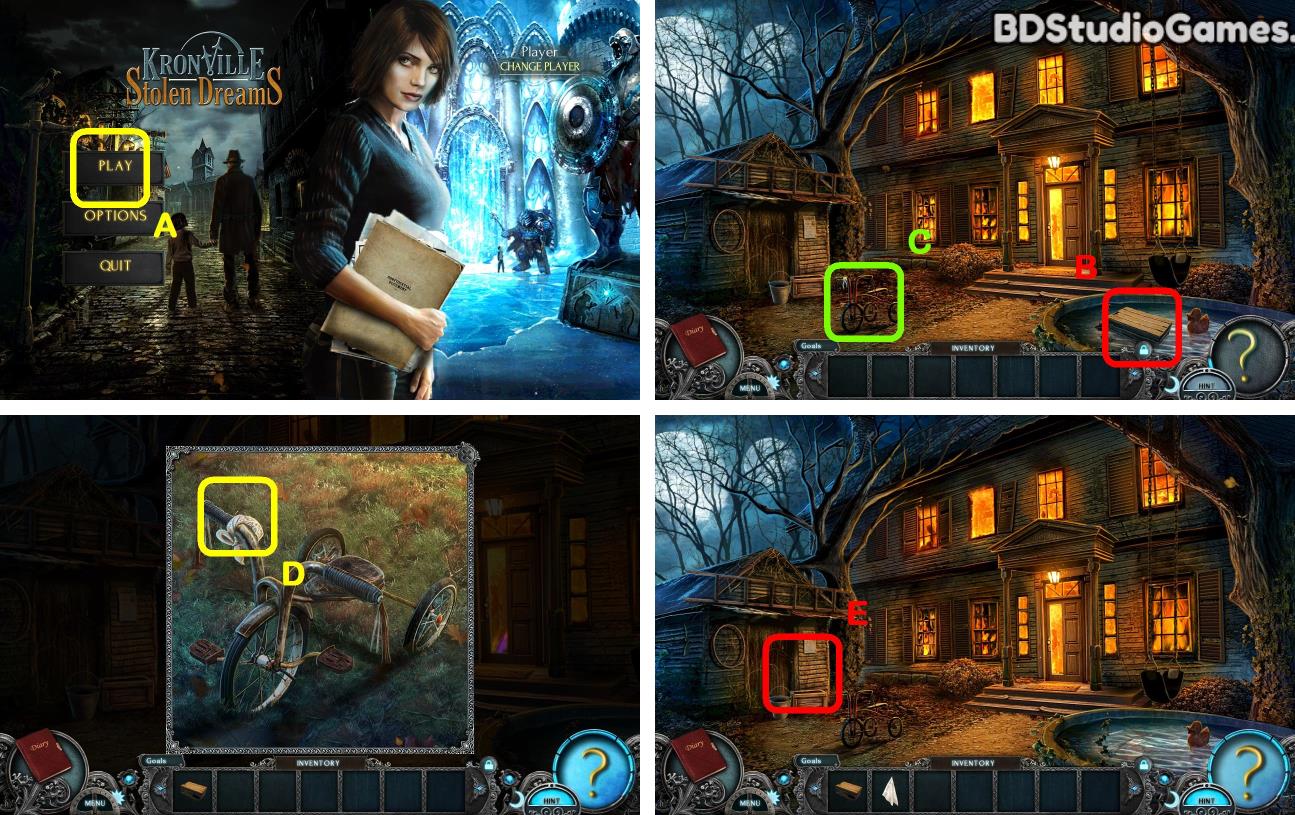

Stolen Dreams A Restaurant Owners Fight For Justice

May 19, 2025

Stolen Dreams A Restaurant Owners Fight For Justice

May 19, 2025 -

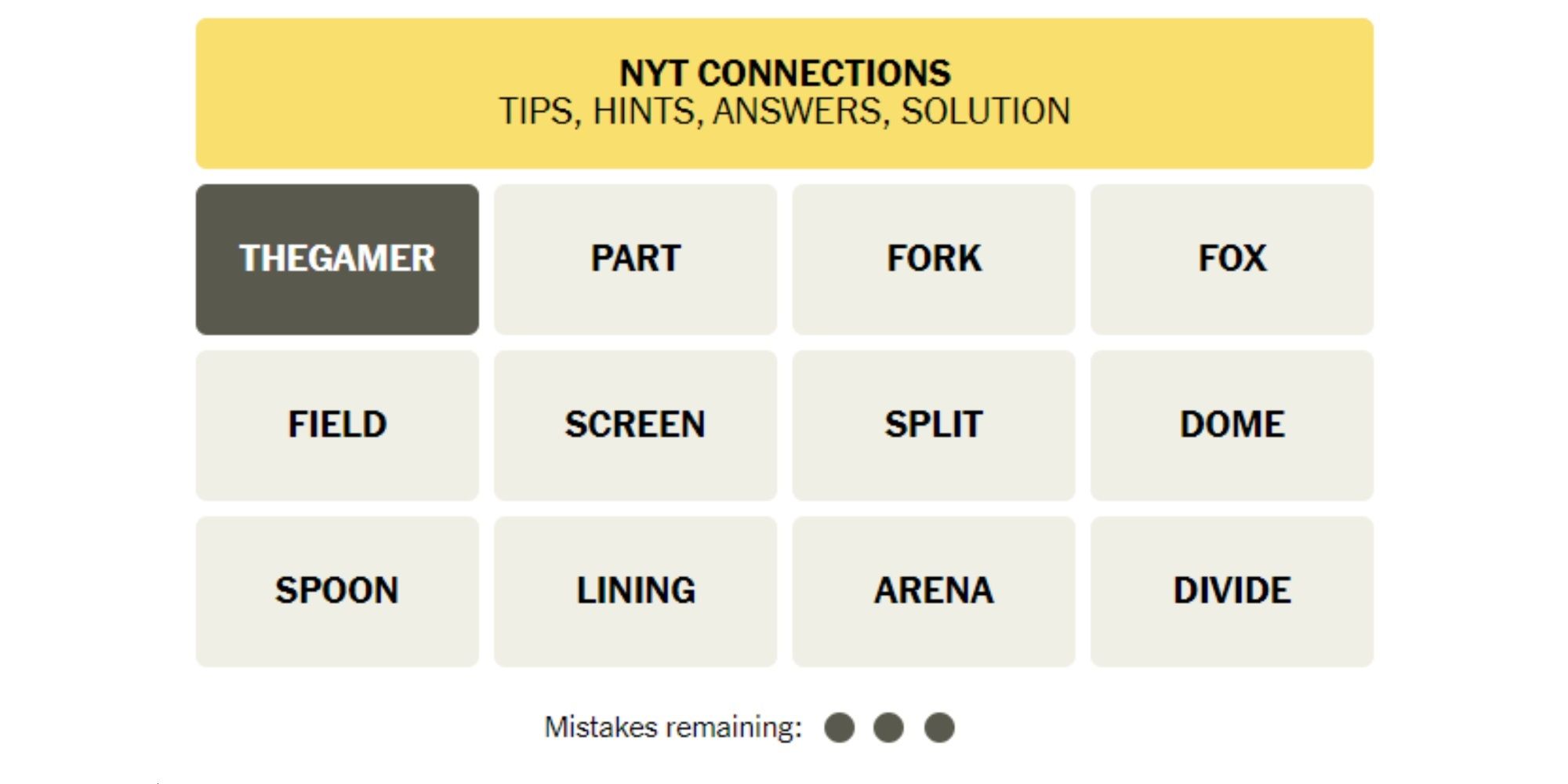

Solve Nyt Connections Puzzle 627 Feb 27 Hints And Answers

May 19, 2025

Solve Nyt Connections Puzzle 627 Feb 27 Hints And Answers

May 19, 2025 -

When Will Erling Haaland Return From Injury Man City Update

May 19, 2025

When Will Erling Haaland Return From Injury Man City Update

May 19, 2025 -

East Hampton Officer Luis Morales Faces Dwi Charges Southampton Police Investigation

May 19, 2025

East Hampton Officer Luis Morales Faces Dwi Charges Southampton Police Investigation

May 19, 2025